Transcontinental Inc. (TSX:TCL.A:CA)(OTCPK:TCLAF) recently delivered beneficial expectations with regards to operating margin growth thanks to recent cost initiatives and the deployment of raddarTM. I believe that recent investments in sustainable packaging could bring the attention of ESG funds and investors interested in sustainability investments. Under my different case scenarios, I obtained a valuation that appears significantly richer than the current stock price. Yes, I did see risks coming from the total amount of financial debt or failed M&A integrations, however TCLAF does look cheap.

Business model

Transcontinental is a leader in the packaging industry in Canada, the United States, and South America. Furthermore, within Canada where its centers are operational, this company is the largest printing company in the country.

The company offers, along with these services, based on its experience in the market, product design, marketing, and product launch strategies to its clients.

The numbers from the last annual report include 50% of revenue coming from the activity of its packaging area, while the remaining 50% is distributed in its printing activities as well as education and training activities. 47% for its printing activities and 3% for its education and training activities, where it publishes, prints, and markets bilingual books in English and French mainly made for educational purposes. Although it represents a small percentage of the company’s annual revenue, this business segment appears to be the largest publisher of bilingual education books in Canada.

Each of these areas represents a segment of operations: packaging, printing, graphics, and editing. The first of these has operating facilities in the United States, Canada, and some South American countries, constituting the hard core of the company’s business.

Outlook: Cost Initiatives Are Expected To Bring Operating Margin Growth

Considering the recent outlook given in the most recent quarterly release, I believe that it is time to have a look at the company. First, management expects an increase in profitability even disclosing certain pressures on volume.

In terms of profitability, despite the pressure on volume, we expect an increase in adjusted operating earnings before depreciation and amortization for fiscal year 2023 compared to fiscal year 2022. Source: Quarterly Press Release

Additionally, management pointed out that future cost reduction initiatives and the continued deployment of raddarTM could have a beneficial effect on the profit margins. As a result, I believe that sufficient FCF growth could lead to an increase in the company valuation.

This anticipated volume reduction, combined with the effect of inflationary pressure, should result in lower adjusted operating earnings before depreciation and amortization for fiscal year 2023 compared to fiscal year 2022. We expect this decrease to be partially offset by cost reduction initiatives and the continued deployment of raddarTM which allows us to secure our retail flyer printing activities. Source: Quarterly Press Release

Market Expectations Include FCF/Net Sales Growth And FCF Growth

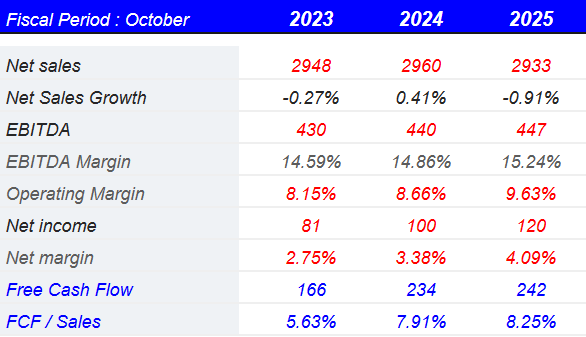

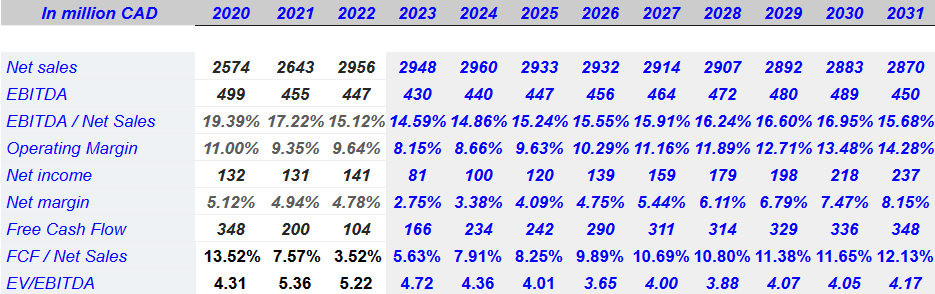

I believe that the most interesting from the expectations of other market analysts is the free cash flows expected for the years 2023, 2024, and 2025. Even if the EBITDA margin and the net sales are expected to remain relatively stable with close to 0% sales growth and EBITDA/Net sales of 14%-15%, I think that the numbers expected are beneficial.

2025 net sales are expected to be close to CAD2.933 billion, with net sales growth of -0.9%, EBITDA of CAD447 million, with EBITDA margin close to 15%, and net income of CAD120 million. Finally, 2025 free cash flow would be close to CAD 242 million, with FCF/net sales of 8.25%. Market analysts expect an increase in the FCF margin of close to 3% from 2023 to 2025.

