At a Glance

In light of Lyra Therapeutics’ (NASDAQ:LYRA) recent financial and clinical data, investors face a complex investment landscape. On the clinical side, Lyra’s LYR-220 shows robust promise, particularly backed by BEACON Phase 2 data. It addresses an unmet need in chronic rhinosinusitis, targeting a substantial patient demographic that remains refractory to existing treatments. Financially, Lyra maintains a stable balance sheet, boasting a 24-month cash runway and a healthy asset-to-liability ratio. However, the company’s high R&D outlays and escalating operating costs bring a layer of risk that warrants scrutiny. Coupled with a microcap structure and absence of revenue, Lyra’s investment thesis is not without its caveats. The upcoming ENLIGHTEN 1 Phase 3 trial stands as a pivotal catalyst, capable of significantly altering the company’s clinical and financial trajectory.

Q2 Earnings

To begin my analysis, looking at Lyra Therapeutics’ most recent earnings report, the company exhibited a net loss of $31.9M for the first half of 2023, exacerbated by increased R&D expenses ($23.4M) and G&A expenses ($9.7M). Collaboration revenue registered a minor dip, landing at $868k, a concern for a company heavily engaged in R&D. Moreover, share dilution is heavy: the count of outstanding shares has increased from approximately 31.8M to 49.5M over the past six months.

Financial Health

Turning to Lyra Therapeutics’ balance sheet, the total current assets are $118.3M, including $54.4M in cash and equivalents and $61.8M in short-term investments. Current liabilities stand at $14.1M, leading to a healthy current ratio of 8.38. Total assets outweigh total liabilities by nearly 4.6 times, marking $125.7M versus $27.1M. The company has burned through $30.1M in operating activities over the last six months, translating to a monthly cash burn rate of approximately $5M. Based on this, the company has a cash runway of nearly 24 months. Note that these values and estimates are based on past data and may not be indicative of future performance.

Based on the provided data, the probability of Lyra needing additional financing within the next 12 months appears low, given the ample cash runway and solid asset-to-liability ratio. However, R&D outlays could necessitate future capital raises. These are my personal observations, and other analysts might interpret the data differently.

Equity Analysis

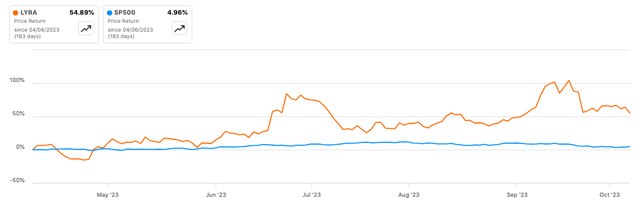

According to Seeking Alpha data, Lyra Therapeutics’ market capitalization of $180.35M seems modest, signaling cautious optimism given its robust balance sheet and low debt. The company’s growth prospects are muted as Lyra remains at least two or three years away from generating revenue from LYR-220. Stock momentum against SPY shows a six-month gain of 54.89%, which outperforms the SP500’s 4.96%, indicating positive investor sentiment in the short term.

Seeking Alpha

Short interest is relatively low at 2.61%, indicating minimal bearish sentiment. Significant ownership comes from PE/VC firms holding 43.25%, a positive signal for long-term investment and strategy. Among institutional holdings, 24 increased their positions, totaling 15.5M shares, while three sold out, releasing just 97,672 shares. Insider trading reflects no recent open market buys or sells, but a net activity of 7,288,331 shares acquired in the last 12 months, generally bullish.

Clearing the Air: How LYR-220 Reshapes CRS Treatment

LYR-220, Lyra Therapeutics’ investigational bioresorbable nasal matrix, offers a nuanced approach to treating chronic rhinosinusitis (CRS), particularly among those who have undergone ethmoid sinus surgery yet continue to experience symptoms. The medication uses mometasone furoate, a well-established corticosteroid commonly used in nasal sprays like Nasonex. Its familiarity in ENT clinical settings offers an advantage: physicians and patients alike trust its safety and anti-inflammatory efficacy. What sets LYR-220 apart is its prolonged, localized six-month delivery mechanism, providing sustained relief from the trio of cardinal CRS symptoms—nasal obstruction, discharge, and facial pain.

In the recently concluded BEACON Phase 2 study, LYR-220 not only hit its primary safety markers but significantly improved key patient-reported outcomes, including notable reductions in SNOT-22 scores. These are substantial milestones given the inherent challenges of managing chronic rhinosinusitis, particularly in post-surgical patients who represent a formidable segment of the approximate 4 million CRS sufferers who don’t respond to current treatments.

