Over the past few months, Overstock.com, Inc. (NASDAQ:OSTK), now officially rebranded as Bed Bath & Beyond has experienced a period marked by significant events. The acquisition of Bed Bath and Beyond in June garnered positive attention from consumers, propelling the stock to notable gains. However, a noticeable downturn has since occurred, with the stock plummeting from approximately $40 per share in August to its present trading value of $17 per share.

Stock trend year to date (SeekingAlpha.com)

While the current stock price and rebranding may seem like a good buying opportunity, there are some significant concerns to consider. These include declining revenue and lower profit margins, the impact of rising mortgage rates on the home furnishing sector, uncertainties about integrating the acquired business, and a prevailing negative market sentiment indicated by a substantial 10.67% short interest. Despite recent insider buying, it’s wise for investors to exercise caution until the acquisition’s outcomes become more evident. Therefore, I maintain a wait-and-see ‘Hold’ rating ahead of the quarterly results.

Company update

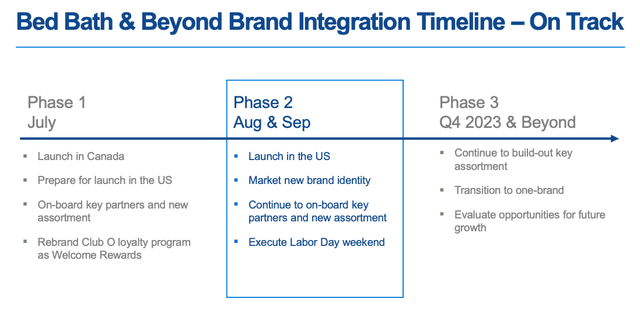

In my prior article, I provided an overview of the company. Overstock recently completed the acquisition of Bed Bath and Beyond for $21.5 million, encompassing its intellectual property (IP), customer database, websites, and brand name. The official rebranding to Bed Bath & Beyond occurred in August 2023. It’s noteworthy that the company has successfully acquired new customers and re-engaged previous ones, which is viewed as a positive development.

Bed Bath & Beyond acquisition timeline (Investor presentation 2023)

Although the integration had an initially favourable response, a closer look at the company’s financial performance over the past year in the last quarter indicates disappointing results that may cause significant concern significantly if market uncertainty increases. In the previous five consecutive quarters, the company has failed to meet EPS expectations and Q2 2023 was disappointing, with a decrease in revenue. It’s important to note that these figures may also be influenced by the current market conditions, which are characterised by high-interest rates and inflation. Furthermore, acquisitions typically require time to generate returns, and it’s still early in this process. Notably, director Marcus Lemonis demonstrated confidence in the company through insider buying, investing $493,020 in shares, resulting in a 3% increase in stock price. Additional actions, such as insider buying and stock buybacks, could strengthen investor confidence.

Financials and valuation

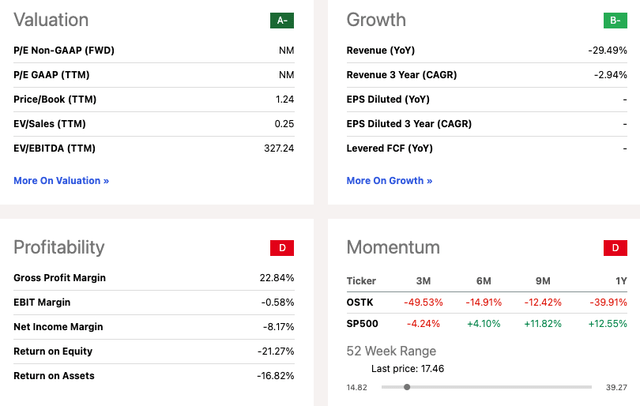

Overstock’s revenue performance has closely mirrored the fluctuations brought about by the COVID-19 pandemic, with peak sales occurring in FY 2021. However, over the past two years, sales have declined, and the TTM revenue of $1.67 billion falls short of pre-COVID levels. The TTM gross profit of $381.1 million has also seen a year-on-year reduction. It’s worth noting that the company has managed to enhance its gross profit margin, which now stands at 22.84%, compared to 19.43% in FY2018.

Annual revenue (SeekingAlpha.com)

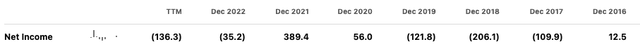

The company’s net income has displayed a consistent downward trend and has been marked by inconsistency. The TTM net loss currently amounts to $136.3 million. Moreover, the company has faced challenges in meeting EPS expectations, with five consecutive quarters of misses. These outcomes raise concerns about the company’s ability to inspire confidence in future forecasts and performance.

Annual net income (SeekingAlpha.com) Quarterly earnings (SeekingAlpha.com)

Reviewing the company’s levered free cash flow reveals a concerning trend, with a negative TTM figure of $58.9 million, indicating an increase from the previous year. Ideally, a positive levered free cash flow is desired as it enables the company to reward investors, settle debts, and reinvest in business growth.

Annual levered free cash flow (SeekingAlpha.com)

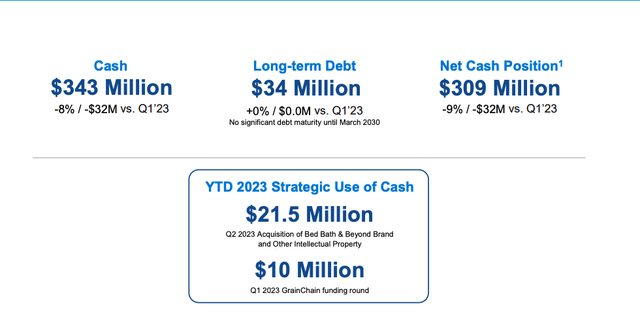

Examining the balance sheet, it’s worth noting that the company doesn’t have any significant debt coming due until March 2030. Moreover, it maintains a cash balance, excluding long-term debt, amounting to $309 million. However, it’s important to highlight that this figure has experienced a 9% decline compared to the previous quarter of 2023.

Balance sheet overview (SeekingAlpha.com)

The stock is presently trading significantly below its average price target of $38.17, offering a substantial upside potential of 118.61%. Additionally, the price-to-book ratio is relatively low at 1.24, which could serve as an attractive proposition for potential investors. However, it’s crucial to note that the stock has been losing momentum consistently over the past year, with particularly weak performance in comparison to the S&P 500 index. While the acquisition of a formerly beloved brand holds promise for the company, the ongoing decline in revenue and negative earnings position it as a risky investment.

Quant rating (SeekingAlpha.com)

Risks

Overstock is currently at an attractive pricing point; however, there are a number of risks to consider. First, the company’s recent acquisition of Bed Bath and Beyond presents integration challenges and uncertainties about the success of this venture. Additionally, Overstock’s financial performance, including declining revenue and gross profit margins, raises concerns about its ability to navigate a competitive market. Economic factors, such as rising mortgage rates impacting the housing market, can further hinder Overstock’s growth potential. Furthermore, the volatile nature of the stock price and its susceptibility to market sentiment make it a riskier investment.

Final thoughts

The recent acquisition of Bed Bath & Beyond presents both opportunities and challenges; while the brand can boost the company’s performance in the long run, there are still concerns regarding a declining top and bottom line and negative levered free cash flow. The integration of the companies may be costly and timely. Therefore, I recommend a wait-and-see-hold recommendation ahead of the quarterly earnings.

Read the full article here