Plains All American Pipeline (NASDAQ:PAA) reported its 2nd quarter earnings with a modest decline quarter over quarter. After updating the 2023 guidance at the top end of the number given during the 4th quarter report, it appears that more distribution increases are on the way. To confirm this, in previous article, we estimated cash flows going forward, a practice we continue. The company has consistently guided for $600M in excess cash this year, a number considerably lower than a previous estimate of $1B+. With the company adding a mysterious distribution of $300M last year, the primary difference, this lowered the number. In spite, the company appears marching toward higher returns. This isn’t a 6″ sub, rather it is a full foot-long one. Let’s head for lunch, and no need for ordering that small one.

The 2nd Quarter Announcements

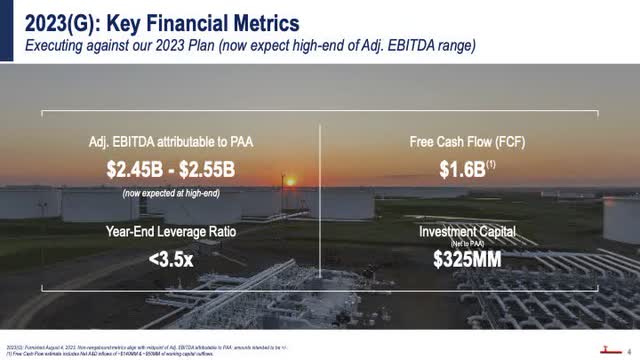

Management updated with confidence “as a result of our year-to-date performance and the Bolt-on Acquisition, we now expect to be at the high-end of our $2.45 billion to $2.55 billion, adjusted EBITDA range for 2023.” They also reiterated the excess cash flow for the year at $600M. This reiteration was accompanied even with “slightly lower-than-expected Permian production driven by lower commodity prices and some weather-related impacts that occurred in June and July.” The of the 2nd quarterly report is summarized in the next two slides:

Plains All American

Continuing:

Plains All American

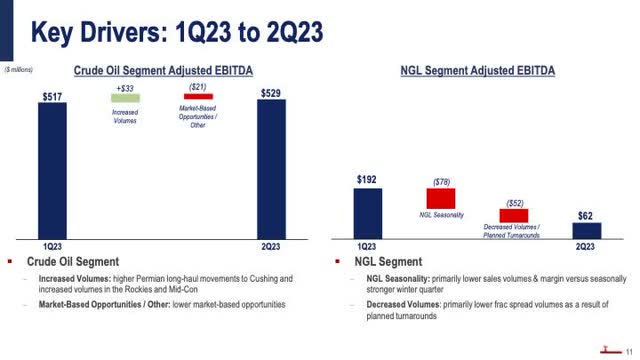

Of importance to investors is the significant drop quarter over quarter in EBITDA displayed next:

Plains All American

The 2nd quarter crude oil segment outperformed the 1st, but the NGL segment dropped from $192M to $62M with approximately half from quarter over quarter seasonality and also more from turnaround losses. The quarter over quarter difference totaled $715M minus $597M or $120M. The total YTD through June equaled $1.3B. To reach the high-end of guidance, the last quarters must average near $650M. It should also be noted the NGL business is heavily hedged and will continue to perform at its hedged rate regardless of NG or NGL pricing.

The Distribution

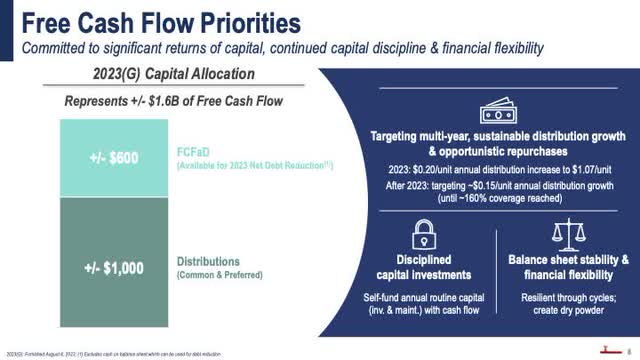

Now let’s get to that sandwich, the full sized one. The next slide lays out management’s distribution plan.

Plains All American Pipeline

The company currently pays out approximately $750M per year on 700 million common units. Each 15 cent target increase adds $100M in cash towards distribution.

