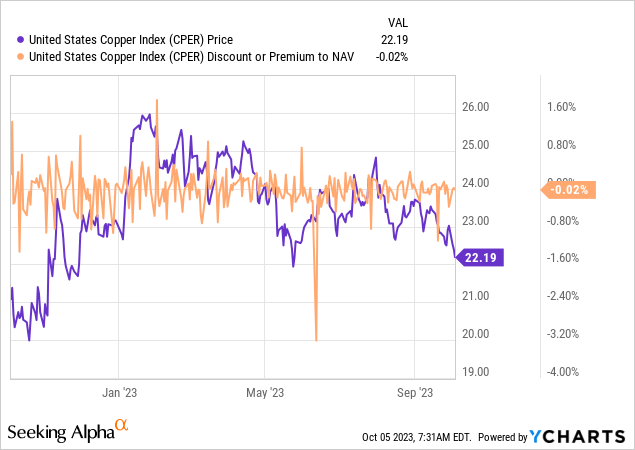

Copper prices may be down since I last covered the United States Copper Index Fund (NYSEARCA:CPER), but the red metal has proved a lot more resilient than other China-exposed metals. Demand support from the recent fiscal/monetary stimulus measures out of China has certainly helped sentiment, but another month of slowing Chinese manufacturing PMI data points suggests there isn’t a quick fix here. Similarly, demand in the West (US/EU) looks poised to moderate further as ‘higher for longer’ rates get priced into sovereign yield curves (note the bear steepening in long-duration Treasuries this week) and flow through to the real economy.

Meanwhile, on/off supply constraints in Chile remain an issue, though production in Peru has picked up the slack, increasing in the high teens % YoY, helped by the post-H2 2022 ramp-up from Quellaveco. Beyond 2023, demand will also need to outpace the upcoming copper mine supply schedule (Quebrada Blanca 2 and Mantoverde in Chile ramping up through 2024/2025) and optionality from producers’ expansion projects. With prices still well above copper mine marginal costs and prior cycle lows, I see no reason to buy the CPER dip anytime soon.

A Pricey Copper Futures Portfolio Offering

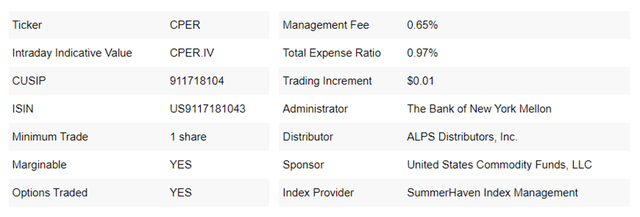

The exchange-traded United States Copper Index Fund tracks the SummerHaven Copper Index Total Return (net of expenses), a portfolio of COMEX-listed copper futures contracts. The ETF’s net assets are broadly unchanged at ~$132m, while the gross expense ratio also remains at a pricey ~1% (0.65% from management fees). Comparable copper ETF options like the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) charge half the expense ratio at ~0.5%.

United States Commodity Funds

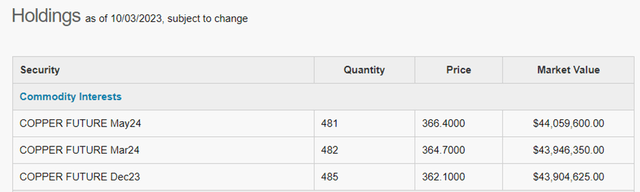

The fund portfolio is rebalanced on a monthly basis and is currently evenly spread across the December 2023, March 2024, and May 2024 copper futures contracts. Offsetting the copper exposure is a mix of cash and equivalents spanning cash reserves, a money-market fund, and short-term Treasury bills spread across the October, November, and December 2023 maturities.

