Accretive acquisitions used to be all about earnings and really not much else. The oil and gas industry has a different idea about accretive acquisitions. Now they need to increase free cash flow. Ring Energy (REI) is following this industry trend with an acquisition that increases free cash flow.

It looks like the strategy is going to get an unexpected boost. The Founders acquisition recently closed. But the really good part about an all cash transaction comes about when oil prices unexpectedly rise to allow the company to repay debt faster than anticipated. Timing is everything in this industry when it comes to financial leverage. So the strong oil prices could hardly come at a better time.

The company definitely had wells with good enough returns to drill its way out of its debt load. But the debt market would not allow such a thing to happen. Both Mr. Market and the debt market appear to be united in wanting solutions to balance sheet ratios that are high right now. Therefore, the way to obtain profit maximizing size is obviously through acquisitions.

Fortunately, a lot of lease sellers have some sharply reduced expectations after about 5 brutal years that ended in fiscal 2020 with the covid challenges. So, it appears to be relatively straightforward to find accretive acquisitions. Ring Energy is a little bit late to the “shopping game”. But it still appears that there is time to get the debt ratios to acceptable levels using the market approved strategy of accretive acquisitions.

Ring Energy has a major advantage over a lot of companies that are going shopping. Ring Energy is a conventional producer that is producing from zones that are not attracting a lot of competition. Therefore, prices were never going to be sky-high for the kind of acreage that this management would be interested in acquiring.

About That Free Cash Flow

This rather small acquisition (at least compared to the previous one) is going to have a big impact on free cash flow. That is just what the market is looking for.

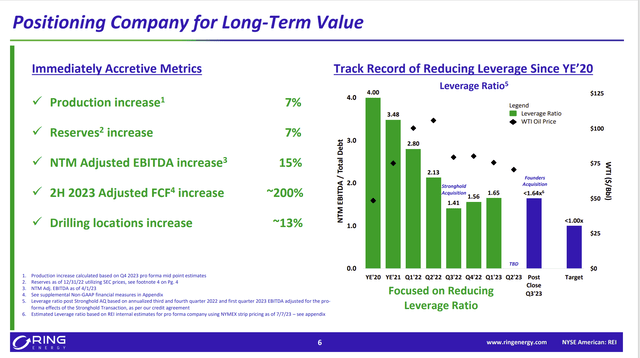

Ring Energy Benefits Of Founders Acquisition (Ring Energy Presentation Of Founders Oil & Gas Acquisition July 2023)

Ring Energy announced the acquisition of Founders Oil & Gas (a privately held company) for all cash. Despite adding to the company’s debt load, management estimates that free cash flow will climb quite a bit. If that number is at all accurate, there is considerable leeway for disappointing oil and gas prices.

This acquisition is similar to the Northwest Shelf acquisition a few years back in that the Northwest Shelf acreage delivered a higher return than the legacy acreage at the time. Interestingly, these wells are extremely profitable no matter what acreage of the company you are talking about. But evidently this new acreage is again more profitable than a lot of company acreage.

The difference is that the Northwest Shelf acquisition immediately ran into the pandemic challenges. What was at the time considered a conservative acquisition became an onerous burden during the pandemic when debt market and industry conditions changed “overnight”. The Founders acquisition is now running into a rising oil price market for the opposite effect. Those rising prices make the leverage situation far safer as long as management repays debt fast for as long as the conditions last.

The sales price appears to be good enough that the debt ratio will not be advancing. Instead, the debt ratio basically holds steady. If the currently strong oil price situation is around long enough, the debt ratio could decline considerably. Mr. Debt Market is concerned about lower prices and this could be that one opportunity to get the debt acceptable to the debt market fast.

But the real key is that management can make the acquisition without raising the capital budget. Therefore, the extra cash flow from this acquisition heads straight to the bottom line (basically). Like any of the company’s previous acquisitions, there are plenty of rework projects with very fast paybacks.

Lower Production Costs

This acquisition will also slightly lower production cost for the corporation as a whole.

