Investment Thesis

Investors interested in natural gas often find themselves compelled to invest in the ProShares Ultra Bloomberg Natural Gas ETF (NYSEARCA:BOIL). The BOIL ETF is designed to double the gains or losses of natural gas prices for a single day. So, if natural gas prices go up by 1%, this exchange-traded fund (“ETF”) should go up by 2%, but if prices go down by 1%, it will go down by 2%. That’s the superficial take. But sadly, on this occasion, there’s more to it than this.

Accordingly, I recommend that investors who seek exposure to increasing natural gas prices, should not invest in the BOIL ETF.

Here I explain why one should be bullish on natural gas as well as point to what I believe is a better way to invest in natural gas prospects, namely to invest in an unhedged natural producer, such as Antero Resources Corporation (AR).

So, let’s get to it!

The Natural Gas Bull Case

In the not-too-distant future, natural gas has the potential to become the leading source of fossil fuel energy, possibly even surpassing oil. This shift is being driven by several factors. First, there is a growing demand for energy due to the widespread adoption of EVs, heat pumps for heating and cooling, and the increasing use of energy-intensive technologies like artificial intelligence AI and data servers.

These applications require a consistent and affordable source of energy, which natural gas can provide more reliably than intermittent renewable energy sources like wind and solar power. Natural gas is available 24/7 and can be used as a consistent energy source to meet these increasing energy needs.

Incidentally, it’s important to note that there are drawbacks to relying heavily on intermittent renewable energy sources. One major challenge is the need to revamp and reinforce our energy infrastructure, particularly the electrical grid, to effectively store excess energy generated during periods of high renewable energy production.

Storing this surplus energy is essential to ensure a stable energy supply during times when renewable sources are not producing electricity, such as when the wind isn’t blowing or the sun isn’t shining. The infrastructure upgrades and energy storage solutions required to address these challenges can be costly and complex, making natural gas an attractive option for providing reliable and consistent energy as we transition to a more sustainable energy future.

Long story short, it’s not that natural gas is here to stay. On the contrary, demand for natural gas is going to rapidly increase, particularly the cheapest natural gas in the world, U.S.-based natural gas.

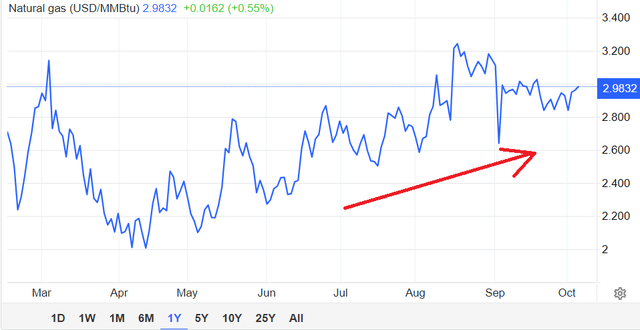

Trading Economics

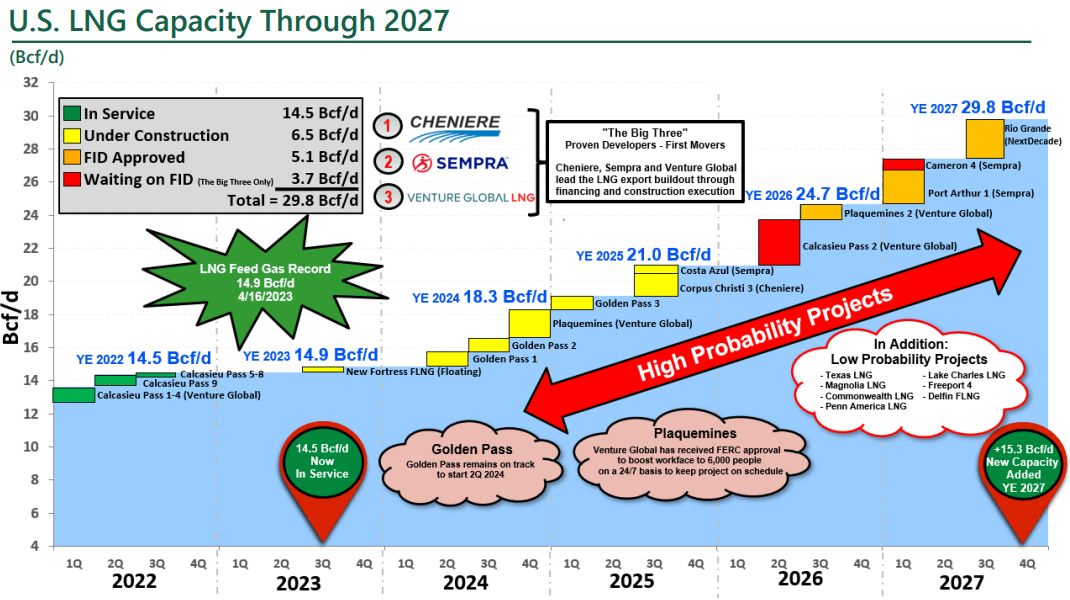

Secondly, it’s important to not only understand the increasing trend towards the ”electrification of everything,” but also that in 2024, there’s going to be significant LNG capacity coming online, see below.

