At the end of the day, what moves stocks?

Answer: Cash flow!

How does Centerra Gold’s (NYSE:CGAU) cash flow look over the next 12+ months?

Answer: MEGA!

Investors, though, are looking in the rearview mirror, thinking that the negative free cash flow Centerra generated in the first half of the year will continue. Not only will FCF surge in the second half of 2023, but it will continue well into next year and perhaps through 2025. CGAU isn’t being priced accordingly, and the stock will likely dramatically outperform the sector if the company delivers on its guidance.

Let’s dig into the details.

A Game Of Two Halves (First Half -$130 Million; Second Half +$150 Million)

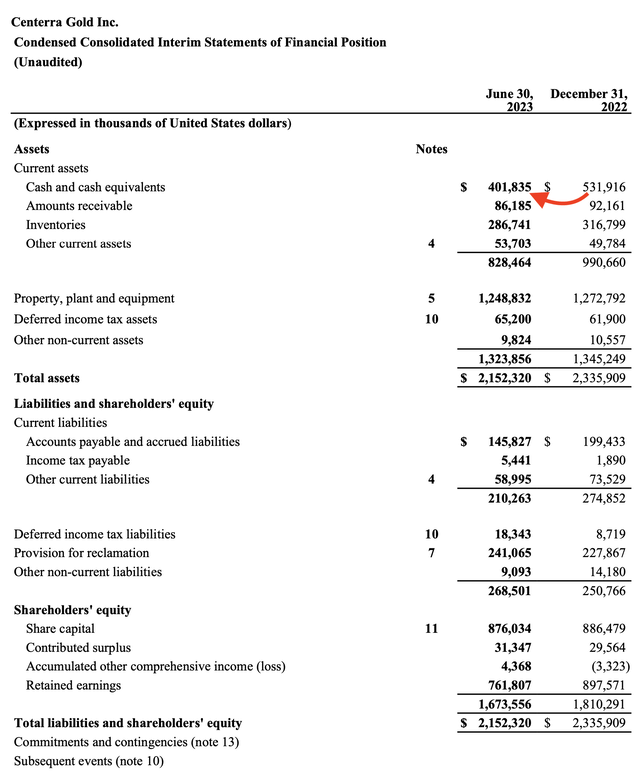

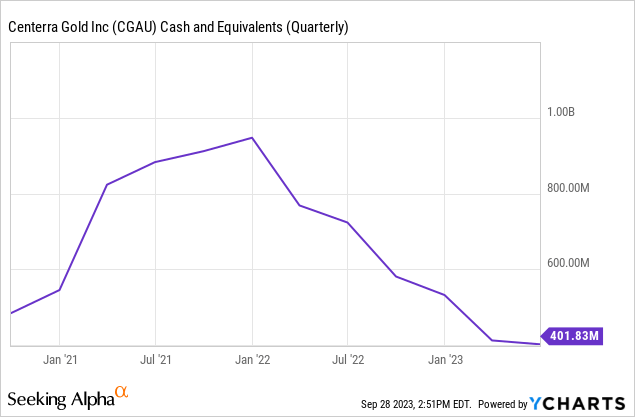

Centerra generated over $100 million of negative free cash flow in the first half of 2023. As the balance sheet shows, cash and cash equivalents declined from US$532 million at the end of 2022 to US$402 million as of June 30, 2023, or a negative swing of US$130 million. Operations consumed about $100 million of this cash, and about $30 million of this cash drain was for dividends and share buybacks.

Centerra Gold

The significant negative operating and free cash flow in H1 2023 was because of one-time events and the vast majority of this negative cash flow occurred in the first quarter.

In Q1 2023, there was substantial negative movement in working capital as Molybdenum prices soared during the quarter, and the company’s roasting facility had to purchase molybdenum concentrate. This resulted in additional cash outflow to cover increased working capital requirements.

