Introduction

For years now, I have been studying large-cap stocks outside the S&P 500. I first began my interest in 2016 when I studied VMWare Inc (NASDAQ:VMW). It returned a healthy 52% while the S&P 500 returned 19.15%. Since then, I have paid close attention to this universe of companies outside the index and have researched an effective way to find good investments. I have and do recommend these stocks to my clients. I call this group of specific equities “Bullpen Stocks,” because these are a collection of bulls before inclusion in the main stock market show. Sometimes, in the case of VMWare, S&P will never include them.

Too often, we as financial professionals do not pay attention to these non-indexed stocks in the age of indexing. It creates too many lost opportunities, and we need to address this. During the summer of 2020, the committee that determines S&P 500 membership did not even include Tesla Inc (NASDAQ:TSLA), the most valuable auto manufacturer in the world. It was not until December of 2020 that the large-cap index added it to its list of components. In the meantime, the investors who thought big have come out big if they had been investing in Tesla during 2020 and realized a near 700% return.

Because of this experience, I am tired of so-called “experts” telling me to just buy the index. It is lazy and unimaginative, and I do not think it fully benefits helping clients to capture all the potential offered in the broader markets. Unfortunately, too many financial clients never realize their potential by investing in this basket of equities. Unfortunately, if an investor wants to invest in the large-cap space outside the index, they must perform their own research and due diligence. For example, “Investor’s Business Daily,” highlighted 16 specific companies that they rated as a “BUY” in 2019 that were not included in the S&P 500, yet none of these companies could be found in an investment instrument such as a mutual fund or unit trust that focused on these types of securities. Here, I hope to remedy that situation.

The S&P 500 Is Not Passive Investing

Tesla is not the only company where it is puzzling the index did not include it. As of this writing, 137 additional large domestic companies are turning an annual profit, which are traded in the two main bourses, the New York Stock Exchange, and the NASDAQ. Yet, the S&P 500 will not include them. The acolytes of index investing are labeled as passive investors, which they are because they copy the homework of others and mirror what they are doing. Lost in the sauce of this conversation is that the S&P 500 index itself is not passive, but instead actively managed. Consider this from the company’s report on the economy (Standard and Poor’s, 2020):

To be eligible for S&P 500 index inclusion, a company should be a U.S. company, have a market capitalization of at least USD 8.2 billion, be highly liquid, have a public float of at least 10% of its shares outstanding, and its most recent quarter’s earnings and the sum of its trailing four consecutive quarters’ earnings must be positive.

Additionally, as we saw with Tesla, there is a committee that makes final determinations for inclusion. According to S&P Global, “Constituent selection is at the discretion of the Index Committee and is based on the eligibility criteria,” (S&P Dow Jones Indices, 2020). By any definition, a criterion where a committee finalizes a decision makes it an actively managed list. So, the whole notion that index investing is passive is simply not valid. The S&P 500, as well as all the indexes, is more managed than one is to believe.

A Solution

I contacted four investment companies, First Trust, Advisors Asset Management (AAM), Invesco, and Guggenheim, to see if they have any offerings that specialize in these non-indexed companies. They do not. I contacted these specific companies because this type of portfolio construction would lend itself well to a Unit Investment Trust, which all four institutions offer to their respective investors. For those of you who do not know what a unit trust is, it is “an investment company that offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period.”

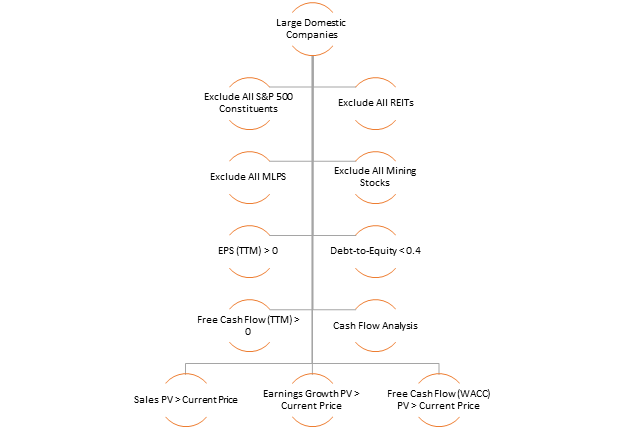

I have included an overview of my portfolio selection process. After screening for domestic large-cap companies, I narrowed the search by looking for:

- Financially strong companies based on Bulletproof criteria from Harry Domash (2002).

- Debt-to-Equity < 0.4 or 40%.

- Current Ratio > 1.5.

- Positive earnings for the last 12 months.

- Free Cash Flow (TTM) must be positive.

- I eliminated all real estate investment trusts (REITs).

- I eliminated all master limited partnerships (MLPs).

- I eliminated all mining companies.

- From there I use discounted cash flow analyses based on either:

- Historical Sales Growth

- Historical Earnings Growth

- Weighted Average Cost of Capital and Historical Free Cash Flow

The company passes the screening process if two of the following are true:

Historical Sales Growth-I use the historical sales growth rate and forecast a future price based on the historical price-to-sales ratio. Using a required rate of return and historical beta, I determine whether the present value is greater than the current price.

Historical Earnings Growth-I use the historical earnings growth rate and forecast a future price based on the historical price-to-earnings ratio. Again, I use the required rate of return with the historical beta to determine whether the present value is greater than the current price.

WACC Method-I use a detailed analysis where I start with historical trends to determine future free cash flow. From there, I determine the cost of equity and the cost of debt to calculate whether the current fair value is greater than the current price.

