Introduction

A year ago, I shared on Seeking Alpha the reasons why I am long Airbnb (NASDAQ:ABNB). The stock has gone through high volatility since then, trading down into the $80s and then moving back up to $150, before retracing back to the current level. Recently, Airbnb has been added to the S&P500. The stock rose and now, as many expected, it is seeing a strong pullback.

Many things can be said about Airbnb. For sure, it is a company with a very successful business and I have gone over the favorable macrotrends that benefit it. However, in this article, I would like to go over a few aspects of how Airbnb works that make it similar to two of my core holdings: Costco (COST) and Amazon (AMZN).

Summary of previous coverage

Since I don’t write often about Airbnb, some SA readers interested in the stock may now know my investing style and why Airbnb is in my portfolio, though it may seem a bit of an outlier.

My portfolio is mainly built around two pillars: high profitability and dividend growth. Some may argue that companies whose profitability is high should not pay a dividend because they can invest their cash into their business at high rates. Yet, highly profitable businesses usually end up generating a growing amount of excess cash that can be returned to the shareholders.

Now, Airbnb is no dividend payer (though it has initiated a buyback program). However, it is in my portfolio because its profitability and its growth trajectory make me consider it as one of the winners of the next decade.

In particular, Airbnb is one of the few growth companies able to couple growth with low debt and high returns on capital employed. This is a setup able to make a company flourish. In fact, Airbnb was able to recover from the pandemic much quicker than Booking and Expedia. Moreover, it is a founder-led company and its CEO, Brian Chesky has told more than once how the pandemic was a turnaround point for his company to focus on its core business.

Now, alongside my coverage on Airbnb, I have to recall some of my past research on Costco and Amazon. In fact, I have been going through both companies, starting from understanding how Costco influenced Amazon Prime. Here I went over the ecosystem created by the membership and explained how Jeff Bezos was inspired by Costco during Amazon’s early stages. Having understood Costco, Amazon has been able to expand Costco’s business model creating an ecosystem, the likes of which are difficult to find.

Latest financials

Before Airbnb released its 2022 Annual Report, I gave a forecast. In this table, you can see my estimates and what Airbnb actually reported.

| (in USD billion, except per share amounts) | My estimate | As reported | Surprise |

| Revenue | 8.5 | 8.4 | -1.1% |

| Net income | 1.8 | 1.9 | +5.5% |

| FCF | 2.8 | 3.4 | +21.4% |

| EPS | 2.80 | 2.97 | +6.1% |

Airbnb came close to my top-line forecast, but exceeded my estimates on all the main financial items showing how profitable a company is. In other words, the company was able to retain a larger portion of each generated dollar in revenue. This, of course, pleased me.

Let’s get to the king of financial metrics: FCF. Now, instead of looking at the quarterly number ($900 million, by the way), let’s read what Airbnb explains in its annual report:

increases in unearned fees generally make our Free Cash Flow and Free Cash Flow as a percentage of revenue the highest in the first two quarters of the year. We typically see a slight decline in GBV and a peak in check-ins in the third quarter, which results in a decrease in unearned fees and lower sequential level of Free Cash Flow, and a greater decline in GBV in the fourth quarter, where Free Cash Flow is typically lower.

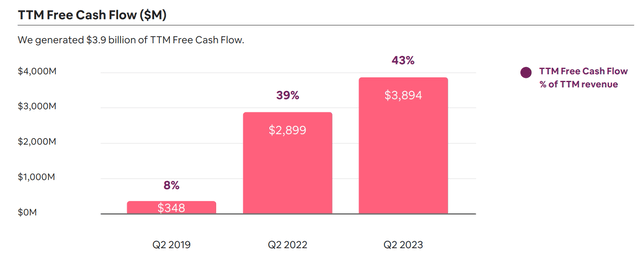

At the end of the first half of the year, Airbnb’s TTM FCF was $3.9 billion. I expect to see the company reach $4.5 billion at the end of this fiscal year, following the trend we can see in the graph below.

Airbnb Q2 2023 shareholder letter

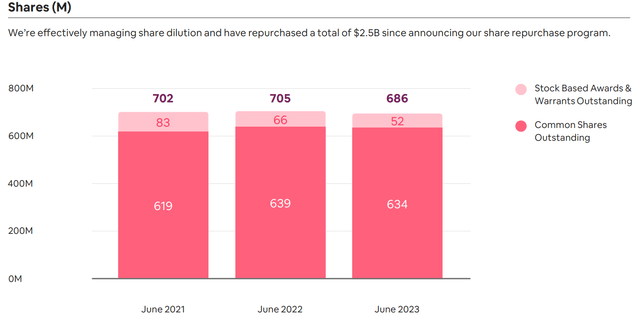

Unfortunately, as many tech stocks, Airbnb has high stock-based compensation expenses, amounting to $544 million for the six months ended June 30th. This eats away around 60% of the FCG generated over the same six-month period. However, Airbnb has taken action to address this dilutive effect and it has approved a buyback program of up to $2.5 billion. In the first six months of the year, Airbnb spent $1 billion to repurchase its commons stock, more than offsetting the impact of SBC.

