Investment summary

Trading at a c.50% discount to the sector at 8x forward earnings and 9x forward EBIT, Allegiant Travel Company (NASDAQ:ALGT) has popped onto our radar with potential relative value.

As I’ll cover here today, though, the economic value of ALGT in the investment context does not support a rating above these compressed multiples. Not in my view. It has plenty of work to do in order to start throwing off attractive rates of earnings and cash from the capital invested in the business. Further, this is a capital-hungry business where the reinvestment runway is limited to expanding its fleet/capacity, and now its Sunseeker development. This report will unpack the moving parts in the ALGT investment debate and link back to the broad hold thesis. Net-net, I rate ALGT a hold, and view the 8x multiple a fair rage for the company at this stage.

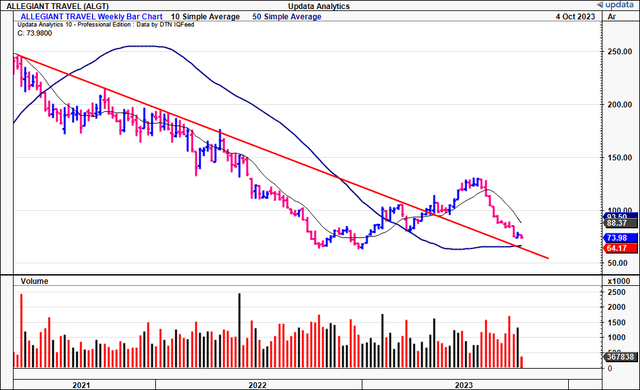

Figure 1. ALGT continues large selloff from ‘pandemic era’ highs in ’21.

Data: Updata

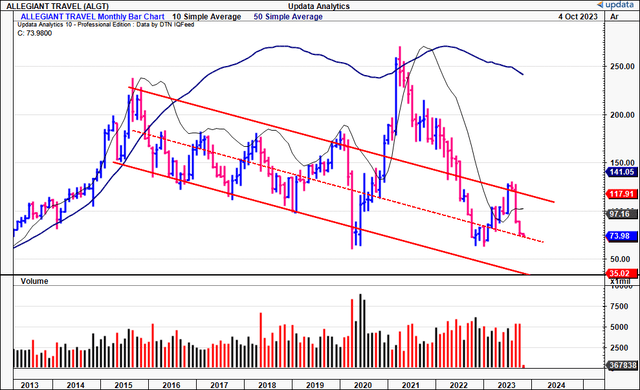

Figure 1(a). ALGT Long-term (monthly) returns. Adjusting for the Covid-impulse, the company continues in its longer-term downtrend of around 8 years now.

Data: Updata

Critical facts underpinning hold thesis

1. ALGT embroiled in the JBLU/SAVE merger

As a background, around this time last year, JetBlue Airways Corp (JBLU) reached a deal to acquire Spirit Airlines Inc. (SAVE). It offered $3.8Bn or $33.50/share for buy the company, including (i) a prepayment of $2.50/share in cash once approved by SAVE’s shareholders, and (ii) a ticking fee of $0.10 per month starting in January this year. This valued the company at an enterprise value of $7.6Bn with all factors included.

The regulators didn’t waste any time in scrutinizing the deal. The Justice Department (“DOJ”), supported by various state attorneys general, initiated a legal challenge to block the acquisition in March.

The lawsuit argues the acquisition could result in higher fares and reduced seating capacity, adversely affecting consumers across various routes. At the time, the DOJ said “As our complaint alleges, the merger of JetBlue and Spirit would result in higher fares and fewer choices for tens of millions of travellers, with the greatest impact felt by those who rely on what are known as ultra-low-cost carriers in order to fly…”.

The trial for the legal challenge initiated by the DOJ and company is scheduled to start on October 16th. If the acquisition does move forward, it would be the largest deal in the U.S. airline industry since the merger of American Airlines and US Airways in 2013. It would see the newly formed company have around 9% of market share, behind United Airlines (UAL), Delta Air Lines (DAL), Southwest Airlines (LUV) and American Airlines (AAL).

