On the 30th of September, the financial year 2023 ended for the Department of Defense. As usual, the conclusion of the financial year also brought a last-minute surge in defense contract awards, many of which have also been covered by the Seeking Alpha news team.

In this report, I will be analyzing the financial year 2023 defense contracts. With over 1,200 contract awards year-to-date, there won’t be space to go into detail, but that is also not the aim. The aim is to provide a sense of the general thesis for investment in the aerospace industry is also reflected by the contract awards.

The Investment Case For The Aerospace Industry

The investment thesis for the aerospace industry is rather straightforward. On the commercial side, there is huge demand for airplanes, and with the current shortages of airplanes the pricing power remains with the OEMs. On the defense side of the business, the war in Ukraine and geopolitical tension with China are spurring demand for defense equipment. The advancing threats also require new weapon system capability such as hypersonics and hypersonic missile-defense and we are seeing more interest in drone solutions as well as electronic warfare. Especially in Europe, the defense spending has to be boosted, as that continent’s leaders for a long time have bet on a rather peaceful standing with Russia. This paid Europe an obvious peace dividend, but with the escalation on the eastern border of Europe, the continent now has to pay back that peace dividend.

In terms of military activity, this has been clear and from my home office in Sibiu, Romania, I can frequently see military airplanes including the Airbus A400M, the Black Hawks, Apaches and Chinooks making their rounds in the Romanian airspace and stopping by at the local airport, sometimes to refuel and sometimes to transport high-ranking politicians or military officers.

Investment In the Aerospace Industry Can Be Tricky

What should be kept in mind is that investing in the aerospace industry can be tricky. The companies are rather complex, and not all companies produce the capabilities that are in demand. Investing in a tracker could be beneficial to spread your investment and risk.

|

Name |

Ticker |

Weight |

Covered by The Aerospace Forum |

|

NORTHROP GRUMMAN CORP |

NOC |

4.5% |

✅ |

|

GENERAL DYNAMICS CORP |

GD |

4.4% |

✅ |

|

TEXTRON INC |

TXT |

4.4% |

✅ |

|

L3HARRIS TECHNOLOGIES INC |

LHX |

4.4% |

✅ |

|

BWX TECHNOLOGIES INC |

BWXT |

4.4% |

|

|

HEICO CORP |

HEI |

4.2% |

✅ |

|

WOODWARD INC |

WWD |

4.2% |

✅ |

|

CURTISS WRIGHT CORP |

CW |

4.2% |

✅ |

|

LOCKHEED MARTIN CORP |

LMT |

4.2% |

✅ |

|

HUNTINGTON INGALLS INDUSTRIE |

HII |

4.1% |

✅ |

|

HOWMET AEROSPACE INC |

HWM |

4.1% |

✅ |

|

TRANSDIGM GROUP INC |

TDG |

4.1% |

✅ |

|

HEXCEL CORP |

HXL |

4.0% |

✅ |

|

AXON ENTERPRISE INC |

AXON |

3.9% |

|

|

SPIRIT AEROSYSTEMS HOLD CL A |

SPR |

3.8% |

✅ |

|

BOEING CO/THE |

BA |

3.8% |

✅ |

|

RTX CORP |

RTX |

3.7% |

✅ |

|

MERCURY SYSTEMS INC |

MRCY |

3.3% |

✅ |

|

VIRGIN GALACTIC HOLDINGS INC |

SPCE |

3.3% |

|

|

ARCHER AVIATION INC A |

ACHR |

3.1% |

✅ |

|

ROCKET LAB USA INC |

RKLB |

3.1% |

✅ |

|

AEROVIRONMENT INC |

AVAV |

2.8% |

✅ |

|

MOOG INC CLASS A |

MOG.A |

2.8% |

✅ |

|

KRATOS DEFENSE + SECURITY |

KTOS |

2.2% |

✅ |

|

TRIUMPH GROUP INC |

TGI |

2.0% |

✅ |

|

AAR CORP |

AIR |

1.9% |

✅ |

|

LEONARDO DRS INC |

DRS |

1.5% |

✅ |

|

AERSALE CORP |

ASLE |

1.2% |

✅ |

|

DUCOMMUN INC |

DCO |

0.8% |

✅ |

|

V2X INC |

VVX |

0.6% |

✅ |

|

KAMAN CORP |

KAMN |

0.4% |

|

|

NATIONAL PRESTO INDS INC |

NPK |

0.3% |

|

|

STATE STREET INSTITUTIONAL LIQ |

– |

0.1% |

|

|

Total |

100.0% |

87.6% |

I looked at the holdings of the SPDR® S&P Aerospace & Defense ETF (NYSEARCA:XAR), and it provides a fairly diversified portfolio of aerospace names. Our investing group covers 87.6% of the exchange-traded fund’s (“ETFs”) exposure either by direct analysis in the form of investment reports or the companies, identified with a checkmark, are part of our data analytics processing the contract awards received.