Source: S&P

Balance Sheet

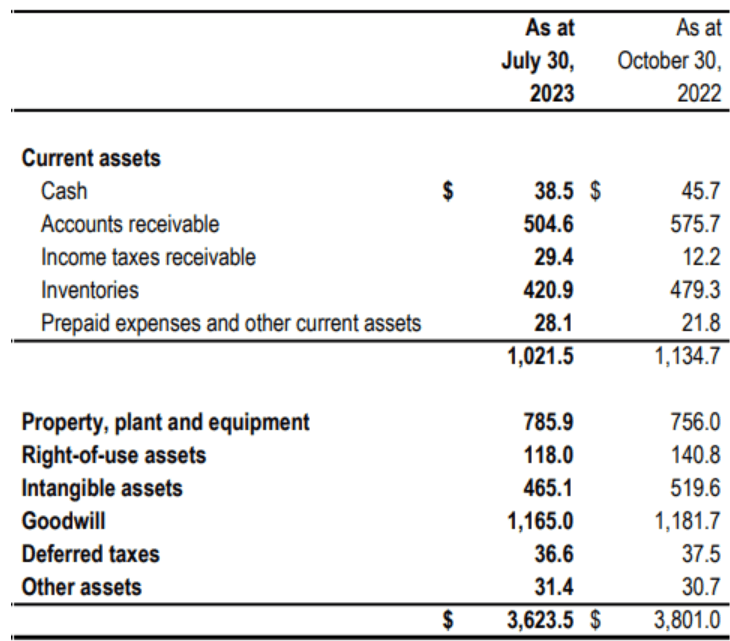

As of July 30, 2023, the company reported CAD38 million in cash, with accounts receivable of CAD504 million, inventories of CAD420 million, and current assets close to CAD1 billion. The ratio of current assets/current liabilities is larger than 2x, so I think that liquidity does not seem to be a problem here. Long term assets include CAD785 million, with goodwill close to CAD1.1 billion, and total assets of about CAD3.6 billion.

Source: Quarterly Press Release

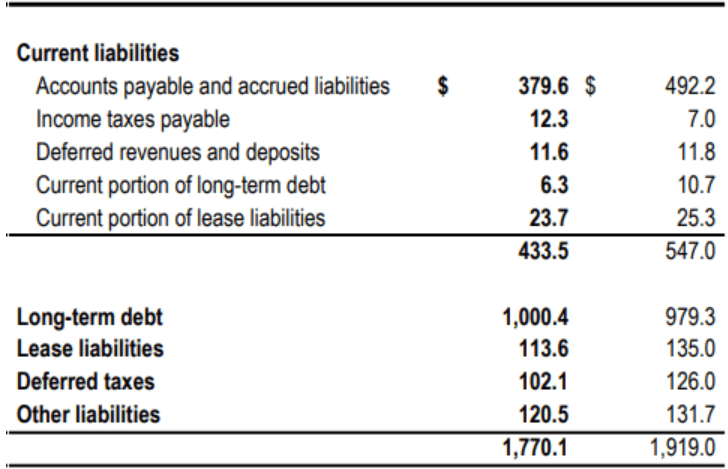

The list of liabilities does not appear worrying. With accounts payable of CAD379 million, total current liabilities are equal to CAD433 million, and long-term debt is equal to CAD1 billion. Given the current amount of debt and the total amount of goodwill, the company seems to finance new acquisitions thanks to long-term debt. The company was founded in the 1970s, and has acquired many targets in the past, so I believe that management knows well how to do M&A. With this in mind, I am not really concerned about the total amount of debt.

Source: Quarterly Press Release

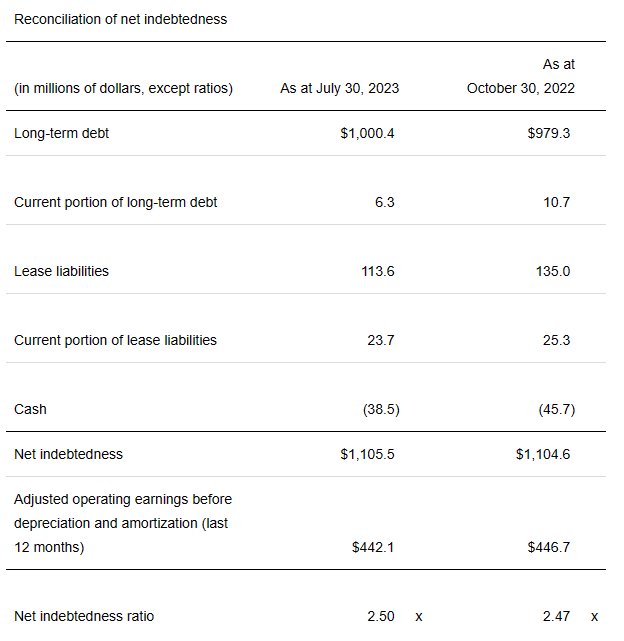

In the last quarterly report, the company noted net debt close to CAD1.105 billion, including the debt and the total amount of leases. The net indebtedness ratio is close to 2.5x, which does not seem that elevated.