United States Commodity Funds

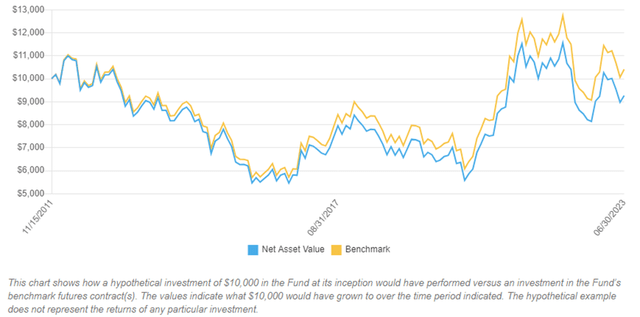

Performance has been poor over the long run (-0.65% annualized since inception), but hardly surprising given commodities are tactical rather than ‘buy and hold’ investments. Perhaps the more relevant metric here is the tracking error, which, after accounting for the high expense ratio, has been fairly minimal.

United States Commodity Funds

Positive Supply Developments in LatAm

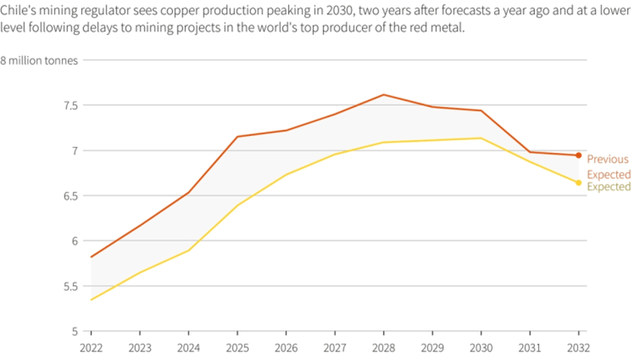

On the supply side, Chile has continued to disappoint, with copper production down low-single-digits % YoY this year, triggering a downgrade to the Chilean Copper Commission’s (Cochilco) full-year production forecast to 5.4m tons (vs 5.7m tons previously). While project delays (mainly at state-owned miner Codelco) aren’t resolving just yet, the country’s production did accelerate in August (+2.7%), supporting the case for Cochilco’s projected +4.3% YoY production growth in 2024.

And there is supply promise in the pipeline, with the likes of Anglo American (OTCQX:AAUKF) recently receiving regulatory approval for its (previously rejected) El Soldado Phase V Project, ensuring the mine’s useful life through 2027. Perhaps most importantly, positive changes are underway at Chilean miner Codelco, with a more technically oriented new CEO (Ruben Alvarado) taking over after repeated delays led to the company falling behind production targets (1.31-1.35m tons guidance for 2023). Given ~29% of Chilean copper production comes from Codelco, any incremental improvements here will have a meaningful supply impact at the margin.

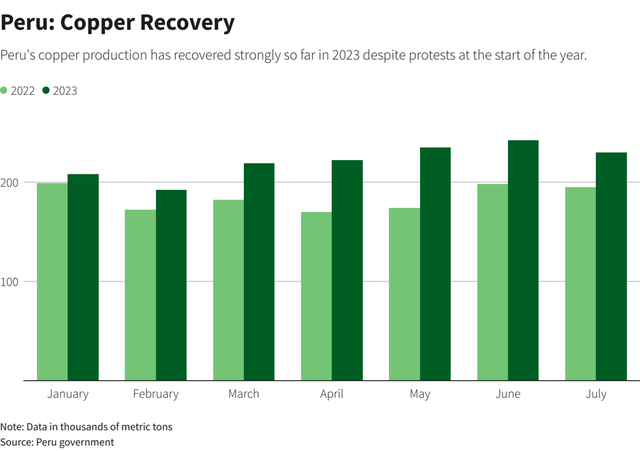

BNN

The supply situation is different in Peru, where production is growing at a high teens % pace YoY (+7.5% YoY in August), boosted by the ramp-up at Anglo American’s Quellaveco mine (+300k tons/year). Note that Peru has achieved this supply growth despite a decline in mining investment YTD. So with a wave of new investment announcements in H2, including >$2bn over the next five years from Peruvian miner Minsur (OTC:MSUTF) to expand production (mainly at the Justa mine that kicked off in 2021) and the increased use of M&A (e.g., the Rio Tinto (RIO) and First Quantum (OTCPK:FQVLF) joint venture to develop La Granja in Peru), all signs point to more supply growth out of Peru in the coming years.

