Introduction

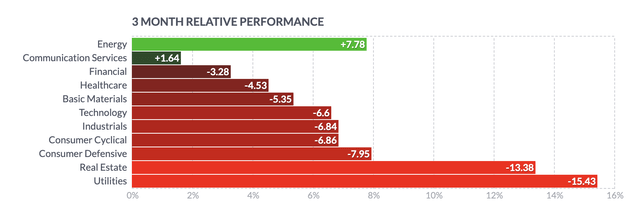

Markets are in turmoil. While the S&P 500 is still holding up well, real carnage has taken place in defensive sectors. Looking at the data below, we see that utilities, real estate, and consumer defensive stocks were among the biggest losers of the past three months. Utilities fell more than 15%, making it the worst sell-off since the pandemic in 2020!

FINVIZ

What we’re dealing with here is the realization that inflation is sticky. This means the Fed will have to keep rates elevated for longer. That wouldn’t be such a bad thing if the economy were in better shape.

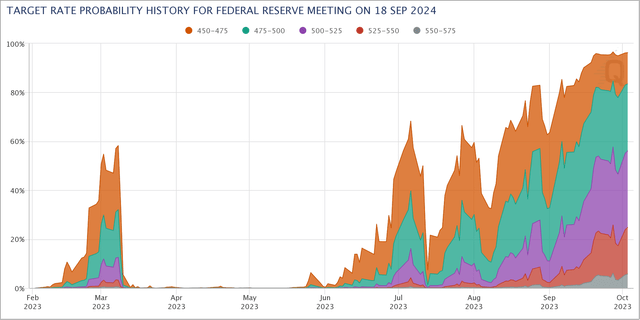

The market is now putting a >90% probability on a >4.50% Federal Funds rate 12 months from now. In August, that number was close to 60%. In the first half of this year, it was 0%.

CME Group

The worst thing on everyone’s mind (at least on my mind) is that Mr. Powell may have to choose between protecting the economy versus fighting inflation soon.

(Looking at the first chart of this article) it is no surprise that energy stocks are doing well in this environment. Energy stocks have pricing power. Most major players have low breakeven prices, healthy balance sheets, and the ability to be profitable at subdued oil prices.

Consumer staples, REITs, and regulated utilities are different. While the strongest players have great balance sheets, they often come with high gross debt levels and business models that make it hard to hike prices.

- Consumer staples are dealing with competition from generic products and the ever-ongoing war for shelf space.

- Real estate companies often have a limited ability to hike rent (capped inflation rates).

Regulated utilities are no different (emphasis added):

Utilities’ costs will be affected by higher inflation in many ways. This includes O&M costs, A&G costs, capital investments, and the cost of debt and equity capital. At the same time, there will be mounting pressure on regulators to minimize customer rate increases. As always, maintaining an appropriate balance between the needs of the utility and its customers is essential. – Concentric Energy Advisors

This brings me to NextEra Energy (NYSE:NEE). On August 11, I wrote that the company offered a compelling investing opportunity. I was wrong. Since then, the stock has fallen 23%.

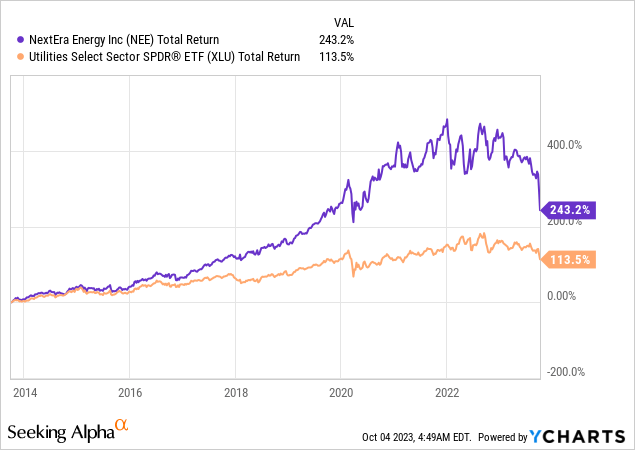

Now, the stock is down 45% from its all-time high, yet its 10-year total return is still 243%, 130 points above the weighted sector average!

As much as I hate being wrong, I’m doubling down.

While we can expect pressure to remain high on utilities, the value is getting great at these levels, which is why I’m writing this article.

So, let’s get to it!

What’s Happening?

In the lengthy introduction, I already briefly explained the core of the problem: sticky inflation and elevated rates.