Personally, I am not a huge fan of sector equity, as I believe that investors could be cherry-picking some names, but ETFs do offer value for those not knowing where to start and wanting to ride the wave of an entire sector. XAR offers a quarterly distribution, but at a yield of only 0.45%. Having a market conform appreciation over the past 10 years, I find it extremely difficult to build a buy thesis for the XAR ETF.

A Look At The FY2023 Defense Contract Activity

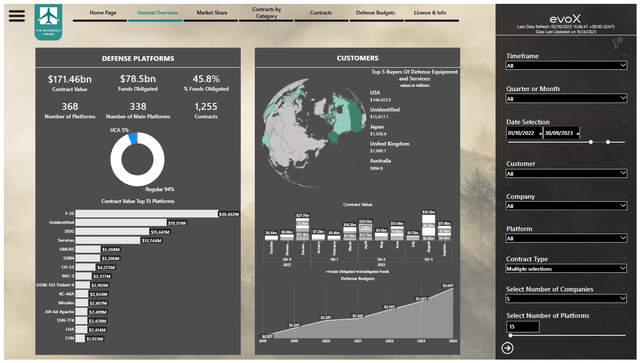

With the ETF not providing an extremely compelling investment opportunity, it is interesting to identify which parties are winning the contracts and build something around those names. For this, I will be using the evoX Defense Monitor, which includes budgets as well as defense contracts since 2018. The monitor includes nearly 10,000 contracts categorized by company, platform, customer, value and contracting type.

Before, I dive into the contracts I want to highlight. While we include contracts for over 120 companies and joint ventures, not all contracts will be included in our analysis. The reason for this is that some contracts are open for competition where multiple awardees will compete for a piece of the pie. There are also indefinite-delivery, indefinite-quantity contracts which are contracts against which the customer can place delivery and task orders. As neither the IDIQ-type contract nor the competition contract add value, we are omitting these from our analysis.

The Aerospace Forum

Overall, 1,255 defense contracts that match my criteria have been awarded with a total value of $171.5 billion and $78.5 billion. At a $2.5 trillion (in 2023-dollars) budget, the defense contract awards are rather small. There are various reasons for that, the first is that a significant portion of the budget is not allocated for contract awards. NATO, for instance, aims for its members to allocate 20% to be devoted to major equipment spending. So, ideally the spending on a $2.5 trillion budget would be $500 billion.

Furthermore, the budget also includes the adversaries of the U.S. and parts of the Western World, meaning that Western contractors cannot count on a piece of the pie of these budgets (Russia, China, and Iran are examples). Excluding these countries as well as India, which does business with the West but also aims to develop its own weapon system capabilities, we would get to a $2 trillion budget, giving space for $400 billion in defense spending according to the 20%-rule.

$171.5 billion covers a little over 40% of the $400 billion space, and that shows two things. The first is that there is additional space for defense equipment spending to grow, even when we add back roughly $55 billion in IDIQ awards covering 55% of what I would call the addressable markets. Furthermore, there are defense contract awards that happen without the intervention of the DoD. So part of the global budget spent on military equipment happens without the DoD, and part also does not reach the minimum threshold of $7 million, which necessitates an inclusion in the daily contract rewards as reported by the DoD.

