For more than a decade there has been a constant debate on whether for retail investors passive investing makes more sense relative to active investing strategy.

The most common arguments for the passive approach are the following: lower costs, diversification and no risk of underperforming the market.

In general, I tend to agree with this concept that for most retail investors assuming an active investing strategy is suboptimal, especially if there is no specific background or interest in the investing/capital allocation world.

Obviously, if following stocks, assessing the financial statements, and being emotionally invested in the capital markets help an investor to actually save money to invest, then applying an active strategy makes perfect sense.

My guess is that most of the Seeking Alpha readers fall into the category, where an active investing strategy, for some reason, is preferred (the same applies to me).

With that being said, let me explain why I consider the U.S. equity REIT universe as one of the most attractive pockets of the stock market in which the conditions have become extremely favourable to cherry-pick specific REITs.

Internal divergences within the overall commercial real estate sector

In the past 3-year period, there have emerged two new headwinds and one has significantly intensified for the commercial real estate sector:

- Higher interest rates.

- Work from home trend.

- Shift to e-commerce.

As a result of this, a couple of REIT sectors are down significantly.

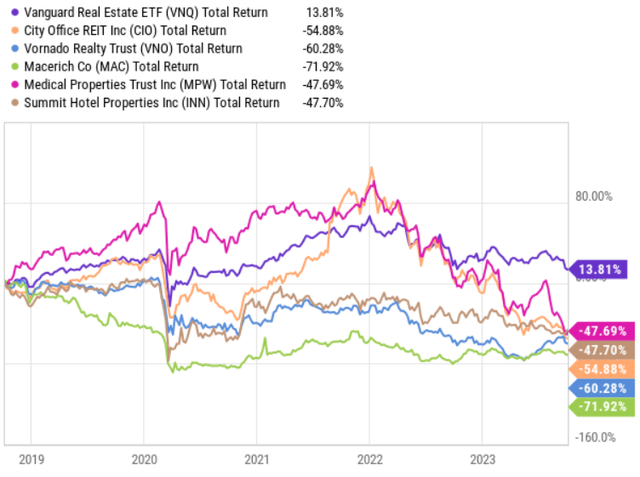

Ycharts

In the chart above, we can see how several REITs have clearly underperformed the overall REIT index. Interestingly, the sectors, that have diverged from the norm are those, which are especially subject to the work-from-home and e-commerce dynamics (i.e., office and retail REITs).

As it is sometimes the case with the stock market, the baby gets thrown out with the bathwater. This is especially relevant in the commercial real estate sector, which optically seems like a homogenous business with a simple buy-and-hold strategy, where the key is to borrow cheaply and buy properties with as high cap rates as possible.

This is clearly wrong. The commercial real estate sector consists of 10+ underlying segments (e.g., timber, office, retail, data centers, infrastructure, storage, etc). Each of these segments carries different cash generation characteristics and different risks.

For example, Prologis, Inc. (PLD) has managed to register a 5-Year AFFO CAGR of 11.5% and a recent YoY growth of 14.7%. At the same time, PLD’s share price has moved in synch with the overall REIT index declines.

Alexandria Real Estate Equities (ARE) is even greater example, where the market has treated the stock just as almost any other office REIT stock.

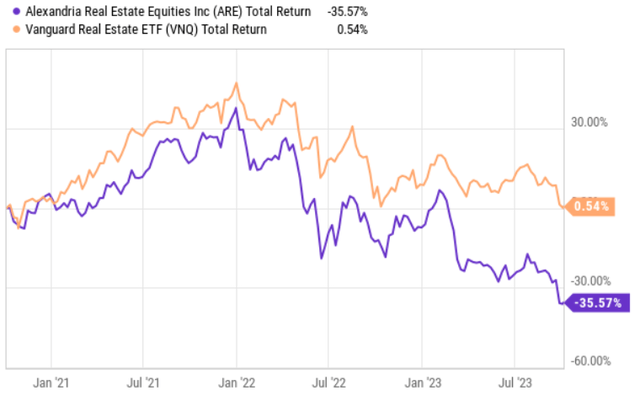

Ycharts

In the past 3-Year period, ARE has lost around 35% of its market cap, while the overall REIT index has remained flat.

The issue here is that ARE has a completely different risk profile than any other publicly traded office REIT. In ARE’s case, we are talking about A-rated balance sheet, AAA, and/or trophy properties, which are occupied by unconventional tenant bases (i.e., mostly life sciences and biotech firms that are immune to work-from-home dynamics).

Moreover, ARE has no debt maturities until 2025 with almost all of the existing borrowings locked in at fixed interest rates at around 3.5% level. So, the decline in ARE could not be justified by deteriorating demand for its properties or an elevated financial risk.

The fact that within the commercial real estate sector we see several disparities gives a favorable ground for active investors to seek and find value.