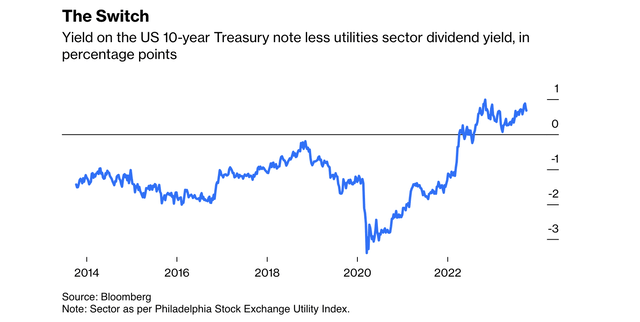

Bloomberg’s Liam Denning hit the nail on the head.

Bloomberg

Essentially, NextEra’s success is built on three pillars: ownership of Florida Power & Light Co., a reputation for efficiency and cost management, and being the largest renewable power developer in the U.S. I remember in 2020 and 2021 when rates were low, and everyone was in love with renewables. NextEra was one of the most popular stocks on the market.

However, the recent fall from grace can be attributed to the troubles faced by its subsidiary, NextEra Energy Partners LP (NEP). The subsidiary’s reduced expectations for dividend growth and challenges in selling planned projects led to a significant drop in its stock value, impacting the parent company.

According to the company (during the September 27 Wolfe Utilities, Midstream & Clean Energy Conference – emphasis added):

We’ve announced some changes that we think will allow NEP to stay out of the equity markets for the most part until ’27, which will really help position, I think, NEP for success over the long run.

So one question you may have is well, why today? Well, the reason why today is we were faced with a decision either lower the growth rate from 12% to 6% or do a drop this quarter that made no sense, right? Had we done the drop that we had planned to do in today’s macroeconomic environment, you all would have been coming to us and saying, why did you do that? Why didn’t you provide NEP with a little bit more flexibility going forward? So we made the hard decision of not doing that drop, buying NEP some more time by going from 12% to 6%, it gives NEP a lot more flexibility. It can stay out of the equity markets until 2027 for growth equity and gives us a little bit of breathing room to see what it is we’re transitioning to?

Hopefully, we’re transitioning to a better macroeconomic environment and the pause we’ve made on the growth rate is something that we can later revisit. But we think this is the best move for unit holders currently.

This is what Bloomberg wrote:

There’s also the reason given for NextEra Energy Partners’ problems: Higher interest rates. Renewables projects are especially sensitive to higher yields because of their upfront investment and because the revenue stream on multi-year power supply contracts is akin to long-duration bond coupons. Higher rates are squeezing renewables developers in general, with this year’s wave of contract renegotiations for offshore wind projects being the most high-profile example – until now, anyway.

In light of funding challenges and risks related to revenue growth, it also does not help that investors get a better yield buying treasury notes (as seen in the chart below). When it comes to income, there is no need to take huge risks. Especially not when it comes to NEE, which still yields less than 4%.

Bloomberg

Furthermore, during the aforementioned conference, the company acknowledged a slow start in the renewables market due to inflation, interest rates, and supply chain issues.

However, they are optimistic about the market gaining momentum in 2024. Despite increased power purchase agreement (“PPA”) prices, renewables remain the low-cost generation option.

Also, early signs of falling panel and battery prices, along with resolving supply chain uncertainties, are boosting the renewables market.

The Upside

“Never catch a falling knife!” may be one of the most important things to keep in mind when investing. However, I also like to buy good investments at great prices. When averaging down, catching falling knives may not be the worst idea. I’ve done it many times. In 2020, I did it with energy. This year, I’m doing it with defense contractors.

For example, Goldman Sachs (GS) did cut its buy rating from $83 to $73, yet it remained bullish.

As reported by Seeking Alpha:

While recognizing that a higher cost of capital on renewables and the broader elevated interest rate environment presents challenges, Goldman’s Carly Davenport believes NextEra’s (NEE) valuation at current levels does not take into account the company’s flexibility around financing and balance sheet capacity, ability and willingness to monetize other non-core assets and tax credits or explore sales to third party investors for renewables, or scale benefits that allow the company to maintain economics on new projects.

Davenport continues to see above average growth going forward at NextEra (NEE), with a five-year earnings compound annual growth rate of 9%.

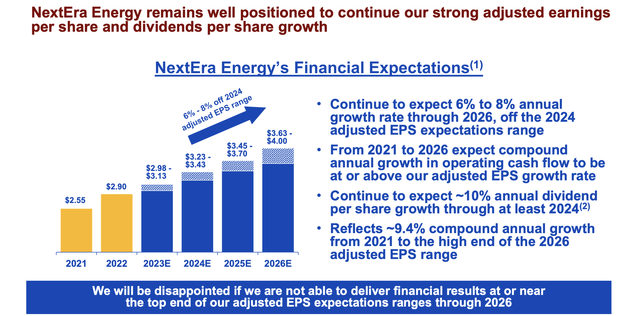

I agree with that. The company, which has a pipeline of roughly 250 gigawatts of renewable energy projects, was very upbeat about its ability to grow its dividend during the 2Q23 earnings call.

