All truly great thoughts are conceived while walking.“― Friedrich Nietzsche.

Today, we take a deeper look at Cerus Corporation (NASDAQ:CERS). This medical device maker is having some challenges, which it believes are temporary. The stock is down some 40% in 2023 and 70% from all-time highs achieved in early 2021. Is CERS oversold or still a “falling knife” at current trading levels?. An analysis follows below.

Company Overview:

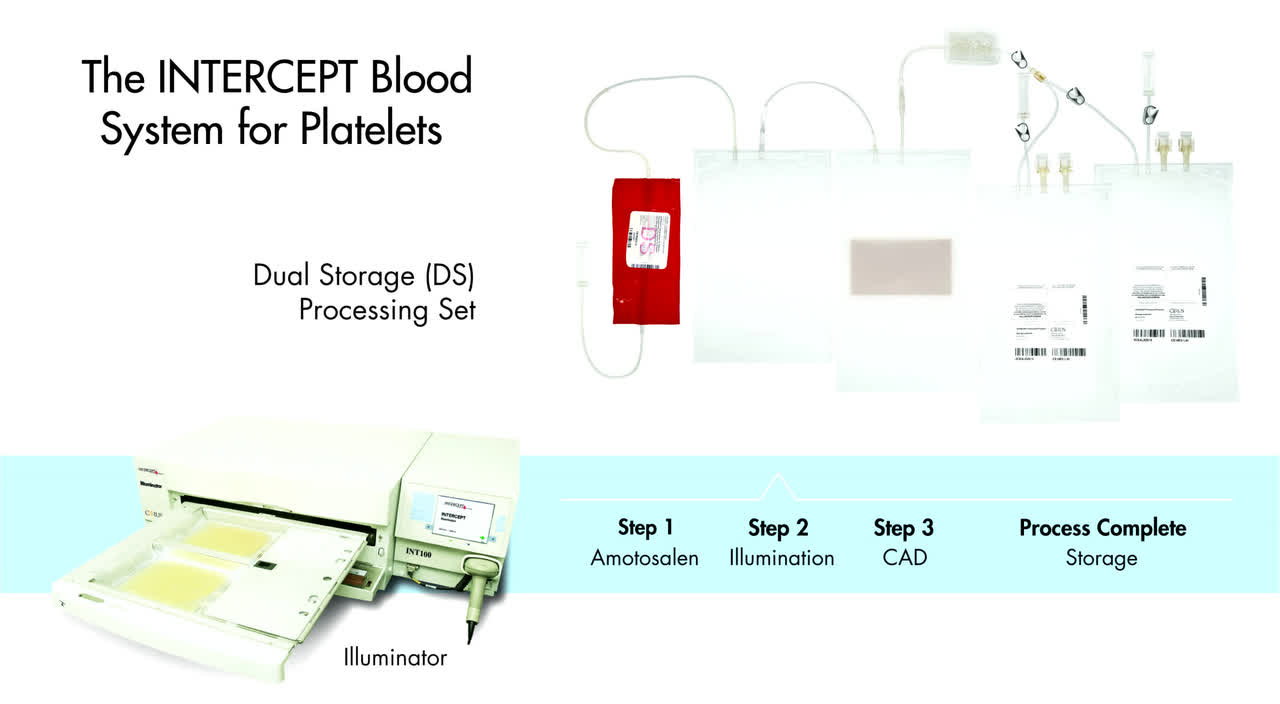

Cerus Corporation is a biomedical products company that is headquartered just outside of Oakland, CA. The company’s key product is the INTERCEPT Blood System. INTERCEPT uses a proprietary technology for controlling biological replication that is designed to reduce blood-borne pathogens in donated blood components intended for transfusion. Cerus sells platelet and plasma systems through its direct sales force and distributors both in the United States and overseas. The stock sells for around $2.25 a share and sports an approximate market capitalization of just under $400 million.

Company Website

First Quarter Results:

Last Thursday, Cerus posted its first quarter numbers. The company had a non-GAAP loss of nine cents a share, a penny below the consensus. Revenue fell just over 10% on year-over-year basis to $38.5 million, approximately $1.5 million below expectations.

Cerus Management blamed the fall in sales to more normalized customer order patterns resuming as the pandemic ends. The company does expect sales growth to return in the quarters ahead and be positive for 2023. They issue FY2023 revenue guidance of $165 million to $170 million. This would be up from the $162 million worth of sales in FY2022. The company is counting on the rollout of the INTERCEPT Blood System for platelets in Canada to contribute this year. In addition, management is making efforts to garner regulatory approval in China via a joint venture there.

Analyst Commentary & Balance Sheet:

There hasn’t been a ton of analyst activity around this equity so far in 2023. In mid-January, Stephens downgraded its weighting on CERS to Equal Weight from Overweight, with a $3.75 price target on the stock. On March 1st, both Stifel Nicolaus ($7 price target from $10 previous) and Cantor Fitzgerald ($9 price target, down from $10 previously) maintained their Buy ratings but lowered their price targets on the stock. Finally, Monday BTIG reiterated its Hold rating on CERS.

Approximately five percent of the shares outstanding are currently held short. Insiders don’t seem to be signaling a bottom in Cerus Corporation stock. Several sold just under $500,000 worth of their equity stakes collectively in March. One has to go back to early 2020 to find the last insider purchase in the shares.

Cerus ended the first quarter of this year with just under $95 million in cash and marketable securities on its balance sheet after posting a net loss for Q1 2023 of $15.6 million, which was up from the net loss of $12.3 million in the same period a year ago. The company has approximately $40 million of long-term debt.

Management did do a successful debt refinancing in the first quarter. This involved extending to a longer time before principal repayments are required. It also gave Cerus options for an additional $20 million of funding and expansion of their revolving line of credit up to $35 million.

Verdict:

The current analyst consensus has the company losing 20 cents a share even as revenues rise 10% in FY2023 to just under $180 million. Sales growth is expected to accelerate to 15% in FY2024 and losses cut to 13 cents a share.

The company is making some progress in rolling out INTERCEPT In different markets and losses are projected to come down in coming years as sales growth returns. That said, the company’s burn rate is concerning given its current balance sheet, insiders are selling and the analyst community is not currently that positive on the near-term prospects for Cerus. In addition, based on last week’s FY2023 sales guidance from the management of Cerus, analyst firm sales projections need to be taken down $10 million to $15 million.

Given the current market environment and the potential for a recession later on in the year, investors are unlikely to reward many unprofitable companies in the quarters ahead. Therefore, until Cerus Corporation significantly reduces its cash burn and significant sales growth returns, this is not a name I am currently interested in as an investment.

It is one thing to be clever and another to be wise.”― George R.R. Martin.

Read the full article here