Investment Thesis

Apartment Investment and Management (NYSE:AIV) is a self-administered and self-managed real estate investment trust (REIT) that is a premier owner and operator of multifamily real estate properties in select U.S. markets. As of June 30, 2023, the Company operated 26 apartment communities, 22 of which are consolidated properties with 5,640 apartment homes and four unconsolidated operating properties. AIV also owns one commercial office building, one 106-room hotel, three residential apartment communities with 1,185 apartment homes, of which 276 have been completed, and another 909 are planned, a single-family rental community with 16 planned homes, plus eight accessory dwelling units, and several land parcels. The Company also holds other alternate investments, such as a Mezzanine Investment in Parkmerced Apartments, an investment in IQHQ, a privately held life sciences real estate development company, and an investment in real estate technology funds.

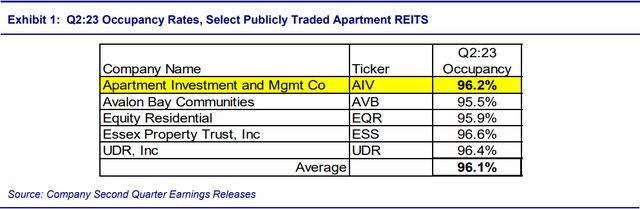

AIV’s occupancy rates for its stabilized portfolio at the end of Q2:23 were 96.2%, which compare very favorably versus industry peers. The Company’s development pipeline looks extremely strong, with over 1,000 new units expected to come online in the next 18 months, which will grow stabilized units by close to 20% and has the potential to grow recurring revenues at an even faster pace. AIV has a solid funding pipeline in place to facilitate near-term development plans.

Management also has shown strong interest in returning value to shareholders. While AIV is not currently paying a dividend, as it is still in a rapid growth phase of its evolution, management has proactively returned value to shareholders in recent quarters through share repurchases. Since January 2022, AIV has repurchased 7.3 million shares of common stock and, at the end of H1:23, had a standing authorization to repurchase up to another eight million shares.

Strong Occupancy Rates on Stabilized Portfolio Provide Predictable, Healthy EBITDA

AIV has a solid stabilized portfolio of apartment communities, which are benefiting from their locations within generally strong and growing metropolitan markets in various parts of the United States. During H1:23, the stabilized portfolio delivered NOI growth of 11.4% and boasted an occupancy rate of 96.2%. This occupancy rate is slightly above the average of the much larger and more mature peer group, as detailed in Exhibit 1 below.

Company Second Quarter Earnings Release

Average monthly revenue per apartment in Q2:23 was $2,291, which was up $230, or 10%, year-over-year. Net operating income for the stabilized portfolio was $51.0 million in Q2:23, up 11.4% versus $45.8 million in Q2:22. The NOI from the stabilized portfolio was enough to cover the Company’s overall gross interest expense in Q2:23 by 5.3 times, illustrating the overall strength and stability that it provides to AIV as management works to grow the Company through its development and redevelopment efforts.

Robust Development Pipeline Offers a Bright Future and Growth Catalyst

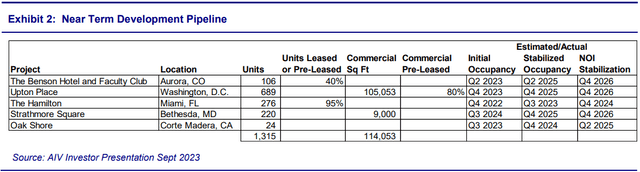

AIV is relatively small versus many of the much larger, more established peers in the apartment REIT space, but that just means that it takes significantly less to grow the Company’s revenues and NOI meaningfully. The Company has a very robust development pipeline that will grow revenue and NOI much faster than the peer group of apartment REITs. Exhibit 2 illustrates some of the details of AIV’s near-term development pipeline.

