ATN International, Inc. (NASDAQ:ATNI) reaffirmed its EBITDA guidance for 2023, which I noted in a previous article. Besides, I expect that a further combination of inorganic growth in new markets, financing obtained from Digital Rural Opportunities Fund, and joint ventures with large telecom companies may accelerate FCF margin growth. Even considering risks from failed M&A or failed expansion into new regions, under my different case scenarios, ATNI appears to be trading undervalued.

ATN: Internationalization Will Most Likely Offer Operating Margin Expansion

ATN is a company that provides digital infrastructure and communication services in the United States and internationally in the Caribbean. The company’s focus is on small rural or remote markets that offer great infrastructure investment and development opportunities. ATN’s main services are the installation of terrestrial and underwater fiber optic networks and communication towers for companies and providers as well as fixed and mobile telecommunications services for residences, businesses, and government entities, with high-speed internet and communication services.

Source: Presentation To Investors

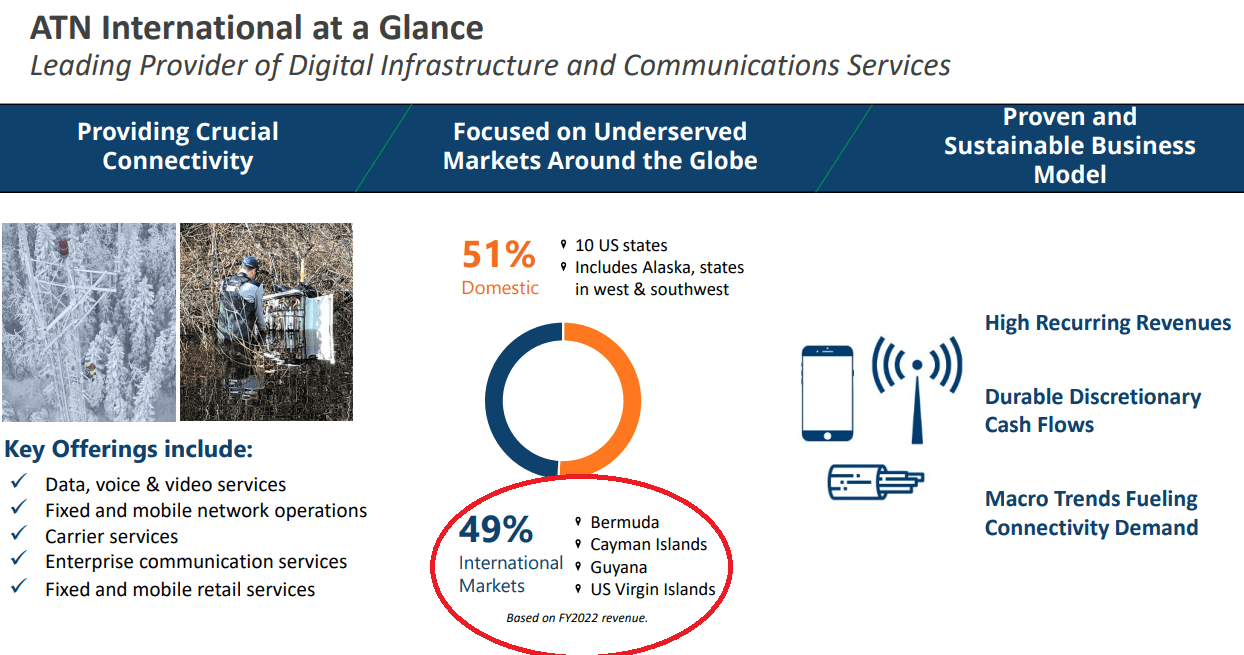

Operations are divided between local and international services in the Caribbean, specifically in Bermuda, Grand Cayman, and Guyana. ATN’s services are the same for both segments: offering of cell phones and mobile telephone devices, with ownership of communication towers, fixed telephony for residences and businesses.