The Aerospace Forum

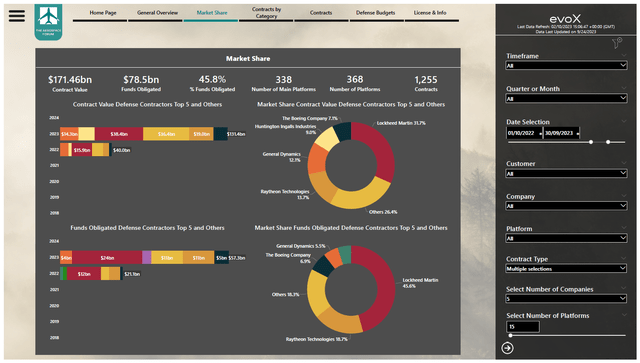

Unsurprisingly, the F-35 is the defense platform that can count of most of the budget, followed by the DDG or guided missile destroyers, the CH-53K helicopter and various missile and defense platforms. With the F-35 being the biggest platform spending-wise, it is no surprise that Lockheed Martin and Raytheon Technologies (RTX) are the top companies measures by contract value. Lockheed Martin took little over 30% of the value in its books followed distantly by Raytheon with 14% while General Dynamics with 9% and Boeing with 7% complete the top 5 with 26.4% going to other parties.

In terms of funds obligated, which are the funds that a company can bill against at contract award, Lockheed Martin took nearly half of the pie with 45.6% followed by Raytheon Technologies with 19%, Boeing with 7%, General Dynamics with 5.5% BAE Systems (OTCPK:BAESF) with 5%, and 18.3% going to others. If one would be interested in getting a quick list of the Top N (N=5 in this case), that would be interesting to explore.

The Aerospace Forum

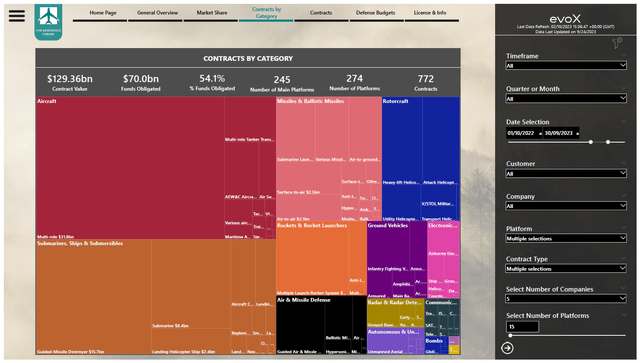

When looking at the categories (after filtering out the miscellaneous group), we see that aircraft, ships, submarines & submersibles as well as missiles and missile defense are the top dollar value categories followed by rockets & rocket launchers and ground vehicles. Interesting to note is that autonomous vehicles such as drones and hypersonics are receiving a lot of attention, but they provide a very small part of the funds deployment.

What Is Next For Defense Companies

|

FY2023 |

FY2022 |

Change |

|

|

Contracts |

1255 |

1152 |

9% |

|

Contract Value [$ billion] |

171.46 |

128.77 |

33% |

|

Funds obligated [$ billion] |

78.5 |

56.5 |

39% |

|

Defense Budget [$ trillion] |

2.47 |

2.39 |

3% |

Comparing the numbers to last year, we see 9% higher contract awards and 30 to 40 percent higher contract value and funds obligated on a defense budget increase by only 3%. When the war in Ukraine unfolded, the big question has been when this would start to incrementally add to the contract flow for defense contractors and the earliest indications have been that it would be at least a year to 18 months and that seems to be right.

We did see, for instance, Germany opting for the F-35, and an initial contract was awarded, but the contracts that we are seeing being awarded right now are mostly the already expected contracts plus defense equipment material purchases for which support has increased since the invasion of Ukraine. Particularly, Germany had been battling with some long overdue decisions that finally gained support and Switzerland also saw an opportunity to commit to the F-35, but the big renewal phase and structurally elevated defense budgets have yet to translate to defense contract awards.

All of this provides a somewhat positive backdrop for defense contractors. As the war on the Eastern part of Europe goes on, NATO members are increasingly more willing to stick to the 2% guideline for defense spending, and the continued tensions with China also drive defense spending in the region and the need for new weapon systems capability.

Conclusion: Defense Offers Opportunities

I believe that defense spending has upside for years to come. Before the invasion of Ukraine, it was unthinkable that a country such as, for instance, Romania would even seriously consider the expensive F-35, but the country now has asked permission to Parliament to procure 32 fighter jets. So, we see a lot of modernizing from countries close to areas of conflict. Also notable is that countries that previously did little to keep their military equipment up to date are now pushing to advance their capabilities.

For investment, however, I would not consider SPDR® S&P Aerospace & Defense ETF. It has merely shown a market performance result over the past decade, and XAR pays a mediocre dividend. Instead, I think investors are better off looking at which companies are currently getting the bigger piece of the pie and what the future defense weapon capabilities are desired, and build a portfolio around those individual and stronger names.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here