Airbnb Q2 2023 Shareholder Letter

When financials point in the right direction, we always have to ask ourselves why that is. In other words, what underlying economics are driving growth?

Focusing on its core business pays off

Airbnb, unlike many other tech companies that IPOed during the post-Covid bull market, has actually switched gears a few years ago, turning into a very profitable and fast-growing company.

In particular, it has been focusing more and more on developing its core business, offering more and more opportunities for any kind of stay consumers may demand. As the company explained in its Q2 shareholder letter, cross-border nights are increasing (+16% YoY), with guests returning to cities. True, New York City approved new renting rules which have curbed the listing in the city by 77%. But Airbnb should lose only around 1% of annual revenue, since New York doesn’t even make the top three more requested destinations (Paris, London, Los Angeles). Had that happened 13 years ago, said Brian Chesky, Airbnb would have seen a hit on 70% of its business. The company is now much more diversified, with no single city comprising more than 1.5% of the whole business. As urban travel recovers, Airbnb has been able to increase its supply by 19% YoY and wrote that it added more net active listings than any quarter in its history. It currently has over 7 million total active listings.

Secondly, guests are staying longer and this is why Airbnb is launching more and more features for long-term stays of 28 nights or longer. Currently, around 18% of total gross nights booked are from this kind of stay. Since gross booking value (GBV) was $19.1 billion in the last quarter, we are talking about a segment worth around $3.4 billion. Just in June, stays for three or more months booked grew to 25% of long-term stays, meaning it is worth around $850 million. Regarding long stays, Brian Chesky said during the last earnings call:

I think there’s going to be a category that is not travel and it’s not classic housing, housing as in one year leases or real estate. There’s going to be a category in between. And it doesn’t even really have a name, but our stays of 30 days are longer. I mean, that is around 100 million nights booked a year. So that is actually a major new category of business that didn’t really exist in a meaningful way when we started Airbnb.

In addition, Airbnb has targeted growth in long weekends, which for the past six quarters has been the fastest-growing trip type on the platform.

In May, Airbnb introduced Rooms, which allows hosts to share a single room of their homes. In this way, Airbnb is going back to its roots offering an affordable way to travel with a reported average price of $67 per night.

Given stays are becoming ever more costly for tourists around the world, Airbnb has taken action to work together with its hosts in order to keep prices low. This is why Airbnb’s ADR was $166 in Q2 2023, representing only a 1% increase YoY. In North America, available prices actually decreased by 2%. This means Airbnb’s offered value has grown compared to traditional hotels.

Finally, during the last earnings call, Brian Chesky explained how the company can think about adding paid listings as a possible stream of revenue from ads. His words show how he is thinking not only about short-term profits for himself and his company, but also about the correct way to find a balance between professional hosts and individuals:

we have to be mindful that we don’t just add something like that can disproportionately benefit professional hosts over individuals and take the balance of the marketplace out of balance. And I think it’s really important to do that because that’s what’s unique and different about Airbnb. We’re not built on the backs of professional hosts. We’re glad they’re there. We’re glad they’re part of the ecosystem, but it’s even more important that we support our individual host community.

Finally, one of Airbnb’s secret assets has been word-of-mouth. The company has grown in this way, with 90% of its traffic remaining direct and unpaid for.

Airbnb’s secret: Unearned fees

Though many look at Airbnb only from the point of view of its future growth, few take a look at its balance sheet. In my opinion, here we can find some of the most interesting items about the business model of this company.

Airbnb Q2 2023 report

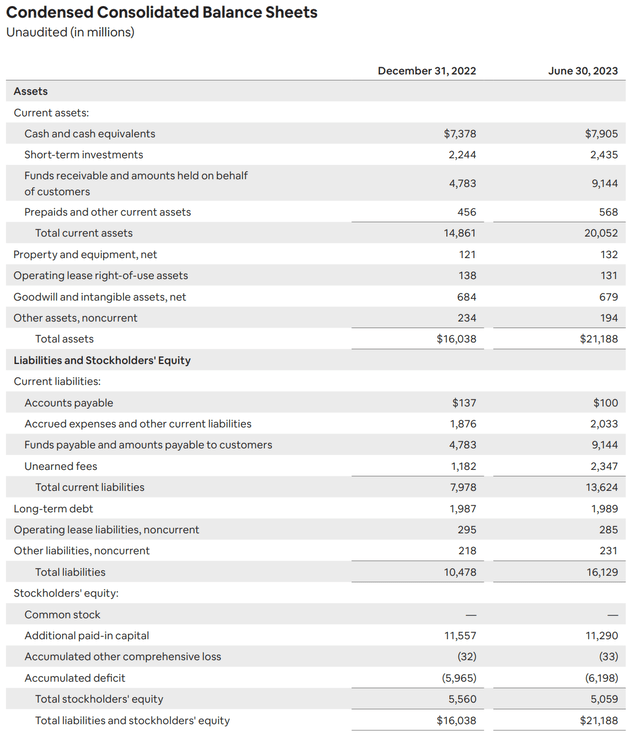

As of June 30, 2023, Airbnb had $10.4 billion of cash and cash equivalents.