The upcoming Phase 3 trial (ENLIGHTEN 1) builds on these strong foundations with a meticulously designed, double-masked, randomized parallel assignment framework. Primary outcomes focus on the change in composite scores of the cardinal CRS symptoms at 24 weeks. Additionally, the study incorporates secondary measures ranging from 3-D volumetric CT scans to rescue treatment requirements, making it a comprehensive evaluation of LYR-220’s clinical utility.

So, what does this portend for LYR-220’s market prospects? Should the Phase 3 data mirror the Phase 2 successes, LYR-220 could redefine the treatment paradigm for a sizeable, yet underserved, CRS patient segment. By leveraging the established trust in mometasone furoate but innovating its delivery, LYR-220 has the potential to fast-track its way to regulatory approval and achieve rapid market penetration. With positive Phase 3 results, Lyra could carve out a dominant position in a niche yet significant CRS submarket, elevating itself from a clinical-stage company to a therapeutic leader in the field.

My Analysis & Recommendation

In summary, Lyra Therapeutics presents a compelling investment thesis underscored by multiple bullish indicators—both clinical and financial. From a clinical perspective, the strong BEACON Phase 2 results suggest that LYR-220 could be a game-changer for treating chronic rhinosinusitis. The upcoming ENLIGHTEN 1 Phase 3 trial results, anticipated in H1 2024, should be closely monitored; they carry the potential not only to validate LYR-220 but also to propel Lyra from a clinical-stage company to a therapeutic leader in a specialized, yet lucrative, niche of the CRS market.

Financially, the firm exhibits robust fundamentals, such as a healthy current ratio and an ample 24-month cash runway, which limit the immediate risk of additional capital raise. Add to this the company’s stock momentum, outperforming the SP500 by a significant margin, and a 43.25% PE/VC ownership—both indicators of institutional confidence. Nonetheless, despite these optimistic markers, prospective investors should not overlook the company’s microcap structure amidst increasing R&D expenditure. Once LYR-220 hits the market, one cannot understate the hurdles of market penetration, competitive pricing, and the need for robust post-market surveillance.

Given these various factors, Lyra is not without its challenges. The company’s R&D expenses are substantial and will likely scale as LYR-220 progresses further into late-stage trials and, eventually, commercialization. Though Lyra’s balance sheet currently signals a lower likelihood of capital raising in the near term, increased R&D and operational costs could change this picture. Therefore, in the coming weeks and months, investors should keep an eye on any updates related to the ENLIGHTEN 1 trial, the company’s capital allocation strategy, and institutional activity, which could serve as proxies for the company’s perceived valuation and potential.

Finally, given the confluence of positive indicators, both clinical and financial, as well as a promising but rigorous drug development roadmap, my investment recommendation for Lyra at this juncture is a “Strong Buy”. Still, this comes with the counsel that all investments carry inherent risks and it is crucial to balance one’s portfolio in line with individual risk tolerance.

Risks to Thesis

In recommending a “Strong Buy” for Lyra Therapeutics, I may have overlooked or underestimated several risks:

-

Single Asset Dependency: Lyra’s focus is mainly on LYR-220. Failure in Phase 3 could severely impact stock value. Investors should consider the risks of a total loss in investment.

-

Regulatory Risk: While Phase 2 data is promising, FDA approval is not guaranteed. Small changes in trial design or interpretation of data could result in setbacks.

-

Reimbursement and Pricing: Even with FDA approval, successful commercialization depends on insurance coverage and competitive pricing, aspects that haven’t been scrutinized in my analysis.

-

Execution Risk: Scaling from a clinical stage to a commercial entity involves unaccounted-for operational complexities and costs.

-

Macro Factors: Unanticipated healthcare reforms or economic downturns can impact Lyra disproportionately due to its micro-cap status.

-

Management Execution: No recent insider buys could indicate less confidence in short-term stock appreciation despite overall bullish sentiment.

Finally, investors should exercise caution when considering an investment in Lyra Therapeutics, a micro-cap company with a market capitalization of around $180.35M. Although its promising pipeline targets an unmet need in chronic rhinosinusitis, it is important to note the company’s lack of revenue and significant R&D expenditures. The firm’s financials, including a negative earnings trajectory and high cash burn rate, add layers of risk. Limited liquidity and narrower analyst coverage may result in less market efficiency, exposing investors to price volatility and potentially inflated valuations. Being a micro-cap, Lyra also faces the challenges of raising capital, scaling operations, and navigating a competitive landscape populated by larger, better-funded rivals.

Read the full article here