Centerra expected a favorable adjustment of working capital over the following quarters, as stated in the Q1 MD&A:

The free cash flow deficit at the Molybdenum BU for the three-month ended March 31, 2023 was $76.6 million. The full year 2023 free cash flow deficit at the Molybdenum BU is expected to be in the range of $45 to $80 million, which is unchanged from the previous guidance.

Implying that the unit would, at worst, see roughly flat free cash flow, even though CGAU is still spending on care and maintenance and other costs. In other words, the MBU was supposed to be a cash drain for all four quarters, but given the working capital change, it might have all flowed into Q1.

The company’s Öksüt mine in Türkiye was also not processing ore for most of the first half of the year, as Centerra was waiting on the approval of the amended EIA, which was finally received at the end of May. The mine was still consuming cash, with negative free cash flow of $23.5 million in H1 2023.

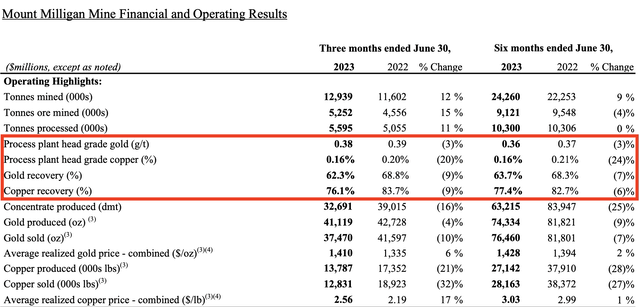

The company’s other operation — the gold/copper Mount Milligan mine in Canada — also had a weak first half as it was working its way through a low-grade transition zone that had high gold and low copper grades, and since it’s a copper flotation circuit, the lower copper grades result in poorer gold recoveries as well.

Centerra Gold

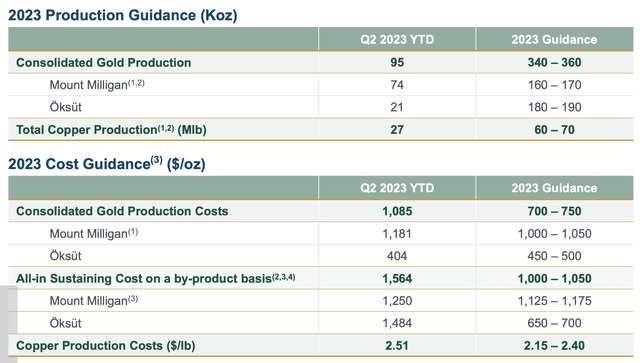

In the first half of this year, Mount Milligan and Öksüt produced 95,000 ounces of gold and 27 million pounds of copper at an AISC of $1,564 per gold ounce on a by-product basis. However, the second half of this year will see a dramatic improvement in both production and costs, as H2 2023 guidance calls for gold production of ~250,000 ounces at an AISC of roughly $800 per ounce. Most of that is driven by Öksüt, as at the end of Q2, gold in-circuit and finished dore inventory was ~20,000 ounces, gold-in-carbon inventory was ~80,000 recoverable ounces, and there were also ~200,000 ounces of gold stockpiled and on the heap leach pad. The remaining cash processing costs for the gold-in-carbon inventory is less than $50 per ounce, and less than $225 per ounce and $100 per ounce for the stockpiled and heap leach ore, respectively, as substantially all of the production costs have already been incurred. Öksüt produced just 21,000 ounces of gold in H1 and is expected to produce ~160,000-170,000 ounces in H2, and most of the revenue generated from these ounces will flow straight to the bottom line. Mount Milligan is also now through the transition zone, and production is expected to be much stronger in Q3 and Q4, with significantly lower costs planned as well. At current gold prices, mine site after-tax free cash flow in the second half of this year will be north of US$200 million, and that’s factoring in the Au/Cu stream on Mount Milligan. Depending on changes in working capital and other expenses, at the corporate level, CGAU could generate ~US$150 million of free cash flow in the back half of the year.