Investor Presentation

AIV’s stabilized portfolio only consisted of 5,600 units at the end of Q2:23. As the table above shows, an additional 1,315 units will come online on the next five quarters, increasing the Company’s rentable units by 23%. We also expect that the new inventory will grow AIV’s revenue at an even faster pace, as the new units are likely to collectively command rents that are higher than the Company’s existing average rent. The table also illustrates how strong the demand is for these new units, with the 95% pre-lease rate on The Hamilton in Miami, Florida.

While the development pipeline offers strong growth potential, it also offers the opportunity to pursue asset sales that could quickly improve an already strong balance sheet while helping management to focus on core assets. For example, The Benson Hotel in Colorado is not an apartment complex that management would deem a core asset. As a high-end hotel property, if an operator were to come along and offer AIV a great valuation for the property, such as $350,000 to $400,000 per key, management might be inclined to divest this asset and recycle the capital.

Looking more specifically at each of these development projects, management provided details in the Q2:23 earnings release on progress at each. In Aurora, Colorado, The Benson Hotel and Faculty Club, featuring a 106-room boutique hotel and 18,000 square feet of event space, is complete and open to guests. Surrounded by the Anschutz Medical Campus, which includes the University of Colorado Medical School, UC Health Hospital, Children’s Hospital Colorado, The Rocky Mountain VA Center, and the Fitzsimons Innovation Community, the hotel has seen strong interest in bookings already and is expected to perform extremely well. In Washington, D.C., construction at Upton Place remains on schedule and on budget. Pre-leasing of the property’s 689 apartment homes began in July 2023, with anticipated initial delivery in Q4:23, and 80% of the property’s retail space has already been leased. In Miami, construction and repositioning of The Hamilton is complete, and as of July 31, 2023, 96.2% of the building’s 276 units have been leased or pre-leased at rates more than 20% higher than the underwritten rents. In Bethesda, Maryland, construction is on plan for the first phase of Strathmore Square, which will contain 220 apartment homes with initial delivery on track for Q4:24. In Corte Madera, California, construction is ongoing at Oak Shore, where 16 luxury single-family rental homes and eight accessory dwelling units are being developed, and initial delivery is expected in Q3:23.

Target Markets

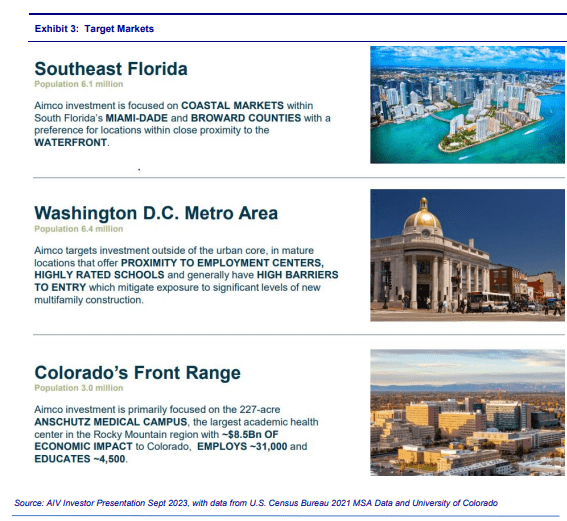

Looking more holistically at AIV’s longer-term development pipeline, the Company is very specifically focused on three core target markets: Southeast Florida (with an emphasis on the Miami and Ft. Lauderdale), the Washington, D.C. metropolitan area, and Colorado’s Front Range. Exhibit 3 below, from management’s September 2023 presentation, better illustrates some of the highlights of this core target market strategy.

Investor Presentation with Data From US Census Bureau 2021 MSA Data and University of Colorado

Taking a closer look at each of these markets, it is evident that populations are either stable or growing. According to recent U.S. Census data, Denver, Colorado, is the 12th fastest-growing metropolitan area in the United States, with population having grown 14.6% between 2010 and 2023 to its current level of approximately 2.93 million people. The Washington, D.C., metropolitan area is the 6th largest MSA in the United States, according to U.S. Census Bureau data, and has also seen meaningful population growth in the past two decades. The Miami, Florida, MSA, which includes Ft. Lauderdale, currently ranks as the 9th largest MSA in the country and has also seen healthy population growth over the past two decades. Given this information, we believe that AIV has chosen to focus on three excellent markets for the Company’s long-term development and redevelopment pipeline.

