We’re downgrading Apple Inc. (NASDAQ:AAPL) to a sell despite the stronger-than-expected iPhone sales in fiscal Q2 2023 that saved the day. While we expect Apple is en route to recover from post-pandemic lows, we expect limited upside in the near term and see favorable exit points at current levels.

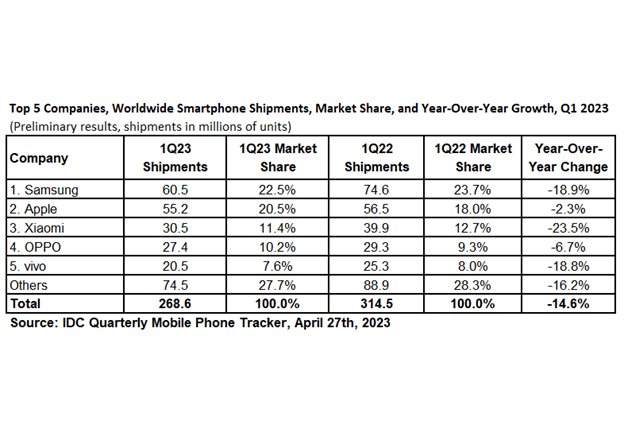

Apple stock is trading at roughly $173 per share, incredibly close to its 52-week-high of $176.15, and trading well above the peer group on both P/E and EV/Sales metrics. iPhone sales are up, signaling that the smartphone market may stabilize after a rigorous wave of weaker consumer spending and recent inventory correction cycles. However, we believe it’s too early to say we’ve exited the smartphone contraction phase of the post-pandemic environment; we forecast the smartphone total addressable market, or TAM, to contract this year by around 2.5% in comparison to 2022, simultaneously Canalys reported global smartphone market “experienced its fifth consecutive quarter of decline, falling by 13% Y/Y in 1Q23” and IDC reported worldwide shipments dropped 14.6% Y/Y in the same quarter.

iPhones still make up the bulk of Apple’s revenues; hence, while the smartphone market appears to be stabilizing, this won’t happen overnight. The smartphone market is currently in oversupply; hence, despite the better-than-expected iPhone sales, we expect a correction to occur in the near term. With this said, Apple could also leverage the opportunity to outperform consensus more easily, as the oversupply in the semiconductor industry and macro headwinds create softer consensus expectations. The company’s installed base is also superior to the competition in the smartphone market, enabling Apple to sustain sales with less risk and without giving into competitive pricing. The following chart outlines the top smartphone companies’ market share in 1Q23.

IDC

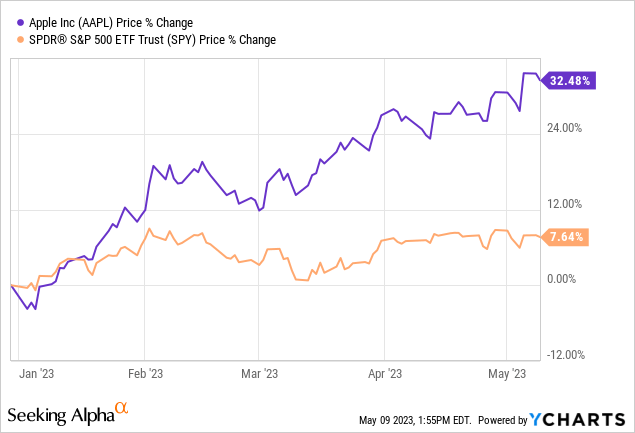

As it stands, the company’s market share is 20.5%, with smartphone shipments dropping 2.3% Y/Y, compared to Samsung Electronics Co., Ltd. (OTCPK:SSNLF), with a 22.5% market share and shipments dropping 18%. We don’t see the company’s share expanding in the near term and believe there will be a window to accumulate at more favorable levels further into 2H23 before Apple’s share expands more meaningfully. The stock is up roughly 33% YTD, outperforming the S&P 500 (SP500) by nearly 25%. Apple is better positioned than it was a year ago to outperform, but we see the best course of action is counting profits at current levels, exiting the stock, and revisiting once the stock drops closer to the $150s range.

The following chart outlines Apple stock against the S&P 500 YTD.

YCharts

Q2 2023 & What’s Next

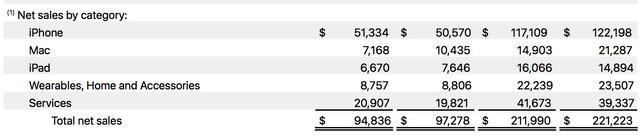

Apple reported 2Q23 earnings beating top and bottom lines this quarter; GAAP EPS of $1.52 and revenue of $94.84B, down slightly 2.5% Y/Y. iPhones were easily the star of the show; iPhone sales came in at $51.33B, up 1.5% Y/Y. Services were the fastest growing segment, with revenue of $20.9B, up 5.4%. Apple also beat expectations on gross margins, reporting gross margins of 44.3% versus the consensus of 44.1%.