Centerra Gold

Paul Tomory, Centerra’s CEO, discussed two weeks ago at the Denver Gold Forum how cash was building in Q3 and it would continue. Quote:

“We finished the last quarter with $400 million dollars on the balance sheet, and that is building rapidly.”

He mentioned the strong free cash flow not just from Öksüt over the last few months (or since the start of Q3) but the robust cash flow from Mount Milligan as well, as they are out of the transition zone and currently mining higher-grade copper and gold zones from Phase 7 and Phase 9.

2024 And Beyond Free Cash Flow Outlook For Mount Milligan And Öksüt

2024 should be a good year at Mount Milligan, especially as Centerra is focused on productivity and cost efficiencies, as well as mine plan optimization. I would expect at least a steady production outlook of ~160,000-170,000 ounces of gold and 60-70 million pounds of copper based on the 10-year life of mine average. Cost inflation, which is still an issue, has negatively impacted the mine’s AISC, but with the substantial copper production being used as a by-product credit, Mount Milligan should still maintain wide AISC per gold ounce margins, especially with the current optimization and efficiencies work being conducted.

Centerra has stated it expects robust operational performance over the next few years from Mount Milligan.

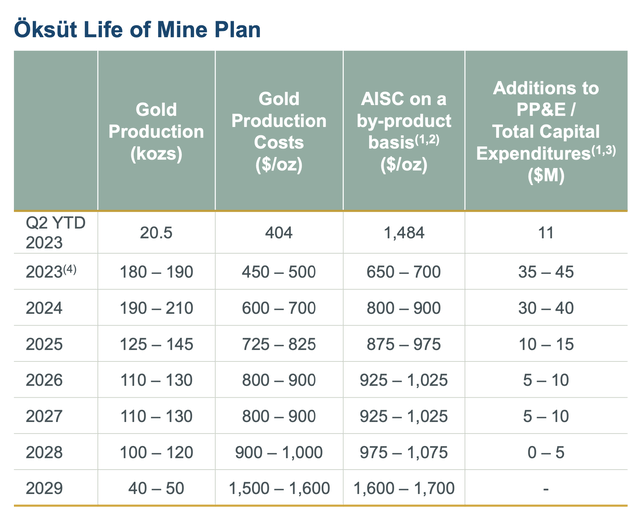

As for Öksüt, Centerra released an updated life of mine two weeks ago that confirms the value of the operation. The mine will continue to spin off huge free cash flow over the next several years, with 200,000 ounces of gold production expected in 2024 at sub-$1,000 per ounce AISC. The operation will then normalize post-2024 as the company will have worked off the build-up of inventory, but Öksüt will still produce over 120,000 ounces of gold per year at an AISC of ~$1,000 per ounce from 2025-2028. At current gold prices, the operation will generate US$500+ million of after-tax free cash flow over its remaining life of mine, and that’s factoring in the higher corporate tax rate in Türkiye.

Centerra Gold

News On Thompson Creek Has Investors Concerned

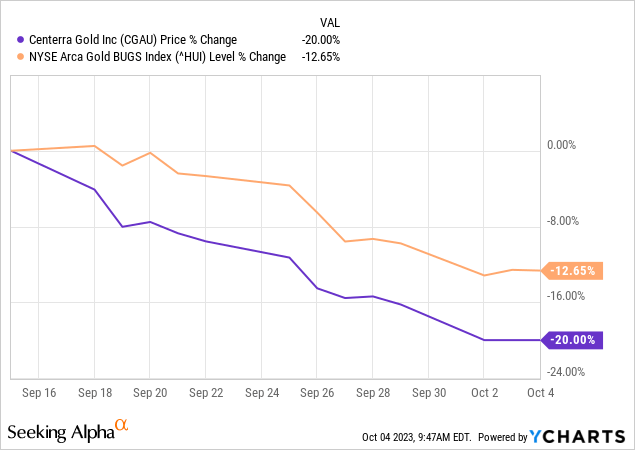

Since CGAU announced its strategic plan for its operations two weeks ago —which included the positive updates on Mount Milligan and Öksüt — the shares have been under pressure. The entire sector has sold off since then, but CGAU is a notable underperformer.

