Introduction

Oportun Financial Corporation (NASDAQ:OPRT) is a company with a history dating back to 2005 when it was founded. Even though it has been in operation for nearly 2 decades it hasn’t managed to achieve a consistently profitable bottom line yet and this is quite concerning. If OPRT was to see a slowdown in the top line of the business I fear the repercussion would be a significant decline in the share price.

The share price has been quite volatile for OPRT for the last 12 months but has ultimately landed on the positive side as it’s appreciated over 50%. The total interest and dividend income revenues of the business have been climbing very well and I don’t see any significant catalyst or headwind stopping this. The projections suggest steady double-digit growth for OPRT and I tend to agree with this sentiment as investing and saving efficiently is becoming more of a standard each year as more people get access to it. But without a profitable bottom line, I can’t make a buy case here and OPRT instead lands in the hold phase.

Company Structure

OPRT is a provider of financial services, specializing in personal loans and credit cards. The company caters to a wide customer base, offering its services through various channels, including online, over the phone, and in-person at retail locations. Additionally, OPRT operates as a Lending as a Service partner, extending its reach and making its financial products more widely accessible.

Company Growth (Investor Presentation)

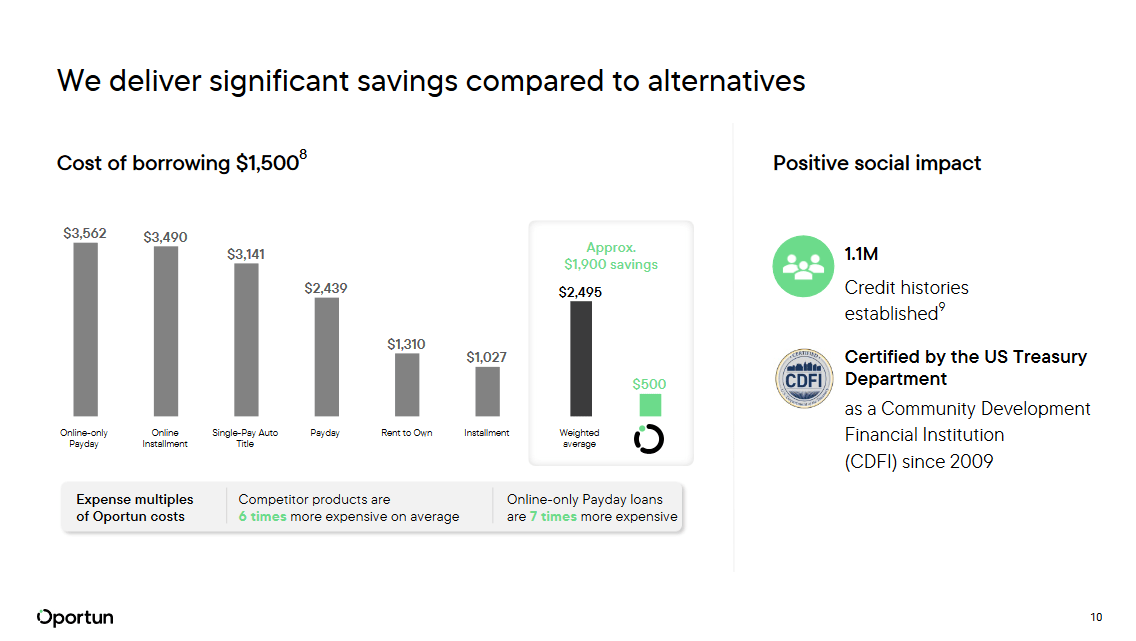

One of the leading reasons for the company’s success in expansion endeavors has come from the significant savings potential of its services compared to others. OPRT has become a recognizable brand in the financial space and gathered over 2 million members. With a lot of Americans struggling with having proper savings habits, OPRT offers a necessary product to this market.