Still, overall sales fell for the second consecutive quarter. We believe the market is getting too excited too soon about stronger iPhone sales as other product lines reported negative growth. In 2Q23, Mac sales dropped 31% to $7.17B this quarter, iPad revenue declined 13% to $6.67B, and Wearables, Home, and Accessories dropped slightly by 1% to $8.7B. The following table outlines Apple’s net sales by category:

Apple 2Q23 earnings results.

We see limited room for the company to grow in the near term aside from possibly outperforming softer consensus expectations and don’t believe that justifies buying Apple at current levels. Apple’s one of the primary consumers of the semiconductor industry; the company is Taiwan Semiconductor Manufacturing Company Limited’s (TSM) largest customer. The semiconductor industry is in oversupply, and inventory correction cycles are underway on NAND and DRAM fronts. We expect inventory digestion to aid the smartphone and PC market recovery. Still, we see smartphone correction taking place post-2Q23 earning results and see the stock dropping further in response.

Management didn’t provide clear guidance for the next quarter, which has been typical in past quarters; what we do know is that CFO, Luca Maestri, said on the earnings call:

“We expect our June quarter year-over-year revenue performance to be similar to the March quarter assuming that the macroeconomic outlook does not worsen.”

We recommend investors exit Apple stock at current levels on a short opportunity and revisit once the downside risk of correction has been factored into the stock.

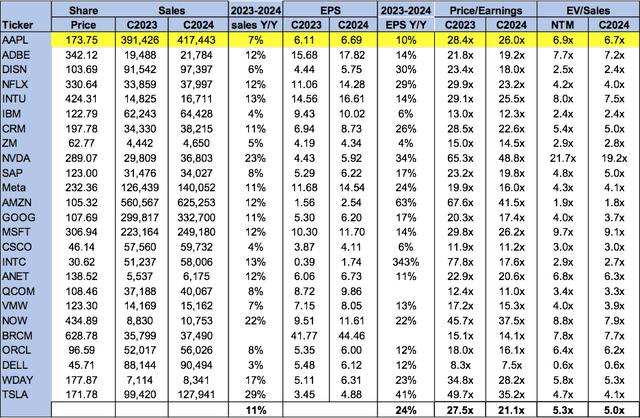

Valuation

Apple Inc. is not cheap, trading at 26.0x C2024 EPS $6.69 on a P/E basis compared to the peer group average of 21.1x. The stock is trading at 6.7x EV/C2024 sales versus the peer group average of 5.0x. We don’t see favorable entry points into the stock at current levels; we see little room for upside in the near term and recommend investors sell the stock at current levels.

The following chart outlines Apple’s valuation against the peer group.

TechStockPros

Word on Wall Street

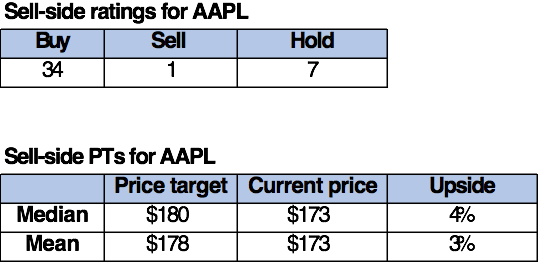

Wall Street is overwhelmingly bullish on the stock. Of the 42 analysts covering the stock, 34 are buy-rated, seven are hold-rated, and the remaining are sell-rated. The bullish sentiment on the stock is primarily driven by Apple signaling signs of recovery from the post-pandemic slump combined with the better-than-expected 2Q23 earning results. Having said that, Wall Street has been bullish on the stock for most of the past year; we attribute this to Apple’s leading status within smartphone markets and the company’s growing services segment. We’ll continue to monitor the stock closely to upgrade once favorable entry points appear.

The following chart outlines sell-side ratings for Apple.

TechStockPros

What to do with Apple stock

We’re downgrading Apple Inc. stock to a sell, as we see favorable exit points at current levels. The company is recovering from post-pandemic weaker end-market demand on the iPhone front; still, we expect a correction in smartphone sales coupled with already declining Mac sales this quarter amid weakening PC demand.

We’re more constructive on Apple than we’ve been for most of the past year, but just don’t see favorable entry points into the stock at current levels. We see further downside risk of correction and recommend investors exit Apple stock at current levels and revisit once the risk has been factored in. We’ll continue to monitor the stock to upgrade once favorable entry points materialize.

Our Investing Group, Tech Contrarians, will be launching on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what’s ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here