Shares of Huntington Ingalls Industries (NYSE:HII) have been steadily declining since August, amid broader market weakness and questions over whether Congress will be able to pass a defense appropriations bill, or if Pentagon spending will be cut under a “continuing resolution.” Last October, I argued that Huntington Ingalls was a sell, given operational challenges and limited growth potential, and since then, shares have fallen by about 14%. Given this decline, now is an appropriate time to consider if HII shares are cheap enough to own. I still see risks skewed to the downside

Seeking Alpha

In the company’s second quarter, HII earned $3.27 per share—this was down from $4.44 last year. This decline in earnings came even as revenue of $2.8 billion was up 4.7%. My core concern about HII has been about costs and profit margins, and this continues to be a challenge for the company. While shipbuilding revenue rose 3.9%, its Ingalls shipbuilding unit saw margins compress by 630bp to 9.8% as costs outpaced contracted price mechanisms, a similar phenomenon weighed on its aircraft carrier production with Newport News shipbuilding margins of 6.3%.

Its less capital intensive and faster growth unit, mission technologies, did grow faster with revenue up 7.5% thanks to strength in cyber and electronic warfare. However, here operating margins are running just 1.4% even as revenue rose from $600 to $645 million. I would expect to see margins improve as revenue grows, as a sign the business is scaling up and achieving some operational leverage, but that really has not happened yet.

As a consequence, operating income fell by $35 million to $156 million as margins compressed 160bp to 5.6%. As a reminder, from 2018-2019, this company often reported operating margins of around 9%. Unfortunately, building ships is a complex, multiyear process that can lead to delays and unexpected expenses, which weigh on profitability. While some contracts have cost-plus inflation riders, not all do, and HII has cited inflation (which we have experienced) as a leading risk factor to its business, as it can make contracted programs less profitable than anticipated.

Huntington Ingalls

In late 2022, the flagship Gerald Ford aircraft carrier finally deployed, after $3 billion (27% of cost overruns). For investors to buy into HII, there needs to be a belief that operating performance and margins can improve. Unfortunately, the second carrier, the John F. Kennedy, has had its delivery date postponed again from 2024 to 2025. Last year, I said HII was a “show me” story, needing to prove it is improving efficiency. Unfortunately, in both the results and in flagship program delays, I am not yet seeing evidence this is occurring.

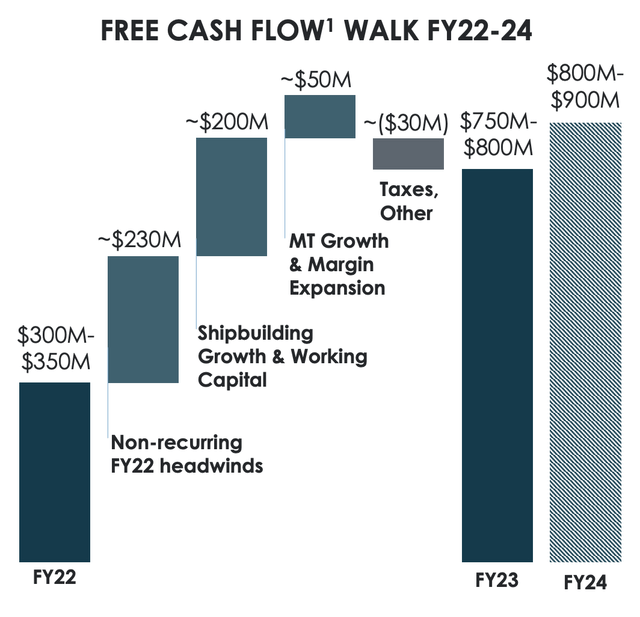

After the second quarter, management did reaffirm guidance for $400-450 million in free cash flow this year and $730 million to $830 million next year. For the full year, management expects shipbuilding margins to be nearly 8% and mission technologies margins about 2.5%. This guidance assumes shipbuilding margins rise back to 9% by Q4, and I see downside risk to this given the lack of improvement we have seen so far.

In Q2, free cash flow was just $14 million; however in the first half of the year, HII tends to see negative working capital movement, which improves in the second half. Indeed, working capital has been a $308 million headwind, and HII has $273 million in H1 free cash flow adjusting for this.