In addition, it reports $9.1 billion of funds held on behalf of guests.

We have to pay close attention to this. In fact, Airbnb usually collects its service fees at the time of booking, which most of the time is before a stay occurs. On these funds held on behalf of its hosts, Airbnb earns an interest, which clearly has an impact on FCF. Because of this, Airbnb tracks its TTM FCF as its most important metric to report it because it accounts for the timing difference between the time it holds these funds until they are paid as revenue to its hosts.

How does the company record these? Guest payments are recorded, as already said, as “amounts held on behalf of customers”, with a corresponding amount that we can find in “amounts payable to customers”, when cash is received before check-in. Host and guest fees appear on the balance sheet as cash and they are balanced with a corresponding amount in “unearned fees”.

Here we are at something Costco’s and Amazon’s investors know quite well.

In fact, unearned fees is actually where the secret of Costco can be found.

It is actually a liability. But, if we think about it, we are talking about billions of cash in the hands of a company that received it at no cost. In addition, Airbnb knows exactly from the moment it receives this cash, when it will have to hand it over to its guests. In fact, Airbnb knows the dates of its bookings. Therefore, it can manage this huge amount of cash quite well, knowing exactly how much of it has to be available in a given week.

Airbnb has a double advantage: it doesn’t need to raise more debt to fund its operations and it can profit from high interest rates. In fact, we see interest income up to $191 million just for Q2 vs. $20 million in Q2 of the prior year. Considering the first six months of the year, the difference is even larger. Interest income in 1H 2023 was $337 million, while in 1H 2022 it was only $25 million. This is a 1248% increase, mostly due to interest rates.

Considering the company’s net income for the first half of 2023 is $767 million and that income taxes amounted to just $39 million, we have more than 40% of Airbnb’s net income coming from interest income.

The same is true for Costco, whose net income mainly comes from membership fees. Amazon does the same with its Prime membership.

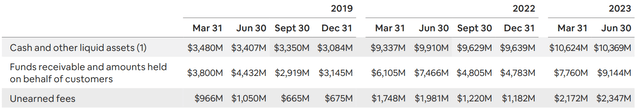

If we look below, we see how Airbnb is now holding on behalf of its customers an amount 250% greater than the one it held just 4 years ago. At the same time, if we consider Airbnb’s unearned fees in 2019 and we compare them to 2022 and 2023, we can see how the company has been able to more than double them in just 4 years (during which a pandemic occurred).

Airbnb Q2 2023 shareholder letter

So, we have a company carrying more than $10 billion as cash with an additional $9.1 billion held on behalf of customers that leave the company with several hundreds of millions as interest income.

In other words, Airbnb is a little bank and it has found a way to fatten its bottom line at almost no cost.

So, we can surely project Airbnb’s top-line growth over the next decade. Estimates see Airbnb reach around $20 billion in revenue by 2028. EPS estimates see Airbnb trading at a 2028 fwd PE of 14.7 (EPS of $8.69) because of EPS growth around 15% per year.

But I have not seen so far anybody trying to understand how amounts held on behalf of customers and unearned fees will develop over the years. From this cash received at no interest, Airbnb earns quite a bit of income, as we have understood.

So, if we can imagine a 2028 revenue around $20 billion, we can consider the company will have at least $18.5 billion of funds held on behalf of customers. Unearned fees will be around $5 billion, considering some fee hikes over the next few years. Just from the money held on behalf of its customers, Airbnb could earn at least a 3% interest, which would be equal to a minimum of $600 million of interest income. Considering Airbnb did more than this just in the first six months of this year, by 2028, I think it can be fair to expect up to $1 billion in interest income. Not peanuts. Not at all, if we consider that by 2028 the company’s net income could be around $6 billion. If Airbnb will keep its outstanding shares count flat from here to 2028 then we have an estimated 2028 EPS of $8.74, close to the one Seeking Alpha reports. However, if the share count does go down, then we may have 2028 EPS around 11-12$. The fwd PE would then come down from 14.5 to 11.6, making the stock a bit cheaper than it actually appears to be.

Conclusion

I have acknowledged more than once how Airbnb is a bit expensive. Yet, compared to other tech stocks that received a lot of attention during the post-pandemic bull market to then be beaten down last year, Airbnb has shifted to profitability mode. My fair price estimate, as I have explained in my previous article is around $130. Therefore, I believe Airbnb is currently trading near its fair value. From here downwards, we are in buying territory and the more the stock drops the larger the margin of safety one buys the stock with. However, Airbnb can be valued only through a discounted cash flow model, just like Costco can’t. In fact, both companies carry a hidden asset which is actually the engine of their profits.

Read the full article here