Naturally, a deal this large is going to attract plenty of regulatory attention.

Here is where AGLT is embroiled in the mix. As a potential remedy to see the deal go through, early last month, JBLU agreed to divest various assets on SAVE’s books to ALGT in an effort to score regulatory approval.

The divestment to ALGT includes the transfer of 2 of SAVE’s gates in Boston, 2 gates in Newark, and 43 takeoff + landing authorizations in Newark, also to be transferred to ALGT. The divestiture, “…while not needed to ensure the continued growth of the vibrant ultra-low-cost carrier segment, is aimed at removing any doubt of [the] commitment to promoting competition”, according to JBLU’s CEO. Note these transfers are still subject to approval from various authorities.

But it doesn’t end there. September was such a busy month with regards to this deal:

- The DOJ will still begin proceedings against JBLU and SAVE on October 16th, regardless of the divestitures to ALGT.

- Then, reports surfaced that JBLU has plans to hike fares on SAVE’s flights up to 40% if the deal is approved. Senator Elizabeth Warren is now further involved, demanding answers and so are others at the DOJ. Warren initially made calls to block the deal in September last year.

Whilst these last 2 points don’t impact ALGT, it does have an impact on the company’s potential asset values going forward. Granted, the company’s operations do not hinge on the transfer of these assets from JBLU/SAVE. Plus, these additions would have been welcomed to grow ALGT’s footprint. So I’d advise to keep a very close eye on updates regarding this deal, as it will have implications to ALGT whether it goes through or not.

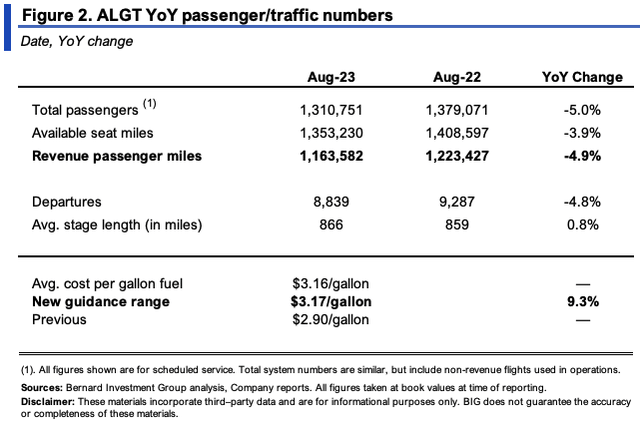

2. Traffic numbers trending down in H2 FY’23

The company’s August ’23 report on passenger traffic, available seat miles and other unit economics came in softer versus August ’22 (Figure 2). Total passengers were down 470bps YoY to 1.32mm, and down 5% YoY in scheduled servicing to 1.31mm, with average stage length flat at 866 miles. In addition, revenue passenger miles were down ~500bps to 1.16mm and available seat miles were down 400bps to 1.35mm. Departures also fell 4.8% to 8,839 from 9,287 this time last year. Critically, the company’s est. avg. cost per gallon of fuel was $3.16/gallon, leading it to revise FY’23 guidance of cost per gallon to $3.17/gallon from $2.90/gallon previously.

BIG Insights

The updates follow a robust set of numbers ALGT put up for its Q2 results in August. It clipped total operating revenues of $1.33Bn (Airline and Sunseeker included), up 18% YoY on $228mm in operating income and earnings of $7.84/share. Critically, total revenue per available seat mile (“TRASM”) came to 13.64c, increasing by 7.5% YoY. Moreover, the company invested $176mm to CapEx, broken down to $147mm in aircraft (including inductions) and $29mm to other maintenance CapEx.

Consequently, airline-specific pre-tax income was $110mm or 16% of revenues, on an operating margin of 18%. Avg. fares were up 8.1% YoY as well to $142, with ancillary fares also up 8.6% to $71.75. Management is eyeing $10-$13 per share on its Airline operations and a loss of $1.25/share on its Sunseeker segment. It is looking to FY’23 CapEx of $695mm across both divisions.

