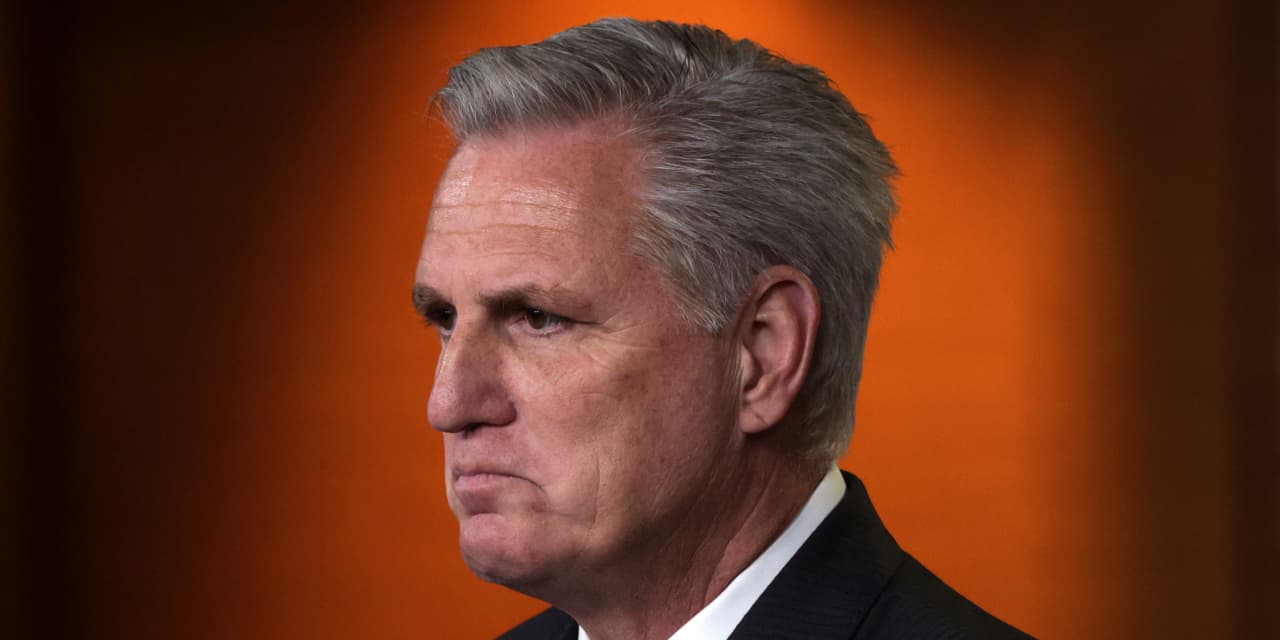

Kevin McCarthy is out as House Speaker—and the financial markets have a problem.

Usually, we like to think that what happens in Washington stays in Washington, at least when it comes to the stock market. Over time, the S&P 500 goes up, no matter who is in office. But what just happened in the House of Representatives is unprecedented. A House Speaker has never been ousted like this in the middle of a term, and it’s unlikely a new one will be selected quickly. That means the government has avoided a shutdown only to see something potentially worse to replace it.

Don’t think the markets haven’t noticed. Bonds sold off as the

10-year yield

climbed to nearly 4.8% at 5:38 p.m., while the

iShares 20+ Year Treasury Bond ETF

(TLT) fell 2.2% during market hours. The

S&P 500

dropped 1.4% and the

Dow Jones Industrial Average

declined 430.97 points, or 1.3%. It wasn’t all because of the craziness in Washington, but it also wasn’t not part of the reason for the selloff.

“If you are wondering why the bond markets are out of sorts the past few weeks, look no further than the dysfunction in Congress,” writes Jamie Cox, managing partner for Harris Financial Group.

McCarthy’s ouster might be unprecedented, but political chaos contributing to market volatility isn’t. Most market strategists tend to look at how the stock market has performed when Congress is united or divided. Rarely, though, do they look at what happens when there is a narrow majority in the House and Senate. Periods of “tight government,” as Evercore ISI strategist Julian Emanuel calls it, can be far trickier—and more volatile. Emanuel notes that there have been just eight periods where the Senate majority was determined by two seats or less and the House by 10 or fewer and the election year was particularly dramatic—each other eight saw double-digit moves, with three being positive and five being negative. “The message is clear: prepare for more volatility,” Emanuel wrote on Sept. 24, before the current shenanigans began. “Near term, confusion carries stocks’ Seasonal decline into Oct, to SPX 4,200.”

Emanuel, too, argues that the stock market is reacting to the Washington dysfunction. “The profound political uncertainty defined by ‘Tight Government’…[is] causing a lot of market volatility, much more than usual,” he writes. “In this regard, today’s news coupled with the yield surge has absolutely affected markets. Markets dislike uncertainty. There is more uncertainty today than there was yesterday.”

The House has fewer than 45 days before it will have to fund the government again, and there is no sign that Republicans will be able to coalesce around a single candidate for Speaker. Without one, the government will be shut down again, with zero chance of a stopgap bill being passed. It’s a worst-case scenario, but one that’s worth contemplating.

No, Washington won’t be the ultimate determinant of whether markets can recover from their recent swoon, but with the S&P 500 already sliding, the dysfunction comes at a painful time for investors.

Write to Ben Levisohn at [email protected]

Read the full article here