General Motors

and

Ford Motor,

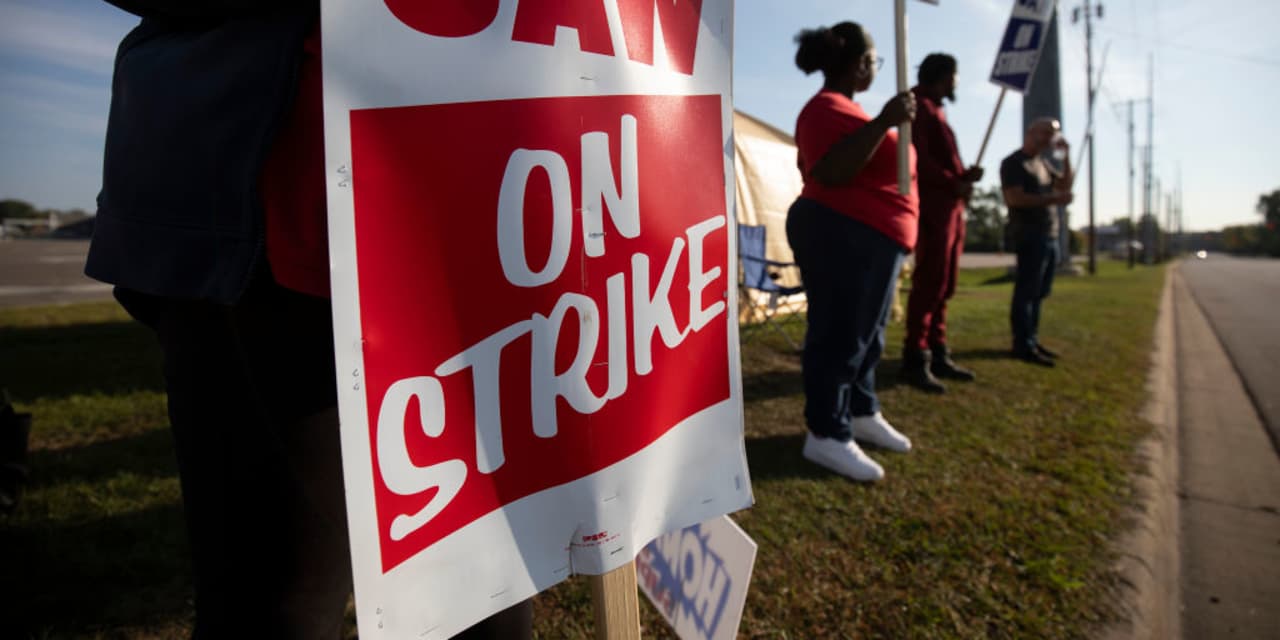

two of the three car makers targeted by United Auto Worker strikes, announced more furloughs for workers at plants that haven’t directly been affected by the action.

It’s another sign that the 2023 UAW strike is unique, and that it isn’t ending soon.

Ford (ticker: F) is laying off 330 workers at plants in Chicago Stamping and Lima, Ohio. GM’s layoffs hit 120 at its Parma, Ohio, metal center and 34 in Marion, Ind. The latest round of about 500 layoffs comes on top of the thousands of workers already on strike.

“These are not lock outs,” Ford said in an emailed statement. “These layoffs are a consequence of the strike at Chicago Assembly Plant, because these two facilities must reduce production of parts that would normally be shipped to Chicago Assembly Plant.”

The automotive-production system is interconnected. One plant going on strike eventually impacts another plant.

The total number of workers furloughed by Ford is up to about almost 1,000. About 8,000 Ford workers are on strike. Laid-off workers likely are eligible for the equivalent of $500 a week in strike pay from the union.

The strike is entering its 19th day and a deal between workers and management doesn’t seem imminent. On Monday, the UAW said it had submitted an offer to GM, but the company didn’t agree to it. The union opened a new round of talks with Chrysler-parent

Stellantis

(STLA).

Some 25,000 workers are on strike, less than 20% of the total UAW employees working at the Detroit-Three auto makers. Limiting the number of workers on strike limits the impact on the UAW strike fund. It also limits the financial damage on auto makers. Both things mean a strike can go longer than if all employees walked out at once.

Late on Sunday, the UAW reached an agreement with

Volvo Group’s

Mack Trucks that avoided another potential strike. That also preserves the UAW strike fund.

The UAW expanded the strikes on Friday to additional Ford and GM plants.

All three stocks traded slightly lower in the premarket on Tuesday, along with stock-market futures.

Since the start of July, when a strike looked likely to investors, GM and Ford shares are down about 16% and 18%, respectively, while the

S&P 500

is off about 4%.

Stellantis shares are up about 8%. Stellantis is a more global company, relatively less impacted by U.S. operations. It’s also a cheaper stock. Stellantis shares trade for about 3.4 times estimated 2024 earnings, while GM shares trade for 4.6 times, and Ford shares trade for 6.6 times.

Write to Brian Swint at [email protected] and Al Root at [email protected]

Read the full article here