Shares of Valley National Bancorp (NASDAQ:VLY) have been a poor performer over the past year, losing about 30% of their value. Rather than being an idiosyncratic issue, VLY has been brought down by weakness across regional banks (KRE), which have similarly lost about a third of their value. Interestingly, VLY has not fallen victim to issues plaguing much of the industry, and so I believe shares may offer compelling upside.

Seeking Alpha

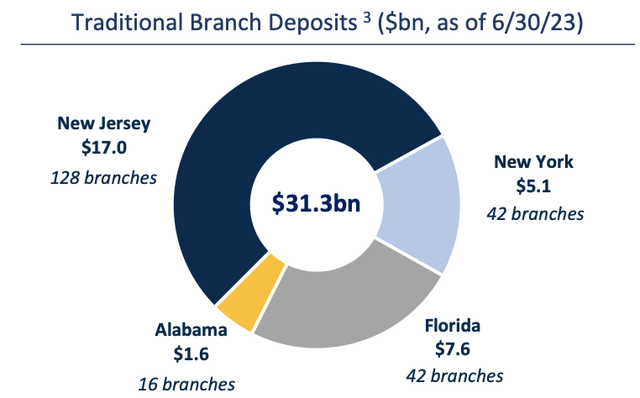

Valley National is a regional bank with about $60 billion in assets. As you can see, the majority of its branches are in New Jersey, with meaningful presences in New York and Florida. While it funds itself largely in New Jersey, a larger share of its lending does occur in New York, given how much New York City drives the region’s economic activity.

Valley National Bancorp

While Valley has historically operated in the New Jersey/New York market, it has essentially followed its customers into Florida, building out a presence in the Sunshine State. From 2014-2018, it executed on several mergers, most notably with USAmeriBancorp, to expand its presence in Florida, and Tampa specifically. Florida was the fastest growing state last year, with Tampa Bay driving much of that growth. This growth opportunity has helped to complement its presence in the more mature NYC-area market, as well as serve its customers who spend time in both regions. Additionally, in Q2 2022, Valley completed a purchase of Bank Leumi’s US assets, deepening its presence in the NYC metropolitan area as well as Miami while providing some lending exposure to Chicago and Los Angeles.

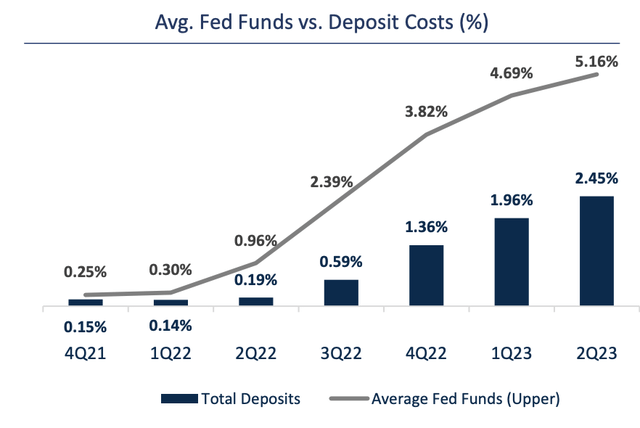

In the company’s second quarter, Valley did see adjusted EPS fall to $0.28 from $0.32 last year, as it faces the headwinds of higher funding costs. The collapse of Silicon Valley Bank and First Republic Bank created a scramble for deposits earlier this year, which has raised the costs for all banks. Valley was not immune from this trend.

As you can see below, its deposit funding costs rose 49bp in the quarter to 2.45%–that is up by 226bp from last year. Last year, banks were able to pass on little of the Fed’s rate hikes to their customers, while this year nearly all of the increase has been passed on.

Valley National Bancorp

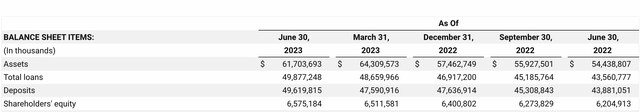

Importantly, Valley has actually been able to grow deposits throughout this crisis, bucking the trend. Deposits were largely flat in Q1, and they rose by $2 billion during Q2. Valley has been a bank that depositors are going to, not running from. Given it has been gaining share, Valley likely has room to cease, or materially slow deposit rate increases.

Valley National Bancorp

It is interesting that Valley has been a winner in this fight among bank for deposits, as many felt in the wake of SVB’s failures that large depositors would shift to “too big to fail banks” and away from smaller ones, like Valley. Indeed, a plethora of regional banks have reported deposit declines this year. Valley benefits from the fact that just $12 billion (about 25%) of its deposits are uninsured. Insured depositors have much less incentive to leave, and VLY’s average account is just $58,000. One could say Valley is a ”boring” commercial bank, but boring has won over the past year. 80% of Valley’s depositors have also been with the bank for over 5 years, providing an important degree of loyalty during a tumultuous period.

Critically, Valley did not face the underlying financial issue that sparked much of this crisis. Most banks, in addition to loans, have large securities portfolios of high-quality fixed income. Given how much rates have risen, these securities portfolios are underwater, with large losses sitting in accumulated other comprehensive income. VLY does not hold a large securities portfolio like this, focusing its asset base more into loans.

