Dear readers,

EssilorLuxottica (OTCPK:ESLOF), which trades under the native ticker EL on the Paris exchange, is a French-based global leader in eye-wear.

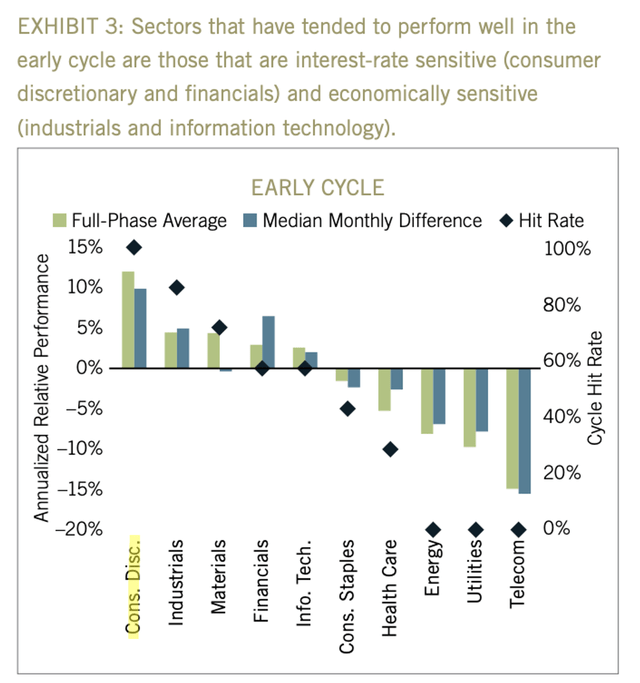

As argued in my recent articles, I believe that the Fed is close to the end of their hiking cycle and that interest rate cut will follow some time over the next 12-24 months.

According to Fidelity, that would put consumer discretionary in a position to out-perform as the cycle turns. Consequently, I’ve slowly started adding consumer discretionary exposure to my portfolio and EL is one of my highest conviction names in the space.

Fidelity research

EssilorLuxottica

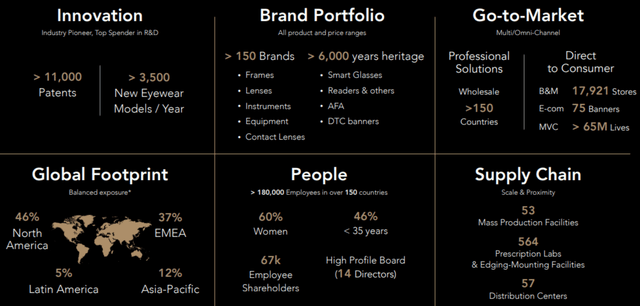

What started by a merger of a French company called Essilor and an Italian company called Luxottica, has become the world’s largest eyewear company. Today the company owns more than 150 world-famous names such as Ray-Ban, Oakley, Versace, Bvlgari, Chanel and many more. The product range includes everything from frames and lenses, to contact lenses, sunglasses and smart glasses. And most recently, the company has even added hearing aids, which are expected to boost profits from 2024 forward.

EL Presentation

EL operates in two segment:

- Professional Solutions (PS) – a wholesale business of prescription products to professionals of the eye-care industry.

- Direct to Consumer (DTC) – a retail business of prescription products and sunglasses

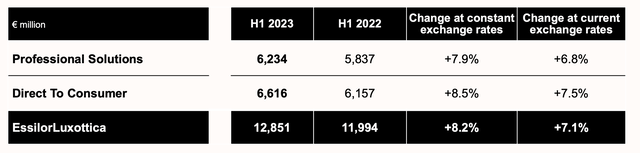

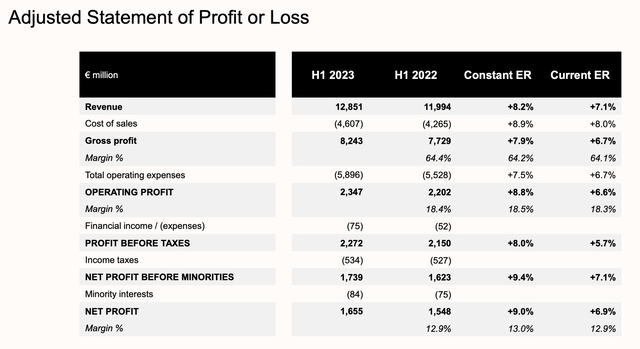

Over the first half of 2023, both segment have done very well, growing by about 8% YoY (in constant FX) and reaching total revenue of nearly EUR 13 Billion.

