Overview

My recommendation for Chegg, Inc. (NYSE:CHGG) is a sell rating. The 2022 financial results for CHGG have raised alarms due to a noticeable deceleration in their growth trajectory. This slowdown seems to stem from waning consumer demand coupled with intensifying market competition. Transitioning into FY23, the financial outlook remained bleak, especially with the second quarter revealing drops in both revenue and margins. In response, the company’s management has taken a cautious approach, revising their revenue forecasts downward for the next quarter. Despite a slight uptick in service revenue, it wasn’t enough to counter the prevailing downturn. Additionally, while CHGG’s exploration into artificial intelligence holds potential, it’s still in the early phases. Its impact on near-term revenue remains ambiguous. Considering these challenges, my assessment leans towards a sell recommendation.

Business

CHGG operates as a student-first connected learning platform, primarily catering to the educational needs of high school and college students. At its core, CHGG offers a suite of services that encompass academic support, such as textbook rentals, study assistance, and tutoring, as well as career services like internships and job placements. The company’s revenue is primarily generated through subscription-based services, digital textbook sales, and rentals. CHGG’s digital-first approach, combined with its focus on affordability and accessibility, positions it as a modern solution for students navigating the challenges of academia and early-career planning.

Over the last six years, CHGG’s growth has been decelerating. In 2022, there was a 1% drop in total revenue. This decline was attributed to several factors, including a reduction in print textbook rental revenue due to the company’s collaboration with GT Marketplace, diminished demand for CHGG’s platform and services, and heightened competition from other EdTech firms. Additionally, the COVID-19 pandemic adversely affected its revenue growth. The pandemic resulted in reduced student demand for its services since many learners could access educational resources online at no cost.

Recent results & updates

The company reported weak second quarter financial results, as the report indicates a year-over-year decrease in total revenue of 6.1%, primarily due to a 5.5% decline in subscription services revenue, which amounted to $165.9 million. The gross margin was reduced to 74.4%, attributed to higher content depreciation from newly acquired professor-led materials. This trend is expected to persist into the third quarter, pushing the gross margin down to between 68 and 69%. The adjusted EBITDA stood at $59.8 million, with a margin of 32.7%. On the back of the weak result, the management has guided a weak forecast for the third quarter, projecting total revenues of $151–$153 million (a year-over-year decrease of about 8%) and subscription services revenue of $135–$137 million (a year-over-year decrease of about 7%). Both revenues were lower than last year’s second quarter numbers. This suggests that the management has little confidence in the company’s business outlook. The adjusted EBITDA is anticipated to be between $34 and $36 million, which translates to a margin of approximately 22.5% based on the lower end of the projection. vs. last year’s second quarter of 30% It’s important to note that the company usually sees a dip in revenue and margins in the third quarter. This impact is expected to lessen in the fourth quarter, with margins likely rebounding. While the company hasn’t provided a full-year forecast, historical data suggests a fourth-quarter recovery in the ballpark of 20%. My assessment aligns with the management’s perspective, anticipating a brighter fourth-quarter outlook. Overall, the current results and next quarter’s guidance suggest weakness in the business and management’s lack of confidence. Although the fourth quarter is expected to recover, I anticipate the numbers to be lower than the 2022 fourth quarter.

On the flip side, the increase in ARPU has led to a surge in subscription revenue, and worries regarding ChatGPT, previously voiced by the management, seem to be diminishing. Although CHGG had reservations about subscriber trends (currently has 4.81 million subscribers) due to ChatGPT in their previous quarter discussion in May, the second quarter update showed an uptick in year-over-year customer acquisition and retention. This suggests that students might find ChatGPT an addition to CHGG’s offerings rather than a direct competitor. From my perspective, the boost in subscription revenue is primarily attributed to the rise in ARPU. This could be because CHGG has momentarily reduced its global localization initiatives to prioritize AI product development. Yet, despite these efforts, the overall vulnerability of the company’s business appears evident. This is underscored by the management’s forecast of third-quarter service revenue that’s lower than that of the same period last year.