Source: Quarterly Press Release

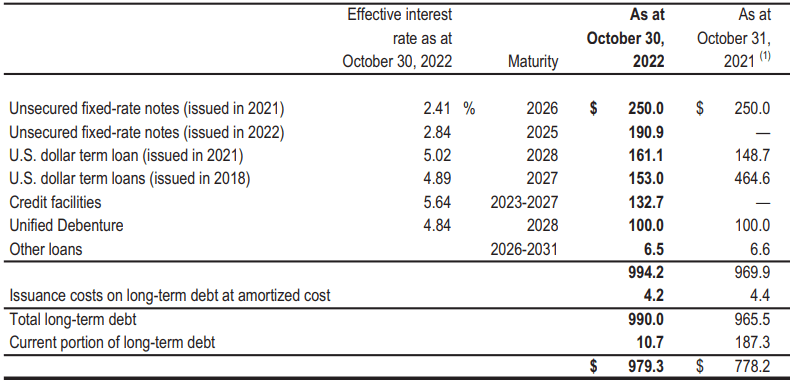

With regard to the effective interest rate paid, the company reported interest between 2.4% and 5.64% and maturities close to 2023 and 2026. Given the FCF, I believe that the company is in a good position to pay its debt obligations. I used some of these figures in my valuation model, so I believe that investors may want to have a look at it.

Source: Quarterly Press Release

First Catalyst: M&A, Introduction Of New Contracts, And New Equipment Purchased Will Most Likely Bring Net Sales Growth And FCF Growth

Transcontinental maintains an active growth strategy driven by both the organic growth of its sales in the packaging segment and the possibility of acquiring national or international businesses within the areas in which it operates. Organic growth is expected due to the purchase of new equipment, new contracts signed, and the introduction of new products in the brand during 2023 and 2024.

In the printing segment, better results are also expected than that in 2022, which will serve for the amortization of losses and the transfer of the increase in costs that the company experienced in the previous year.

From the increase in profits and margin due to the growth of its commercial activities in these two segments, the company expects to have sufficient amounts and liquidity to continue with its current investments, reduce debt margins through the payment of obligations, and have better margins for the search and investigation of potential acquisitions.

I Believe That Further Investments In Sustainable Packaging Solutions Could Not Only Bring Long Term Worth, But Also Attention From ESG Funds

In the last quarterly report, management noted that recent investments in sustainability in the Packaging Sector will most likely bring long term growth. In my view, if the company successfully communicates its investment in sustainability to the market, the demand for the stock could increase. Let’s keep in mind that there is a significant number of new funds out there specialized in companies that incorporate environmental, sustainable investing, social sustainability, and corporate governance factors in their investment processes.

In the Packaging Sector, our investments in sustainable packaging solutions position us well for the future and should be a key driver of our long-term growth. Source: Quarterly Press Release

Sustainable Finance Market size was valued at USD 4.2 trillion in 2022 and is projected to register a CAGR of 22.4% between 2023 and 2032. Source: Sustainable Finance Market Size

Base Case Scenario

Taking into account previous financial figures and my own assumptions, under my base scenario, I assumed small net sales growth from 2023 to 2031 along with a small increase in the EBITDA margin and FCF growth.

My results included 2031 net sales of CAD2.8 billion, with an EBITDA margin of 15.6%, operating margin of 14%, and net margin close to 8.1%. Besides, with FCF/net sales close to 12%, 2031 FCF would be close to CAD348 million.

Source: My Expectations

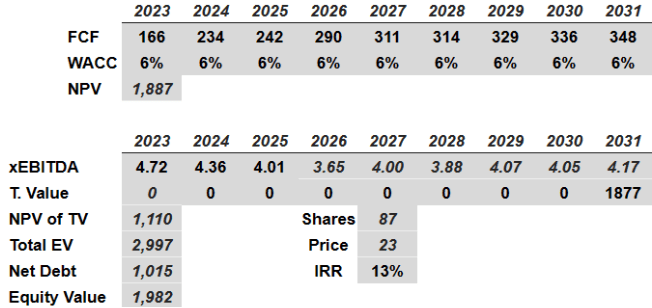

If we also assume a WACC of 6%, which is not far from the cost of debt reported by management, and 2031 EV/EBITDA of 4.17x, the implied enterprise value would be CAD2.9 billion. The equity value would also stand at close to CAD1.9 per share, and the implied fair price would be close to CAD22-CAD23 per share with an internal rate of return of 13%.