Source: Presentation To Investors

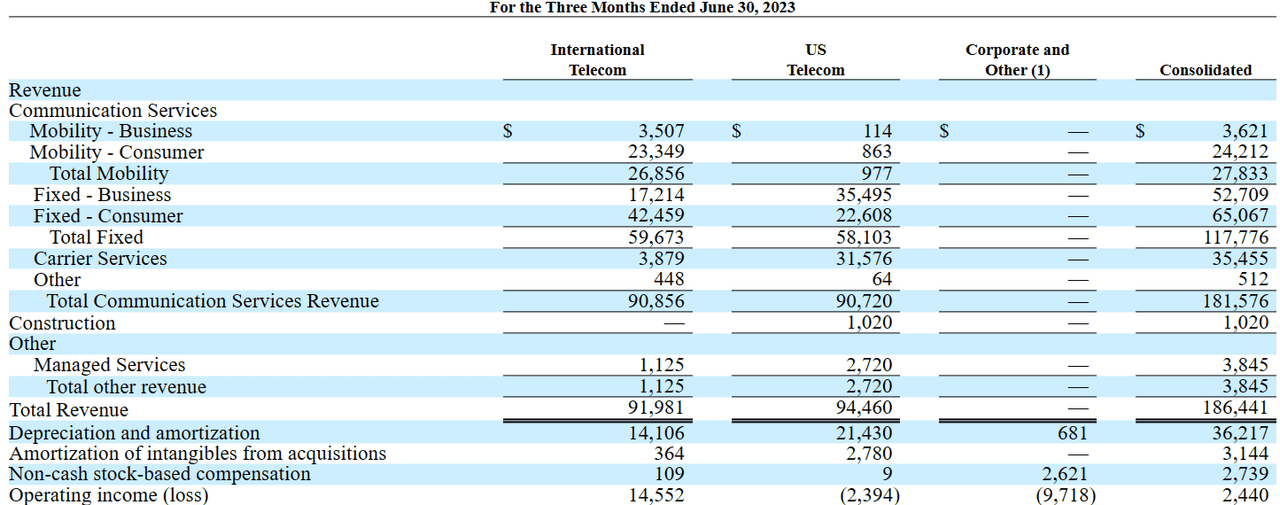

Revenue from both segments is close, however the operating income offered in international markets appears to be quite superior as compared to that from the US telecom. With this in mind, I continue to believe that internationalization will most likely bring significant FCF margin expansion.

Source: 10-Q

ATN’s current approach has to do with the expansion of its services in growing markets, especially in the Caribbean and the areas of the United States where there is still no expanded telecommunications network intervention. Examples of this are the acquisition of Alaska Communication Group, with 52% of the ownership and control of the shares of this company, a provider of fixed and management services for clients in the region, and the acquisition of Sacred Wind Enterprises, a telecommunications company present in rural areas of New Mexico.