Alternative Investments

In addition to the robust portfolio of apartment complexes that AIV owns, the Company also has several alternative investments that need to be considered when evaluating the overall value of the enterprise.

- Parkmerced. The first of these investments is a mezzanine loan investment in Parkmerced apartments in southwest San Francisco. In November 2019, the Company made a five-year, $275 million mezzanine loan to the partnership owning Parkmerced. On a periodic basis, AIV evaluates the investment for impairment and took a non-cash impairment charge of $212.6 million to reduce the carrying value of the investment to $158.6 million as of December 31, 2022. On June 23, 2023, the Company announced it had closed on the sale of a 20% non-controlling interest in its Parkmerced mezzanine loan investment for $33.5 million. Pursuant to the terms of the agreement, the purchaser will have the option to acquire the remaining 80% for an additional $134 million plus interest accruing at no less than 19% annually through May 2024. The purchaser pre-paid $4 million of interest at the time of closing.

- IQHQ. During 2022, AIV invested $50 million in a passive equity investment in IQHQ Inc., a life sciences developer. In July 2022, the Company redeemed 22% of its investment for $16.5 million. AIV retains 2.4 million shares worth $59.7 million and the opportunity to collaborate with IQHQ on future development opportunities that include a residential component.

- Property technology funds and other. AIV owns an interest in property technology funds consisting of entities that develop technology related to the real estate industry. During 2022, the Company acquired 14.9 acres of land in its target markets and subsequently sold 0.8 acres in Ft. Lauderdale.

Management constantly evaluates opportunities to invest or divest assets, such as the alternative investments discussed in the preceding section. As can be seen from the recent monetization of a portion of the Parkmerced mezzanine investment, management is primarily focused on the core apartment community portfolio while trying to take advantage of alternative investment opportunities very selectively.

Solid Capital Structure and Financial Profile

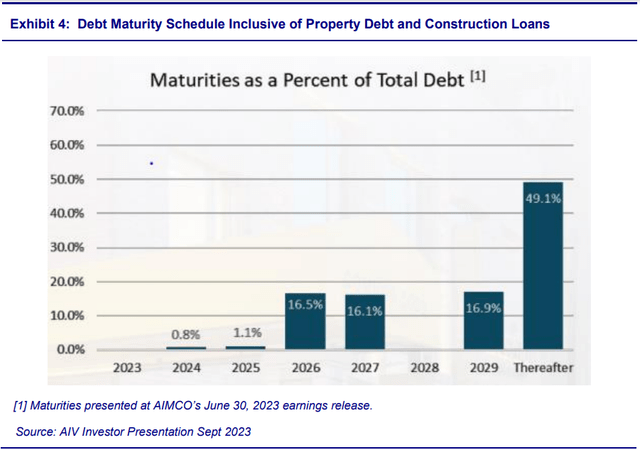

One potential concern when considering an investment in a REIT is that they typically do utilize leverage in a meaningful way in their capital structure. In a rising interest rate environment, this outcome becomes a particularly significant concern, as higher rates lead to higher interest expenses, giving the Company less available capital for expansion. AIV has a rock solid debt maturity profile, with a weighted average cost of debt, including interest rate caps, of 5.28%. The Company’s debt maturity schedule from their most recent investor presentation is displayed in Exhibit 4 below.

Investor Presentation

As the table shows, approximately 66% of the Company’s debt service occurs in or after 2029, with no material debt maturities occurring before 2026.

On the liquidity side, the Company exited Q2:23 with $192.4 million in cash and restricted cash on the balance sheet and had access to an additional $147 million of available credit, which should be more than sufficient to fund current development and redevelopment efforts.

