Back in March, I wrote a bullish article on Weatherford International (NASDAQ:WFRD) saying that the company trades at a large discount to international rivals and that it should benefit from an upswing in E&P CapEx spending after years of underinvestment. Since then the stock has returned over 50% versus a -6% return for the S&P.

Company Profile

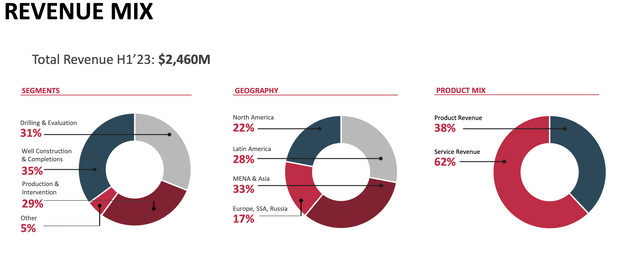

As a refresher, WFRD is an energy services company whose products and services span the lifecycle of a well from Drilling & Evaluation (DRE), to Well Construction & Completions (WCC), and Production & Intervention (PRI). The company operates in 75 countries across the globe.

Within its DRE segment, WFRD offers services such as drilling and wireline services, as well as products such as drilling fluids and drilling tools. In its WCC segment, it provides services such as tubular running services, completions, and well services, as well as products such as cementation systems, packer systems, and liner hangers. And for PRI, it offers services such as intervention services, fishing services, sub-seas intervention, and pressure pumping, as well as products such as plunger pumps, production automation & software, and gas lift systems.

Company Presentation

Solid Q2 Results and Raised Guidance

WFRD has been putting up solid results since I first looked at the stock, and the company has announced a number of nice contract wins and extensions since.

For Q2 WFRD saw its revenue rise 20% year over year to $1.27 billion. That topped the analyst consensus for revenue of $1.24 billion. Adjusted EPS came in at $1.12, but missed analyst estimates by 6 cents.

Adjusted EBITDA soared 56% to $291 million. Operating cash flow came in at $201 million, with an adjusted free cash flow of $172 million.

International revenue climbed 27% to $1.0 billion, led by 40% growth in Latin America to $371 million. The Middle East/North Africa/Asia region grew revenues 20% to $421 million, while Europe/Sub-Sahara Africa/Russia grew revenue 20% to $217 million.

North American revenue slipped -1% to $265 million. The company said the results were impacted by weaker drilling and completions activity, as well as Canadian wildfires.

By segment, DRE revenue climbed 24% to $394 million. Adjusted EBITDA in the segment soared 54% to $106 million from $69 million a year ago. The company credited increased activity across all product lines and geographies

WCC revenue, meanwhile, rose 15% to $440 million. Adjusted EBITDA jumped 63% to $109 million compared to $67 million a year ago. The company cited increased activity for completions and cementation products internationally for solid growth.

PRI revenue grew 5% to $366 million, while segment EBITDA jumped 19% to $81 million from $68 million a year earlier. The company said that strong activity in the Latin America and Middle East/North Africa/Asia regions was partially offset by weaker activity in North America.

Turning to its balance sheet, WFRD ended the quarter with $2.0 billion in debt and $787 million in cash and equivalents, good for 1.1x leverage.

Looking ahead, the company expects Q3 revenue to be flat to up low single digits sequentially. EBITDA margins, meanwhile, are expected to be in line with Q2 results. It anticipates free cash flow of $100 million.

DRE Q3 revenue is expected to be flat to down by low single digits, which it said was largely from a shift in the timing of certain activities. WCC revenue is projected to grow by low to mid-single digits, while PRI revenue is forecast to rise by low to mid-single digits as well.

For the full year, WFRD guided for revenue growth in the mid to high teens. DRE is projected to deliver mid-teens growth; WCC to grow in the mid to high teens; and PRI revenue growth to be mid- to high-single digits. It is looking for adjusted EBITDA margins to increase by at least 350 basis points over 2022 levels. Previously WFRD forecast mid-teens revenue growth for 2023, with EBITDA margins expanding at least 250 basis points. Originally it projected revenue to grow low double digits to mid-teens, with EBITDA margins up at least 100 basis points.

