In an ideal world, investing would be a simple and easy process. But when you are picking individual companies to buy into, the picture gets complicated very quickly. One thing that investors always need to balance is the ratio between how cheap companies are and other risk factors that might justify the price at which shares are trading. A really good example of this that I would like to delve into involves Hope Bancorp (NASDAQ:HOPE), a fairly small community bank with a market capitalization of $1.06 billion as of this writing. Leading up to the present year, management has done well to grow both the top and bottom lines of the bank. But this year, we have seen some weakness. Shares have taken a tumble since earlier this year and have barely recovered. This could represent a good buying opportunity for value-oriented investors, especially given how cheap the stock is. However, when you factor in some of the negatives inherent in acquiring the stock, I don’t think that this is as clear-cut a bullish prospect as many might like it to be.

A cheap bank

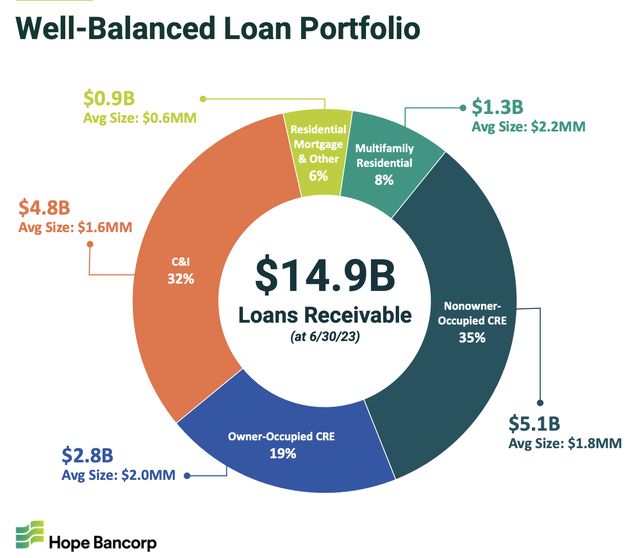

According to the management team at Hope Bancorp, the institution operates as a bank holding company that is based out of Los Angeles, California. As of the end of its 2022 fiscal year, the bank had 54 branches and 10 loan production offices spread across the markets in which it operates. Through these locations, the company provides customers with deposit services. It operates 24-hour ATMs, and engages in a wide variety of lending activities. On the lending side, the bank is fairly diverse. For instance, it does provide commercial business loans, such as those that are used by individuals and small businesses in order to acquire companies, purchase real estate, and more. Real estate loans, including both for commercial real estate and residential real estate, are also offered up. The company gives out loans for purchasing cars, and it provides home equity lines of credit to those that need them. It even has a history of originating SBA loans. And lastly, the company engages in various investments, including the purchase of government securities, and equity investments.