Competition

AIV’s competition varies in each of the markets where the Company’s communities are located. Broadly speaking, AIV competes against all other potential housing alternatives that are present in any given market, from single-family homes to other apartments, townhomes, and even hotel assets. There are also many other developers, managers, and owners of apartment real estate and undeveloped land, as well as REITs, private real estate companies, and investors, that compete with AIV in acquiring, developing, obtaining financing for, and disposing of apartment communities. Some of the specific, publicly traded apartment REITs that investors may be inclined to compare AIV to include AvalonBay Communities (AVB), Equity Residential (EQR), Essex Property Trust (ESS), and UDR, Inc. (UDR). This competition can impact AIV’s ability to realize its development and transactional goals.

Investment Risks

- Adverse economic and geopolitical conditions, local, regional, or national health crises, or dislocation in the financial and credit markets could have a material adverse impact on AIV’s business operations.

- Development, redevelopment, and construction risks could affect AIV’s profitability and ability to grow revenues, earnings, and cash flow.

- AIV does have meaningful borrowings, and continuing increases in interest rates could cause interest expense to rise to a level that is challenging for the Company to service.

- With exposure to only a few metropolitan areas in the United States, a material adverse change in the local economy of any of those areas could materially impact the Company’s financial results.

- Rent control laws and other regulations limit AIV’s ability to increase rental rates, which could negatively impact rental revenues, income, and profitability.

Valuation

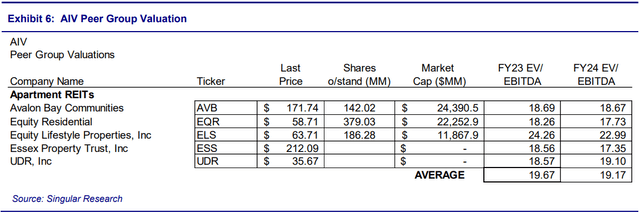

We value AIV using a peer group analysis valuation framework, as well as a Net Asset Value (NAV) valuation. There are several publicly traded competitors that enable a reasonably healthy comparable company analysis. The identified peer group is shown in Exhibit 6 below.

Singular Research

The publicly traded company comp group trades at an average multiple of 19.7 times projected FY:23 EBITDA. But, very importantly, note that they trade at 19.2 times projected FY:24 EBITDA, which implies that EBITDA growth for these peers is expected to be very modest in FY:24. Conversely, we are expecting AIV to grow EBITDA by 23% in FY:24. Therefore, we believe that AIV should trade at a material premium FY:23 EBITDA multiple to the peer group, and value the Company at 30.0 times our FY:23 EBITDA forecast. This valuation method produces a price target of $11.25.

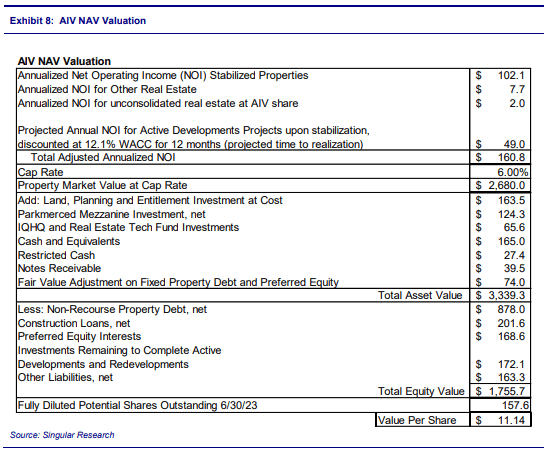

As an alternative, we used an NAV valuation methodology. We start with projected NOI once the current developments are fully online and stabilized. We discount the projected NOI from the development portfolio by our weighted average cost of capital of 12.1% to calculate an adjusted projected annual NOI of $160.0 million. We divide by a 6% cap rate to discount, then add the Company’s assets, subtract liabilities, and divide by the potential fully diluted shares outstanding to arrive at a NAV price target of $11.14 per share. Exhibit 8 below details this valuation.

Singular Research

Blending our two valuation models, we arrive at a twelve-month average price target of $11.19, which we round up to $11.20 per share.

Read the full article here