This is a difficult time for REIT investors. Intrinsically linked to interest rates, it would be tough to find a REIT ticker that hasn’t fallen since rates began rising sharply last year.

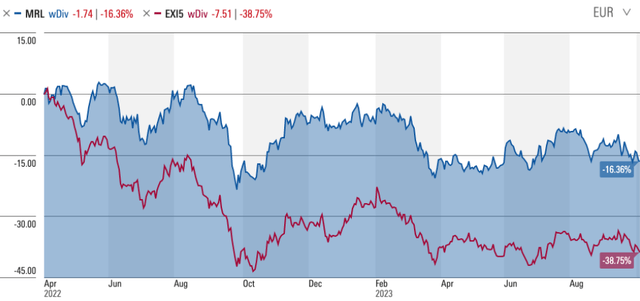

Spanish REIT Merlin Properties (OTCPK:MRPRF) is no exception, albeit with a very welcome ~2,000bps outperformance versus its European REIT peer group (represented here by the STOXX Europe 600 Real Estate Index).

Fig 1 (Source: Morningstar)

Merlin operates a diversified property portfolio across Spain and Portugal, mainly in Madrid, Barcelona and Lisbon. Office is the largest exposure by property class (a little under 55% of gross rental income), followed by shopping malls (~27%) and logistics (~17%).

Large office exposure has been something of a concern for US REIT investors recently given the continuing high vacancy rates in certain areas. However, just as not all US office is in trouble, so goes the situation in Europe. Some parts of the European office space are undoubtedly struggling due to work-from-home trends (e.g. financial district properties in Paris and London), but Merlin’s portfolio seems to be doing just fine right now.

My main concern with Merlin is basically all macro related, with rising cap rates putting downward pressure on the valuation of its portfolio. While that will likewise threaten debt-to-equity ratios and so on, asset divestments last year mean that Merlin is now in a good position to see off the challenges posed by higher interest rates.

On the flip side, investing in REITs when rates have topped out has historically been a good idea, and there is a reasonable chance that we are close to (or at least very near) the top in this cycle. With the shares currently trading at around 13x management-guided FY2023 AFFO per share, Merlin could be a good longer-term bargain unless you think Eurozone rates have much further to rise.

So Far, So Good In 2023

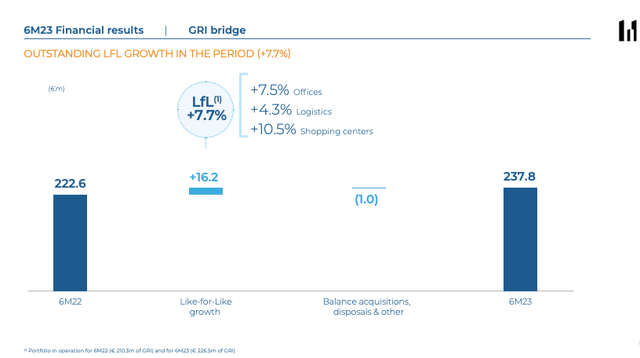

Inflation may be bad for REITs in the sense that it typically means higher interest and discount rates and lower property valuations, but it does often mean higher rental payments too. Merlin is seeing that dynamic play out currently, with gross rental income up 7.7% YoY in H1 on a like-for-like basis.

Merlin’s underlying property portfolio is performing well. Office is an area that is coming in for increasing scrutiny right now, understandable given the pressure that work-from-home is having on certain parts of the space, but Merlin’s exposure doesn’t seem to be a cause for much concern. Occupancy in its office portfolio was 92.3% in 1H2023, a circa 190bp improvement YoY to take it a shade above comparable-period pre-COVID 2019 levels. Office rents were up 7.5% YoY on a like-for-like basis, with the release spread (i.e. difference between new rent on renewal and prior rent) coming in at 3.2%.

Source: Merlin Properties Interim FY2023 Results Presentation

Merlin’s shopping malls are also performing well after a challenging past few years, with occupancy levels up to a record 96.4%, like-for-like rent up 10.5% YoY, and release spread also up by 10%.

