Investment Thesis

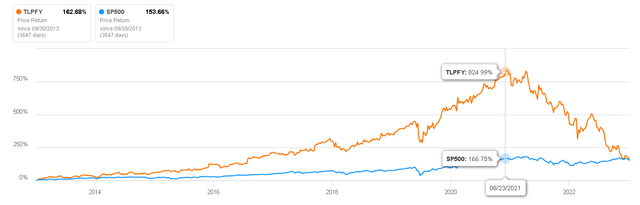

Teleperformance (OTCPK:TLPFF) serves as a striking example of how harsh the market can be when multiple challenges converge simultaneously. A company that once outperformed the index by a staggering 650% in 2021 is now experiencing a significant underperformance.

In this article, we will delve into what I consider to be the three primary concerns that have led to this substantial decline: the uncertainty surrounding how AI will impact the business, the substantial acquisition of a competitor, and the recent reduction in guidance. We will provide insights into each of these factors and I will elaborate on why I believe that, even when taking these issues into consideration, Teleperformance (OTCPK:TLPFY) remains a strong buy.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

Teleperformance is an outsourcing company specializing in customer experience management, which includes services like customer support, technical support, sales, and related assistance. They offer these services on behalf of over 1,200 clients, ranging from large multinational corporations to smaller businesses. Teleperformance operates contact centers and customer interaction hubs, employing a vast workforce to manage customer inquiries and support requests through various channels such as phone, email, chat, and social media.

These services hold particular value for companies looking to harness specialized expertise and resources to enhance their customer service and operational capabilities, thereby improving customer satisfaction and loyalty through the delivery of high-quality customer service. Customer service is often the cornerstone of any business, and Business Process Outsourcing (BPO) offers these services at a lower cost, with the flexibility of not having to hire in-house employees with the required expertise and technology.

This is why Teleperformance’s services are in high demand among its clients and the market has growth projections between 8 and 10% annually by 2030.

The impact of AI

One of the most discussed topics regarding Teleperformance is the adoption of Artificial Intelligence (AI), and judging by the share price, it appears that the market is not particularly optimistic about it. There seems to be a prevailing belief that AI could potentially disrupt TEP business.

In the context of businesses like Teleperformance, the adoption of Artificial Intelligence holds the potential for significant positive impact on operations. One of the primary advantages is the potential for improved efficiency, as AI can automate routine and repetitive tasks, resulting in enhanced operational efficiency and cost savings. This automation can free up human resources to concentrate on more complex and value-added tasks, ultimately leading to improved productivity. However, AI struggles with handling complex, nuanced, or emotionally charged interactions. Resolving intricate customer issues, providing empathetic support, and understanding context often require human intervention, so AI will be a great tool for Teleperformance to reduce its operating costs, but it will not be a substitute for the company’s services.

It’s also important to note that integrating artificial intelligence into businesses is not a simple automatic process. Implementing AI solutions involves initial investments and integration costs. The upfront expenses and the complexities of seamlessly incorporating AI into existing workflows should not be underestimated. Therefore, it may make sense for Teleperformance clients to opt for outsourcing this task, enabling them to focus on their core business. Additionally, Teleperformance’s scale provides a competitive advantage, as the benefits of integrating AI into operations represent similar costs for smaller BPOs. The difference lies in Teleperformance’s greater financial muscle, allowing it to make this investment and reap the benefits sooner.

The Majorel Acquisition

On April 26 of this year, Teleperformance announced the purchase proposal of Majorel, offering 30 euros per share, equivalent to €3 billion. Majorel shareholders would also have the option to acquire Teleperformance shares at an exchange ratio of 0.14 Teleperformance share for each Majorel share, up to a maximum of €1 billion in Teleperformance shares, instead of receiving the cash of €30 per share.

Although the acquisition may seem expensive at first, with a 43% premium of the price at the time, the reality is that considering the FY2022 results, the €3 billion offered would represent a P/E ratio of 17x and an 8.7x EBITDA. The amount will be paid with €2 billion in cash and €1 billion in TEP shares (valued at €217), which will represent an 8% increase in the total number of shares in the company. It is not a bargain, but we must consider that Teleperformance would be acquiring a competitor that had a quarter of its revenue, creating a company with $12 billion in revenue, nearly 50% more than the revenue the company had during FY2022.

The market did not react favorably to this move at all; since the day the purchase was announced, the shares fell 12% in a single day. I understand the uncertainty that such a large acquisition can generate. However, the valuation at which it was made does not seem expensive to me, and the dilution of shares is not so significant, considering the increase in sales that it would entail. The company did not go into debt, which I think is the best news of all. Majorel grew by 16% in FY2022 and 32% the previous year, achieving EBITDA margins of 13.5% and a net margin of 8% in FY2022. So, we are not talking about a low-quality company either. This makes me give the benefit of the doubt to this strategically interesting move, leaving Teleperformance as the almost undisputed leader in the BPO market.