Different situations in REIT balance sheets

Most of the recent price declines in the REIT universe have stemmed from higher interest rates. For REITs having low levels of interest rate is vital to capture a positive spread between the cost of funding and property cap rates. This is how REITs create value.

Now, when the cost of financing or SOFR has increased in an aggressive and notable fashion, the REIT market is in shock.

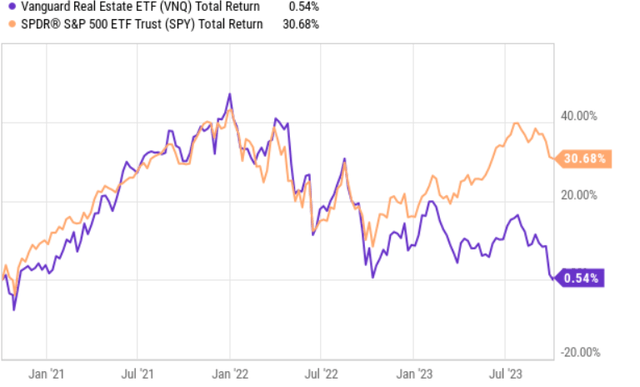

Ycharts

We can capture this story very nicely by looking at the chart above. In early 2023, when the market finally understood that high interest rates are not that transitory and that there is a meaningful probability of a higher for longer scenario, the REIT market completely diverged from the S&P 500.

In my humble opinion, this provides investors with yet another opportunity to assume an active approach since not all REITs are created equal.

Let’s take two examples.

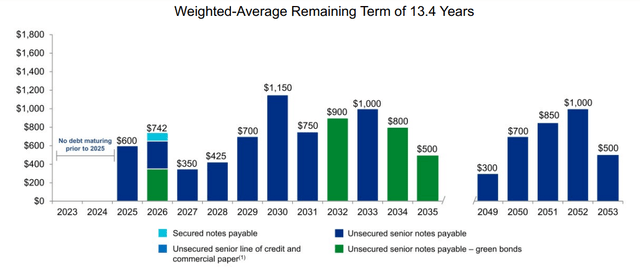

By exploring ARE once again, we find that for this Company the balance sheet is structured in a way, which mitigates well both the financial and interest rate risk. ARE has over 13 years of a weighted average remaining maturity term with no maturities until 2025.

ARE Investor Relations

The fixed charge coverage ratio is at 4.7x and net debt to EBITDA is at 5.1x. These are solid levels especially in the context of an upper investment grade credit rating. Plus, ARE has ~ $6.3 billion in liquidity that can be used for refinancing or accretive M&A.

In other words, while the interest rate has moved up impairing cash generation for many REITs, ARE is largely isolated from this at least until 2025. Again, this is a sign of incorrect punishment by the market.

However, in Global Medical REIT Inc. (GMRE) case, the picture looks a bit different. The weighted average remaining maturity term for GMRE is significantly shorter than for ARE. Here we are talking about 3.7 years with an embedded cost of financing at 4.28%, which, in turn, is considerably below the market level at which GMRE can borrow.

For GMRE the risk of weakening fundamentals and decreased cash generation is much bigger as first notable maturities kick in already in the next couple of years, where the likelihood of still having relatively high interest rates is strong. Through repricing (i.e., debt rollovers), the cash flows are set to drop materially.

So, the fact that we are seeing a synchronized decline in REIT market capitalization levels due to higher interest rates introduces great opportunities for active investors. Investors have now favourable conditions to identify and cherry-pick those specific REITs, which possess robust balance sheets with well-laddered maturity profiles but have fallen due to fears of higher interest rates.

The bottom line

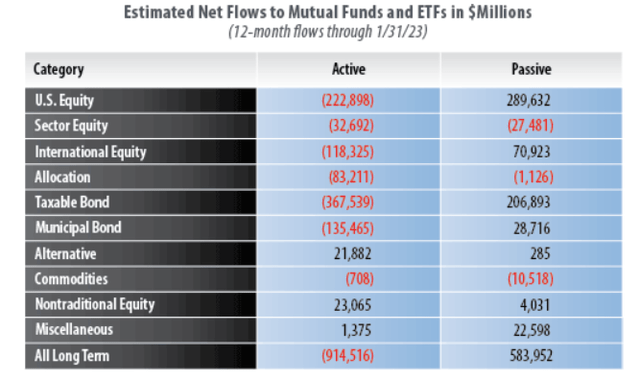

Passive flows and passive investing strategies have dominated for already many years in a row. Currently, it seems that the trend has not changed with passive money dominating the overall investing landscape. Their logic or argumentation for the passive approach is strong and understandable.

Yet, the REIT market at this particular moment presents very great opportunities for active investors due to the market’s misunderstanding of commercial real estate and many REITs possessing fundamentals, which are immune to the drivers of recent price declines in the REIT market.

Morningstar Direct Access Flows

All in all, this is a very favourable environment for active REIT investors to leverage their insights with an aim to identify companies, which have been unfairly punished.

Read the full article here