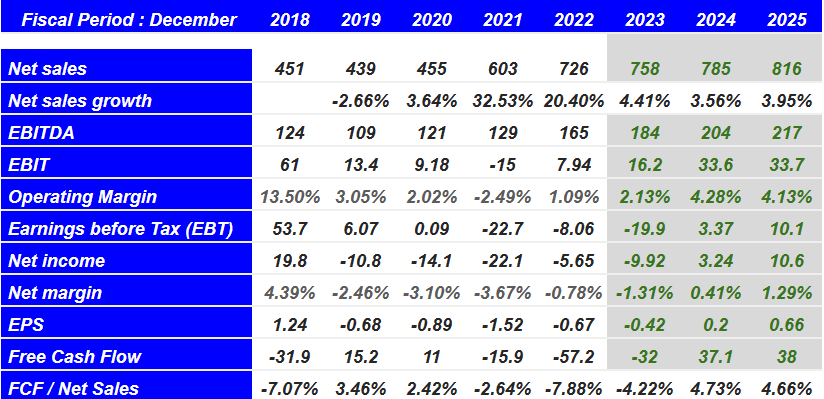

Market Expectations Include Positive FCF From 2024 And Positive EPS In 2025

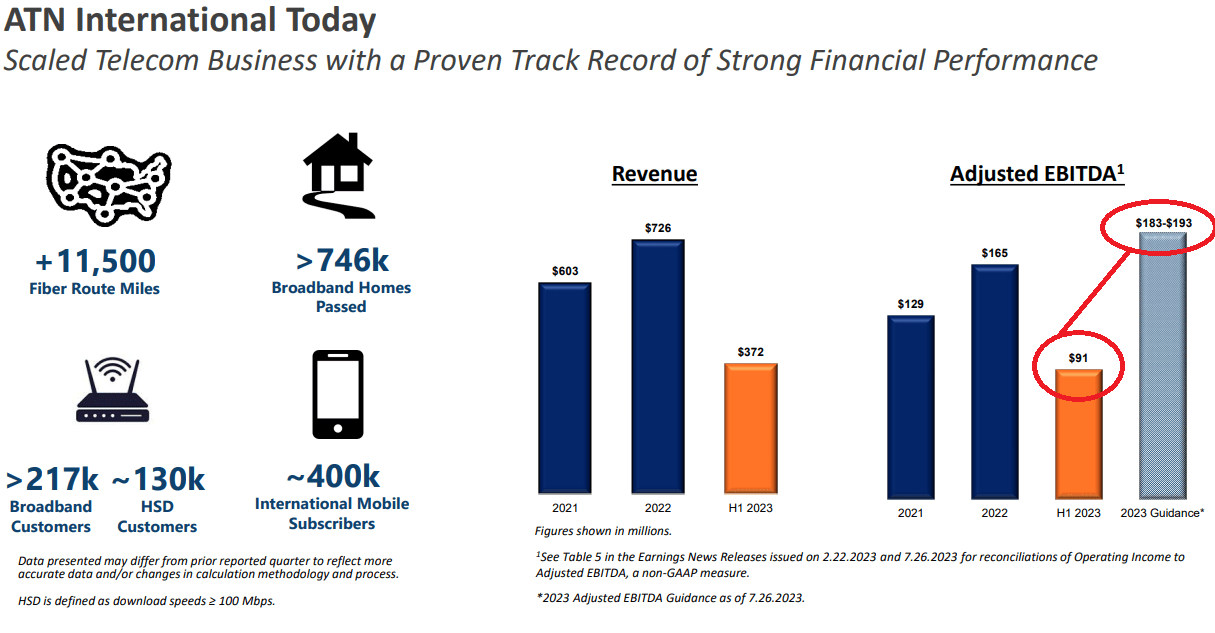

In a previous article, we noted that 2023 Adjusted EBITDA was expected to be close to $183-$193 million. In my view, it is quite beneficial that the company continues to deliver the same expectations many months later.

Finally, the company included Adjusted EBITDA in the range of $183-$193 million and 2023 guidance with further growth coming in the second semester. I believe that the figures are close to what other analysts were expecting, but they seem beneficial. Source: ATN Q4 Earnings: Beneficial 2023 Guidance And Double-Digit Mobile Business Growth

Source: Presentation To Investors

Professional forecasters expect lower net sales growth in 2024 and 2025. However, they also believe that ATN may deliver positive net income in 2024 and 2023 as well as FCF growth. In my view, positive EPS and positive FCFs will most likely have a positive effect on the stock valuation.

More in particular, investors are expecting 2025 net sales close to $816 million, with EBITDA of $217 million, 2025 EBIT close to $33 million, and positive FCF. In my view, as soon as investors learn about the new FCF/Net Sales expectations for 2024, we may see an increase in stock demand.

Source: Market Screener

Investment In New Regions, Further Inorganic Growth, New Joint Ventures With Large Telecom Companies, And The Expertise Accumulated Will Most Likely Enhance FCF Growth

ATN’s main objective is to become a leading company in the provision of telecommunications networks and services in the markets in which it is present, with a focus on regions where there has historically been no investment. With know-how from the United States, I believe that ATN may successfully receive some demand in new markets. As a result, we may see certain net sales growth and FCF margin improvements thanks to economies of scale.

I also expect FCF margin expansion from the implementation of the first fiber program, which consists of the implementation of joint financing programs with regional governments and federal resources for the installation of optical fibers in communities and schools.

Besides, I believe that ATN will most likely deliver further net sales growth making use of the company’s historical experience and knowledge in the development and operation of telecommunications networks and infrastructure, in collaboration with local managers and administrators. Let’s keep in mind that ATN reports a more than 30-year history of investing in bandwidth infrastructure in historically underbuilt rural and remote markets.

Additionally, I assumed further successful inorganic growth and disciplined allocation of capital with a focus on long-term sustainable businesses, such as recent acquisitions in the expansion of its subsidiaries in underdeveloped regions in the field of telecommunications. In addition to the aforementioned acquisitions, ATN may bring further net sales growth thanks to currently developing joint programs with important service provider companies within the United States, such as the project with Verizon (VZ) for the development and modernization of wireless networks or the infrastructure construction project for AT&T Mobility (T) in the west of the country.

