The dividend-paying firms of the U.S. stock market turned in a lackluster performance in September 2023. The month’s news for both favorable and unfavorable dividend changes was negative, with a low number of rises and a small increase in decreases tipping the scales to the downside.

There was a positive surprise in the data for one sector of the stock market, which we’ll really get into toward the end of this month’s analysis.

We’ll tease that part up front by pointing out that had this sector had a typical month for it, the number of dividend decreases would have been higher and our description of what happened with dividends would be more negative.

Instead, it had an unusually strong month, which may be good for it and investors in that sector. But given why that happened, we think that’s not a good sign for the relative health of the U.S. economy.

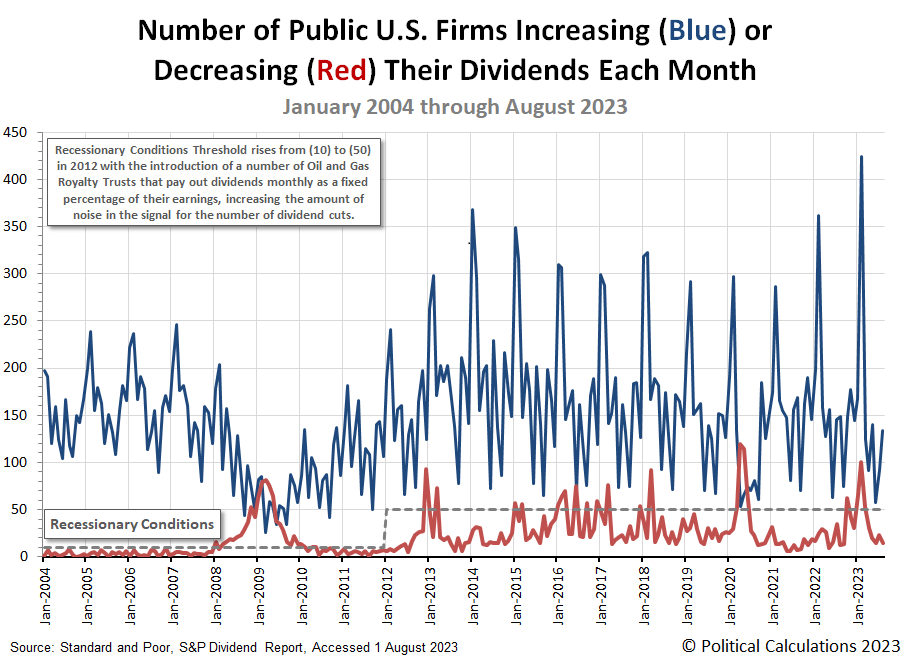

Here’s our chart showing the number of monthly dividend increases and decreases announced each month from January 2004 through the just completed September 2023.

The following table presents September 2023’s dividend metadata. It provides the last month’s figures for the number of dividend declarations made, the number of increases, resumptions, and extra dividends announced on the “favorable” side of the ledger, and also the number of dividend decreases and omissions (or suspended) dividends on the month’s “unfavorable” side.

It compares those values against August 2023 for a month-over-month (MoM) view, and against September 2023 for a year-over-year (YoY) perspective.

| Dividend Changes in September 2023 | |||||

|---|---|---|---|---|---|

| Sep-2023 | Aug-2023 | MoM | Sep-2022 | YoY | |

| Total Declarations | 4,408 | 4,465 | -57 ▼ | 4,082 | 326 ▲ |

| Favorable | 99 | 218 | -119 ▼ | 109 | -10 ▼ |

| – Increases | 62 | 134 | -72 ▼ | 74 | -12 ▼ |

| – Special/Extra | 36 | 81 | -45 ▼ | 33 | 3 ▲ |

| – Resumed | 1 | 3 | -2 ▼ | 2 | -1 ▼ |

| Unfavorable | 22 | 17 | 5 ▲ | 13 | 9 ▲ |

| – Decreases | 22 | 15 | 7 ▲ | 13 | 9 ▲ |

| – Omitted/Passed | 0 | 2 | -2 ▼ | 0 | 0 ◀▶ |

Some quick notes about the data in the dividend change table:

- Standard and Poor’s revised the number of dividend declarations announced in August 2023 down from 5,309 to 4,465.

