Summary

Following my coverage of Chewy Inc. (NYSE:CHWY), I recommended a buy rating due to my expectation that CHWY will continue to benefit from the secular uptrend in the large pet health market. This post is to provide an update on my thoughts on the business and stock. I continue to recommend a buy rating for CHWY as I believe multiples have been overly beaten down as investors focus on one single metric but overlook other positive aspects of the business. Nonetheless, I would tone down my bullish view by suggesting investors hold a smaller position, as there is a risk that active customers (on which the key metric market seems to be focusing) might continue to stay weak in the near term.

Investment thesis

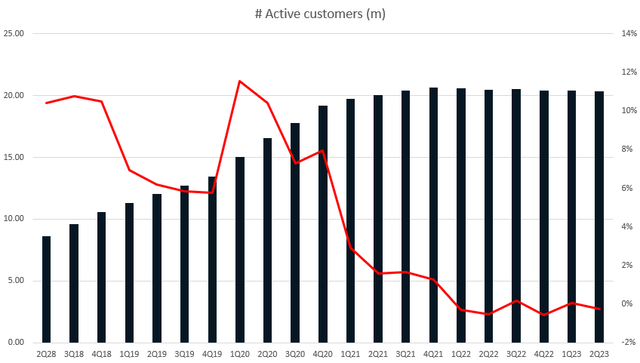

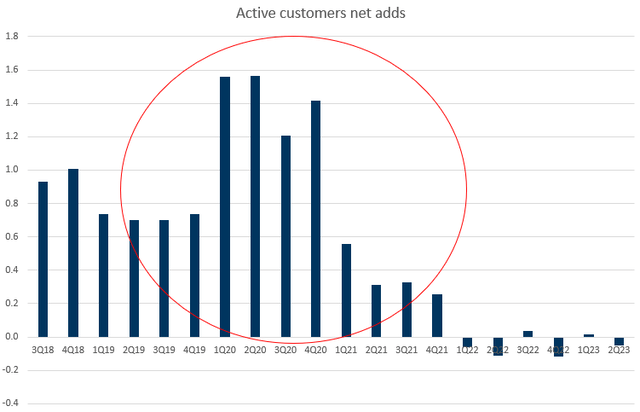

The 14% increase in sales that CHWY reported for 2Q23 was better than the upper end of the $2.75 billion to $2.77 billion range that management had predicted. However, the number of active customers fell by 5,000 on a sequential basis, continuing the weakness seen for the past six quarters. My previous evaluation of the company and stock was flawed because I failed to account for the fact that investors care more about the short-term active customer metric than they do about the fact that the long-term secular trend is still intact and CHWY is on track for margin expansion.

Own calculation

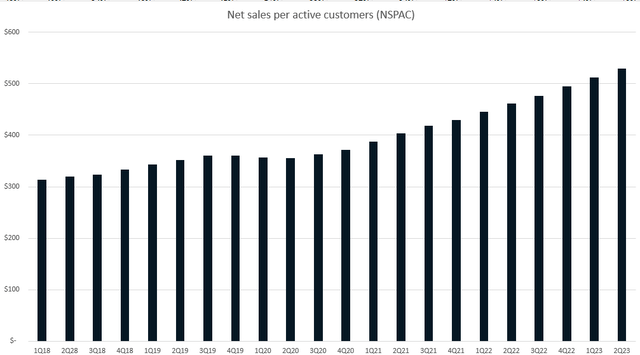

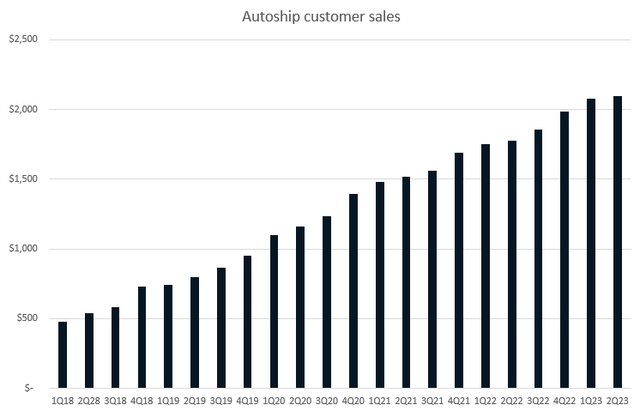

While the number of active customers was weak, the net sales per active customer performance was very strong, growing to above the $500 level and remaining well above pre-covid levels. This was the major growth driver for the overall sales growth. Also, autoship customer sales performed very strongly, growing at 18% year over year, driving sales levels to $2,100. Viewed in isolation, I would think the positives from these two metrics outweigh the weak performance in the number of active customers, as it could be attributable to the macro weakness.