AR Presentation

What you can see above is that in Q3 2023 there were about 14.5 billion cubic feet per day of natural gas being transported as LNG. But you can see that by this time next year, there’s a further +20% capacity coming online.

Having understood the underlying fundamentals that will propel natural gas demand higher in 2024, I will now explain why BOIL isn’t the right way to invest, in my opinion.

Why Boil is Not the Right Way to Invest

The BOIL ETF aims to double the daily performance of the Bloomberg Natural Gas Subindex, which follows the price of US-traded natural gas futures contracts.

These futures contracts are changed periodically, a process known as “rolling.” For instance, currently, the Subindex tracks the 2023 NYMEX Natural Gas futures.

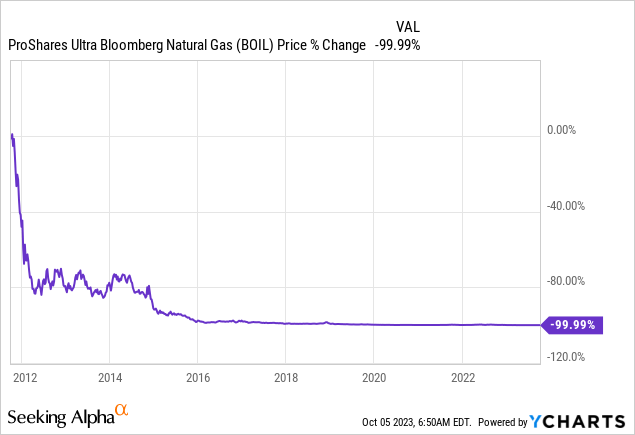

As a rough example, the next roll will happen in October, transitioning to January 2024 futures. This rolling process is essential to understand because it affects how the ETF performs over time relative to the natural gas futures it tracks, and the ETF’s returns can differ from simply being twice the benchmark’s returns due to this rolling mechanism. And while this sounds complicated, and it somewhat is, what’s not complicated is how this ETF performs over time.

Anyone long this instrument over a prolonged period of time will likely lose all their capital.

Yes, an investor that believes natural gas prices will go up on a particular day, can buy the BOIL ETF. And if the price of natural gas increases that day, BOIL ETF should go up by approximately double that amount, allowing the investor to profit.

However, it’s important to note that the BOIL ETF is designed for short-term trading and is not suitable for medium or long-term investors.

Other Factors to Consider: Slippage and Drift

The longer the investors hold the BOIL ETF, the more the investor is exposed to drift and slippage effects, which can lead to price decay or erosion. I explain what this means next.

Slippage occurs when the actual performance of an ETF doesn’t precisely match its expected performance. In the case of BOIL, which aims to double the daily performance of natural gas, slippage can be significant. If natural gas prices experience fluctuations over several days, the ETF’s returns may deviate from the expected 2x multiple.

The combination of slippage plus the 2X leverage can lead to drift in the BOIL ETF.

This is true even if natural gas prices remain relatively stable or move sideways, the ETF’s performance is still likely to erode.

This happens because BOIL’s daily reset uses the previous day’s closing price as a reference point, and any deviations from the expected daily returns can accumulate. Over time, these small discrepancies between expected and actual performance can result in noticeable price decay (or price erosion).

In essence, the longer one holds BOIL, the more they are exposed to the compounding, leverage, and slippage effects, which can lead to price decay.

This is why BOIL is often considered suitable for short-term trading or as a hedging tool but may not align with the performance of natural gas prices over extended periods.

Then What is the Best Way to Invest in Natural Gas?

In my opinion, if one understands that natural gas demand is going to increase, a better way to invest is in an unhedged natural gas producer, like Antero Resources (Disclosure: I’m long AR). Antero Resources isn’t the only way to invest in natural gas producers, but I believe it’s one of the best since it’s fully unhedged.

This means that if natural gas prices increase by 50%, Antero’s free cash flow could increase by 75% or more.

In fact, I believe that if natural gas prices move to $4.50 per MMBtu, this would see Antero Resources making around $1.8 to $2 billion in free cash flow, meaning that the stock today is priced at less than 4x forward free cash flows.

Whichever natural gas producer one ultimately decides to consider, I’ll simply remark that readers should ensure their balance sheets are clean and with ample maneuverability.

The Bottom Line

In my view, natural gas has the potential to become a leading fossil fuel energy source, driven by rising energy demands from technologies like EVs, heat pumps, AI, and data servers. These applications require a consistent and affordable energy supply, something natural gas can offer more reliably than intermittent renewable sources.

However, relying heavily on intermittent renewables poses challenges like upgrading energy infrastructure to store excess power during peak production periods. Natural gas emerges as an attractive option for providing consistent energy as we transition to a sustainable energy future.

But when it comes to investing in natural gas, I recommend steering clear of the BOIL ETF. This ETF aims to double daily natural gas price performance but is designed for short-term trading and may not suit medium or long-term investors.

Instead, consider investing in unhedged natural gas producers like Antero Resources, which I believe could benefit from increasing natural gas demand. Their unhedged nature means that if natural gas prices rise, their profits could potentially surge, making them a potentially promising investment option in the evolving energy landscape.

Read the full article here