Business Overview (Investor Presentation)

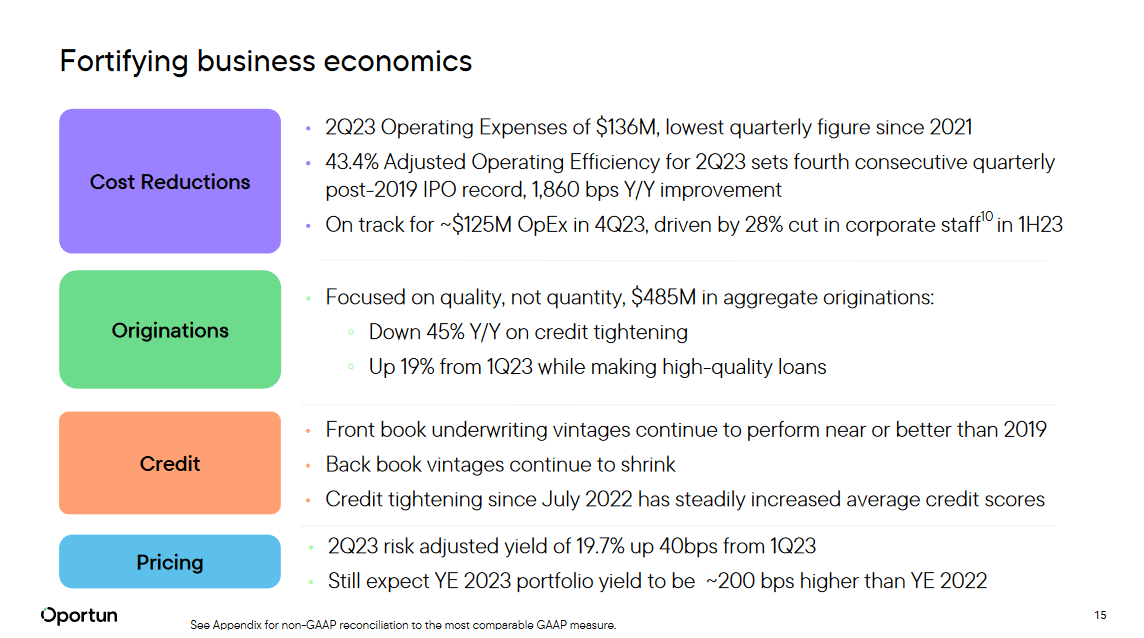

The rise in interest rates has a positive effect on the interest-bearing revenue streams of the business like loans for example. But it has also halted the activity the company is experiencing. This has driven cost reductions to be a key priority right now. Q2 2023 operating expense was $136 million, the lowest amount dating back to 2021. Further decreases in this part along with stronger revenues I think will be key drivers of share appreciation over the coming couple of years.

Yields (Investor Presentation)

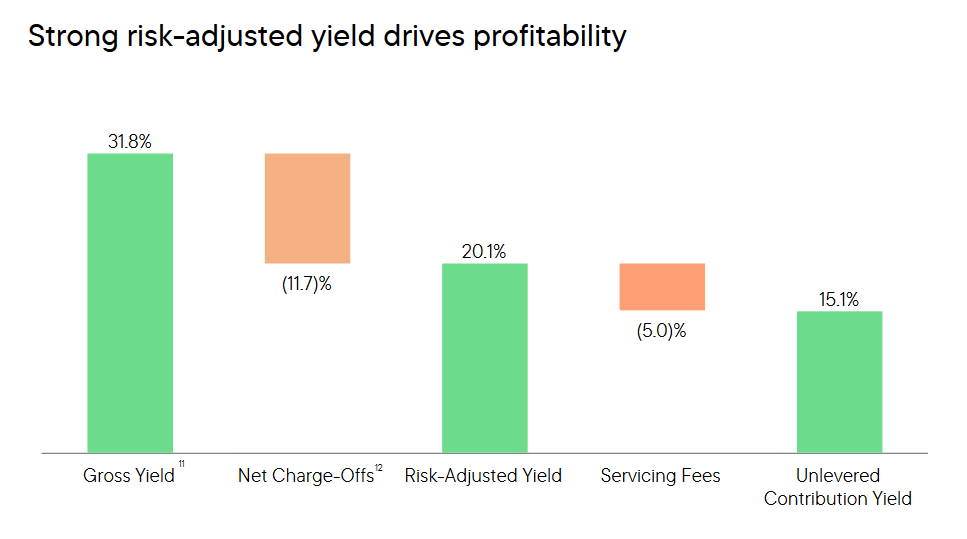

OPRT was created with the mission of providing consumer loans to individuals with lower credit scores or those who have been inaccurately assessed in terms of their creditworthiness. The company takes a personalized approach to its services, tailoring its offerings to meet the unique cash flow profiles of each customer. The company has since June 2022 tightened the credit part of the business which has increased the average credit score during this period, further, delivering the company and indicating that the loans the company offers are less risky. Even though the company began by trying to service underserved parts of the market by taking on riskier credit loans, the last few years have shown a reversal here and OPRT seems to aiming towards building up a quality asset base instead.