- Coming at the end of the third quarter, September is typically a slow month for dividend increases. Even so, the 62 dividend rises recorded during the month just barely beats September 2020’s total of 61. We have to go back to the Great Recession-impacted years of 2008 through 2011 to find lower figures. That’s not a healthy sign for the stock market.

- The number of dividend decreases ticked up to 22, the highest for the months making up the third quarter. Even so, this total is below the threshold that signals recessionary conditions are negatively affecting dividend-paying firms. What we see is consistent with typical month-to-month noise, except for one particular sector of the stock market that we’ll discuss shortly….

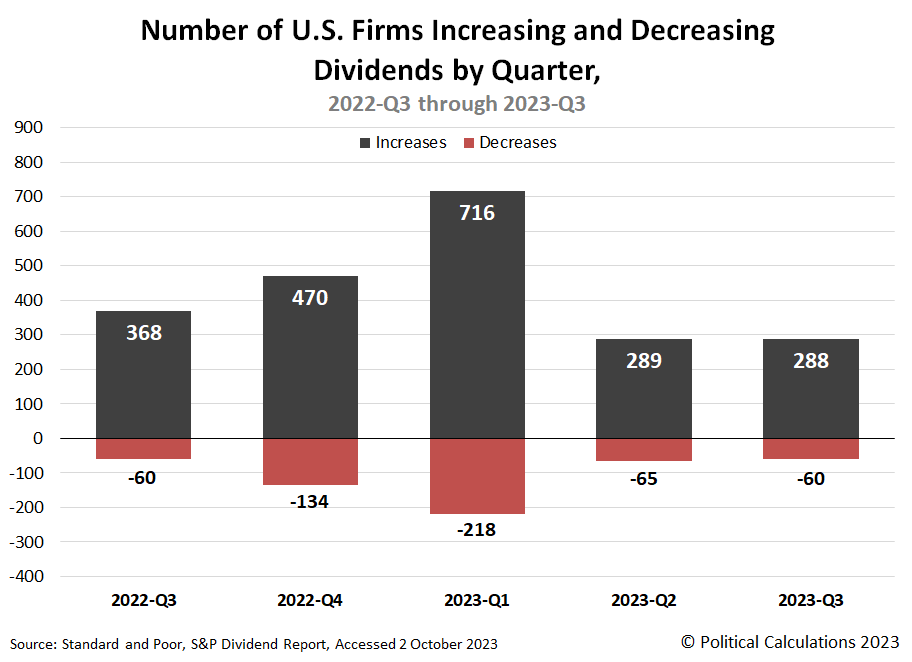

Before we get to that discussion, let’s look at the entire third quarter. The next chart illustrates the number of dividend increases and decreases reported in each of the last five quarters:

With 288 dividend increases and 60 dividend decreases, 2023-Q3 came close to duplicating the preceding quarter of 2023-Q2. The year-over-year comparison with 2022-Q3 however shows 2023-Q3 was worse, with the same number of dividend decreases but many fewer dividend increases.