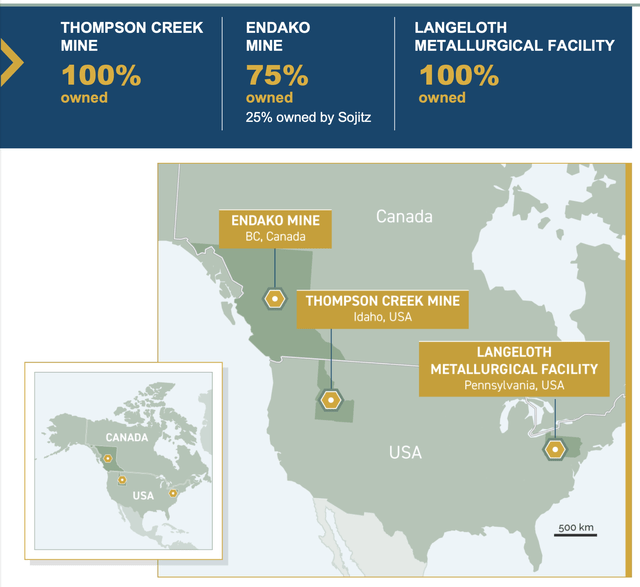

What’s likely driving the decline is the news on the company’s Molybdenum Business Unit (or MBU), which consists of the Thompson Creek (Idaho, USA) and Endako (BC, Canada) mines and Langeloth metallurgical facility in Pennsylvania. Thompson Creek and Endako have been on care and maintenance for the last 8-9 years, but the Langeloth facility still operates, as Centerra purchases molybdenum concentrate from third parties, refines it at Langeloth, and then sells finished molybdenum products. However, the Langeloth facility is only operating at about one-third of its capacity.

Centerra Gold

For months, CGAU has discussed bringing Thompson Creek back online and ramping up production from its MBU.

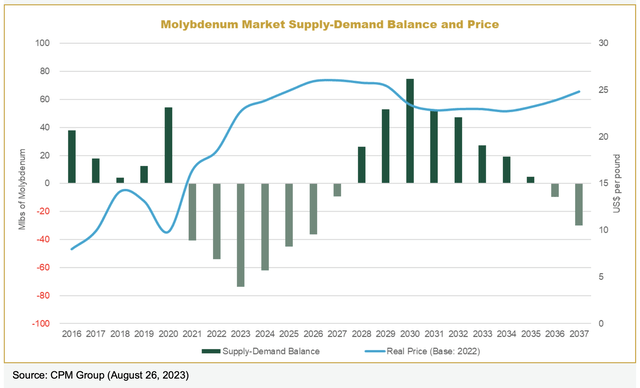

Molybdenum prices are still very strong, as there is a significant supply-demand imbalance in the market, which is expected to remain in place for the foreseeable future.

Centerra Gold

Molybdenum, which is mostly used to make alloys as it adds strength properties to steel and helps make it corrosion resistant, has been headed for this supply/demand imbalance for the last several years, as major primary molybdenum mines have been mothballed since ~2015 because of low moly prices, and there hasn’t been significant secondary molybdenum production from primary copper mining come online either. Centerra also expects molybdenum by-product production from existing large Chilean copper mines to remain low.

Centerra completed a Prefeasibility on the restart of Thompson Creek, which showed a US$373 million after-tax NPV (5%) and 16% after-tax IRR using a molybdenum price of $20 per pound. At the current price of ~$25, the after-tax NPV more than doubles to US$761 million.