Reuters

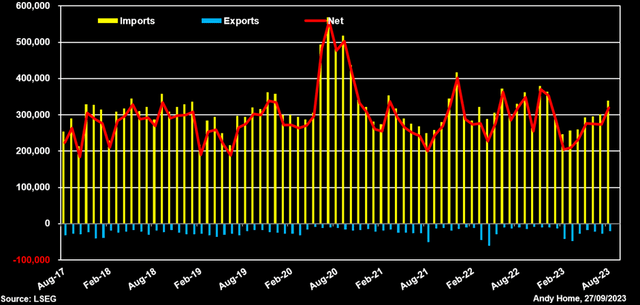

Demand Side Under Pressure Amid Economic Concerns

The key concern on the demand side is China’s slowing macroeconomic environment (note China is the world’s biggest copper consumer), with fragilities in the property sector threatening to ripple through the rest of the economy. While bulls will point to strong Chinese copper consumption YTD, growth this year is being helped by a favorable base effect (i.e., on/off COVID-driven lockdowns since 2020) and recent fiscal/monetary stimulus. On a trailing twelve-month basis as well, import activity (including partially processed copper concentrate) has still slowed – a timely reminder that copper demand remains closely tied to a sluggish macro outlook.

Refinitiv

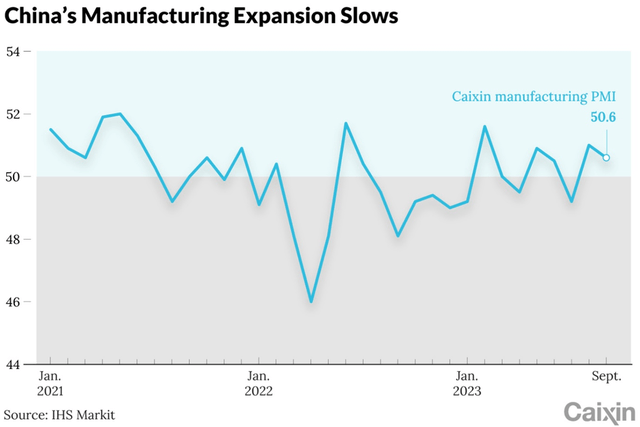

Forward indicators suggest no turnaround on the horizon anytime soon – China’s headline Caixin manufacturing PMI slowed again to 50.6 in September (down from 51.0 in August), with the contractionary new export orders indicator (49.1 in September per the sub-index), particularly worrying. Recent stimulus measures have also been constrained by limited balance sheet headroom, so the large-scale fiscal support needed to stabilize the real estate sector is unlikely to come through. In the meantime, the rest of the world is unlikely to provide much demand offset as higher interest rates continue to bite, keeping a lid on copper demand growth near-term.

Caixin

Fade the Copper Dip

Another month of lackluster PMI data points out of China (both manufacturing and services) suggests economic activity is slowing despite the wave of stimulus measures rolled out in recent months. As the benefits of this initial stimulus wave fade and the rest of the world also slows from monetary tightening, I don’t see a particularly compelling near-term outlook for copper demand.

The supply side isn’t providing much relief to prices either. Yes, copper production in Chile has fallen well short YTD, but signs of a reversal are emerging, with the ramp-up of Quebrada Blanca mine’s second phase, in particular, set to kick-start a recovery in production. Production in the second-largest copper-producing country, Peru, has also ramped up at a ~18% YoY pace, helped by Quellaveco copper mine contributions since coming online late last year. The one-two punch of incremental supply growth and weaker demand points to a surplus in the market over the near term, in turn, supporting an overhang on copper prices from here. Net, I won’t be accumulating CPER anytime soon.

Read the full article here