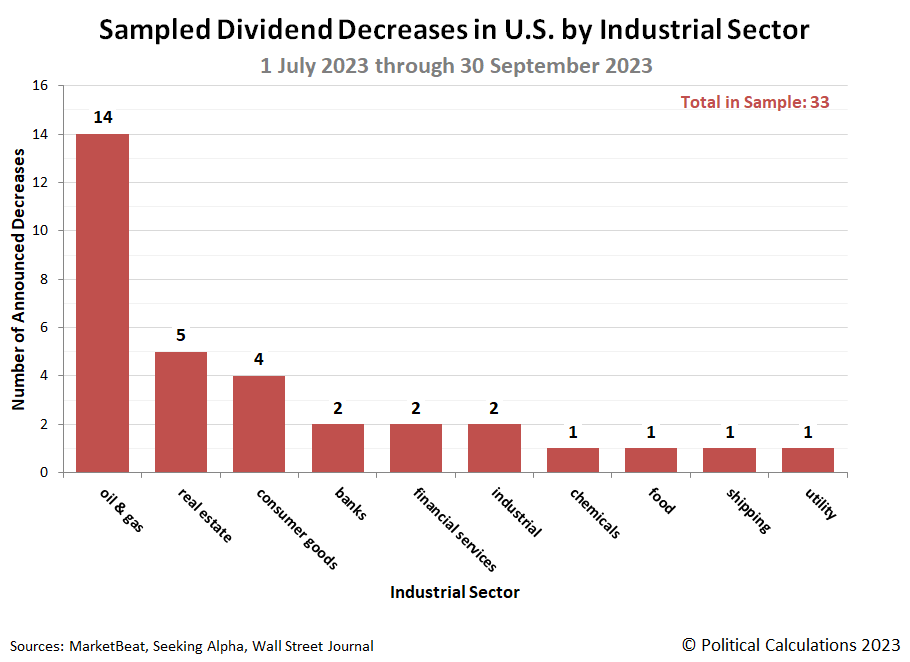

The number of announced dividend cuts identified in our regular sampling declined to its lowest level since June 2022. There are six firms in this month’s sampling: there are three REITs, one bank, one utility, and one firm from the oil and gas sector of the U.S. economy.

Grouping the Real Estate Investment Trusts and bank together, we can see the impact that rising interest rates are having on these sectors, particularly the mortgage REITs.

But what really stands out about this listing is the absence of oil royalty firms like Permian Basin Royalty Trust (PBT) in the sampling of dividend decrease announcements in September 2023.

Because these firms pay variable dividends, they often make up a significant number of firms we see in our monthly sampling, which is attributable to how the price of oil fluctuates over time.

They did however represent a larger share in both July and August 2023. The following chart reveals the oil and gas sector tallied up the most dividend decreases in our sampling for the full calendar quarter.

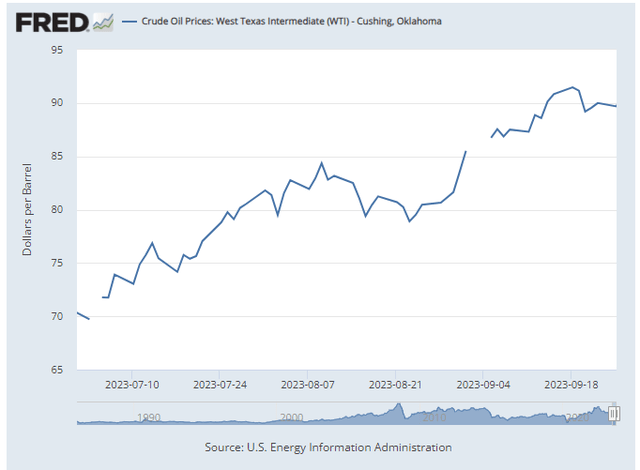

So what changed during the quarter to benefit the variable dividend payers of the oil and gas sector? In short, from the beginning to the end of 2023-Q3, the price of oil rose and stayed elevated, increasing from about $70 per barrel to $90 per barrel.

Overall, the data for dividend decreases during 2023-Q3 points to a continued recovery from 2022’s earnings recession for the U.S. stock market.

Rising oil prices however are a contributor to higher inflation for the U.S. economy, which will have consequences that aren’t so good for other sectors of the stock market. Especially those sectors counting on interest rates retreating.

References

Standard and Poor’s. S&P Market Attributes Web File. [Excel Spreadsheet]. 29 September 2023. Accessed 2 October 2023.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here