While management reiterated its most recent guidance in Q2, I would note this is below what the company originally anticipated for this year. One year ago, management thought it would generate $750-$800 million in free cash flow in 2023–$350 million more than it will. Its 2024 guidance is also $70 million lower. This underperformance is a reason, in my view, to believe the anticipated ~$300 million increase in free cash flow next year, as an ambitious target that should be viewed with some caution.

Huntington Ingalls

Now, if the company did achieve its cash flow forecast over the next 18 months, it plans to pay down about $680 million in debt through 2024. This would leave about $250-$350 for share repurchases after its dividend, enough to buy back about 4% of shares. Given working capital improvement that should come over the balance of the year, getting to $400 million in free cash flow this year is reasonable, but I am skeptical that cash flow can ramp up that aggressively next year, given my lack of confidence in the margin improvement.

Ultimately, cash flow growth will be more predicated on margin growth than revenue growth. The company does have a $46.9 billion backlog, and $24 billion of the backlog is funded whereas the other half is subject to appropriation. In Q2, Huntington had a 0.9x book to bill ratio with$2.6 billion in orders. Mission technologies’ backlog has fallen by about 9% this year to stand at $4.5 billion as HII’s efforts to diversify beyond shipbuilding continue to struggle to gain meaningful traction. Revenue growth at the shipbuilding operation is unlikely to surpass low-to-mid single digits. Given the physical infrastructure requirements, not to mention the need for qualified workers, it is not as though it is possible to dramatically increase production, even if there was demand for more ships.

HII is also subject to the political process. Over the medium term, there is national security appetite to expand the Navy as we face a rising China, but in the near term, significant resources are focused on the Russia-Ukraine conflict, which has limited impact on HII’s business given it is primarily a ground war. The debt ceiling deal also capped Pentagon spending at up 3.3% or $886 billion for fiscal 2024.

In fiscal 2023, the Navy was allocated $31.96 billion to build ships. The Senate is proposing $33.3 billion this year, a 4% increase. While this is better than the overall Pentagon’s allocated increase, with inflation running about 3.7%, this is not much of a “real” increase. The House has also proposed $3 billion less for total Naval procurement than the Senate, so this 4% increase is really the “best case” scenario. This provides context for what HII’s achievable revenue growth is: low to mid-single digits.

However, this assumes all goes well, and Congress passes a spending bill. If congress cannot pass appropriations bill for all 12 agencies by January 1; there would be an automatic 1% budget cut based on the debt ceiling agreement. Given the uncertainty in Washington about who the Speaker of the House will be, there is definitely a risk that this automatic 1% spending cut happens. Predicting politics is extremely difficult, but if this occurs, achieving management’s free cash flow target would be unlikely in my view. This is a challenge as a defense contractor—the business is tied politics.

Overall, HII’s business continues to perform mediocrely. Inflation and a tight labor market, combined with delays and overruns, have kept margins compressed below pre-COVID levels. Management is guiding for a return toward that margin level as we exit this year, but I do not see evidence this is occurring. Additionally, its growth efforts in missions technologies remain mixed, and there is downside risk to next year due to political events.

Shares currently trade with a forward 9.75% free cash flow yield using the midpoint of 2024 guidance ($780 million). However, given the risks highlight, I believe investors should assume less margin expansion. Now, inflation has slowed, which should ease pressures, so if we assume the company can see half of the anticipated gains, free cash flow would be about $600 million, giving shares a 7.5% free cash flow yield. I view this as fair value for a capital intensive, slow-growth business that needs to prove itself and has struggled to do so this year.

However, this assumes defense spending does rise next year. If automatic spending cuts do go into effect, free cash flow is unlikely to be greater than $500 million, giving shares just a 6% free cash flow yield, and meaning buybacks would be de minimis given the need to pay down debt.

With a spending deal, shares are at fair value around $200, but absent one, shares could push into the $180 area to get back towards a 7% free cash flow yield, in my view, to reflect the lack of buybacks. With limited upside but a clear downside risk, I would continue to sell shares of HII and look for better opportunities elsewhere.

Read the full article here