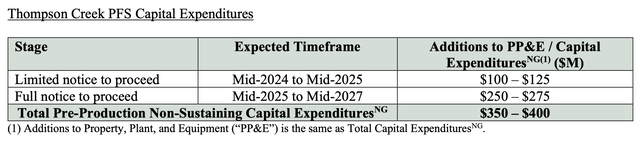

CGAU is taking a phased approach to restarting operations at the Thompson Creek mine, with a total capital allocation of $350–$400 million in two phases. The company has started a Feasibility Study and expects that to be completed by the middle of next year. Once the FS is finished, it will begin Phase 1 of the project which will be from mid-2024 to mid-2025 and require $100–$125 million for pre-stripping and purchases of long lead items. Centerra will need modified permits for the full scope of the project and won’t move forward with Phase 2 ($250–$275 million) until mid-2025. If everything goes to plan, first production is expected in the second half of 2027.

Centerra Gold

The bottom line, CGAU is spending $400 million on a non-gold project over the next several years. Some would argue this isn’t the best use of capital, and CGAU also runs the risk of deploying substantial cash on a project that could see a greatly diminished return if molybdenum prices don’t remain elevated. That’s why the shares are underperforming.

I’ve been saying for a while that Centerra needs to sell this MBU as it’s been a drag on cash flow and is a substantial liability on the balance sheet — as it’s a 100+ year reclamation project. The story would be much cleaner if the MBU were divested.

I don’t believe CGAU is moving forward with this project with the intent to hold onto it over the long term. Rather, it’s investing the capital required (or at least some of the capital) to show the market the value of the Thompson Creek project and the other moly assets while also obtaining all of the permits, as this is the best way Centerra can maximize the value of the MBU and finally get it sold. The company stated that it “will evaluate all strategic options for the assets,” so it’s clear the company is looking to sell.

If there isn’t a buyer today, then sitting on the project won’t help. The more CGAU de-risks these assets and moves them up the value chain, the more interest the MBU will receive. I believe that’s the goal.

Also of note, Thompson Creek has the lowest expected CapEx of all new primary molybdenum supply ($350M-$400M versus more than $800M for other projects).

Since no significant capital will be required over the next four quarters and the heaviest of the spending won’t occur until after mid-2025, it’s possible that CGAU will be able to sell the MBU before the more aggressive capital outlays commence.

A sale of the MBU sometime in the next 1-2 years would be a major bullish catalyst.

The positive updates on Öksüt and Mount Milligan have been overshadowed by the company’s plans for Thompson Creek, but CGAU shouldn’t be down on this news, as the short to medium-term outlook for the company is exceptionally bright.

By the time Centerra starts phase 1 of Thompson Creek in mid-2024, the company’s cash balance should be $200-$250 million higher, and cash will continue to build aggressively over the following year even with the spending planned on the MBU.

Centerra’s cash and cash equivalents have fallen from over $800 million in early 2022 to $400 million at the end of Q2 2023. This trend has already begun to reverse; investors just haven’t seen the results posted yet. Q3 is in the books, and I would expect a notable increase when results are reported. By this time next year, the cash balance should be at least $600 million, assuming flat gold and copper prices.