From 2021 to 2026, we continue to expect that our average annual growth in operating cash flow will be at or above our adjusted EPS compound annual growth rate range. And we continue to expect to grow our dividends per share at roughly 10% per year, through at least 2024, off a 2022 base. As always, our expectations assume our usual caveats, including normal weather and operating conditions.

NextEra Energy

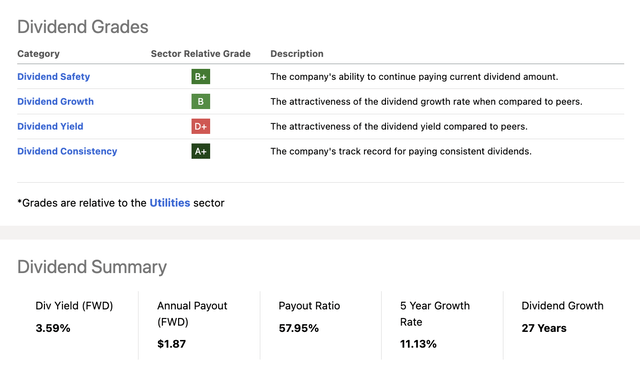

The current dividend yield is 3.6%, backed by a 58% payout ratio and the strong (aforementioned) dividend growth outlook. The company also has dividend aristocrat status and an A+ score for consistency on Seeking Alpha’s dividend scorecard.

Seeking Alpha

While we could see some downside after 2024 (less than 10% dividend growth), the company continues to have one of the healthiest balance sheets in its sector.

Next year, it is expected to end up with $80 billion in net debt. That’s a huge number but less than 5.5x EBITDA. It has an A- credit rating from both S&P and Fitch.

Valuation-wise, it is also fair to say that the market has priced in a lot of weakness.

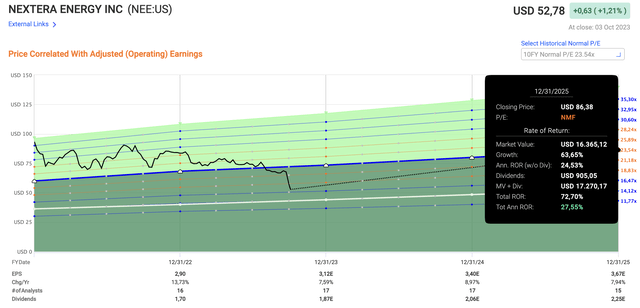

This year, the market expects 7.6% EPS growth. Next year, that number is expected to be 9.0%. In 2025, that number is expected to be 7.9%.

While these numbers are obviously subject to change, we do have an attractive risk/reward. Purely technical speaking, if the stock were to hold its 10-year average valuation of 23x earnings, it could return 28% annually through 2025. All of these numbers are visible in the chart below.

FAST Graphs

Even at a lower valuation of 18x earnings, the expected annual total return would be 16%.

The problem is finding a bottom. If the economy goes off a cliff, we could see 10% to 20% more downside – especially if it comes with elevated inflation.

In that case, we’re talking full-blown stagflation.

In light of the risks and opportunities, I stick to what I said in my prior article. I like NEE’s long-term opportunities. Despite rate and inflation challenges, the company is doing well. Long-term investors looking for a good utility investment may benefit tremendously from buying NEE at these levels.

Personally, I started buying NEE shares aggressively. For now, it’s mainly a trade, as I’m not sure how much utility exposure I want to hold (in light of other investments). I’m just a big fan of the risk/reward and may end up holding shares on a prolonged basis.

People who are less aggressive than me (which I highly advise) may benefit from buying shares gradually. If the stock keeps dropping, investors can average down. If the stock takes off, investors have a foot in the door.

This strategy is simple and has guided me very well in the past.

Takeaway

In a market marred by inflation and rising rates, defensive sectors like utilities, real estate, and consumer staples took a hit, with NextEra Energy experiencing a substantial decline.

However, despite challenges faced by its subsidiary and broader market headwinds, NEE remains a resilient investment. The company’s trifecta of strengths – ownership of Florida Power & Light Co., efficiency, and renewable power leadership – positions it for growth.

Investors should exercise caution but not dismiss NextEra. With a robust balance sheet, optimistic growth projections, and the potential for future dividend increases, NextEra Energy presents a compelling opportunity.

Read the full article here