Rithm Capital (NYSE:RITM) offers a very high dividend yield, but there are other mREIT companies yielding higher, and the risk of overpaying for acquisitions may put downward pressure on its share price in the short term.

Company Overview

Rithm Capital is a real estate investment trust (REIT) focused on the real estate and financial services space. It was founded in 2013 when it was separated from Drive Shack and rebranded itself from New Residential Investment to Rithm Capital in 2022. Its current market value is about $4.3 billion, being a relatively small player in the REIT sector.

RITM’s business model has evolved over the past few years, both through organic initiatives and acquisitions, moving from just solely a manager of mortgage servicing rights (MSRs) to a diverse platform that includes its operating companies and its own investment portfolio. Additionally, while it was previously externally managed, it decided to end that agreement in 2022 and became an internally managed REIT.

RITM’s investment portfolio is currently composed of MSRs, residential securities, loans, single-family rental properties, and commercial properties. Additionally, it also owns operating entities related to origination and servicing platforms, and other companies that provide mortgage-related services.

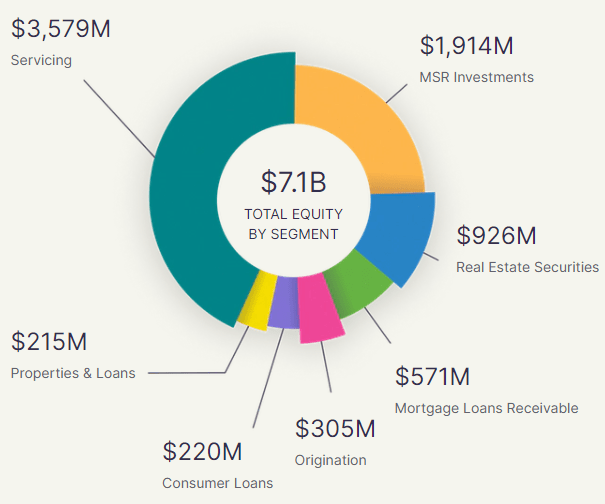

At the end of last June, RITM had close to $34 billion in total assets, while its equity investment of about $7.1 billion was well diversified across several asset classes. Nevertheless, the vast majority of its equity investments are still in servicing and MSR, a profile that is expected to change gradually as the company grows its exposure to other financing sources, such as private credit. Its goal is to generate stable cash flows over the long term, enabling it to produce a positive income throughout different interest rate environments.

Portfolio (Rithm Capital)

This means that its business is nowadays much more diversified than in the past, being a positive factor for a more resilient business model over the long term. Its current strategy is to become a leading global asset manager, for which it has made several acquisitions over the past year and launched a private capital business, aiming to overhaul its business profile in the near future.

Strategy (Rithm Capital)

It also launched Rithm Europe this year, seeking equity and debt investment for private capital, also diversifying its business geographically and giving it a new growth source over the long term.

Beyond that, RITM also wants to monetize its mortgage origination business, potentially through an IPO, as part of its strategy to become an alternative asset manager. An important step to reach this business transformation is its planned acquisition of Sculptor Capital Management (SCU), in a transaction valued at some $639 million, or $11.15 per share, paid in cash to Sculptor shareholders.

Sculptor is an alternative asset manager with some $34 billion of assets under management, being specialized in opportunistic credit, real estate, and multi-strategy. In 2022, Sculptor reported revenues of about $369 million, but a negative bottom line of $16 million. RITM will fund this acquisition through its own cash position, given that at the end of June, it had some $1.36 billion in cash, and expects to be neutral to earnings in 2024 and accretive in 2025.

While this transaction will boost RITM’s business transformation into becoming an alternative asset manager, it’s not a cheap acquisition and there seems to be low synergies with its existing business. Sculptor will operate as a separate business unit within RITM, thus the main merit of this acquisition seems to be further diversification of RITM’s business profile.

While Sculptor’s management recommends this deal, a competing bid appeared at $12 per share from a group of hedge funds, thus it’s not certain that RITM will be able to acquire Sculptor, at least at the share price offer of $11.15 per share.

Additionally, the group of investors led by Boaz Weinstein has reportedly recently raised its offer to at least $13 per share, putting further pressure on RITM to increase its bid. While this deal makes some sense for RITM because it allows it to grow in alternative asset management in a much faster way than it could achieve on its own, due to the competing bid it may need to raise its offer to more than $800 million, which seems to be an expensive price for a company that has an erratic bottom-line and has reported declining revenues over the past two years.

Therefore, I think the market will react well if RITM decides to walk away from this deal, but investors should be aware that there is a strong probability that RITM will increase its bid given that it has the financial resources to do it, and the acquisition seems to fit its desire to further diversify its business into alternative asset management and other targets may not be available. If RITM decides to open its purse and increases its bid by a significant amount, it’s quite likely that its shares will react badly, making this acquisition somewhat questionable from a value perspective for RITM shareholders.

Financial Overview

Regarding its financial performance, RITM has a mixed track record given that it has a positive growth history, but its business was impacted by the pandemic and loan forbearances, which impacted its residential loans and securities.

Nevertheless, over the past couple of years, its business has been on a positive operating trend, given that RITM has a large exposure to MSRs, which are one of the few fixed-income assets that benefit from higher interest rates. This provides RITM with a different business profile than most mortgage REITs, as MSRs increase in value when interest rates rise because this leads to lower loan prepayments and increases the expected life of MSRs.