Earnings Transcript

Given that OPRT remains unprofitably but is taking a lot of measures in improving the margins I think it’s worth hearing some from the management of the company. From the last earnings call the CEO Raul Vazquez had the following to share.

First, we returned to profitability in Q2 with $2 million in adjusted net income, driven by strong top line performance and the steps that we took earlier this year to streamline our operating expenses. We’ve now reported positive adjusted net income in 11 of the last 12 quarters. Our adjusted EBITDA, which also turned positive at $4 million was within our guidance range and more importantly, we expect to deliver $35 million to $40 million in adjusted EBITDA in Q3″.

I think that a large part of the drawdown the share price saw in earlier parts of this year came from the risk of profitability being lower for the company. They seem to have made strong improvements on this front which is great to see of course. However, on a nonadjusted base, OPRT is still not profitable and this is where I want to see improvements. On an adjusted net income base the last 11 quarters have been positive which I think is a move in the right direction at least.

Within this category, we’re leveraging our new Opportune mobile app fully launched in Q1, which will drive increased cross-selling, higher conversions and lower customer acquisition costs over time”.

Seeing that a large part of OPRT is strong membership growth, the next few quarters will need to show a lot of improvements on this front I am to make a buy case without profitability yet. I think that the mobile app the company has launched is going to play a big part in membership conversions and should stronger EBITDA growth ultimately.

Valuation (Seeking Alpha)

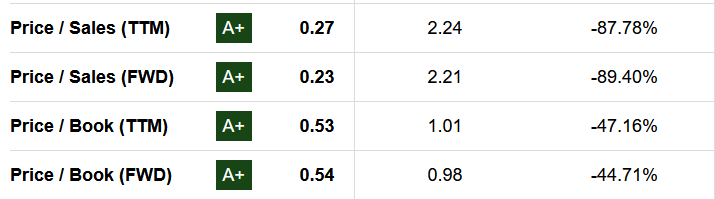

For the investors that don’t mind investing early then I think OPRT still looks quite promising. The company has a p/s under 0.3 and a p/b under 0.6 which are very low multiples in comparison to the sector. Based on these I think that OPRT exhibits a decent buying opportunity still for those that want to get in early.

Risk Associated

OPRT is a provider of financial services, specializing in personal loans and credit cards. The company caters to a wide customer base, offering its services through various channels, including online, over the phone, and in-person at retail locations. Additionally, OPRT operates as a Lending as a Service partner, extending its reach and making its financial products more widely accessible.

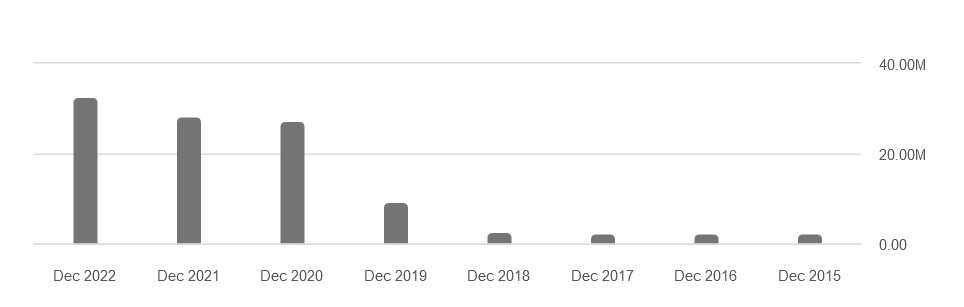

Shares Outstanding (Seeking Alpha)

Due to its negative bottom line, OPRT is faced with the challenge of raising capital to address its liabilities. One method it may employ is share dilution, which carries the potential risk of suppressing the stock price and, consequently, poses a risk to investors. Share dilution can have adverse effects on existing shareholders as it increases the number of shares in circulation, potentially diluting their ownership and impacting the stock’s market value. Given the current lack of profitability, dilution might be a necessary practice for OPRT to secure the capital it needs, but it’s a risk that investors should be aware of, especially if profitability remains a distant goal in the near term.

Investor Takeaway

OPRT is an interesting company that has had some quite volatile last couple of quarters but I think the future is looking very promising if cost reductions can continue and the mobile app launch is a success in converting more members.

However, without a positive bottom line, I think that investors are better off holding shares until the non-adjusted EPS is positive. Watching membership growth is a key point for the coming quarters and any lack of growth here could lead to a significant reduction in the share price. Risks like these make holding more justified than buying I think.

Read the full article here