Last month, CEO Girishchandra Saligram was at the Barclays CEO Energy Conference. At the conference, he discussed how the issues that hampered the company and led to its bankruptcy were behind the firm. At the conference, he said:

“The way I describe it is the existential crisis that have pretty much plagued Weatherford for the last 10 years or so are behind us. They’re firmly in the rearview mirror. But we always want to keep an eye on them to make sure we never do a proverbial u-turn and head back. But now it’s all about for us, how do we grow the business? How do we continue to deliver margin expansion, even greater cash flow conversion, but with this mentality of growth. So it’s a much different focus. It’s a much different mentality, but never forgetting the lessons from the past. What I’m really excited, though, about is all of the great work that has been done, and there has been a lot, we’ve gotten a lot of success, but in my view, it’s still just the early innings because now we can turn our attention to technology development, to operational excellence, to a lot more focus on our customers on how do we develop different commercial models. And so I think we will see a lot more innovation out of Weatherford, and I think this is just a start for us. … So as we think about the portfolio, what I think is particularly effective and special at Weatherford is we’ve got a portfolio that covers pretty much the broad scope of offerings that allows us to offer fully integrated services to an extent. And that allows us to go head-to-head with our larger peers in several cases. But we are able to complement that with some very highly differentiated specialty service offerings. So things like NPD, or PRS or intervention services that very few people really have. So that combination gives us a very unique footprint, and allows us to provide these value-added services while doing the broader stuff but again, always with differentiation. So 1 of the things that we are now driving — we have talked a lot about our market-leading product lines, so MPD, TRS, cementation products and intervention services. But over the last couple of years, we’ve put a lot of effort and a lot of funding into our technology programs on our other product lines to make sure we’ve got differentiation on those as well.”

WFRD has continued to put up solid results and raise guidance since I first looked at the stock. The second quarter showed strength across its product line and geographies, outside of North America, which is actually a much smaller component compared to its international presence. Meanwhile, the company’s balance sheet is the best it’s been, allowing it to invest this year in technology and other longer-term oriented growth opportunities.

Valuation

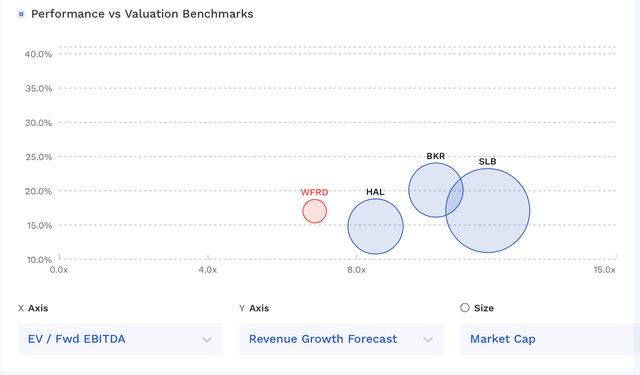

WFRD currently trades around 6.7x the 2023 consensus EBITDA of $1.15 billion and 5.8x the 2024 consensus of $1.32 billion.

It trades at a forward PE of 16x the 2023 consensus of $5.48.

Analysts expect the company to grow revenue by 17% in 2023 and over 9% in 2024.

WFRD trades at a discount to large international rivals Baker Hughes (BKR), Halliburton (HAL), and Schlumberger (SLB). This is likely due to its past issues, but those now look to be behind the firm.

WFRD Valuation Vs Peers (FinBox)

Conclusion

Despite its over 50% rise since my original write-up, WFRD still trades at a pretty significant discount to its international peers. While its past bankruptcy may lead some investors to take a more cautious approach with the name, the company’s balance sheet is in good shape and it is growing nicely. At some point, the company should begin to regain investors’ trust and the multiple gap should start to close.

Given its strength and increasing guidance, I’m going to up my price target to $110, which is a 7x multiple on the 2024 consensus. That’s still quite a discount to its larger peers, so I think the stock has plenty of room to run.

The biggest risk to WFRD at this point would be a big decline in oil prices that could see E&Ps curtail activities. China’s re-opening has helped spur oil demand, however, a major global recession could change that, which could impact drilling plans. That said, right now the cycle is working in the favor of energy service companies, with offshore drilling making a resurgence and the Middle East increasing natural gas production for regional consumption.

Read the full article here