EL Presentation

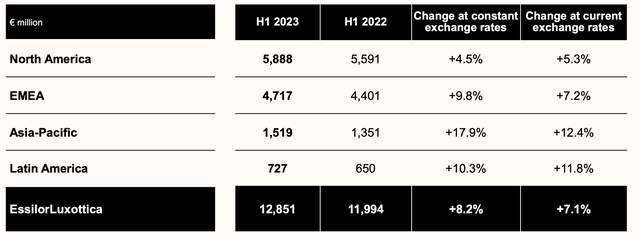

I want to point out that currently, the vast majority of sales comes from North America (46%) and EMEA (37%), while Asia-Pacific and Latin America remain very under-penetrated leaving a lot of room for future growth. Expending more in the Asia-Pacific market would be particularly interesting, as this has been the fastest growing market year to date with 18% YoY growth, primarily lead by China.

EL Presentation

Not only is the company able to grow, but it’s quite profitable with a gross margin of 64%, an operating margin of 18.5% and a net profit margin of 13%.

EL Presentation

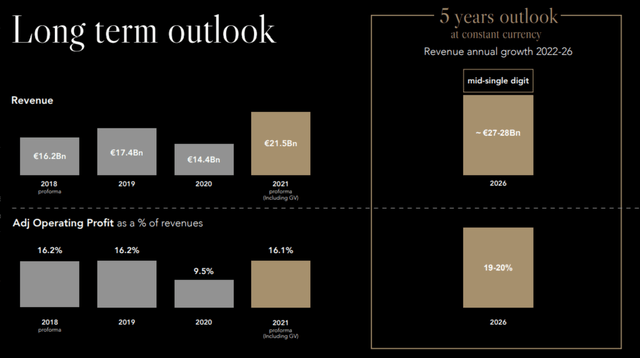

While the gross margin is admirable, the net margin could be higher for a company of EL’s caliber. The problem is SG&A expense which consumes nearly half of all revenues. Going forward, by 2026 management targets an improved 19-20% operating profit margin, but frankly even then, the net margin will be significantly below other luxury brands which average 17-20% net margins.

EL Presentation

Nonetheless, I see EssilorLuxottica as an interesting investment, with a long growth runway in Asia, if we can buy it at the right price.

Valuation

This is a healthy and profitable business with plenty of cash on hand (EUR 1.7 Billion), an A rating and a continually improving low debt of 1.6x LTM EBITDA. As such, it’s one of those companies that can barely ever be called cheap. What we’re looking for here is a valuation that is fair and can reasonably deliver low double-digit returns going forward.

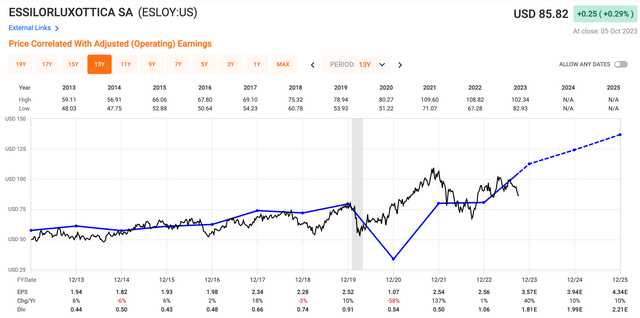

Over the first half of the year, the company has generated EPS of EUR 3.06 and full year earnings are expected at EUR 6.20 per share. At today’s price of EUR 163 per share, that’s a forward P/E of 26x. For comparison, the long-term average stands at 31x.

FAST Graphs

With a sub-2% dividend yield, growth will no doubt be needed to generate upside. The consensus calls for 10% annual EPS growth in 2024 and 2025 driven by high-single digit revenue growth and a slight margin improvement, but this would actually put the company ahead of management’s mid-single digit revenue growth target.

To be more conservative, I’m going to forecast EL at an 8% annual growth, which I see as very achievable, especially if the company can continue to expand its presence in Asia. My target EPS for 2025 stands at EUR 7.23. Assuming the stock continues to trade at 26x earnings, investors would earn roughly 10% per year.

But given the quality of the business, I do see a bit of upside here from multiple expansion. An increase to 28x earnings would bump up the annual return to 13% which is more than enough for me to rate the stock a BUY here at EUR 163 per share and slowly start adding shares to my portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here