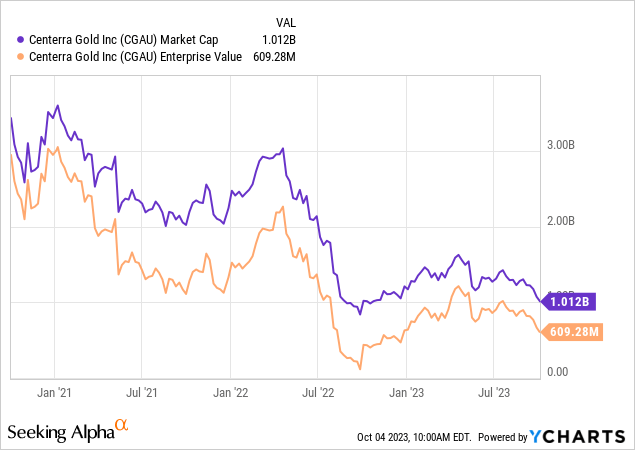

Valuation = EV Of US$609 Million

Centerra’s market cap has continued to contract over the last several years, declining to just over US$1 billion. However, accounting for the company’s net cash position, the enterprise value is much cheaper, as CGAU trades at an EV of just US$609 million. That figure equals the after-tax NPV (5%) of Mount Milligan at current gold and copper prices and includes an aggressive assumption of a 20% increase in OpEx (on a per-dollar basis) to account for additional cost inflation. Which means the $500+ million of cash flow from Öksüt is free, the MBU (after-tax NPV of US$761 million) is free, the Goldfield project in Nevada (which Centerra paid US$200 million for last year) is free, the ~C$1 billion of infrastructure at Kemess and millions of ounces of gold and billions of pounds copper at the project are free, and the additional 1.8 million ounces of gold and 700 million pounds of copper resources at Mount Milligan are free. CGAU is effectively trading at around 0.4x NAV.

As shown, there is significant re-rating potential in CGAU. I think as the cash flow from Öksüt and Mt Milligan rolls in over the next 6-12 months, the market will ignore the spending planned on Thompson Creek. It’s one stock that doesn’t need higher gold prices in order to increase in value.

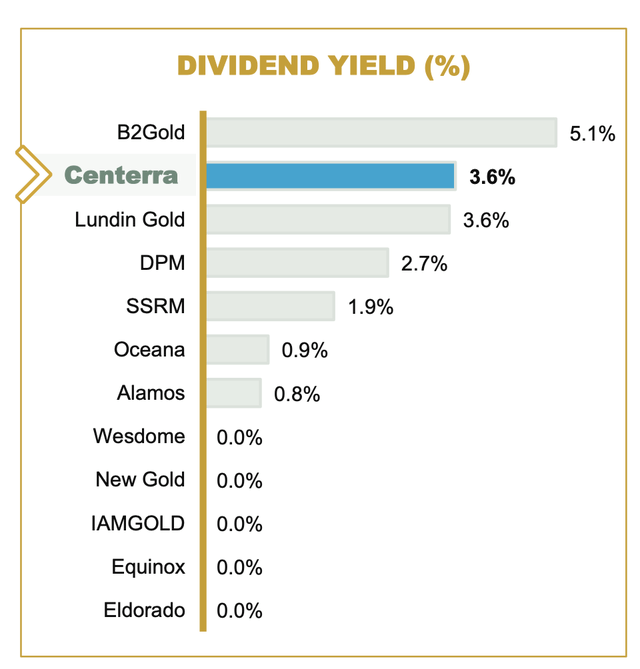

Investors also get a healthy dividend, which is the second highest in its peer group and now above 4% with the recent share price decline. Given the company’s current liquidity and growing cash balance, not only is the dividend fully supported, but the company is also buying back shares.

Centerra Gold

I would prefer the company become more diversified and solidify the long-term outlook, and with the healthy cash balance, M&A is likely. There are many companies in the sector trading at similar discounts to fair value. If CGAU can find a suitable merger-of-equals partner (and there are several options), then a zero-premium merger could unlock even more value.

I believe CGAU will become a much larger gold/copper mining entity over the next few years. Tomory was previously CTO of Kinross, and has experience overseeing multiple mining operations.

The biggest short-term risk is Centerra overpays on an acquisition and/or uses all of its cash to do so.

CGAU deserves inclusion if one is looking to build a well-diversified basket of high-quality, undervalued gold/silver mining stocks, and the recent news from the company reinforces my bullish outlook, especially with more detail on Öksüt’s life of mine.

I consider CGAU a core holding during this gold bull market, and it remains one of my top 10 picks.

Read the full article here