Q3 2023 Performance

In Q3 I returned +7.9% versus -3.0% for the S&P 500 (SPY). In 2023, I’ve returned +21.1% versus +13.4% for the index. I’ve gone from a fairly large underperformance to a sizable outperformance.

My performance in Q3 was driven by, well, pretty much everything I owned other than Dole. I sold out of PBF and GEL entirely, and sold the chunk of HRB I added at $33.50. I’m back to my highest level of cash ever, but I made several trades this quarter that did well.

Closed Positions

PBF Energy (PBF)

With the benefit of hindsight, I closed this too early, selling in late July for $47.50. But, I used the proceeds to buy more Cenovus at $18.8, so it’s been a wash.

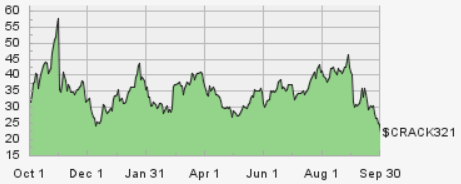

3-2-1 Crack Spread (Energy Stock Channel)

I’m bearish on refiners right now. Gulf Coast crack spreads are the lower than they were in the spring, when refiners made their yearly lows (PBF went under $32!) The US has added some additional refining capacity, and we’ve added a significant amount internationally.

Add to this any risk of a global slowdown and further demand destruction via EVs, and I’m happy to take the win here and move on. I’m more bullish on integrated producers or pure E&P’s here.

Genesis Energy (GEL)

This was a miss and with the benefit of hindsight, a reactionary sell.

I sold out around $9.3, which was my cost basis. I still like the story here, but my disappointment in the Q2 results, coupled with how overweight energy I already am made me decide to cut this position. The overarching part of my investing strategy is “don’t lose money” and I have less conviction in Genesis now than I did previously.

Current Positions

Cash and short duration bond funds (46%)

Still holding the most cash I ever have held, while opportunistically deploying it for trades. I still believe this is a time to be defensive.

Cenovus Energy (8%)

Still holding my position in Cenovus, and remain bullish on the company long term. Cenovus returning 100% of capital in dividends and repurchases is getting closer.

I’m considering selling calls against this position. Above $20, I think Cenovus management opts for more dividends over repurchases, and the premiums on the call options look enticing.

Energy Transfer (18%) units (14%) and preferred shares (4%)

I added a small amount of common units in the low $12’s, and added more of the Series E (ET.PR.E) under $23 back in Q2.

I still believe Energy Transfer offers a lot of value, but we may start hitting some near-term resistance after such a strong run. I think the common units are worth between $18-$20 and the prefs offer a lot of value for floating rate securities. The Series E prefs start trading at LIBOR + 5.161% starting in May (nearly 11%!)

Berkshire Hathaway (10%)

Berkshire Hathaway (BRK.A) (BRK.B) remains an anchor in my portfolio, though its valuation is certainly on the “high end” of fair. After repurchasing the Jan24 $350 call at a 20% profit, I recently sold a Jan24 $380 call with the stock at $365.

H&R Block (8%)

This was a 12% position up until a few days ago. I said it was Time to Reload at $33.50, and when shares hit $43.50 late last week, I decided to ring the cash register on the 30% gain in two months.

Still have a significant position that I don’t plan on selling.

Dole (4%)

Still patiently waiting for the Fresh Vegetable sale to close. FCF will inflect when it does.

JPMorgan Chase (3%)

I still hold a small JPMorgan Chase (JPM) position from my original $90 purchase price. I’m considering selling this. I don’t love buying banks in general, and I’m negative on the sector. My dislike of the sector is mostly driven by spiking interest rates.

That said, JPM is the best of the banks and the valuation is very reasonable.

NuStar Preferred C Shares (3%)

These get safer by the quarter as the company continues to redeem the privately held class D Prefs, and Nustar’s common units have had a good run this year. I’ll continue to hang on to these 12% floating rate prefs.

Outlook for the rest of 2023

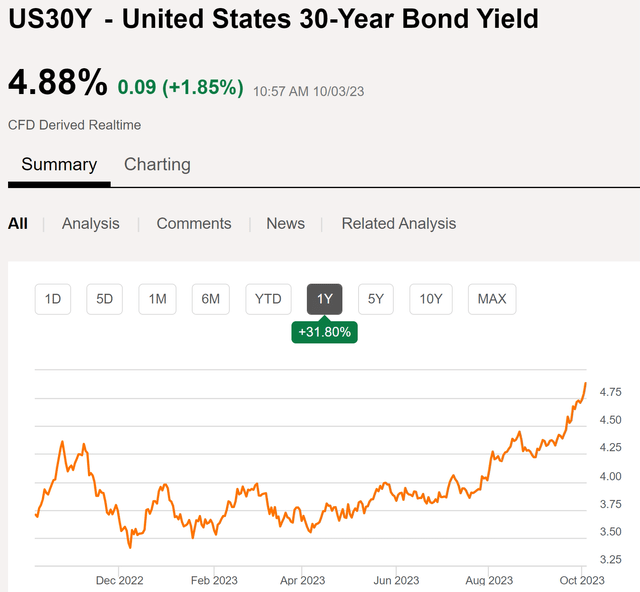

In July I said that, with the S&P500 above 4500, that it was a poor time to be chasing stocks, especially when you can earn 5% in Treasuries. With the S&P around 4300, I still think the risk/reward in stocks is poor, with the bond market flashing warning signs.

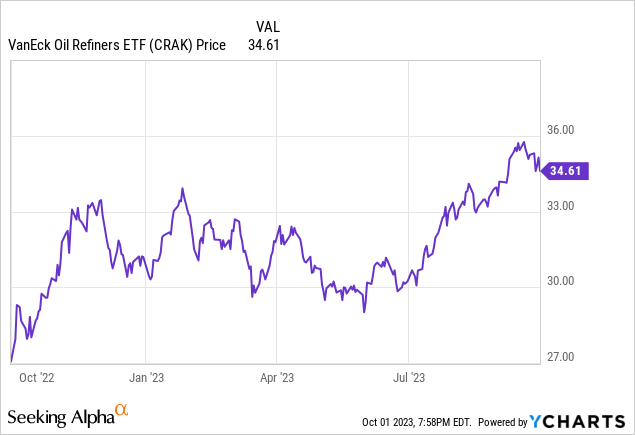

30 Year Treasury (Seeking Alpha)

We are running close to a $2 trillion dollar deficit and just ran past $33 trillion in national debt. We are adding this much to the debt during a non-recessionary period with rates resetting higher. I’m old enough to remember when the “National Debt” was a big concern for far more people than it is today, and it’s a far bigger problem today than it was back then.

This gets solved through a combination of 3 things:

- Higher Taxes.

- Lower Government Spending.

- Inflation.

They are all major negatives for the economy and US stocks. I’d be wary of owning anything that has a reliance on the government as a major customer. I know that trying to time things like this are difficult, but I’m also reminded of 2008 when the bond market started flashing warning signs far before the stock market.

I don’t know what’s going to happen, but everything I see makes me think that Capital Preservation is the name of the game right now. I’ll continue to look for trading opportunities, but otherwise, I remain defensive.

Read the full article here