CHGG is just beginning its journey into AI, shifting its focus to creating its own large language models [LLMs] in collaboration with Scale AI. It revealed a collaboration with ScaleAI to craft their unique LLMs, aiming to enhance their tailored learning assistant. This move marks a departure from their earlier approach of utilizing ChatGPT for a product named CheggMate. Although the company introduced a preliminary version of its generative AI experience in May and garnered positive responses, they recognized the importance of seamlessly integrating generative AI into their offerings. With Scale AI’s assistance, they plan to roll out specialized LLMs over the next two academic terms. I perceive this approach as beneficial since it curtails their incremental cost as the use of generative AI expands in their offerings, eliminating the need to pay per-interaction fees to OpenAI. While I appreciate this shift, the company is still in the infancy stages of this strategy. Effective implementation is essential, especially when students’ preferences between ChatGPT and other established digital study aids are evolving. If successful, I expect a significant boost in both revenue and profit margins. However, given its nascent stage, I don’t predict this endeavor to significantly influence short-term revenue. It’s worth noting that the company consistently strives to enhance its products and services in response to the ever-evolving technological landscape.

Valuation and risk

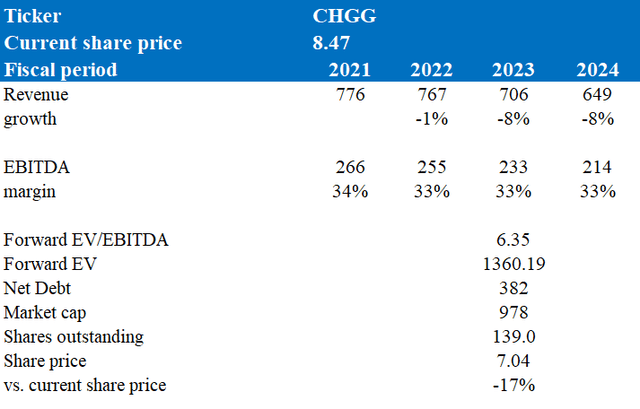

Based on my model, CHGG is projected to be valued at ~$7 in FY24, marking a 17% decline. This target price stems from my forecast of a 3% decrease over the upcoming two years. My assumptions are rooted in the company’s lackluster 2022 revenue, which displayed a marked slowdown due to dwindling consumer demand amidst rising competition. This downward trend persisted into FY23, with the second quarter revealing further drops in both revenue and margins. Consequently, the management has set even lower revenue expectations for the third quarter. These indicators suggest that the company is grappling with significant business challenges. While there was a rise in service revenue, it wasn’t sufficient to counterbalance the decline. Although CHGG is exploring opportunities in AI, this initiative is still in its early stages, and I don’t foresee it making a substantial contribution to revenues in the near term. On a positive note, CHGG has consistently maintained a robust EBITDA margin of around 33%, which I’ve factored into my model.

Author’s valuation model

Peers overview:

- Strategic Education (STRA): EV/EBITDA: 8.52x, EBITDA Margin: 15.12%, NTM expected revenue growth: 8%

- Lincoln Educational (LINC): EV/EBITDA: 5.98, EBITDA Margin: 11.93%, NTM expected revenue growth: 4%

- Peers Median: EV/EBITDA: 7.25, EBITDA Margin: 13.53%, NTM expected revenue growth: 6%

Currently, CHGG is trading at a forward EV/EBITDA multiple of 6.35x, which I consider reasonable given that it’s below the median of its peers. CHGG’s EBITDA margin stands at 12.90%, trailing behind its competitors. Its NTM growth rate is negative 3%, in contrast to the positive rates seen among its peers. Given the deteriorating business outlook, if CHGG’s revenue decline surpasses expectations and guidance, the stock price could face further declines. With a potential 17% drop from its current stock price, I recommend a sell rating.

Risk

A potential upside risk for CHGG is the earlier-than-anticipated launch of its partnership with Scale AI. This collaboration could position them to effectively compete with ChatGPT, which has been taking a share of their market. Moreover, by partnering with Scale AI, CHGG can reduce incremental costs as the integration of generative AI into their services grows, removing the necessity to pay per-interaction fees to OpenAI. This cost-saving could lead to an expansion in margins, potentially resulting in an improved EPS.

Summary

CHGG’s 2022 financial performance has been concerning, with a pronounced slowdown in growth. This deceleration can be attributed to a combination of diminishing consumer interest and a surge in competitive pressures. As the company moved into FY23, the situation didn’t show signs of improvement, as the second quarter showcased reductions in both revenue and profit margins. On the back of these trends, the company’s management has adopted a conservative stance, further reducing their revenue predictions for the upcoming third quarter. These patterns underscore the substantial challenges CHGG is currently facing in its business landscape. While there was a modest increase in service revenue, it failed to mitigate the overarching decline. Furthermore, CHGG’s venture into the area of artificial intelligence, though promising, is still in its infancy. Given its early-stage status, it’s uncertain whether this venture will provide a meaningful boost to the company’s revenues in the immediate future. Given these headwinds, I recommend a sell rating.

Read the full article here