Macro Still The Main Risk

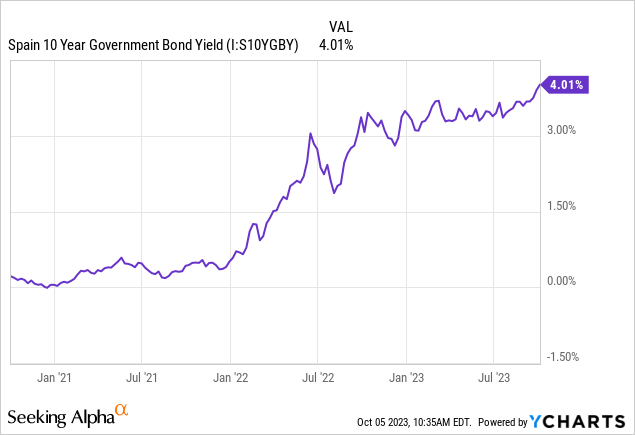

Merlin’s main risk right now is macro related. Rising yields pose a few issues, most obviously in the form of lower property valuations and more expensive funding costs. As solid as its properties’ cashflow performance is proving, this can only go so far in the face of higher yields. Merlin’s gross asset value fell 1.4% YoY in 1H2023 following a 1.5% decline in 2022.

Given the above, an investment in Merlin is typically negatively correlated to Spanish 10-year government bond yields, which have been heading higher:

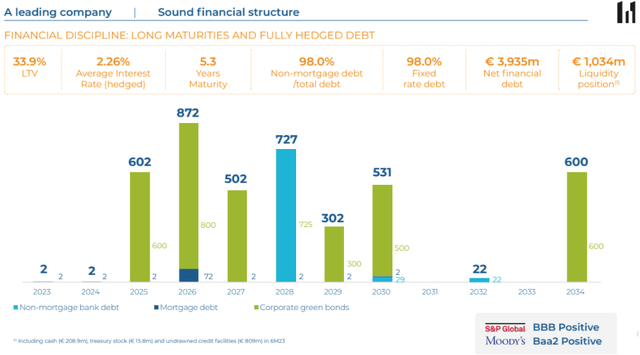

Management has been proactive in getting Merlin into a good position to face this challenge. It raised around €2 billion last year from various asset disposals, mainly from the sale of a portfolio of hundreds of BBVA (BBVA) bank branches. With the proceeds management has paid down debt, reducing Merlin’s loan-to-value ratio to just under 34% versus over 39% at the end of FY2021. That gives it a degree of headroom to absorb further likely declines in property valuations. I’d also add that debt reduction means there are no maturities due here until mid-2025, reducing the need to seek out funding or sell assets outside of management’s usual capital recycling plans.

Source: Merlin Properties September 2023 Results Presentation

There is another risk from higher rates, of course, and that is that they bring about an economic downturn. The Spanish economy has actually been one of Europe’s bright-spots in recent times, a welcome change from being one of its sick sectors in the 2010s. GDP growth is currently forecast to grow 2.2% in 2023, before moderating to 1.9% in 2024. Even so, a sharp downturn remains a risk to consider given the possible negative impact on occupancy levels and rent renewals.

Merlin shares trade hands for €7.88 apiece at time of writing in Madrid trading, putting them at around 13x FY2023 AFFO guidance (€0.60 per share). The dividend yield is 5.60% based on FY2023 guidance of €0.44 per share. In the past, Merlin’s dividend yield has traded on roughly 150-200bps spread versus the Spanish 10-year yield. At 400bps right now, that would make the current share price roughly fair.

Where Merlin goes from here is therefore largely a question of where you think rates are headed. Eurozone inflation slowed again in September as per Seeking Alpha, with core inflation likewise falling. That raises the prospect that the ECB may be close to being done as far as this hiking cycle goes. Having delivered some dovish remarks when it last raised rates in September, there is good reason to think that might be the case. If so, now could be a good time to take a closer look at these shares, notwithstanding the continuing tough environment for REITs more generally.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here