Digital Rural Opportunities Fund And Other Investments In Public Infrastructure Will Most Likely Accelerate Capital Expenditures, And Enlarge The Implied Valuation Of ATN

Likewise, the company is part of different federal programs of the United States government that invest in the development of infrastructure through the capabilities of ATN, specifically the Digital Rural Opportunities Fund, through which the company expects to receive financing in the next ten years for the installation of networks in more than 10k homes. In general terms, we can say that the company’s positioning strategy is supported by great relationships with private and public investment funds.

Balance Sheet

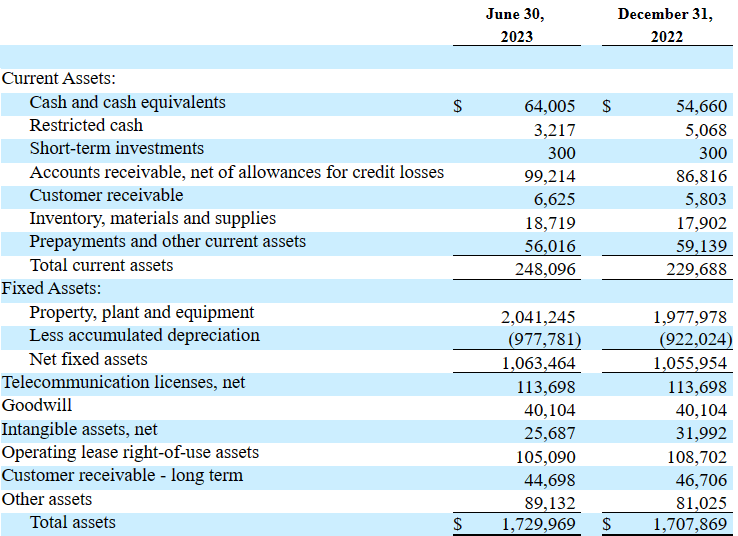

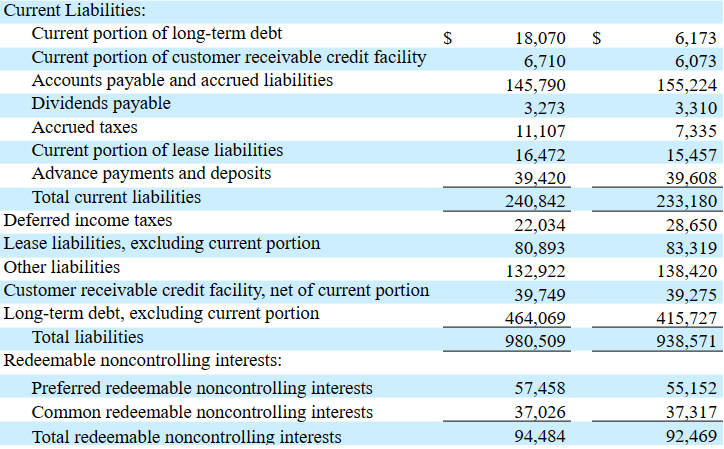

As of June 30, 2023, ATN reported cash and cash equivalents worth $64 million, restricted cash over $3 million, and accounts receivable worth $99 million. Total current assets are equal to $248 million, just above the total amount of current liabilities. With this in mind, I do not think that liquidity is an issue here.

Fixed assets include property, net fixed assets of about $1.063 billion, with telecommunication licenses worth $113 million, goodwill close to $40 million, and total assets over $1.729 billion. The asset/liability ratio is close to 2x, so I believe that the balance sheet stands in a good position.

Source: 10-Q

I am not concerned about the total amount of liabilities because the company reports a considerable amount of fixed assets. However, the total amount of debt does not seem small as compared to the current FCF and EBITDA levels. The current portion of long-term debt is equal to $18 million, and the long-term debt, excluding the current portion, is equal to $464 million. If we assume forward EBITDA close to $170 million, the net debt/EBITDA is not far from 3x. I feel comfortable about the level of debt because of the properties and the stability of the business model, however I would understand that quite conservative investors may not appreciate it.