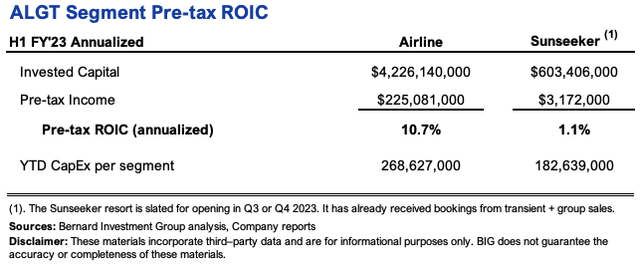

As to segments, the airline remains the most profitable division (for now), until the Sunseeker resort is fully opened in either Q3 or Q4 this year. Airline pre-tax ROIC was 10.7% (annualized) in H1, producing $225mm in pre-tax earnings off $4.22Bn invested into the segment.

With the Sunseeker resort, the company has begun taking bookings from transient customers and group sales. The investment to Sunseeker is noteworthy and has totalled $182.6mm in tangible capital this YTD, as seen in Figure 3. Total capital invested now resets at $603.4mm to the venture. ALGT’s rationale for the investment “is an extension of the company’s leisure travel focus and it is expected that many customers flying to Southwest Florida on Allegiant [flights] will elect to stay at this resort and enjoy its amenities”. Again, I’d be watching the early stages of Sunseeker closely to gauge how successful this investment will be.

Figure 3. Considering the $603mm investment to date, Sunseeker will need to produce substantial pre-tax earnings to qualify as a successful use of capital. Consider a 15% pre-tax return as attractive-it would need annualized pre-tax earnings of $90.5mm to justify this, not considering any future CapEx/investment needs.

BIG Insights

3. Financing secured for new fleet additions

On October 3rd, ALGT obtained financing commitments for acquiring 7 Airbus A320 and 4 Boeing 737 MAX aircraft. It obtained financing from BNP Paribas (OTCQX:BNPQF), and Jackson Square Aviation (“JSA”), who are in the commercial aircraft leasing business.

Currently, ALGT exclusively operates an Airbus-only fleet, consisting of 127 Airbus A319s and A320s. These additions will therefore diversify its fleet composition. Critically, the firm also agreed to purchase up to 130 Boeing 737-7 and 737-8-200 models as part of a multi-year deal with Boeing (BA).

The financials include a $412mm deal structured via banking and lessor capital. In practical terms, ALGT has already drawn down $196mm from this facility on September 29th, with the balance to be drawn on the deliveries of the 737 MAX aircraft. Adjusting for the delivery timelines, the company expects to retire 21 A320s-each with a seating capacity of 177-from its operational fleet by FY’25.

4. New (returning) CEO announced in September

It’s also worth noting that ALGT last month announced that its current chair, and previous CEO, Maurice Gallagher, will return to the post of CEO after former CEO John Redmond resigned with immediate effect. No reasons were provided for Redmond’s exit, but it does come at an intriguing time in the company’s journey. Per ALGT, “When Gallagher took control of Allegiant in 2001, it had one aeroplane and was just emerging from bankruptcy. Gallagher has grown the company into one of the most profitable airlines in the world with more than 120 aircraft, operating more than 550 routes across more than 120 cities in the United States.”

The new outfit will include Gallagher as CEO, Greg Anderson as president, and Micah Richins heading up Sunseeker. Both Anderson and Richins come with plenty of experience in their respective domains. So the next phases for ALGT under this new leadership will be integral to assessing the company’s long-term competitive position. In my view, FY’23 results will be an early indication of this in the early stages. Gallagher has a large equity interest in ALGT, so naturally, it is in his interest to see the company’s valuation flourish. In this vein, keep a close eye on Gallagher’s comments from here in my opinion.