Q2 Results

On July 26, Teleperformance presented the results for the first half of 2023, showing that the economic weakness of the economy is also affecting the company. The results presented were the following:

Revenue: €3.96B vs €4.03B expected by analysts (-1.8% vs expected)

EBIT: €577M vs €596M (-3.2%)

EPS: €5.49 vs €5.70 (-3.7%)

These results were unfavorable because they represented zero growth on a year-over-year basis. However, what likely worried the market the most was the company’s decision to revise its guidance for FY2023. In February 2023, the company had provided guidance of a 10% sales growth with EBITDA margins of around 18%. But, in the 2023 half-year report, this estimate dropped to a 7% sales growth with an EBITDA of 16%.

Although this is far from positive news, the market’s reaction seems somewhat exaggerated to me, considering that between February (the date of the initial guidance) and July (the date of the 30% adjustment in sales growth), the company’s shares had already fallen by 38%. Additionally, after the half-year report, the shares fell another 16%. In other words, if the market were efficient, a 30% reduction in guidance should have been penalized with a 30% adjustment, not the -48% decline that the company has experienced since February. This is what the board said about the new guidance:

We expect the macroeconomic environment to continue to be challenging, and it’s driven by three factors. One, we’re seeing increased uncertainty almost every few weeks, we are seeing a different commentary, whether it, be a recession, a hard landing or a soft landing or no recession at all. And that does have a bearing on the psyche and the decision-making of our clients. So we are seeing slowing decision-making, especially in the U.S. Number two, we have seen fewer launches of new products and services, and that has impacted the volumes. And number three, with the increased efficiency drive, we’re also seeing increased offshoring. So we expect headwinds in terms of top line.

In essence, the issues faced by Teleperformance are similar to what its direct competitors, such as Concentrix, are going through. They also resemble the challenges experienced by companies involved in digital transformation, such as Accenture or EPAM. These problems have been largely caused by the economic slowdown and concerns about a potential recession. Therefore, in this regard, the situation does not appear to be cause for alarm, as it is not unique to Teleperformance.

Key Ratios

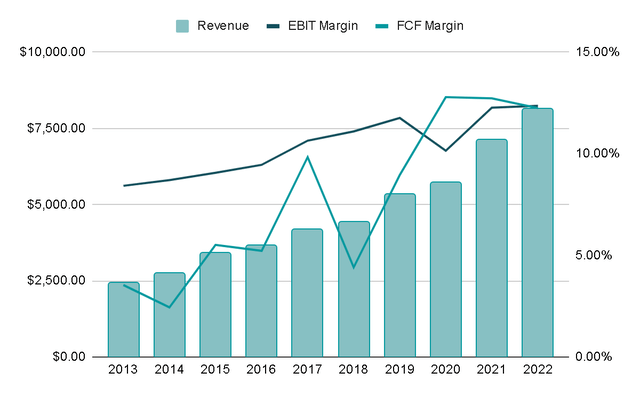

Over the past decade, revenues have exhibited consistent growth, with an annual rate of 14%. This expansion has been accompanied by an increase in both EBIT (Earnings Before Interest and Taxes) and FCF (Free Cash Flow) margins. In 2013, these margins stood at 8% and 3.5%, respectively, but by FY2022, they had risen to 12% for both. This notable improvement is attributed to the scale that Teleperformance has achieved. As the company grows and establishes customer service centers, the ongoing maintenance expenses remain minimal, primarily limited to paying the personnel required for operations. This, in turn, contributes to the widening of profit margins.

Author’s Representation

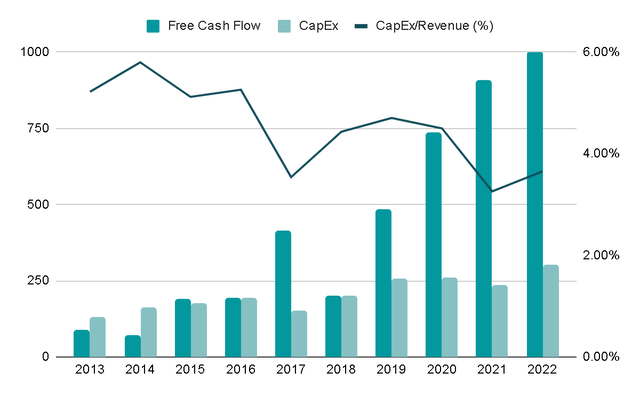

Another contributing factor to the improvement in the Free Cash Flow margin is the reduction in Capital Expenditures (CapEx). This underscores the point made earlier that the company’s need for significant CapEx has diminished over time. Once the customer service centers are established, they can operate efficiently for many years. Moreover, as one of the largest companies in its sector, Teleperformance experiences reduced yearly investments in infrastructure and facilities, highlighting the advantages of its scale.