Accounts payable and accrued liabilities stand at close to $145 million, with total current liabilities close to $240 million, lease liabilities excluding current portion close to $80 million, and total liabilities worth $980 million.

Source: 10-Q

DCF Models

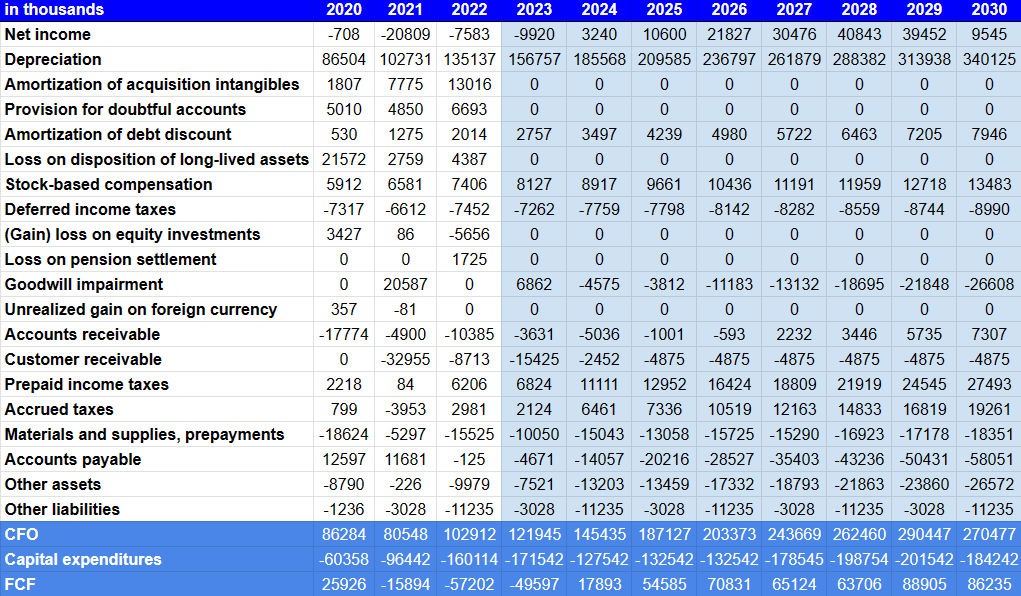

My financial model includes quite conservative assumptions including long term net income growth, D&A growth, growing capital expenditures, and growing FCF. The free cash flow levels that I expect from now to 2030 do not exceed previous FCFs reported by ATN in the past.

More in particular, I assumed 2030 net income of about $9 million, with depreciation close to $340 million, but no amortization of acquisition intangibles or provision for doubtful accounts.

Besides, with 2030 stock-based compensation of about $13 million, deferred income taxes of about -$9 million, and goodwill impairment worth -$27 million, I included changes in accounts receivable of $7 million and changes in customer receivable close to -$5 million. Additionally, with changes in materials and supplies and prepayments of -$19 million, 2030 CFO would be close to $270 million. If we also assume 2030 capital expenditures of -$185 million, the implied 2030 FCF would stand at $86 million.