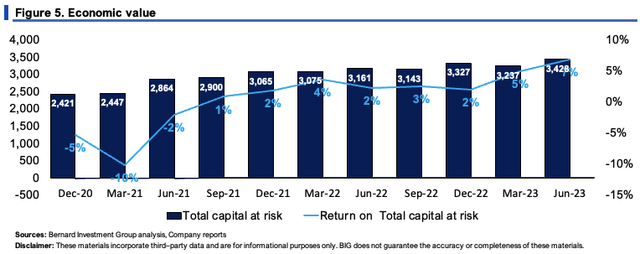

5. Economic value

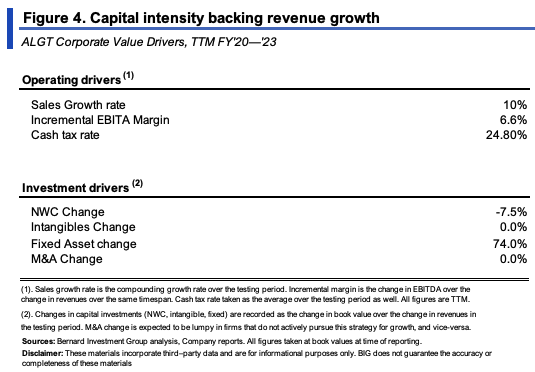

The critical value drivers to ALGT’s operations for the last 3 years are seen in Figure 4. Sales have compounded at 10% per period-quite high in absolute terms-on relatively tight operating margins of 6.6%.

Each new $1 in sales required $0.74 investment towards fixed capital, reducing FCF by that amount. However, the firm managed to reduce its NWC requirements by $0.075 on the dollar over this time.

BIG Insights

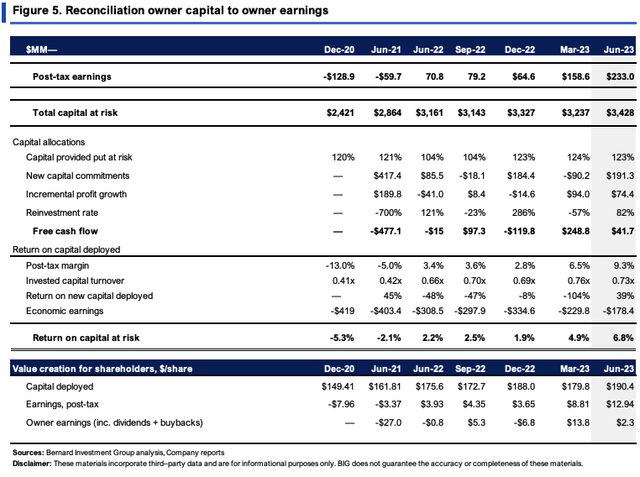

Like the industry at large, this is a capital-intensive, low-returns business. ALGT had put $190.4/share of capital at risk into the business, returning $12.94/share in post-tax earnings last period (TTM values), equating to a 6.8% return on investment. After all new investments were made, it threw off $2.30/share in cash to its owners. FCF has been both lumpy and small relative to the assets employed in the business. Furthermore:

- Post-tax margins are atrociously tight at <10% last quarter, although have rebounded off pandemic lows.

- Capital velocity is equally as tight at just 0.73x. So each $1 investment brings in just $0.70 in sales and $0.10 in earnings after-tax.

This squares off with the economics of the business, and industry for that matter. Each airline offers the same ‘product’ in effect, meaning there are no cost differentiation or consumer advantages (save some for brand loyalty). Moreover, given (i) the industry’s competitiveness, and (ii) the OpEx involved, there aren’t cost leadership advantages where providers can sell at a reasonable discount to peers (there are no production advantages either). Hence the low-margin, low-capital turnover economics.

It’s no different for ALGT on inspection, meaning 1) you are buying largely unproductive assets (excluding Sunseeker, granted) that 2) produce a sub-par rate of earnings on the investments made. The economic value of ALGT in the investment context is low in my opinion.