Author’s Representation

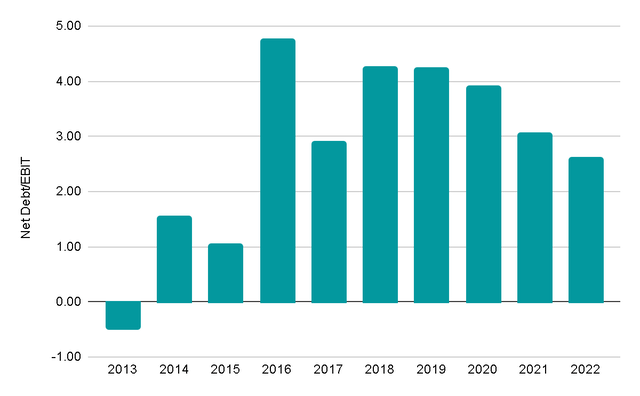

The Net Debt/EBIT ratio has hovered around 3x in recent years. However, since 2018, the board of directors has been committed to reducing leverage, and by FY2022, the ratio had decreased to 2.6x, a level that has been maintained in the last twelve months (LTM). It’s worth noting that the decision not to accumulate substantial debt for the acquisition was prudent, as the company typically operates with a relatively high ratio. The current levels are not a cause for concern, but they would have been if the acquisition’s €3 billion had been financed primarily through debt.

Author’s Representation

Valuation

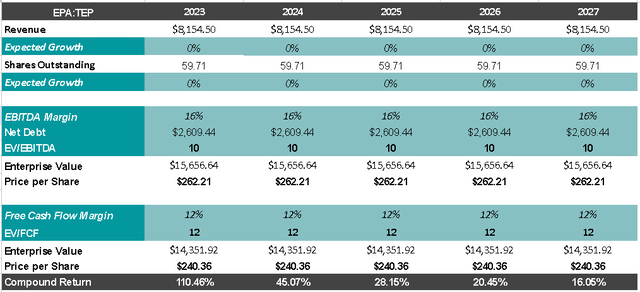

In terms of valuation, let’s consider a scenario based on the market biggest fear for BPO companies: the substitution by AI.

For FY2023, the company anticipates modest growth of 7%, primarily due to consumer apprehension amid the widely discussed recession. However, let’s adopt a more pessimistic perspective and assume zero growth. Looking ahead, the increasing adoption of AI is expected to prompt many current clients to forego Teleperformance’s services, resulting in zero growth too.

If we maintain current profit margins, assume a Net Debt/EBITDA ratio of 2x, and apply greatly discounted multiples of 10x EBITDA and 12x FCF (Free Cash Flow) due to the company’s bleak future outlook, we would arrive at a target price over the next 5 years of approximately 250 euros. This would yield an annualized return of 16% if one were to purchase the stock from the Paris stock exchange at its current price of 120 euros. The downside risk appears minimal, even in this scenario.

These calculations were made using the Paris Stock Market price with the ticker symbol “TEP”.

Author’s Representation

Risks

While AI does not pose a risk to the company and the valuation appears to discount any bad scenario, there are still two risks worth mentioning.

Majorel Integration: Undertaking a large acquisition presents numerous challenges. The process of integrating systems, procedures, and personnel from both companies can be intricate and may result in operational disruptions. Moreover, a poorly executed integration can lead to operational inefficiencies and diminished performance in both the acquiring and acquired entities.

In this regard, closely monitoring performance in the upcoming years will be crucial, and effective management will play a pivotal role in ensuring a successful merger.

Market Saturation: The BPO industry is fiercely competitive, with numerous providers offering similar services. This market saturation often results in pricing pressures and shrinking profit margins, creating a formidable challenge for companies to differentiate themselves. Additionally, if Teleperformance were to deliver subpar services or lag behind technologically, it could risk losing customers, a situation that might necessitate substantial discounts, adversely impacting profitability.

Final Thoughts

Overall, it appears to me that the company is facing:

- A temporary problem: the economic slowdown that has led to a reduced guidance for this year. This has been the common denominator in companies related to IT services this year, so it is not exclusive to Teleperformance and much less is it permanent, since the demand is still there and the product is necessary for its clients.

- A complex situation: the acquisition of Majorel. Since it is done with full cash and equity, at a reasonable price, I see no reason why this should not go well. Of course, this is the biggest risk and that is why I included it in the Risks Section.

- An unfounded fear: AI potentially disrupting the business.

Based on the analysis presented in the article, I am quite optimistic about how the company will address these three main challenges that the market associates with it. I believe that it will emerge from this downturn as the leading player in its sector. This is why I consider Teleperformance a strong buy, since the current valuation already factors in all these considerations and allows for a significant margin of safety.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here