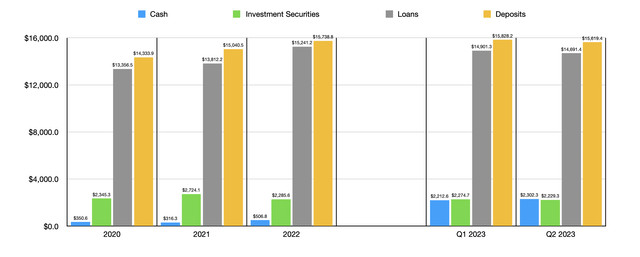

Author – SEC EDGAR Data

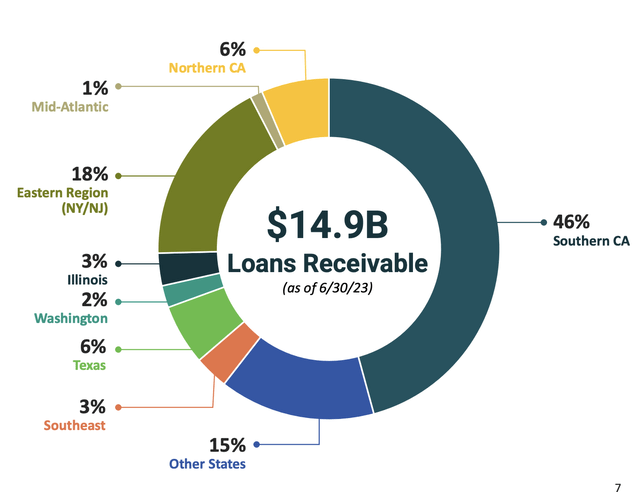

In the years leading up to the current year, management had done well to grow the company’s physical footprint. The value of loans on its books expanded from $13.36 billion in 2020 to $15.24 billion in 2022. Unfortunately, since then, the institution has seen a bit of a pullback. As of the end of the most recent quarter, which would be the second quarter of the 2023 fiscal year, Hope Bancorp had seen the value of loans on its books drop to $14.69 billion. Geographically, the greatest exposure to the company is in Southern California. 46% of its loans, by value, stem from that region. Another 6% of loans involve Northern California, bringing total exposure to that state up to 52%. Outside of that, the greatest exposure is to New York and New Jersey, with a combined 18%.

Hope Bancorp

One thing that separates Hope Bancorp from most banks is that it concentrates on a specific demographic. According to management, in the areas in which it operates, areas that are heavily dominated by individuals of Korean origin, it represents both 46% of the total loans and 46% of the total deposits stemming from or going to Koreans. I do understand that one area of the economy that many are worried about, justifiably, involves office spaces. As of the end of the most recent quarter, only $464 million, or 3.2%, of the company’s loan portfolio is dedicated to these types of assets. The actual number might be a bit higher than this. I say this because it has another $835 million of exposure to mixed-use properties. And it is possible that some of those could involve office spaces. But even if it were 100% of the mixed-use picture, it would still be a very small percent of the company’s overall portfolio exposure.

Hope Bancorp

Though not unique to Hope Bancorp, it is a bit peculiar because of how much of its assets are held in both cash and securities. As of the end of the most recent quarter, the bank had $2.30 billion in cash and cash equivalents on its books. This is up from only $506.8 million reported at the end of 2022. Securities, however, have long been elevated. At the end of the most recent quarter, they totaled $2.23 billion. From 2020 through 2022, they were around the $2.2 billion to $2.7 billion range.

Author – SEC EDGAR Data

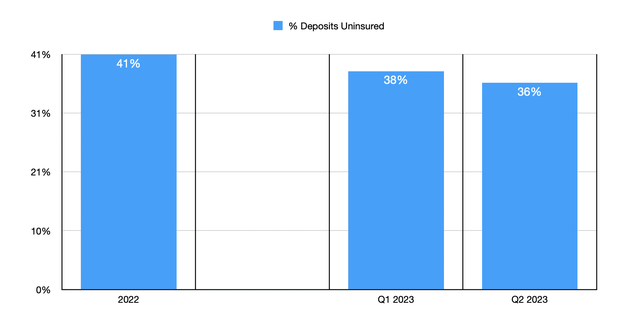

The next thing that we have to discuss from an asset and liability perspective would be the deposits that the bank has. From 2020 through 2022, its deposit values rose from $14.33 billion to $15.74 billion. After climbing further to $15.83 billion at the end of the first quarter, we saw a drop of $208.8 million to $15.62 billion by the end of the second quarter. This corresponds with the cash outflows seen at many other banks because of the banking crisis that began in March. Over the past two quarters, the firm’s exposure to uninsured deposits has fallen. At the end of last year, the company had $6.48 billion, representing 41% of its deposits, that were classified as uninsured. By the end of the second quarter, this had fallen to $5.58 billion, or 36%, of the company’s deposits. Frankly, the direction that uninsured deposit exposure is moving is what I like to see. But in order for an investment opportunity to be truly appealing to me, I would like that number to be 30% or lower.

