Investment thesis

My first cautious call about Immersion Corporation (NASDAQ:IMMR) stock aged well since the price declined almost 16%, significantly underperforming the broader U.S. market. My updated analysis suggests there is still no room for optimism because the company still struggles to monetize its business model. It seems to me that the management is mostly focused on litigation with IT giants instead of driving revenue growth and profitability expansion. My valuation analysis suggests that the business’s fair value mostly comprises its current substantial net cash position, while the present value of future cash flows is insignificant compared to the market cap. The probability that the company will win its patent infringement litigations is above zero which means that the spike in the stock price might happen in case of favorable court decisions. However, this possible share price appreciation is unlikely to be sustainable. Therefore, I reiterate my “Hold” rating for the stock.

Recent developments

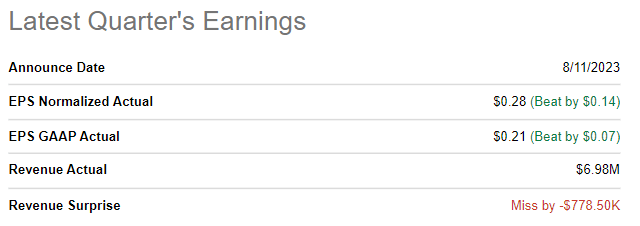

The latest quarterly earnings were released on August 11, when the company missed consensus estimates. Revenue declined 12.5% YoY. Operating margin followed the revenue decline and shrank from 51.4% to 44.6%.

Seeking Alpha

The warning sign to me is that IMMR’s revenue declined across both of its revenue streams. Fixed fee license revenue declined 5% YoY, while the per-unit royalty revenue dropped more significantly by 14%. It means the company is weakly protected by unfavorable swings in the macro environment as its portfolio of revenue streams is not broad enough to compensate for the weaknesses of each other.

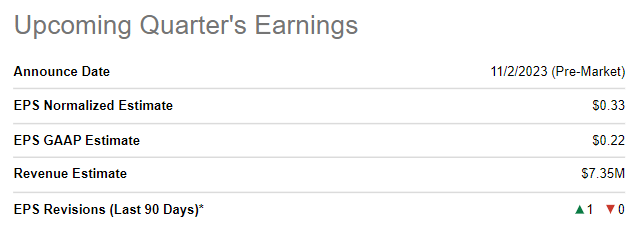

The upcoming quarter’s earnings release is scheduled for November 2. Quarterly revenue is expected by consensus at $7.4 million, which means the topline will drop almost two times on a YoY basis. Despite a dramatic revenue drop, the adjusted EPS is expected to expand slightly.

Seeking Alpha

The economic viability of the business model looks doubtful as the company’s revenue stagnated over the past decade despite the fact that IMMR offers interesting, cutting-edge technology to the market. Recent poor financial performance suggests that the company still struggles to monetize its offerings.

I would also like to point out that Immersion is currently suing several large companies for IMMR’s patent infringement. Giants like Meta (META), Xiaomi, and Valve are among Immersion’s legal opponents. While protecting the company’s intellectual property is sound, I see a couple of red flags here. First, such a large number of legal controversies with big companies means that IMMR’s intellectual property is not safe enough from a legal perspective. Second, the management’s focus is highly likely to be significantly dedicated to these litigations and the company’s operations and development might now lack attention from IMMR’s leadership. Third, if the company loses these litigations it might indicate that its technology is not unique and might be easily replicated, which will bring reputational damage.

Valuation update

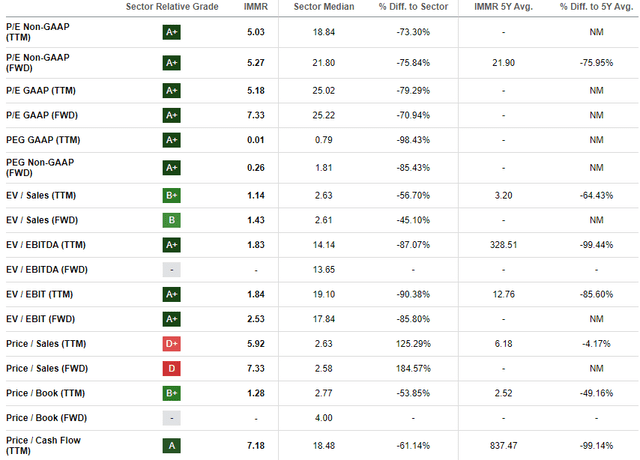

The stock price declined about 12% year-to-date, significantly underperforming the broader market. Seeking Alpha Quant assigns the stock the highest possible “A+” valuation grade. IMMR’s current valuation ratios are substantially lower than the sector median and the company’s historical averages. That might indicate undervaluation, but when multiples are too far below peers and historical averages, it can also be a big red flag.

Seeking Alpha

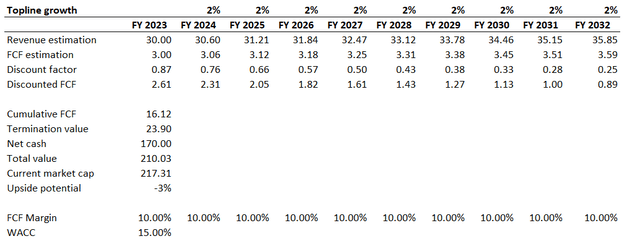

So, I must simulate the discounted cash flow [DCF] model to get more conviction. The company’s weak track record of revenue growth over the long term, which I emphasized in my first thesis, gives me a high level of uncertainty regarding the ability of the business model to scale up. The company’s profitability metrics were very volatile as well over the past decade. That said, I use an elevated 15% WACC for discounting. I expect the base year revenue to be $30 million and to compound at a 2% CAGR. I implemented a flat 10% FCF margin for the whole next decade.

Author’s calculations

According to my DCF valuation, the business’s fair value is $210 million, which is close to the current market cap. However, I would like to emphasize that out of the total fair value, $170 million comprises the current net cash balance. That said, the value of future cash flows is insignificant compared to the current market cap, and the stock is unattractively valued.

Risks to my cautious view

As I mentioned above, the company currently sues large companies like Meta and Xiaomi regarding patent infringement. That said, the company may succeed in these litigations, and the court may decide that IMMR opponents are indeed liable to pay royalties to the company. This will boost IMMR revenue and profitability over the short term and will likely lead to a stock price spike. However, I have a high level of conviction that a potential stock price surge will be emotional and speculative. Therefore, the stock price growth is unlikely to be sustainable in this case.

The board might also appoint new management who can add the missing monetization opportunities to the business model. However, it is crucial to understand that such a transition is not a quick process. It will take multiple quarters, if not years, before the potential new management transforms the business and realigns its priorities. Implementation of fresh strategies is highly likely to be a complex and time-consuming endeavor. It is also important to underline that the appointment of new management does not mean that success is guaranteed.

Bottom line

To conclude, the stock is still a “Hold”. While the valuation might look fair according to my analysis, it is crucial not to miss the forest for trees since the fair value of the business mainly represents the solid net cash position and not the present value of future cash flows. The stock price might spike in case of favorable court decisions in the company’s litigation for patent infringement but. However, it seems unsustainable to bet on possible court success because the company still struggles to drive revenue growth and profitability improvement. This might indicate that the business model is not economically viable and there is not much evidence that the management is taking steps to transform it in order to boost financial performance.

Read the full article here