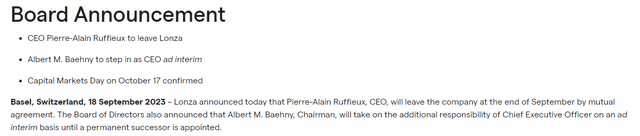

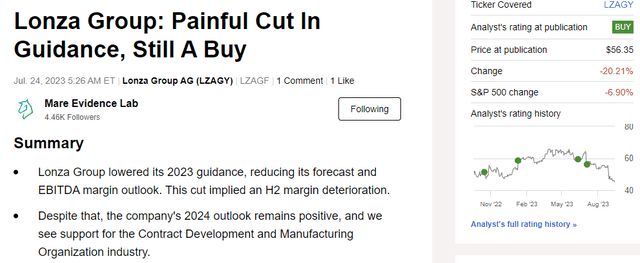

Given Lonza Group’s recent development (OTCPK: LZAGY), here at the Lab, we are back to comment on the Swiss CDMO player. We see a positive risk-reward with a downside scenario well priced before the Capital Market Day (CMD), which will be held in Visp (Switzerland) on October 17th. In a nutshell, our internal team confirmed our buy target with a price of CHF 620 per share, and we believe the CMD is essential to kicking off a potential stock price recovery. However, we should report that the company communicated that Pierre-Alain Ruffieux (CEO) left Lonza in September-end ‘by mutual agreement,’ the company also reconfirmed its 2023 outlook.

Lonza: Ad Hoc announcement pursuant to Art. 53 LR

Chairman Albert Baehny will (once again) be Lonza’s interim CEO until a suitable candidate is found. As a reminder, Baehny has been the company’s CEO since November 2020, joining Lonza just after the CMD’s financial target was set for 2024. There was no specific reason for Ruffieux’s departure in the press release, and we might suspect this change is related to a different opinion on the following strategy plan targets. Here at the Lab, we believe that Wall Street and investors are avoiding the stock, pending more visibility on the CMD and the next CEO. We also anticipate that the CEO’s departure raised questions about Lonza’s business continuity, given that the company had four CEOs in the last five years, and we are also wondering how quickly the company can replace the interim CEO. While rebuilding investor confidence could take time, the stock offers an attractive entry point. Lonza offers strong growth in biologics and is looking to consensus expectations. At the same time, the achievability of targets is a concern; cross-checking analysts’ lower-end guidance, we only see a 5% downside to consensus. Therefore, Lonza’s worst-case scenario is already reflected in the stock price.

Mare Past Analysis

Why is Lonza still a Buy?

- Post H1 results, Lonza lowered its guidance for 2023 and 2024. In detail, the company revised down the mid-term core EBITDA margin from 33-35% to 31-33%. This is due to Cell & Gene development and lower biotech funding. This development has increased debates on Wall Street on sales expectations (moving from mid-teens to low-teens growth, order book development, and long-term margins). Following the previous CMD, Lonza will set up a target that should cover the period 2023-2026, and cross-checking Visible Alpha consensus, on average, analysts are forecasting 2023 revenue of CHF 6.35 billion with a core EBITDA of CHF 1,8 billion (with a margin of 28.7%). In 2026, VA consensus expects top-line sales to CHF 8.86 billion with a core EBITDA of CHF2.91 billion (sales of 12% CER growth and a core EBITDA margin of 32.9%). Therefore, the consensus is pricing the bottom end of revenue growth and core EBITDA margin. Therefore, a positive confirmation of Lonza’s guidance will imply limited changes to 2026 estimates. Since mid-September, Lonza’s share price recorded a minus 15%, and here at the Lab, we anticipate that the company could grow faster on the revenue line (12-15%) with a core EBITDA margin in the range of ’32-34%’ in 2026, this would lead to approximately a 6-8% long term EBITDA upgrades to Wall Street consensus, confirming our supporting buy rating;

- Given the significant investment of the past years and the project ramp-up, especially in Biologics, Lonza has two supportive trends. In our numbers, we forecast an acceleration in revenue at 13.5% driven by biologics growth (you can also check our recent Stevanato update called ‘ Secular Tailwinds In Biologics Support Downstream Demand‘); however, we are also factoring a sales offset due to the Cell & Gene division. Secondly, we believe 2023 temporary cost headwinds (given startup costs) and an improving mix would support Lonza’s margins. Lonza’s track record on profitability is mixed, but the company also previously guided a reduction in CAPEX as a percentage of top-line sales to drop to ‘high teens‘ by 2025. Therefore, we might anticipate lower D&A trends in the longer term;

- To support our buy thesis, Lonza is moving on with a current CHF 2 billion buyback, which started in early April 2023 (expectation to be completed in 2025). As of mid-September, the company repurchases approximately CHF 600 worth of shares. Therefore, 30% of the buyback is now completed. The company’s Net debt/EBITDA target is lower than 2x, but given the solid FCF, we model a ratio to drop by 0.9x in 2026. Therefore, we might suggest a cumulative higher buyback of almost CHF 5 billion in the CMD visible period. Lonza might also have M&A flexibility to take advantage of any strategic initiatives.

Conclusion and Valuation

Given the recent stock price development, we believe CMD target reiteration could be sufficient to convince investors to buy back into Lonza’s investment story. The company trades on a 20% discount on an EV/EBITDA basis vs. CMDO players, and we see the CMD release as the first tap to close the valuation gap. Valuing Lonza with a 10% discount and a 2024 EV/EBITDA of 21x, we confirmed our buy rating. Lower CAPEX, start-up cost already recorded, and a supportive biologics positive trend trajectory make Lonza a clear buy to the current stock price levels. Aside from the risk already anticipated, additional threats are the earnings recovery story to be delayed post-2024, negative investor sentiment around the stock and the new CEO, uncertainties from volatile FX, development of new medicines that might cannibalize existing sales, supply/demand dynamics and lower order books. Another limited downside is that pharmaceutical conglomerates might start to increase internal production, limiting Lonza’s growth and margin expansion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here