Author – SEC EDGAR Data

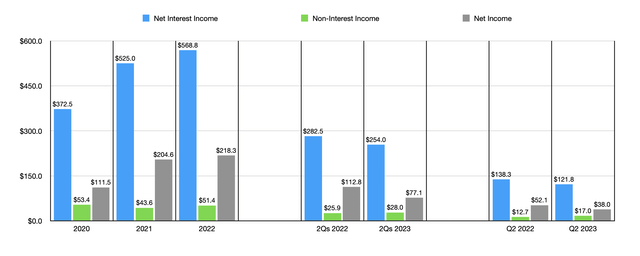

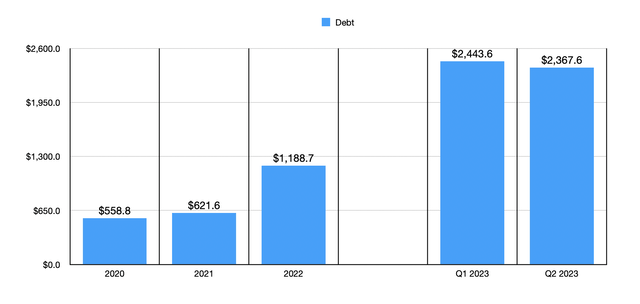

The increase in assets that the bank has experienced in recent years played a large role in the expansion of its top and bottom lines. In 2020, the bank generated $372.5 million in net interest income. By 2022, this had grown to $568.8 million. As you can see in the chart that references income statement data, non-interest income has remained in a fairly narrow range in recent years. But net income has succeeded in almost doubling from $111.5 million to $218.3 million. Unfortunately, this year is turning out to look a bit different. Net interest income and net income are both down year over year, irrespective of whether we focus on the most recent quarter alone or the first half of the year in its entirety. The drop in loans was partially responsible for this. Also, problematic was a decline in the company’s net interest margin from 3.28% in the first half of last year to 2.85% the same time this year. That is a common occurrence during these times, with banks having to compete with other investment opportunities for client funds. On top of this, the bank also saw its debt increase materially. At the end of 2022, it had debt of $1.19 billion. Today, that number is $2.37 billion. This leads to additional interest expense that ultimately hurt the firm’s top and bottom lines. The likely reason behind this increase was to bolster liquidity during uncertain times. As I mentioned earlier, deposits did decline so, in order to stave off fears and avoid having to sell off assets at a major discount, the company borrowed. The good news is that this increase in debt has allowed the company to boost its cash reserves, as disclosed a couple of paragraphs earlier.

Author – SEC EDGAR Data

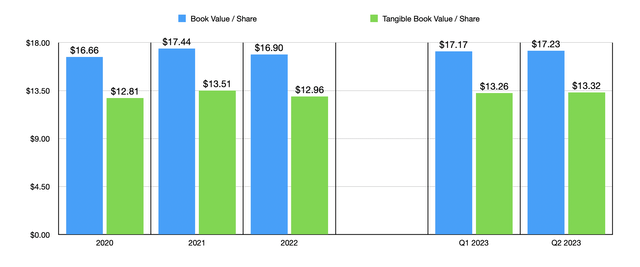

Despite this recent pain, management has been successful in growing both the book value per share and the tangible book value per share of the bank. At the end of 2022, these numbers were $16.90 and $12.96, respectively. And today, we have readings of $17.23 and $13.32, respectively. In fact, when you compare these figures to the company’s share price, you might be in something of a shock. The firm is trading at only about half of its book value of equity and at 64% of its tangible book value. If we use data from 2022, the stock also looks cheap on a price to earnings basis, with a price to earnings multiple of 4.9. I’m pretty sure this is the cheapest bank that I have seen using this particular metric. Even if we annualize results experienced so far for this year, the forward price to earnings multiple comes in at 7.1.

Author – SEC EDGAR Data

There is one more thing that should be discussed: earnings. Although management has not yet revealed when they will announce financial results covering the third quarter of the 2023 fiscal year, that date will likely be sometime later this month. At present, analysts have rather negative expectations for the quarter. Revenue is forecasted to come in at $147.7 million. The definition of revenue that they use is net interest income without factoring in provisions for credit losses, plus non-interest income. If this does come to fruition, it would translate to a decline compared to the $166.6 million reported one year earlier. Earnings per share, meanwhile, are expected to come in at around $0.24. That would represent a significant drop compared to the $0.45 per share reported in the third quarter of 2022. This would take net profits from $53.7 million last year to only $29 million this year. Frankly, given the performance seen so far this year, that would not be surprising.

Takeaway

If we use February 28th of this year as the starting point, shares fell as much as 42.1% during the heights of the banking crisis. But even today, the stock is down 33.1% from that time. This means that it has barely recovered at all. Given how cheap the bank is, I would argue that significant upside potential does exist. However, I don’t like seeing the decline in deposits and loans. The increase in debt is less than ideal, and uninsured deposit exposure is greater than I would like it to be. Because of all of these factors combined, I cannot help but to rate the enterprise a ‘hold’ for now. But if this picture changes when management reports third quarter earnings data, I could change my mind.

Read the full article here