Free to move about the cabin

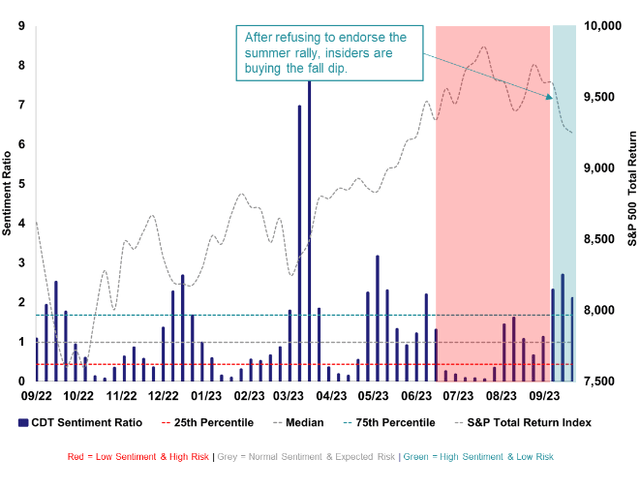

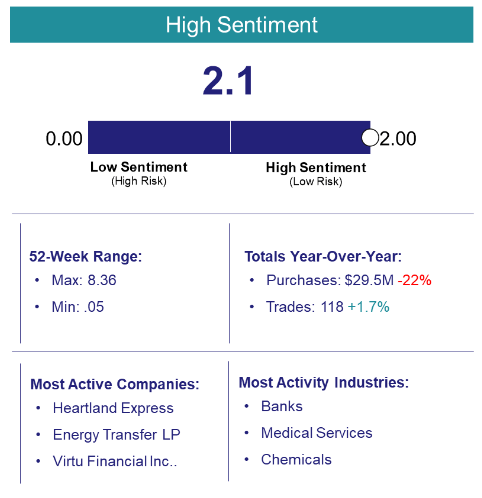

After refusing to endorse the summer rally, insiders are buying the fall dip. The S&P 500 concluded the third quarter on a whimper down -4.8% on a total return basis for the month of September.

A pullback in equity market valuations and a return to a healthier level of insider sentiment are both welcome developments. Still, the continued rise in bond yields, particularly on the long-duration end of the yield curve, is curbing enthusiasm.

During Q3, yields on maturities at least 5 years out, on average, increased by +.71%. For stocks that are typically framed as long-duration investments, the increase in their long-duration fixed income counterparts is particularly distressing, which in our opinion explains why stocks underwhelmed this quarter.

On the precipice of earnings season, insider activity is quiet (not sentiment) as black-out periods begin, preventing insiders from transacting in their stock until they report their numbers.

It is our guess that investors will be keen to know how, if at all, the jump in interest rates has affected a company’s ability to generate value for shareholders.

As we reflect on the specific sector activity in the last three months, we believe that those highly interest-sensitive parts of the market that have ferociously sold off during this period will likely produce better than expected results – at least relative to the amount of fear exhibited in their stock prices today.

Expect clear skies ahead.

How it Works:

Objective:

Predictive model that measures the historical relationship between insider sentiment and the future probability of downside volatility (risk)

Insider Trading Activity:

Purchase activity of an insider’s own stock filtered by proprietary parameters to scrub noisy data

Insight:

Executive-level insider sentiment is an indicator of near-term financial market risk

– Low executive sentiment suggests a high level of risk

– High executive sentiment suggests a low level of risk

Scale:

A ratio of current insider trading activity in relation to historical patterns

– (0 to ∞) with a historical median measure of 1

– Below 1 implies an above normal level of risk

– Above 1 implies a below normal level of risk

Frequency:

The measure is updated daily and historically been subject swift and possibly extreme shifts

*This webpage is updated monthly and provides just a snapshot of the most recent month-end

Disclosures:

This presentation does not constitute investment advice or a recommendation. The publisher of this report, CDT Capital Management, LLC (“CDT”) is not a registered investment advisor. Additionally, the presentation does not constitute an offer to sell nor the solicitation of an offer to buy interests in CDT’s advised fund, CDT Capital VNAV, LLC (“The Fund”) or related entities and may not be relied upon in connection with the purchase or sale of any security. Any offer or solicitation of an offer to buy an interest in the Fund or related entities will only be made by means of delivery of a detailed Term Sheet, Amended and Restated Limited Liability Company Agreement and Subscription Agreement, which collectively contain a description of the material terms (including, without limitation, risk factors, conflicts of interest and fees and charges) relating to such investment and only in those jurisdictions where permitted by applicable law. You are cautioned against using this information as the basis for making a decision to purchase any security.

Certain information, opinions and statistical data relating to the industry and general market trends and conditions contained in this presentation were obtained or derived from third-party sources believed to be reliable, but CDT or related entities make any representation that such information is accurate or complete. You should not rely on this presentation as the basis upon which to make any investment decision. To the extent that you rely on this presentation in connection with any investment decision, you do so at your own risk. This presentation does not purport to be complete on any topic addressed. The information in this presentation is provided to you as of the date(s) indicated, and CDT intends to update the information after its distribution, even in the event that the information becomes materially inaccurate. Certain information contained in this presentation includes calculations or figures that have been prepared internally and have not been audited or verified by a third party. Use of different methods for preparing, calculating or presenting information may lead to different results, and such differences may be material.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here