Investment Action

I recommended a hold rating for The Duckhorn Portfolio (NYSE:NAPA) when I wrote about it the last time, as I believe the right time to invest is when the macroeconomic environment turns for the better, at which point the growth visibility and stability will be a lot better. Based on my current outlook and analysis of NAPA, I still recommend a hold rating. I expect the near-term uncertainties to be the focus of investors, which will put pressure on the stock (as can be seen from the recent share price action).

Review

The $0.15 adjusted EPS and $34.2M adjusted EBITDA reported by NAPA for 4Q23 were both higher than the $0.13 and $30.5M expected by consensus. Revenue growth of 27.8% was largely responsible for the beat, with help from increases of 10.6% in volume and 17.7% in product mix. There was robust expansion across all distribution channels, from wholesale to distributors (23.9%) to wholesale to California-direct to retailers (7.6%) to direct to consumers (74.8%). Gross margin increased by 350 basis points, to 55.1%, as a result of the robust revenue growth performance. With operating expenses at 30.1% of revenue, the margin on adjusted EBITDA increased by 570 basis points to 34.3%.

The NAPA business has certainly proven to be much more resilient than I previously expected, as revenue performance was strong, supported by stronger wholesale performance. This suggests that the business is not heavily impacted by any trade-down movement, as inflation impacts consumers’ discretionary income. In fact, 4Q23 results showed that NAPA benefited from the shift in product mix (leading to higher average prices) as a direct result of the quarter’s pricing and trade spend optimization efforts. This demonstrates that management has a firm grasp on what NAPA’s core customers value and how to provide them with value products (by adjusting prices), which puts the company in a better position to weather the current inflationary period.

It’s important to keep in mind that while off-premise accounts grew more quickly than on-premise ones, on-premise growth was against a tough comparison to last year’s numbers, which were inflated by the reopening trend (post-Covid). The fact that on-premise label trade-downs have not been noticed by management is particularly encouraging in light of the more pessimistic commentary from players in the fine dining industry.

And with respect to trade down, I would note relative stability, frankly, across the price points in the portfolio. 4Q23 call:

NAPA’s CEO’s retirement came as a surprise, despite the company’s recent signs of stability. I’m not a fan of these sorts of shifts, especially given that NAPA just saw its CFO leave after 14 years. Alex Ryan, the outgoing CEO, has been at the helm of the company since 2005 and has established a strong reputation within the business community and among investors. The past 2 years of revenue guidance were in line, for example. The company’s success under his leadership is obvious. Although there is little information available to the public, between FY19 and FY23, he helped increase the company’s revenue from $241 million to $403 million and its earnings per share from $0.17 to $0.66. I think the biggest shock to me was that the departure is immediate and the transition of authority and governance will be effective immediately with Deirdre Mahlan taking over. Until I hear more (e.g., the appointment of a new permanent CEO, details on the company’s new strategy, etc.), I’m going to play it safe until I know for sure what’s going on with this high-level management change. Whatever the case may be, it casts even more doubt on the stock during a time when consumer spending is already shaky in my view.

All in all, even though NAPA performance appears to be stabilizing and management has found a way to navigate the trade-down environment, there is still some uncertainty on the forward trajectory given the macro uncertainty. On top of that, I believe the uncertainties with the CEO transition and a fairly new CFO are likely to put pressure on the stock as investors stay risk-averse. I reiterate my view that investors should wait for better visibility before considering investing.

Valuation

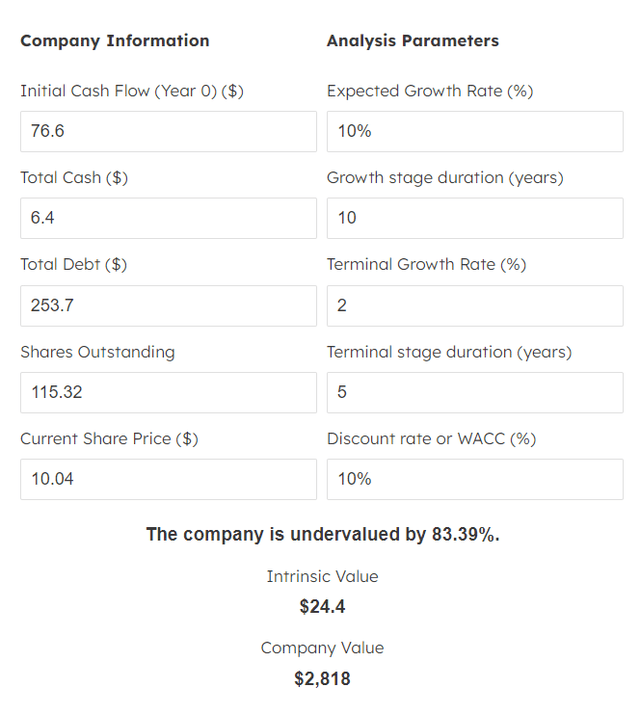

For long-term investors who do not mind the near-term volatility, NAPA could be interesting from a valuation perspective. NAPA is cheap from a relative standpoint (vs. history). NAPA has a historical trading range between 20x and 37x forward PE over the past 3 years, making the average around 29x forward PE. Currently, it is trading at only 14.5x, which is way below the lower end of the range. Assuming NAPA can recover its growth back to ~10%, the median of its historical growth rate excluding the FY21 COVID surge, my DCF model indicates that the stock could be worth $24, close to where the stock traded just early last year.

Author’s work

Final Thoughts

My recommendation for NAPA remains a hold as the near-term outlook is clouded with uncertainty, primarily due to the unexpected departure of the CEO. NAPA’s resilience in managing revenue growth amidst a challenging macroeconomic environment and the ability to adjust pricing to navigate inflation are positive signs. However, the uncertainties surrounding the CEO transition and a relatively new CFO are likely to keep investors risk-averse and may put downward pressure on the stock. While NAPA presents an attractive valuation opportunity for long-term investors, trading at a significant discount compared to historical PE ratios, the current macroeconomic uncertainties warrant caution. Investors should wait for clearer visibility before considering investment in NAPA.

Read the full article here