Back in July, I wrote that JD.com (NASDAQ:JD) was facing increased competition and that its business model was not as strong as some other Chinese e-commerce firms. With the stock down over -20% since then, let’s catch on the name.

Company Profile

As a refresher, JD is one of the largest e-commerce companies in China, where it operates as both a marketplace as well as an online retailer. The company also owns some offline retail brands including JD Mall and the 7FRESH food market.

The company also owns a logistics and fulfillment network with over 1,500 warehouses throughout China. The JD Logistics segment also trades separately on the Hong Kong Exchange. The company is also involved in other ventures, including property development, healthcare, AI, and cloud computing.

Q2 Results Fail To Excite Investors

In my initial write-up, I noted that Q2 was a big quarter for Chinese online retailers, with the country’s 618 shopping festival falling in June. With the Chinese consumer being cautious coming out of pandemic lockdowns, a number of merchants including JD introduced large subsidiary programs to third-party merchants to get them on their platforms and to entice sales. For its part, JD introduced a RMB10 billion ($1.4 billion) subsidy program.

The promotions had the desired impact on sales, with its JD retail unit seeing revenue growth of 5% to $34.9 billion. Electronics and home appliance sales lead the way with 11% growth to $21.0 billion, while marketplace revenue jumped 9% to $3.1 billion. General merchandise sales were down -9% to $11.3 billion, hurt by its supermarket category, which had benefited last year from Covid-related lockdowns.

The company said the number of 3P merchants more than doubled year over year, and that it has now seen two straight quarters of double-digit 3P growth. It said most of the growth came from advertising as more merchants allocated spending to the JD platform. The company has lowered platform service fees and take rates to help entice new merchants to its marketplace.

However, the increase in retail sales did not lead to an improvement in retail operating income, which was flat year over year at $1.12 billion.

Its JD Logistics segment saw revenue grow 31% to $5.66 billion. Organic revenue was up 5%. Meanwhile, operating income for the segment soared from $5 million to $70 million. The company said external customers accounted for 69% of the segment’s revenue in the quarter.

Overall, the company saw sales climb 8% to $39.7 billion, topping the $38.5 billion consensus. Adjusted EPADS came in at 74 cents, beating analyst estimates by 6 cents.

Adjusted EBITDA rose 44% to $1. 4 billion. The company generated $6.1 billion in free cash flow.

Gross margins came in at 8.6%, and improvement from 7.4% a year ago.

On its Q2 earnings call, CEO Sandy Xu said:

As the retail estate market and demand of durable goods are still recovering, the overall home appliances market has faced pressure. However, JD’s home appliances business meaningfully outperformed the industry and continue to gain market share. We attribute this achievement to JD’s strong user mindshare and matched the shopping experience we provide and the competent supply chain that we have been diligently built over the years. Furthermore, our 3C categories showcased a strong performance. This can be attributed to our robust supply chain capabilities, competitive pricing and the deep user mindshare, exceptional shopping experience, including convenience trade-in services and our active development in the O2O market. Notably, our sales of mobile phones achieved a double-digit growth rate in Q2, surpassing the industry level. It is worth highlighting that we have made significant progress in the development of an open platform ecosystem this year, with both merchant base and product supply expanding at a faster pace. Growth of 3P GMV has also accelerated over the past two quarters. Moreover, since the start of the year, despite we have introduced a series of supporting policies for our new merchants, such as lowering platform service fees and take rates, our 3P revenue growth rate continued to outpace that of 1P in the first two quarters, remaining at double-digit range.”

Overall, JD posted a decent quarter in a tough environment that saw a cautious consumer and a lot of competition looking to compete on low prices. However, its sales growth trailed large competitors such as PDD Holdings (PDD), which saw its Q2 revenue soar 66% (article here), and Alibaba (BABA), which saw its retail revenue from Taobao and Tmall climb 12% in its June quarter. Vipshop (VIPS), meanwhile, saw its Q2 revenue climb 14%. At the same time, JD had to sacrifice margin to get its only 5% retail sale growth, which led to no increase in operating income for its retail segment.

Where the company was strong, though, was with its Logistics unit, which saw a surge in sales and profitability. The Logistics segment is a bit of a gem, but just much smaller than its Retail segment. Not surprisingly, while the company topped expectations, it still was not enough to get investors excited about the stock.

Valuation

JD trades at 4.1x the 2023 EBITDA of $5.75 billion and 3.5x the 2024 EBITDA consensus of $6.79 billion.

On a PE basis, it trades at 10x EPS estimates of $2.93. Based on the 2024 consensus for EPS of $3.42, it trades at 8.5x.

It’s projected to grow revenue nearly 5% in 2023 and 10% in 2024.

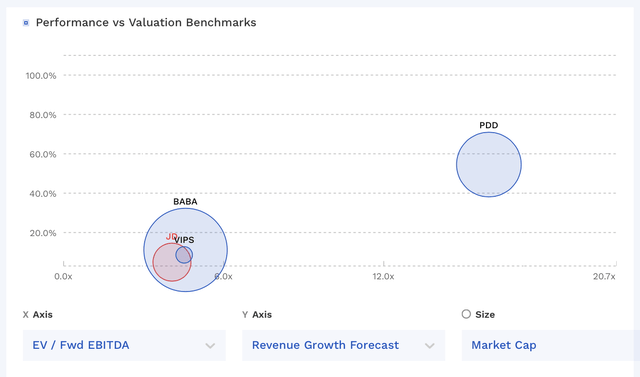

The stock trades at a similar valuation to its Chinese e-commerce peers outside PDD, which is growing much faster than its peers.

JD Valuation Vs Peers (FinBox)

Conclusion

Overall, I continue to think other Chinese e-commerce companies are doing a better job than JD and have stronger business models. The company is facing tough competitive pricing pressure, and its main category of electronics and appliances has been pressured by cautious consumer spending in China.

That said, I think JD has gotten too cheap at this point. The stock is inexpensive, as are its Chinese e-commerce peers, and it should benefit from any recovery with the Chinese consumer. At the same time, its logistics unit is solid and one of the gems of the company.

As such, I’m going to upgrade the stock to “Buy.”

The biggest risk to the stock is that the Chinese consumer remains weak and that competition continues to cause further pricing pressure. The stock while inexpensive, currently doesn’t have an immediate catalyst, which could cause the share price to linger or even just continue to drift lower.

Read the full article here