Icahn Enterprises (NASDAQ:IEP) was a vehicle that allowed you to invest along Carl Icahn, who through this vehicle holds a portfolio of public and private equities. We covered IEP in 2020, and back then the stocks were somewhat impaired by low oil prices and general economic pain around the shock of COVID-19. It had to be valued assuming normalized profitability. It does not seem the benchmarks we set in our last valuation ended up being reached, and even then the company was overvalued 20% comprehensive of generous assumptions. Even now with IEP, there is still a big premium to indicated NAV in current prices. Hindenburg’s report takes issue with the indicated NAV figure in addition to noting the premium – specifically around the meat packaging business that is publicly traded where IEP states a much higher value than the market – based on the notion that it trades thinly, which it really does (at a couple of thousand dollars a day in liquidity). We don’t have an issue with the indicated NAV figure, and as for all the other assertions about malice, we really don’t have an opinion, because as long-only value investors we don’t need to, and it’s enough to say that the general issue of lower PE valuations as well as the specific premium to NAV in IEP makes the valuation simply uncompelling at current prices.

Since dividends don’t create value in our view (we don’t want to ruffle feathers we’re just going with logic and Miller-Modigliani) we won’t comment on it, except for that the market price clearly must depend on more than just valuation and that must mean the dividend plays a role. As far as we’re concerned there’s no value case, and that should be sufficient reason to stay on the sidelines for long-only types.

Breakdown of IEP

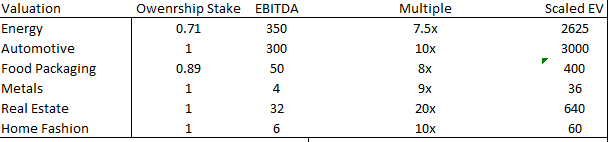

The following is our original look at IEP’s segments, where we tried to value the parts independently.

Old Segment Value Spread (VTS)

At the time of our article, energy was doing really poorly, including refineries, and we had to take a more normalized EBITDA figure for the energy business to even propose a valuation since that part of the markets was so damaged – CVR Partners (UAN) is public but the valuations for oil then were clearly unsustainably low so we didn’t use them. Otherwise, we used valuations endemic to a free-credit environment, which we believe has come to an end with regional bank woes and rate hikes – Private Equity thinks so too apparently since their activity has cratered.

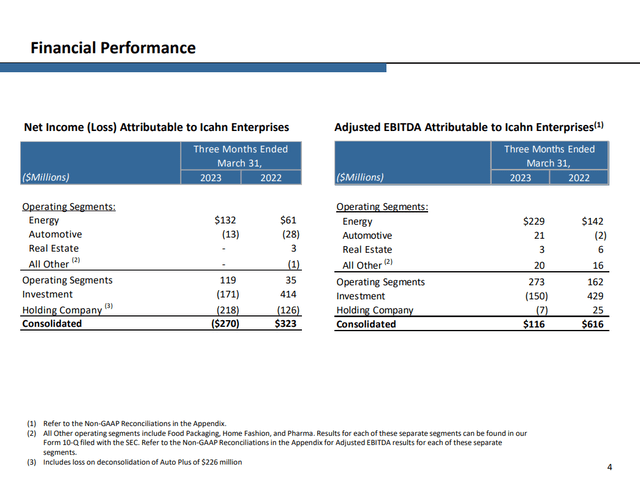

EBITDA is certainly ahead in energy now if you annualize the latest quarterly figures, almost 3x our proposed normalized levels, with the situation around the Ukraine war rocketing product spreads on fertilizers and various cracked products like gasoil/diesel.

Current Financials (March Quarter 2023)

The run-rate automotive figures are not as hoped though, where we used some comparable margins of aftermarket focused automotive players, and the food packaging business Viskase has not accomplished the theoretical EBITDA that we applied to it as of yet either. On balance, the outcomes are not that great, although they’re not really so behind the annual EBITDA figures we were predicting then for the investments – less than 20% or so off on a total basis.

