After the bell on Wednesday, we received first quarter results from Beyond Meat (NASDAQ:BYND). The plant-based meat company has been one of the biggest disappointments in recent years, failing to meet lofty revenue growth targets. The latest report from the company was decent, but there’s still a lot that needs to go right moving forward for this stock to be a winner.

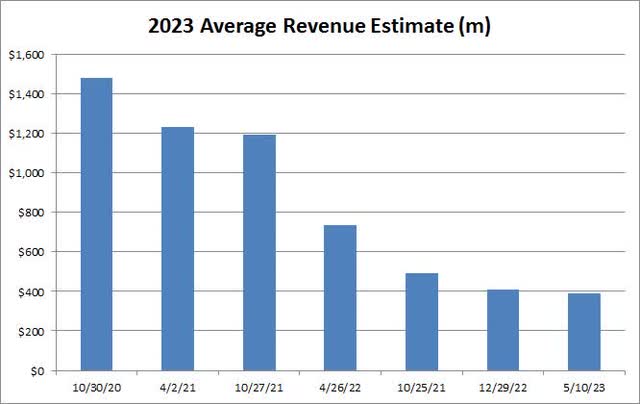

For Q1, revenues came in at $92.2 million. While this was a nearly 16% decline over the prior year period, it did actually beat street estimates by roughly half a million dollars. However, the slight outperformance here isn’t something to tremendously celebrate when you consider that estimates for this period just a year ago were nearly $148 million. As the chart below shows, full-year revenue estimates for 2023 have collapsed in recent years.

BYND 2023 Revenue Estimate Average (Seeking Alpha)

While revenues were down in the mid-double digits, the volume of products sold (in pounds) was only down 7.3%, so pricing power here remains rather weak. Gross margins for the period came in at 6.7%, which on the face of it is a dramatic improvement from the 0.2% figure in the year-ago period. However, 5.5 percentage points of that improvement came from an accounting change, where the company extended the useful life estimate for some of its large manufacturing equipment.

One piece of good news here is that the company has improved its operating expense base. Operating expenses (excluding restructuring items) were under $65 million in the period, a roughly $30 million improvement from a year earlier. On the bottom line, a net loss of $59 million is still large when you consider the revenue number, but Q1 2022 saw a loss of more than $100 million. The 92-cent per share GAAP loss beat street estimates by a dime, but almost all of that had to do with the accounting change.

When it comes to guidance, management mostly reiterated its yearly forecast. Revenues are expected to be in a range of $375 million to $415 million, with that midpoint being a little ahead of the street’s revenue average estimate of $389 million. Even at the high end, however, total sales would still be declining on a full-year basis. The only change to guidance was that gross margins are expected to be one to two percentage points ahead of the previous forecast for the low-double-digit range, thanks to that accounting change.

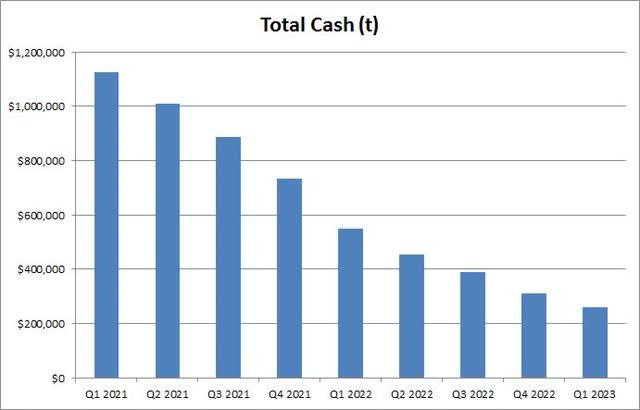

The one issue that worries me the most currently is the company’s balance sheet. Beyond Meat reported another $51 million decline in its cash position, finishing Q1 with less than $260 million as seen in the chart below. Management is targeting cash flow positive operations within the second half of 2023, but that doesn’t necessarily mean free cash flow will be positive after including capital expenditures. With $1.1 billion of debt on the books, this is a company that could certainly use some fresh capital, but at a sub $900 million valuation, any potential dilution from an equity raise would be quite painful.

Beyond Meat Total Cash (Company Earnings Releases)

As for Beyond Meat shares, they did jump about 9% in the after-hours session. This is a very highly shorted name, and so a little bit of a relief rally isn’t a surprise, since this wasn’t another terrible report like so many we have seen in the past. Going into the report, the average price target on the street was $12.62, so the stock is now a dollar above that in late afternoon trading. Of course, a year ago the street saw this name as worth nearly $50, and the stock remains only a couple of bucks from its multi-year low that was just over $11 a share.

In the end, Beyond Meat delivered a decent set of results on Monday, but you must take into account just how much estimates have come down. Total revenues and losses were both better than the street expected, although the latter was almost completely due to an accounting change. Revenue guidance was maintained for the year, although that happened last year at the Q1 report as well, and then guidance was cut multiple times afterward. The balance sheet remains rather weak here, with large losses leading to more cash burn, so a capital raise is still a possibility. Shares are up a bit on the news, but pretty much fairly valued according to the street, so another quarter or two of progress needs to be seen here before sentiment really improves. If the company disappoints again later this year, however, a new low is definitely possible.

Read the full article here