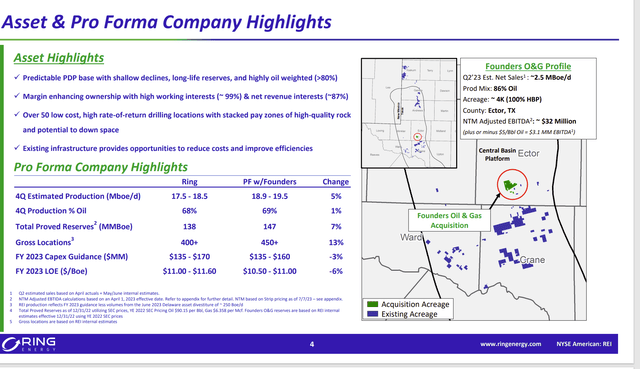

Ring Energy Founders Oil & Gas Acquisition Highlights (Ring Energy Presentation Of Founders Oil & Gas Acquisition July 2023)

Note that this acreage is not bolt-on. But the acquisition is probably justified by the higher oil production percentage shown above than is the case of the current Ring Energy acreage. Also, the acreage is within reasonable distance of the company’s operations so that there could still be some synergies.

Now this would likely make some legacy acreage non-competitive. But that effect will not last long because the new acreage position only has 50 proposed locations.

It should also be noted that the price per acre is less than $20K an acre. For the more visible unconventional purchases (by other oil companies) the price of an acre can be as high as $60K. That lack of competition for this conventional opportunity pays off in many ways.

Both production costs and the capital budget range decline slightly. Since management generally gives conservative numbers, it is a reasonable expectation for management to beat these numbers one way or another.

The Original Challenge

Management was converting from a lease acquisition strategy to an operating strategy when the covid challenges hit. Oil prices went so low that management shut-in production and lived off the hedges. Neither the debt market nor Mr. Market appreciated that strategy.

Furthermore, the debt market changed overnight. What had been a very conservative debt load became quite a burden because the debt market was not about to allow the company to borrow enough money to finish the conversion to an operating company. Had that been allowed, the wells here were profitable enough for that to be accomplished quickly. But the debt market had a blanket answer to the whole industry with no exceptions.

Therefore, this management has had to “buy” the incremental acquisition to get operations to the appropriate level. Management also has to have enough free cash flow to convince the market it can service the debt.

The stock price has likely lagged due to the lack of free cash flow to repay the debt at an acceptable pace.

Obviously, management has a long-term goal to get the key debt ratio below 1 in the current environment. that is going to happen a lot faster with purchases of production rather than drilling (and it’s more acceptable to the debt market). The market considers things like reserves behind each share only when the debt situation is satisfactory. Therefore, the resolution of the debt situation to the satisfaction of the debt and stock markets could result in a considerable share price pop.

Conclusion

Management has used the recent oil price pullback from the high prices of fiscal year 2022, to purchase some properties that aid the company’s goal of getting an optimal amount of production to properly service the debt while minimizing operating costs.

This action would not have been necessary back in 2018 because the debt market was far more receptive to companies like Ring Energy. But fiscal year 2020 drastically changed the debt market requirements. Fortunately, management was able to come up with a viable “Plan B” to dig its way out of what was a conservative amount of debt.

Selling prices do appear to be rising. But the selling prices are still well below the “hot years” during the “go-go” days of the past boom times. I say that as the higher prices like right now, have not lasted that long. So, over a fiscal year, the company is still dealing with lower average prices than roughly 5 years ago.

As long as that remains the case, this company appears to be in a position to pick up some very profitable acreage that will aid the company debt ratios considerably. It is the market-approved way to resolve the issues.

There appear to be a lot of sellers that “want out” because the years 2015-2020 were very disappointing to the industry and speculative investors who hoped to make a killing. Many times, that same speculative money just “dumps and moves on”. That is a good thing for many companies in the industry as it aids the balance sheet repair process throughout the industry considerably.

Ring Energy always had very profitable wells. It just never had the cash flow that the market demanded to self-fund the continuing conversion from a startup to an ongoing upstream business. Therefore, management is doing what it can to become that very profitable upstream company that the founders envisioned under very different industry conditions.

It does look like management will get where it needs to go. For investors willing to overlook some high debt ratios, this company (with above-average financial risk) offers a speculative strong buy chance to recover and become that upstream producer. This stock is not for risk-averse investors.

Read the full article here