Own calculation Own calculation

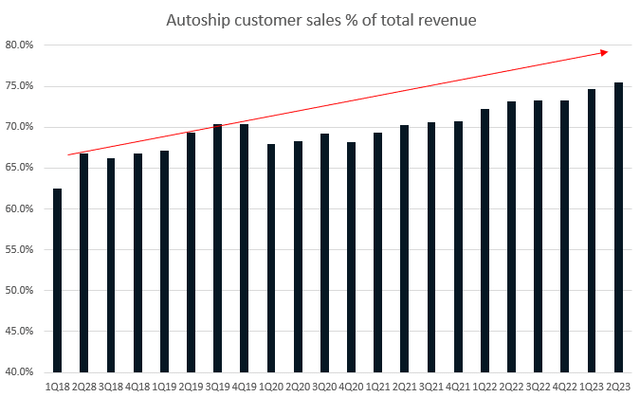

I remain positive that growth in net sales per active customer and autoship customer will continue, as management mentioned they continue to see shifts in customer spending as customers aggregate behavior around trusted platforms (which CHWY has an advantage given it’s the most visited pet food site). Importantly, the growth ahead should be accompanied by better unit economics as autoship sales become a larger percentage of total revenue. Note that Autoship customers have a higher customer lifetime value as they have a recurring nature and lower customer acquisition costs.

Own calculation

Looking ahead, while the share price has dipped significantly since I wrote about it, I remain confident that the business fundamentals have not derailed. I expect sales to continue sustaining at the current low to mid-teens level as I expect active customers to return to growth as it laps pandemic-related headwinds and the current macro situation. I would also remind readers that a bunch of active customers are going to mature, which means higher spend per customer, as they were added during the COVID period. Comparing the net loss and net gain, it is apparent that a bulk of these net gains during the COVID period are still within the system.

Own calculation

As CHWY continues to grow its private label and healthcare divisions, which generate higher profit margins, I believe there is a good chance of consistent margin expansion over the next few years. The success of these initiatives is likely to lead to improvements in gross margins. With the ongoing improvements to the supply chain and the automation of the fulfillment centers, we should see an increase in EBITDA margins. Notably, recent financial results show that this positive trend is already in motion, and it is moving faster than the market anticipated. For example, CHWY beat expectations for 2Q23 with adjusted EBITDA of $87 million, or a margin of 3.1%. Strong gross margins and efficient fulfillment costs were the primary factors in this outperformance.

Overall, I remain bullish on the business and stock, but acknowledge that bears were right in the near term, where the weak number of active customers performance has outweighed all other positives. Nonetheless, at the current valuation, the stock is, in my opinion, very attractive. The two catalysts that will drive the stock up are the return of positive active customers and CHWY staying on track to expand the EBITDA margin.

Valuation

Own calculation

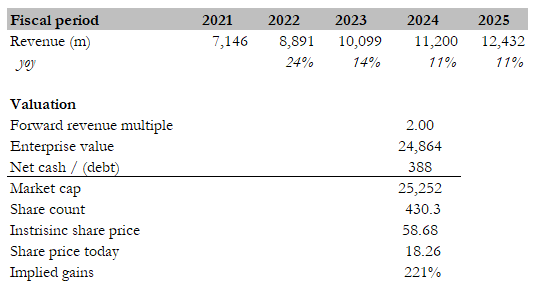

I believe the fair value for CHWY based on my model is $58. My model assumptions are that CHWY will sustain its 10+% growth rate for the near term as it continues to see NSPAC remain strong (10+%), grow a percentage of Autoship customers (better unit economics and spend), and benefit from the maturity of cohorts that were added over the past few years. The underlying assumption I made is that active customer adds will remain flattish, as I am not confident of the timing of recovery given the current macro situation. Hence, there is potential for further upside growth if CHWY sees a recovery of positive active customers. The main driver of investment returns would come from multiples rerating back to the mean. CHWY used to trade at an average of 2x forward revenue before the recent dip, which I think has been overdone. When compared to peers, CHWY is the only player with both steady 10+% growth and profitability. While Rover and Wag! are growing faster, their profitability metrics are way worse than CHWY. As for Petco Health, while its profitability is much better, growth is much lower than CHWY. So comparatively, I would expect CHWY to trade at a premium to peers’ averages. Using the CHWY historical valuation average as a yardstick, I believe it should be trading at 2x forward revenue.

Risk

Management highlighted that they are seeing more discerning consumers in July and August and now expect a wider range of outcomes for net ads. As such, the risk is a greater decline in the number of active customers. This could really drag CHWY share price and sentiment down as long-term investors give up on the near-term, and momentum investors pile on the weakness.

Conclusion

My recommendation for CHWY remains bullish, but I advise caution regarding the ongoing weakness in active customer numbers in the short term. Despite the recent emphasis on this single metric, I maintain a buy rating for CHWY due to its potential to benefit from the long-term growth in the pet health market. The 2Q23 sales increase of 14% exceeded expectations. While active customer numbers have been weak for six consecutive quarters, the net sales per active customer and strong Autoship customer sales demonstrate positive trends.

I believe CHWY will sustain its growth with active customers returning to growth post-pandemic and maturing cohorts contributing to higher spending per customer. Furthermore, the company’s expansion into private label and healthcare segments, with higher profit margins, may drive consistent margin expansion.

Though acknowledging the short-term bearish sentiment, I find CHWY’s current valuation very appealing. Positive catalysts for the stock include the return of active customer growth and EBITDA margin expansion. I estimate CHWY’s fair value at $58 and expect multiples to re-rate back to historical averages, given its strong growth and profitability compared to peers.

Read the full article here