Source: My Cash Flow Expectations

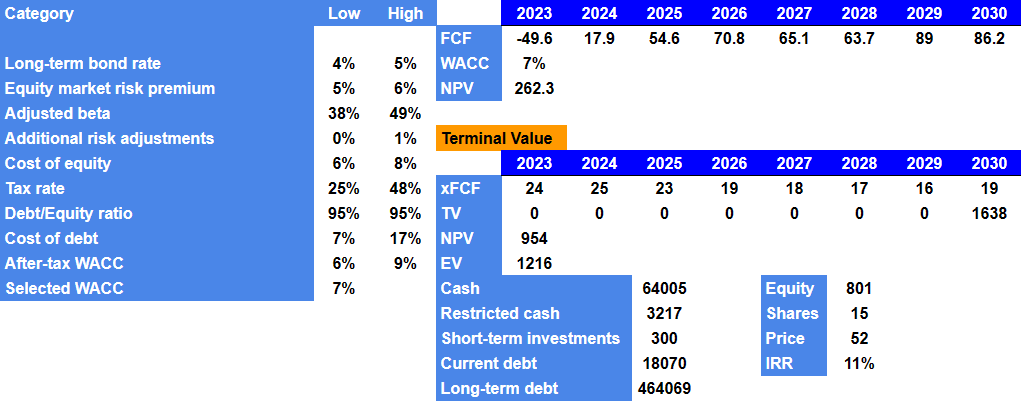

My CAPM model under my conservative case scenario includes an equity market risk premium close to 5% with adjusted beta of 0.38, cost of equity of 6.1%, a tax rate of close to 24%, cost of debt of 6.8%, and a WACC of 7.1%. With these figures, the NPV of future FCF would be close to $262 million. Besides, assuming an EV/FCF multiple of 19x, the implied enterprise value would be close to $1.216 billion. Adding cash and subtracting debt, I obtained an equity valuation of $52 per share and an IRR of 11%.

Source: My Cash Flow Expectations

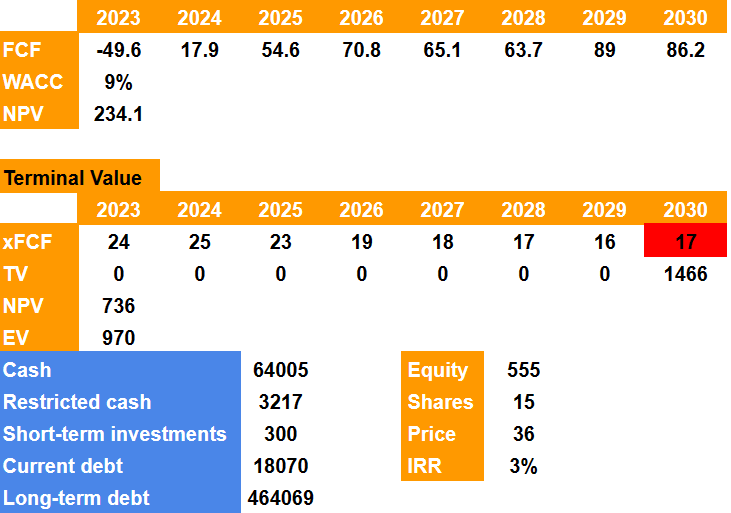

Taking into account exactly the same cash flow expectations, under a CAPM a bit more conservative, I used a WACC of 9%, which would imply a NPV of future FCFs of $234 million.

Now, with an EV/FCF of 17x, the implied enterprise value would be $970 million, and the equity valuation would not be far from $555 million. Finally, we would be talking about a valuation of $36 per share and an IRR of 3%. I believe that the previous model is a bit more likely, however I wanted to run a bearish scenario for those investors who dislike the total amount of debt.

Source: My Cash Flow Expectations

Competitors And Risks

To analyze the competition for this company, it is necessary to segment the competition that exists for each type of service it offers. In many cases, competitors have a similar service, and in others, they offer specific services. In the case of fixed services, the participants are limited within the market, and those that stand out are Digicel and Liberty Latin America. In mobility services, competition is more varied depending on the region, although the two main participants in ATN’s markets of interest are Digicel (DCEL) and Liberty Latin America (LILA).

There are risks in the operational sense, in compliance with contractual obligations with government funds, Verizon, and AT&T. Regarding the agreement with AT&T, obligations depend on external factors such as the supply or provision of third-party services for compliance. The dependence on third parties also expands to certain areas of the company’s operations, on the sale of mobile devices, accessories and parts for the repair, or construction of communication infrastructures.

In terms of the market in general, the acceleration of change trends with digital innovations and installation of 5G networks pose a challenge for the company in the integration and renewal of its networks. In the same sense, regarding transformations, ATN expects to achieve revenue growth in the local markets of the Caribbean above the historical records of the operating segment in the United States. If ATN delivers lower FCF growth than expected outside the United States, in my opinion, certain investors may sell their stakes, which would lower the stock price.

My Takeaway

ATN did not lower its 2023 EBITDA guidance, and many analysts out there are expecting positive FCF and net income in 2024. In my view, further investments in new regions, inorganic growth, and financing received from the Digital Rural Opportunities Fund will most likely bring FCF margin growth. I do see risks from failed net sales growth in the international markets, failed M&A growth, or issues with supply chain. With that, under my two case scenarios, I obtained a fair price that is significantly higher than the current stock price.

Read the full article here