It has just $5 billion of securities (8% of assets). As a consequence, its AOCI loss is a relatively negligible $165 million (less than 3% of equity). By comparison, other regional banks like Zions Bancorp (ZION) have 30% assets in securities, and factoring in losses would reduce Truist’s (TFC) capital by nearly a third. To be clear, TFC and ZION are in-line with the norm in regional banks; VLY is the exception. While other banks will take several years to see their securities portfolios recover, holding down net interest income, Valley simply does not face that headwind.

Still, given the industry-wide rise in deposit costs, Valley’s net interest margin (NIM) was 2.94%, down 49bp from last year, and 66bp from its Q3 peak. Net interest income fell $16 million sequentially to $421 million. Its average loan yield was 5.78%, which was up 58bp from last year. This helped to partially offset higher deposit costs, but it could not offset the entire increase.

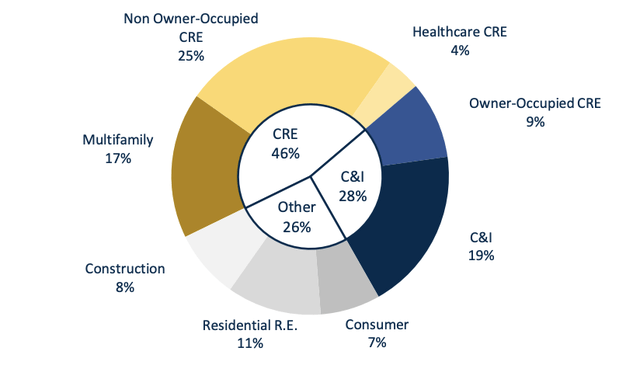

Drilling into Valley’s loan book, loans rose about 2.5% to $49.9 billion. As with most regional banks, commercial real estate is the largest component of its loan book, followed by commercial & industrial loans (business loans), and consumer loans.

Valley National Bancorp

Commercial real estate has been a key focus area, given the rise in interest rates and shift to remote working, and it is important to drill into Valley’s exposure here. Importantly, just 10% of its CRE is non-healthcare office ($2.8 billion), which is the primary area of concern. This is less than 6% of Valley’s total loan book, a manageable sum. There are also just $153,000 of non-accruing loans, so as of now, this portfolio is performing extremely well.

This portfolio is also well diversified—Valley is not just exposed to a handful of large loans. The average loan size is $2 million. The average loan to value is 51% for office space, below the 58% across its total CRE portfolio. Given this low LTV, property values can fall significantly before Valley would actually take a loss, and losses it does take on any defaults would likely be less severe.

The portfolio has some geographic diversity with: Florida 25%, New Jersey 20%, and New York is 33% (10% Manhattan, 13% other boroughs, 10% rest of New York). I also am comforted by the fact 72% of these properties have multiple-tenants. When you have just one tenant, if that tenant chooses not to renew, it can imperil the building’s viability, but with several, occupancy declines, should they occur, will be more gradual and manageable.

Commercial real estate is a risk to watch—there is no doubt, given well-known headwinds. That said, Valley has constructed its portfolio in a responsible way that should help it navigate through the downturn.

In fact, while many banks have seen credit deteriorate, Valley has seen improvement as rising economic activity has helped businesses in the region recover. A smaller share of loans are non-accruing. Charge-offs were also a light $9 million last quarter, leading the bank to take just $6 million in provisions.

Valley National Bancorp

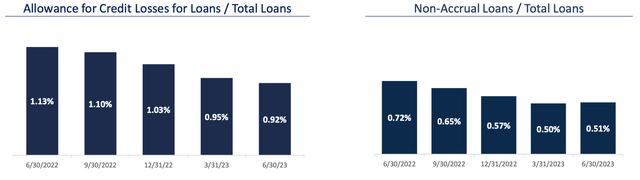

Alongside the decline in non-accruals, Valley’s allowances as a share of loans have fallen to 0.92% from 1.13%. Still, these $459 million in reserves provide almost 2x coverage of current non-accruals. Valley’s reserves are based on a 50% weighting to downside economic scenarios (30% negative, 20% severely negative) and 50% baseline, and the “performance of the portfolio continues to be exceptionally strong” according to management. If the economy were to worsen, credit costs may rise, but Valley’s reserves do appear sufficient given the actual trends in the portfolio.

Valley also has a solid capital position with a common tier one equity ratio of 9%. This supports it continuing to pay its $0.11 quarterly dividend, which offers a 5.5% yield. Shares are also trading at a 5% discount to tangible book value of $8.51. Given how well the franchise weathered the storm this year, I view that discount as unjustified.

Assuming a further 10bp compression in NIM as we have a full-quarter impact of deposit increases in Q2, a flat ACL/total loans ratio, and 5% annualized loan-growth (half of last quarter’s pace), earnings over the next twelve months would be $1.08-$1.20.

That gives shares a ~7x earnings multiple. Valley may be a small bank that gets less attention, but over the past year, it has shown that it can perform well and gain market share, even during a crisis when big banks were expected to do better. This is an attractive entry point to buy into VLY with a 7x multiple and discount to book value. Most regional banks are trading at a single digit multiple, which will cap multiple expansion, so I would look for shares to move back to $10, or about 9x earnings as Valley continues to report solid results, providing about 25% upside, on top of the dividend.

Read the full article here