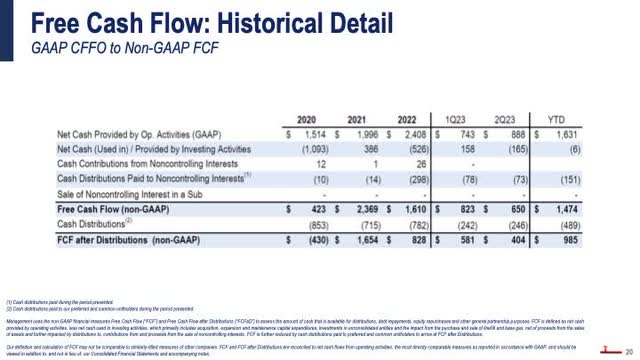

This next slide was included in reaffirming cash balances for the past few years. Investors may want to take a peek in that it reflects a different view with slightly difference numbers.

Plains American

Continuing, we developed next a recent history for the company’s EBITDA performance.

Over the past few years, EBITDA remained flat. Investors, like ourselves, expecting changes in cash flow driven by higher EBITDA (Permian Basin primarily) might be disappointed. Any change in cash flow rather than from revenue seems only possible from debt payoff. Currently, All American has $900M cash and plans to payoff the $700M due in October from this cash.

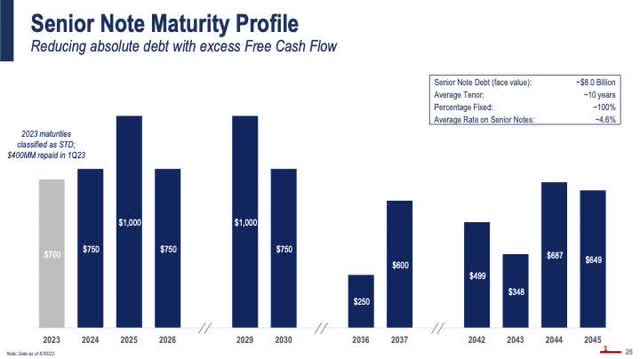

A net slide shows the debt profile coming.

Plains All American Investor Day

Viewing the senior debt structure for Plains, $700M and $1000M come due in the next two years after this year. The interest rate on that long-term debt coming due in 2024 and 2025 equals approximately 4%. The $700M next year could lower debt payments by $30M per year and the $1000M could save $40M more. Saving from extinguishing debt might save $70M a year, a relatively meagre amount.

Cash Balance

Next we look at a possible cash balance going forward.

| Plains | Cash | 2023 Balance of Year | 2024 | 2025 | 2026 |

| Cash Generation | $900M | $300M | $650M * | $650M | $600M |

| Total Cash | $1200M | $1100M | $950M | ||

| Debt to Retire | $700M | $700M | $1000M | ||

| Increase in Distribution (from 2023) | $0M | $100M | $200M | ||

| Net Cash | $500 | $300M | -$250M | Negative |

* Approximately $50M in interest reduction should management decide to retire the 4% average interest rate debt in 2023 and 2024. (The 2023 debt is being paid in October.)

At the end of this year, the coming cash could add an additional $300M in excess cash bringing the total to $500M at years end. By 2025, the cash needed to retire all debt and pay higher distributions is short by $250M.

From an investment perspective, a simple calculation, $750M (distribution paid in 2023) times 2.16 (distribution coverage), yields a total value of $1620M, the value management is apparently using to calculate the coverage. To figure the total cash available for future distributions at constant EBITDA and 1.6 coverage, Plains could increase spending to $1000M per year, a value that equals $250M more than is currently being paid. This represents an increase of $0.35 per year. In three years, Plains might pay $1.40 per year in distributions. Our investment thinking suggests that a unit price of $17-$18 might be considered full value.

Risk

Risks within this company could be many. A severe recession with its demand destruction creates an obvious risk. The level of drilling, especially in the Permian, is also another risk. From OilPrice, “The rig count in the Permian Basin fell by 5 this week—the second week in a row for that size of a drop, and 32 rigs below this same time last year.” What isn’t a long-term risk is renewable energy over taking traditional sources. From Larry Fink of Blackrock, “There will be no energy transition unless we can find new technologies that bring down the cost of renewables, . ..” The costs are way high with the current technology. We read this everywhere where honest research exists.

On weakness, Plains is a buy, but at prices above $14 and current distributions at approximately $1.10, yields are much too low in our view. We rate the units a hold based on price.

Read the full article here