BIG Insights

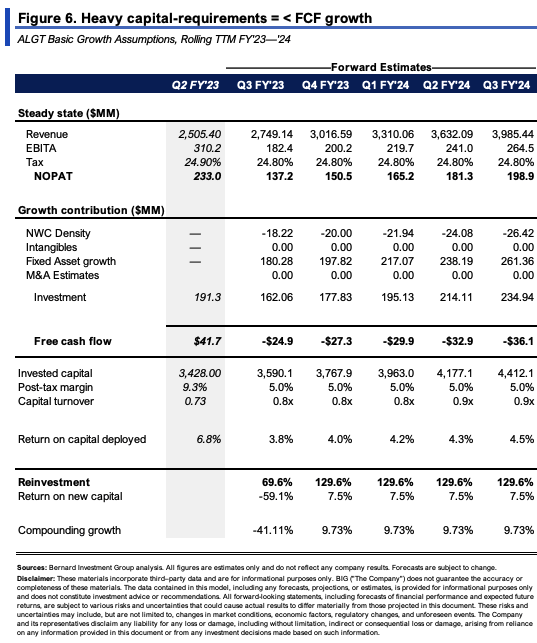

The steady-state numbers shown in Figure 4 are reasonable expectations to carry forward in my opinion. Consensus expects 10% sales growth this year, and an average 10% over FY’24-’25. Based on these assumptions, this could require $162-$235mm quarterly investment first to achieve the growth, and then maintain ALGT’s competitive position. The thing is, this is likely to produce continued cash outflows, ultimately hurting shareholder value. I believe this is a classic example why low returns on capital, below a reasonable threshold rate, means growth can be destructive to value. Low ROICs mean more/all FCF must be ploughed back into the business to remain competitive or grow, leaving none left over for shareholders. Plus, it is being reinvested at sub-par rates. In this kind of business, business growth is most sensitive to margins vs. sales, but the question is-what will cause margins to decompress in the first place? On this examination, not much in my view.

BIG Insights

6. Valuation and conclusion

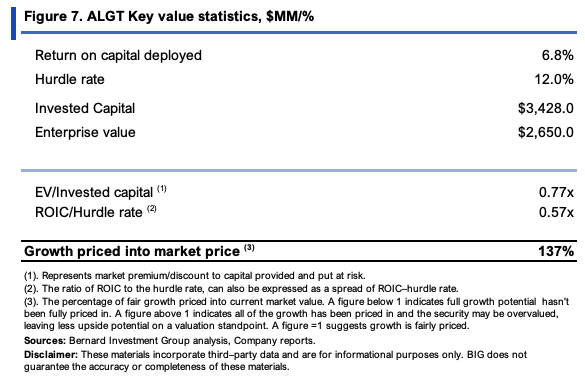

The stock sells at 8.1x forward earnings and 9x forward EBIT. We employ a 12% required rate of return on capital across all equity holdings, corresponding to an 8.3x ‘commodity multiple’ (1/12*100 = 8.3x). So ALGT is within this range. A few additional factors to consider:

- The market has priced ALGT at a 0.77x multiple to the capital invested in the business. This is rare, and could signal value.

- But this needs to be compared to the business performance. At a trailing 6.8% return on capital required to operate, this is just 0.57x multiple compared to the 12% hurdle rate.

- EV = market value of equity + market value of debt, whereas IC = roughly book value of equity + debt. At 0.77x, it implies ALGT has generated a market loss on the investments it has made. Taking the ROIC/12% ratio as a no-growth multiple, it also implies the market has little view on earnings power from ALGT’s assets going forward. Comparing these two ratios implies the market has captured ALGT’s earnings potential well in its current valuations.

Consequently, the 8x multiple looks fair based on ALGT’s economics and value drivers. This supports a neutral view.

BIG Insights

In short, there are multiple economic hurdles ALGT must overcome in order to warrant a buy rating in my opinion. This is a capital-intensive, low-margin, low-capital margin turnover business, with heavy reinvestment requirements and low rates of return to show for it. The Sunseeker development will be an interesting play once operational. But I fear it will continue to consume cash flow for this capital-hungry business. There’s already been an extensive outlay for the division so far, so a high rate of earnings is required to see decent returns on this. Based on the culmination of factors presented here today, I rate ALGT a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here