Source: My Expectations

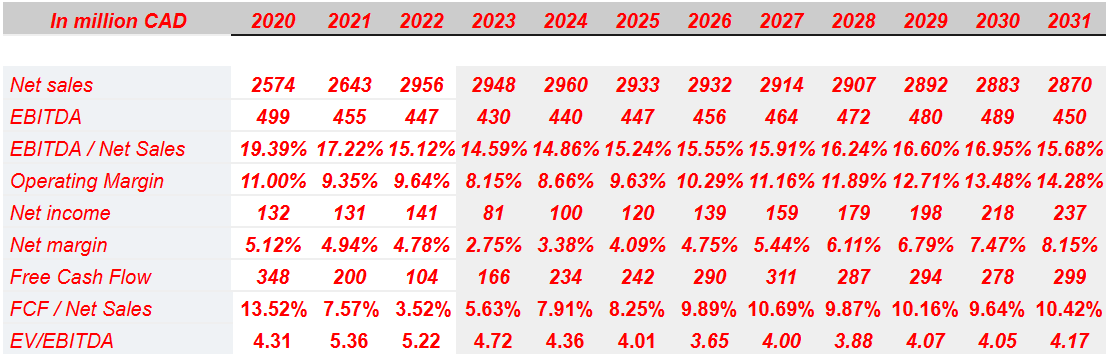

Best Case Scenario

After carefully reviewing previous financial results, I included what I believe is the best potential outcome for Transcontinental. Under my best case scenario, my numbers were 2031 net sales of CAD2.870 billion, with EBITDA of CAD450 million, EBITDA / net sales of about 15%, and operating margin of 14%. Additionally, with net income close to CAD237 million, 2031 free cash flow would be close to CAD299 million.

Source: My Expectations

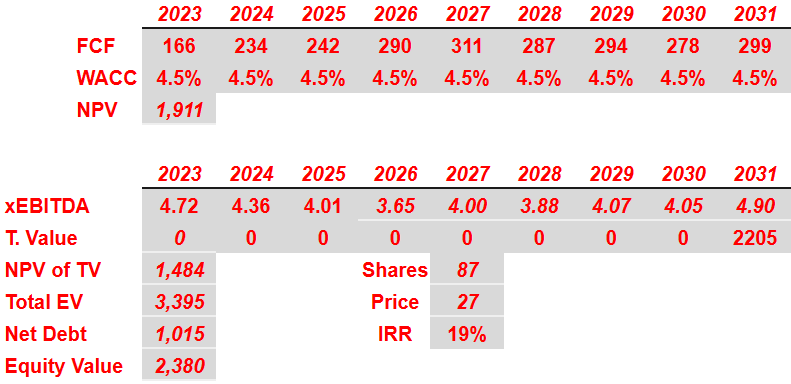

If we assume a WACC of 4.5%, the net present value of the FCF from 2023 to 2031 would be close to CAD1.9 billion. Now, with a terminal EV/EBITDA of 4.9x, the NPV of future terminal value and the NPV of future FCF would be close to CAD3.3 billion. Subtracting net debt of CAD1.10 million, the implied equity would be close to CAD2.38 billion. Finally, the implied price would be close to CAD27 per share, and the IRR would be 19%.

Source: My Expectations

Competitors

Although there are, at the national level, not a large number of competitors offering services similar to those of the company, the competitive environment is made up of other companies that have greater resource capabilities, better technical knowledge about the operation of the products within the industry, and broader sales channels than those available at Transcontinental.

On the other hand, in addition to the competitors within the local area, there are a large number of companies from the United States that manage to insert themselves into portions of the Canadian market. Market conditions are currently open as an increase in demand is expected for both the packaging and printing segments and future consolidation in the medium term.

Risks

First of all, we must point out that the global printing industry is undergoing major changes since a large portion of customers has digital alternatives to produce the same products. This factor, added to possible regulations on the door-to-door distribution of posters and strategies that were previously common in this type of market, may represent a risk factor in the short term for the development of the printing segment.

In another sense, although Transcontinental expects to maintain organic growth in its sales throughout 2023, this projection may not be true, and may be affected by the great growing competition within the markets, which would lead the company to have to adapt its sales strategy growth in the short term by not representing the expected growth in financial results.

We must add the context of an uncertain economy in general, any cut in the distribution and supply chains, the long sales cycle typical of this industry, and the debt situations that could eventually lead to not having credit lines for investment and future acquisitions.

Conclusion

Transcontinental recently delivered beneficial expectations about future operating margin growth driven by cost initiatives as well as inorganic growth. In my view, it is also quite beneficial that management made investments to develop more sustainable packaging. As a result, I believe that ESG funds and other types of investors may bring further demand for the stock. Under my two case scenarios, I obtained a double digit IRR and a target valuation that is significantly higher than the current stock price. There are some risks derived from the total amount of debt, potential supply chain crisis, and inflation, however I think that the stock is undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here