Investment Thesis

Duckhorn Portfolio (NYSE:NAPA) has underperformed over the past year and has further declined by about a tenth since the Q4 print as a result of the departure of its long time CEO and conservative guidance. We believe the company is likely to achieve the top end of its revenue guidance due to pricing action and stable volumes. However, we remain on the fence as a result of uncertainty given the current economic environment as consumers look to trade down along with moderating outperformance of its portfolio performance compared to the $15+ luxury wine market. We initiate at Hold.

Company Background

Duckhorn Portfolio) is a leading premium luxury wine producer housing a portfolio of 10 luxury brands at $20+ price point. Key brands include Duckhorn Vineyards and Decoy which contributes ~80% of the total revenues.

Company

It offers wines through wholesale channels to various distributors across the US as well as directly to the customers through its DTC channel via its e-commerce platform and portfolio wine shop. DTC channel contributes 15% of total sales while the bulk of the sales comes through wholesale channel.

Resilient Q4 with Conservative Guidance

NAPA reported a relatively in line Q4 with revenues of $100 mn, up 28% YoY, driven by robust growth in both volumes (up 11% YoY) and price/mix (up 18% YoY driven by Kosta Browne shift). By channel, wholesale sales were up 24% YoY, representing 65% of total sales, California direct to retail sales grew 8% YoY, while DTC sales grew a strong 75%, primarily due to the shifting of sales of Kosta Browne from Q3 into Q4. Gross margins improved ~350 bps YoY to 55.1% ahead of the estimates pegged at ~53% and management’s own guidance of ~200 bps expansion. The strong improvement was driven by favorable brand mix as well as pricing actions along with improving contribution of DTC sales. SG&A dollars grew by ~$5 mn YoY as a result of investments in sales force and higher fulfillment costs within its DTC channel but leveraged from top line growth. Adj. EBITDA came in at $34 mn, up 54% YoY, with margins expanding 560 bps driven by strong gross margins and SG&A leverage. In all, it reported an EPS of $0.15, slightly ahead of the expectations pegged at $0.13.

What remained a surprise was the relatively sudden exit of the longtime CEO Alex Ryan after 35 years at the company, having served as the CEO since 2005. This departure adds to the recent turnover of C-level executive where in the long time CFO, Lori Beaudoin, left in June 2023 after spending 14 years at the company. The departure of several C-level executives adds to the uncertainty around the business, however, we think the company continues to be in good hands with the Interim CEO Deidre Mahlan, who has a strong track record of professional experience in Beverage industry (Former President of Diageo (DEO) North America and Former CFO of Diageo Plc).

Management provided initial guidance for FY24 below street expectations which led to the stock sinking over 12% since reporting. It expects FY24 sales to be between $420 – 430 mn (up 4 – 7% YoY) below consensus expectations pegged at $433 mn. It expects Adj. EBITDA of $150 -155 mn (vs consensus at $156 mn) and Adj. EPS of $0.67 – $0.69 (vs consensus at $0.70). We believe the initial guidance is likely conservative as the company has a history of guiding conservatively (In FY23, NAPA guided FY23 EBITDA margins to decline by 50-100 bps YoY but ended with +150 bps while in FY22 as well its EBITDA margin came in ~60 bps ahead of their initial expectations). In addition, we believe, given the departure of its top level executives, the incoming CEO will likely want to just sound out the situation and adopt an ‘underpromise and overdeliver’ motto. However, we expect the pricing benefit to moderate going forward given tough comparables, and expect gross margins to shrink further in FY24. Q1 FY24 sales are likely to be down between mid-single digits to high single digits as a result of pull forward pricing benefits last year, and we believe the FY24 sales guidance is likely achievable even considering a modest price benefit.

Decelerating Trends

NAPA witnessed a strong outperformance compared to the luxury industry over the years. For example, it reported a 14.5% growth in volumes and a 13.6% jump in dollar sales compared to the $15+ luxury wine market reporting 1.5% and 3.5% growth respectively. However, for Q4 FY22, dollar sales for Duckhorn portfolio came in at 7.6% compared to 5.4% of the $15+ luxury wine market which highlights that the industry is soon catching up to NAPA’s premiumization in our view. In addition, IWSR has noted that the US wine industry is expected to report a continued gentle decline in volumes. We believe that while the premiumization is the theme to play within the wine market, there could be near term challenges amidst macro uncertainty and consumers choosing to trade down.

Valuation

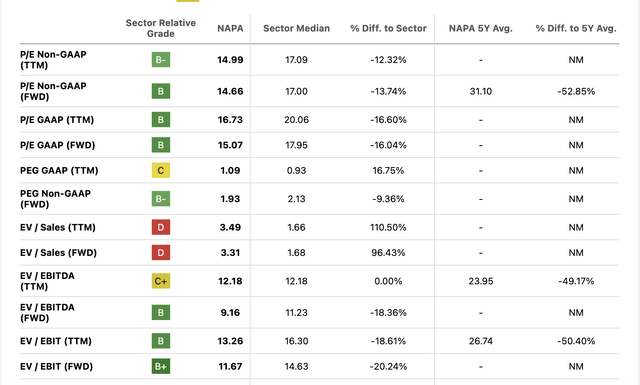

From a valuation standpoint, NAPA trades at 15x Fwd P/E, at a slight discount to the sector average and at a steep discount to its long term average. While the valuation appears cheap relatively, we believe there are significant near term challenges as a result of turnover from long-time C-level executives, macro uncertainty, potential trading down and normalization of its outperformance compared to the industry. We initiate at Neutral.

Seeking Alpha

Risks to Rating

Risks to rating include:

1) Macroeconomic uncertainty which can lead to potential trade downs and decline in demand for luxury fine market.

2) Wine consumption can further decline as a result of shift in consumer tastes.

3) Upside risks includes continued premiumization of the wine industry and outperformance of NAPA compared to industry to drive better than anticipated growth.

Final Thoughts

NAPA shares have been under pressure post the conservative outlook and sudden departure of its CEO. We believe the company is likely to be at the top-end of its revenue guidance driven by modest pricing benefits as well as stable volume growth, however, the near term uncertainty as a result of macro slowdowns, departure of several C-level executives and industry volumes catching up with Duckhorn portfolio, makes us want to be on the sidelines. We initiate the stock at Hold.

Read the full article here