The other assumptions we made at the time were for the impaired public equities portfolio focused on oil and cyclicals to double. That was funnily enough a reasonable assumption, since some of those stocks actually did double, but assumptions like that were necessary in order to get even close to the market value for IEP, where we still saw a 20% premium after being extraordinarily charitable.

It was clear that the valuation even then stood on the cash distribution, which is not sustainable on the basis of the business’ cash flows, but appeared to be on the assumption that Carl Icahn would continue to receive unit distributions, passively grow his control of IEP which he already controlled substantially, and allow for the residual distributions to retail unitholders to be done in cash.

This is at least how we interpreted things. Hindenburg makes further assertions which we don’t really have any views on, since we don’t care about these dimensions of the thesis as long-only investors, where the buy thresholds have already not been met by our reasonably strict standards.

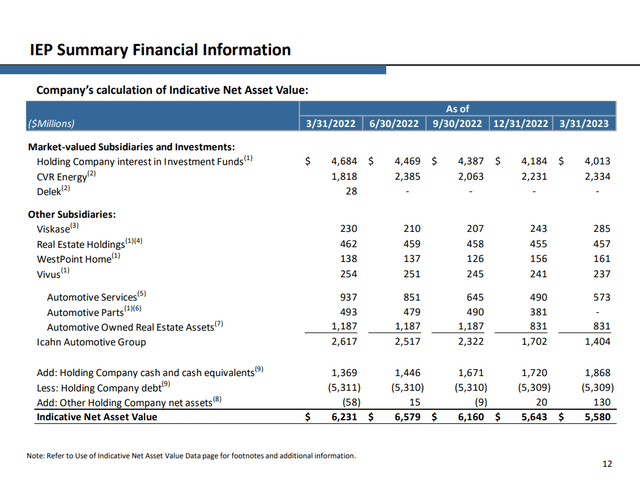

Current NAV (March Quarter 2023)

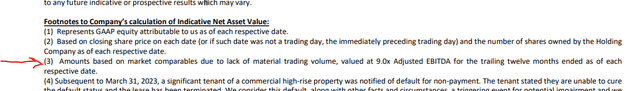

One of the things that Hindenburg mentions that we actually do not agree with is the assertion that Viskase’s proposed valuation is extraordinarily problematic, as IEP states a higher value than what its shares trade for on the OTC markets. It trades so thinly that valuing it like a private holding is fine by us, although it’s possible the applied multiple is too high given what has been going on this last year in PE markets. In all, we take at face value the IEP NAV, and simply say: there is a massive premium of ~100% that cannot be justified, especially when P/E multiples in general have to be coming down substantially, since those markets have really not been active at all at previous status quo multiples.

Why IEP values Viskase as in the NAV chart (March Quarter 2023)

Bottom Line

Our issue with IEP ultimately comes down to our position on dividends. Anyone with eyes can see the premium to NAV, so we believe the only reason to invest is the dividend. IEP raised its distribution in response to the Hindenburg attack, and say that they will come out with a detailed retort to the points of the short thesis. That’s nice if you care about income, but we don’t. Dividends just shift value of cash from the stock to cash sitting separately in your brokerage account. We aren’t moved by dividends in most cases, so we aren’t moved by the distributions here.

Intelligent investors should stay away from IEP not because of a corrosive short attack, where actually the volatility could be a gift for more risk-loving investors, but because there simply isn’t a margin of safety in a company whose NAV, already substantially below market, is based on an array of multiples, like 14x for automotive, that just cannot really be justified at all in the current environment. PE firms are so burned by over-allocating in 2021, and are likely going to be so much more careful going forward and require much lower multiples from sellers before we see any restoration in PE activity, that any multiple predicated on the free-liquidity environment before the rate hikes are just not reasonably tenable. Enough is said with the NAV, and let this be a moment to reflect on the importance of not just chasing yield.

Read the full article here