Selection Process (Author)

Historical Returns

The idea here is to find companies that can outperform the overall market as measured by the S&P 500. Here is the data based on calendar returns from January 1, 2001, through December 31, 2022. This approach has yielded a 10.32% (±27.2%) annual return compared to the S&P 500’s return of 6.33% (±18.6%). Based on rolling 12-month returns, this selection process yields an average gain of 13.64% versus the market’s return of 8.23% (from January 1, 2001, to September 23, 2023), and beats the market average 57.3% of the time. Normally, it generates about 9.7 components per period. As is my habit, I will disclose that the twenty passing companies in 2008 lost an average of -38.5% per stock.

Passing Companies

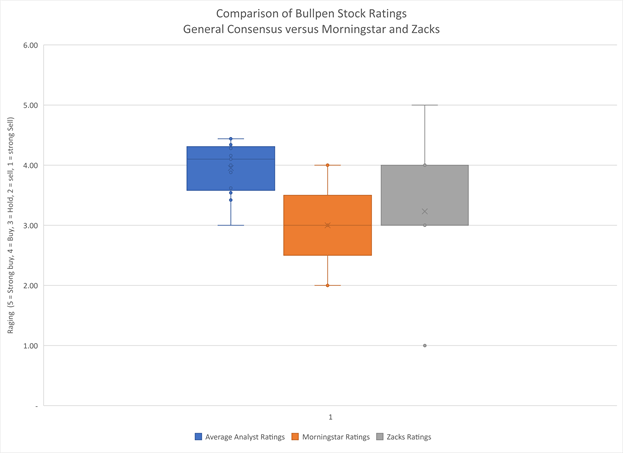

As of October 1, 2023, there are thirteen passing companies. These companies are in a variety of sectors including consumer services, cyclicals, energy, financial, healthcare, industrial, materials, and tech. It is always interesting to look at the ratings from analysis sites, though. I compared the consensus ratings for each company from analysts to the ratings one might find on Morningstar and Zacks. Here is a chart making the comparison. The average consensus rating for each passing company is a “Buy” (3.95± 0.42). Now compare that to Morningstar which gives each company a “Hold” rating (3.00± 0.68) or Zacks which gives an average rating of “Hold” (3.23 ± 0.89). These differences between the consensus ratings compared to these research firms are significant. This shows me that a community of analysts feels strongly about these companies too, contrary to more mainstream analysts.

Author

It gets even worse if one looks at the ratings from a large wirehouse firm. In checking the stock tables from Edward Jones, for example, none of the passing companies even warrant a rating from this large full-service broker. Perhaps, therein is the answer as to why there are no investment instruments where one can invest in this specific universe of equities. Our investment advice comes from closet indexers, and they do not want to take the risk in this more risky form of investing.

I am cautioning that investing in this space is highly speculative. The average yield (TTM) of these passing companies is 0.78%, and the average P/E ratio is 59.83/x. If one chooses to invest in these companies on their own, it is highly advisable to perform adequate due diligence and to fully understand the risks that are involved.

Having said that here are the passing companies:

|

Company (Exchange: Ticker) |

Industry |

Yield |

|

ZOOM VIDEO COMMUNICATIONS, INC. (XNAS:ZM) |

Software & IT Services |

0.0% |

|

NEUROCRINE BIOSCIENCES, INC. (XNAS:NBIX) |

Biotechnology & Medical Research |

0.00% |

|

VEEVA SYSTEMS INC. (XNYS:VEEV) |

Healthcare Equipment & Supplies |

0.00% |

|

HF SINCLAIR CORPORATION (XNYS:DINO) |

Oil & Gas |

3.16% |

|

THE TRADE DESK, INC. (XNAS:TTD) |

Software & IT Services |

0.45% |

|

KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC. (XNYS:KNX) |

Freight & Logistics Services |

1.12% |

|

GRACO INC (XNYS:GGG) |

Machinery, Equipment & Components |

1.29% |

|

TRADEWEB MARKETS INC. (XNAS:TW) |

Investment Banking & Investment Services |

0.45% |

|

UNITED THERAPEUTICS CORPORATION (XNAS:UTHR) |

Biotechnology & Medical Research |

0.00% |

|

DECKERS OUTDOOR CORPORATION (XNYS:DECK) |

Textiles & Apparel |

0.00% |

|

WATSCO, INC. (XNYS:WSO) |

Machinery, Equipment & Components |

2.59% |

|

RELIANCE STEEL & ALUMINUM CO. (XNYS:RS) |

Metals & Mining |

1.53% |

|

SUPER MICRO COMPUTER, INC. (XNAS:SMCI) |

Computers, Phones & Household Electronics |

0.00% |

The Call to Action

John Bogle, the founder of indexing said it best in 2017:

“If everybody indexed, the only word you could use is chaos, catastrophe. There would be no trading. There would be no way to turn a stream of income into a pile of capital or a pile of capital into a stream of income. The markets would fail.”

As I wrote in my introduction, there is no current mutual fund, exchange-traded fund, or unit trust that focuses on this style of investing. I continue to call investment companies, and they tell me they simply do not exist. This cannot remain as the status quo any longer. I am asking for investment companies like First Trust, Invesco, AAM, Guggenheim, and others to piece together unit trusts based on these principles so their clients can pursue superior growth over time too. All of us as financial advisors need to do our thinking in what should be a larger box. There are opportunities outside the S&P 500 if one is willing to do the research.

Read the full article here