ArcelorMittal (NYSE:MT) is a steel manufacturing company that is currently trading at low multiples and under book value. The company uses its scale and power as the second largest steel manufacturer in the world to post consistent revenues and high profits. With a good track record, high equity and low net-debt, I believe ArcelorMittal represents a reasonable buy in the steel industry at these prices.

Steel Industry Outlook

In 2021, the global steel industry saw growth in revenues, with total global revenue estimated at approximately $1.7 trillion. This uptick was primarily fuelled by increased demand across various sectors, including construction, auto, and infrastructure development. As a result, the industry reported robust profit margins, with net profits for major steel producers, such as ArcelorMittal, surging by an average of 40% compared to the previous year.

However, 2022 did not continue to follow that trend. Despite strong demand, the steel sector grappled with rising raw material costs, supply chain disruptions, and uncertainties stemming from the ongoing global pandemic. As a result, growth moderated across the board.

Looking forward to 2023 and 2024, the industry is still forecasting small growth of around 4% over the next two years. However, it’s worth noting that the industry’s outlook is not without challenges, including the need for sustainable and environmentally friendly production methods, supply chain resilience, and potential shifts in trade dynamics. Navigating these issues will be crucial for maintaining profitability and ensuring long-term success in the steel sector.

ArcelorMittal Growth Prospects

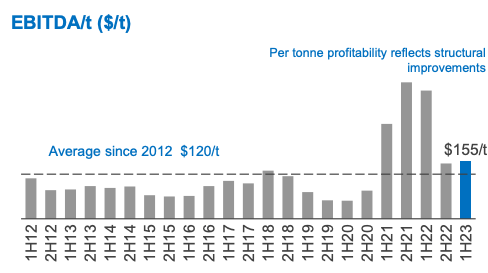

Mainly due to the size of ArcelorMittal and geographical diversification, the company is posed to capture at least some of the industry’s overall growth. Here it is important however to make clear, that even if the industry will grow as projected, it is unlikely that prices (and in turn margins) will stay as high. Due to the normalisation of steel prices and increase in raw materials and energy, the per tonne profitability of ArcelorMittal normalised since the covid-highs of 2021 and 2021, and will probably go down further, closer to the average since 2012 of $120 per tonne.

ArcelorMittal EBITDA per tonne chart (ArcelorMittal Analyst Slides Q2 23)

Currently, ArcelorMittal is trading at a trailing-twelve-months (TTM) P/E of ~4.93 standing at TTM net income of $4.21b. This is down from a full-year 2022 net income of ~9.54b, representing a decline of over 55%. The top-line, however, only declined from ~$79.84b full-year 2022 revenue to ~$72.97b TTM revenue.

So, while the industry as a whole is projected to continue to grow and as one of its biggest players, ArcelorMittal is positioned to capture some of that growth, bottom-line income might not grow as much as top-line revenues.

On a TTM basis, ArcelorMittal currently posts EBITDA of ~$8.27b, representing a Price-to-EBITDA ratio of ~2.5. Assuming a further EBITDA per tonne decline to the average since 2012, we project an EBITDA decline of 23% to ~$6.37b, representing a Price-to-EBITDA ratio of ~3.25.

Assuming an improvement to a Price-to-EBITDA of ~4, there is a upside in share prices of ~25% to ~$30. With this assumption, we are not factoring in any growth in tonnes sold, which would probably translate to a declining top-line. Hence, this can be seen as a pessimistic assumption.

The Balance Sheet

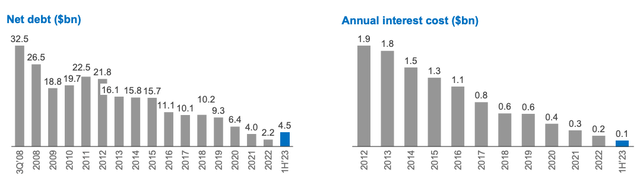

ArcelorMittal posts a strong balance sheet, providing considerable margin of safety to our above assumptions and reducing the overall risk for investors. With Cash and Equivalents of ~$5.83b the company’s net debt is only ~$4.5b. The company made an effort to reduce debt over the past 15 years, reducing the annual interest cost, which is especially valuable in a high-interest environment. This supports higher FCF in the future and more opportunity regarding returns to shareholders or growth investments.

ArcelorMittal Net Debt and Annual Interest (ArcelorMittal Analyst Slides Q2 2023)

Ignoring intangibles of ~$5.07b, the company posts a Total Common Equity of ~$50.65b, representing a Price-to-Book of ~0.41. It is important to note, however, that most of the company’s assets consist of Net Property, Plant & Equipment (PPE) and Inventory and thus cannot easily be used to return capital to shareholders through dividends or buybacks. These assets can be considered productive though, as ArcelorMittal posts a TTM ROE of 10.3% in their last quarterly report.

Capital Returns

While the company was more focused to reduce net debt and fund further growth over the last 15 years, the company has made an effort to increase capital returns to shareholders over the last 3 years, through buybacks and dividends.

The company currently pays out an annual dividend of ~$0.44, representing an annual dividend yield of ~1.83%. Through 2021 and 2022, the company has also repurchased common stock worth ~$8.1b, reducing the total amount of outstanding shares from ~1.1b to ~0.88b.

The company also currently has a share buyback program with a goal of buying back up to 85 million shares until May 2025. This is on top of the share buybacks in the amount of ~$442m the company already performed in 2023 as part of their previous share buyback program. More information on their share buyback programs here. Combining the dividends and the share buybacks, the company is returning an average of over 5% annually.

What to watch out for

Due to macroeconomic uncertainty, I am expecting some general volatility in the steel market. While ArcelorMittal as a company has a healthy balance sheet and profitable business, the overall situation in the steel market could heavily affect both top-line and bottom-line numbers over the next couple of quarters.

I am mainly looking for any big changes in either the steel markets, or in the company’s ability to maintain their growth projections. As long as the company is not performing worse than the above mentioned “pessimistic” projections on EBITDA over the next couple of quarters, I will remain on a buy-rating for the common shares.

Conclusion

Due to the strong return on equity, low Price-to-Book and low Price-to-EBITDA values ArcelorMittal is posting, I consider the common stock to currently be undervalued. Low net-debt and high FCF gives the company a lot of freedom regarding capital allocation. The current dividend combined with the buyback program that is currently ongoing provide current shareholders with decent returns, while still giving the company the ability to fund further growth initiatives. Due to the scale of the company and the strong balance sheet, there is some margin of safety when investing at current prices. However, the current volatility of steel prices and also volumes, combined with broader macroeconomic uncertainties do add some risk for shareholders and require closer attention for investors over the next couple of quarters. With any drastic changes in the company’s profitability or external factors, investors need to be flexible with their standing on the common shares.

Read the full article here