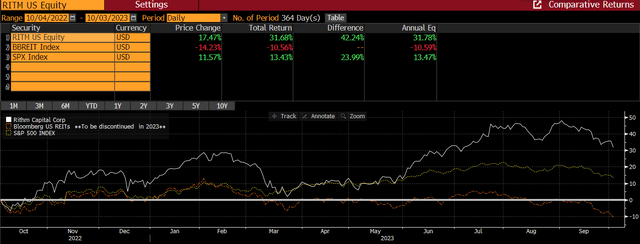

Given this backdrop, it’s not surprising that RITM’s shares (white line in the graph) have clearly outperformed the market (yellow line) and the REIT sector (orange line) over the past year, as shown in the next graph.

Comparative returns (Bloomberg)

Due to the rising interest rate environment, RITM’s financial performance during 2022 was quite strong, a trend that was maintained in recent quarters.

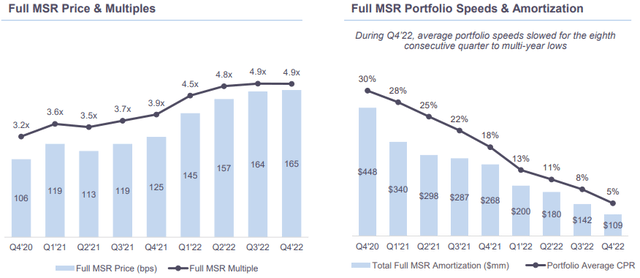

Indeed, in 2022, RITM’s total revenues increased to more than $4.7 billion, an increase of 30% YoY, driven by higher service fee revenue related to MSRs and positive changes in fair value of MSRs and MSR financing receivables. Its servicing revenue amounted to $2.54 billion, up by 160% compared to 2021, reflecting to a large extent improved MSR valuations.

MSRs (Rithm Capital)

MSRs accounted for some 55% of RITM’s total revenue, showing that, despite its efforts to diversify its business, it’s still largely exposed to MSRs and continues to be a main driver of its growth. Income from other business lines, including loans and income from residential units, amounted to more than $1 billion (+33% YoY), while on the other hand gains on originated residential mortgage loans decreased significantly ($1.08 billion in 2022 vs. $1.82 billion in the previous year).

Due to the inflationary environment and higher funding costs, RITM’s total expenses increased to $3.3 billion in 2022, up by 28% YoY, while its net income amounted to $864 million (+22% YoY).

During the first six months of 2023, its operating performance can be considered positive, even though MSR valuations have been negatively impacted by slightly higher amortizations from multi-year lows, being a negative factor for its top line. While MSR fee revenue was up slightly compared to the previous year, changes in fair value were negative leading to overall lower revenues than compared to the same period of last year.

In H1 2023, RITM’s total revenues amounted to $1.8 billion, while in the same period of 2022, they were above $3 billion, but RITM showed good cost control and expenses decreased to $1.3 billion (vs. $1.93 billion in H1 2022). However, in the first half of 2022, RITM’s expenses included a $400 million termination fee to its external manager, thus adjusted for this its operating expenses declined by some $200 million, which is still a good achievement. Its net income in H1 2023 was $426 million, down by some 35% YoY, and its book value per share at the end of June was $12.16 (vs. $12 per share at the end of 2022).

Going forward, RITM is likely to continue to perform relatively well as the high interest rate environment is not likely to change rapidly in the short term, being positive for its MSR portfolio. However, in my opinion, the Fed’s hiking cycle is almost done and more likely we are currently at peak rates, thus this tailwind for RITM is probably near its end.

This means that despite the company’s efforts to diversify its business, it’s still quite exposed to interest rates and for the time being this remains a key factor for its investment case. While RITM has been a good play during a rising interest rate environment, this can change in the near future if the Fed starts to cut rates during 2024, as the market seems to believe.

This backdrop also explains why RITM’s valuation is quite cheap right now, trading at only 5.5x forward earnings and 0.7x book value. In absolute terms, this valuation seems to be very undemanding, but the market is not willing to value RITM’s business at much higher multiples due to its business profile that is highly cyclical and very exposed to interest rates (average book value multiple of 0.9x over the past five years). This also explains, in my opinion, management’s desire to overhaul the company’s business profile towards alternative asset management, which should have a more recurring revenue and earnings profile over the long term, and hopefully a higher valuation in the future.

Until this happens, one of the most attractive features of RITM’s investment case will remain its high-dividend yield, like other mREITs. As I’ve covered previously on Annaly (NLY) and AGNC Investment Corp. (AGNC), mREITs offer double-digit yields that can be considered sustainable in the short term, even though for long-term investors they can be considered speculative to a large extent.

RITM is no exception, and while it had a good dividend history until 2020, it then made a significant dividend cut showing that its business can be quite vulnerable to external shocks. Over the past couple of years, its quarterly dividend has been stable at $0.25 per share, despite the company’s improved earnings during the hiking cycle, showing some conservatism from its management, which is a positive sign regarding dividend sustainability.

At its current share price, RITM’s dividend yield is above 11%, which is quite attractive for income investors, but lower than compared to other mREITs. Indeed, both Annaly and AGNC offer yields of around 16%, thus only from a yield perspective do they appear to be more interesting than RITM. Nevertheless, RITM’s dividend has been covered by its earnings in the past few quarters and it’s likely that its distributions will be maintained in the near future, something the market also seems to believe considering that, according to analysts’ estimates, its annual dividend is expected to remain stable at $1 per share over the next three years.

Conclusion

Rithm Capital is a different mREIT due to its sizable exposure to MSRs, making it a great play during a rising interest rate environment. While its management wants to overhaul the company’s profile towards alternative asset management, this will take some time and there is the risk of overpaying to acquire Sculptor Capital Management.

While RITM currently yields more than 11%, there are higher yielding plays in the mREIT sector, and RITM only makes sense right now for investors that expect higher interest rates in the coming months, which personally is not my expectation. Thus, despite its high-dividend yield, RITM’s investment case does not look particularly interesting right now for long-term investors and it’s a pass for me for the time being.

Read the full article here