The Company

Rush Enterprises, Inc. (NASDAQ:RUSHA) is a $3.3 billion market cap company that operates as a retailer of commercial vehicles and related services in the United States and Canada. They have a network of commercial vehicle dealerships known as Rush Truck Centers, where they primarily sell vehicles from manufacturers like Peterbilt, International, Hino, Ford, Isuzu, IC Bus, and Blue Bird. They have only 1 operating segment [the Truck Segment].

In addition to vehicle sales, Rush Enterprises offers services such as aftermarket parts, repairs, financing, leasing, and insurance for commercial vehicles. They also provide installation and repair services for vehicle equipment, modification services, and sell trailers and tires for commercial vehicles.

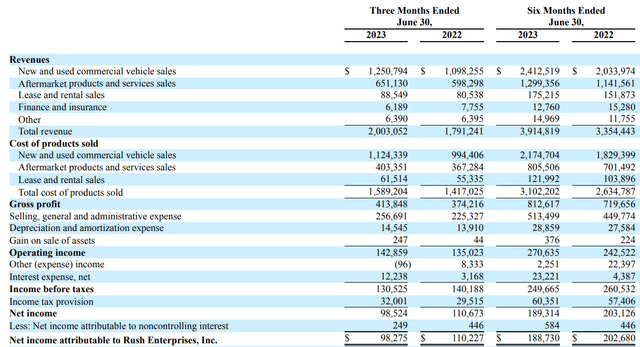

In Q2 FY2023, Rush reported strong financial performance, with $2 billion in revenues and a net income of $98.3 million ($1.75 per diluted share). They also declared a stock split and increased the dividend by 21.4%, according to Seeking Alpha Dividend Stocks News.

The growth in revenue volumes came from national accounts and pent-up demand for Class 8 and Class 4-7 trucks, the CEO noted during the earnings call.

RUSHA’s 10-Q

RUSHA’s focus on the aftermarket and operational excellence contributed to robust results: aftermarket revenues amounted to $651 million [+8.8% YoY], with a record absorption ratio of 139.7%. While over-the-road customers faced challenges, the company’s diverse customer base helped them outperform the industry. They now expect moderate aftermarket growth for the rest of the year.

In truck sales, they sold 4,300 Class 8 trucks and anticipate continued strength due to demand and emissions regulations. Class 4-7 new truck sales increased by 25%. Used truck sales also went up, but pricing remained low, expected to stabilize.

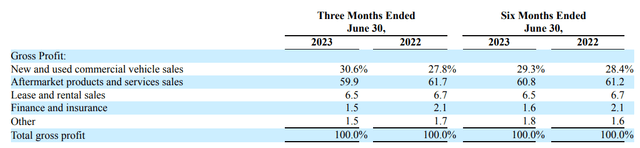

During the earnings call, Jamie Cook from Credit Suisse noted the exceptional margins in new and used truck sales, specifically highlighting the historically high margin of the firm in Q2 FY2023. He inquired about the backlog of trucks at this margin level and how normalized margins would evolve over the next 12 to 18 months. Marvin Rush [the CEO] attributed the strong margins to effective inventory management and a rebound in used truck margins, acknowledging the potential for a slight decline in margins but not foreseeing any substantial drops, citing ongoing demand and the expected expenditure on infrastructure projects that would drive truck purchases in various sectors (even as some segments, like over-the-road carriers, continue to face challenges).

RUSHA’s 10-Q

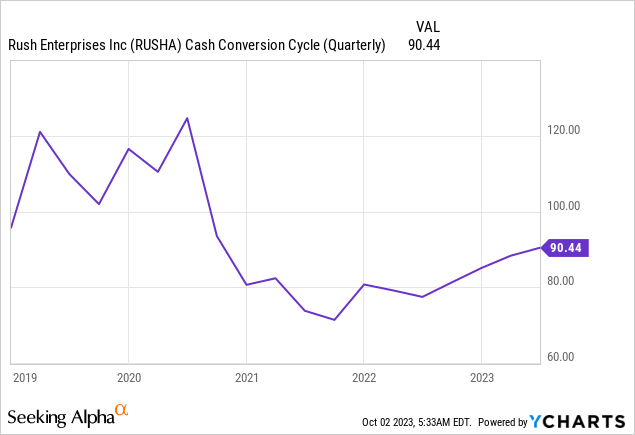

Despite the aforementioned improvements in inventory management, the cash conversion cycle continued to increase in the second quarter:

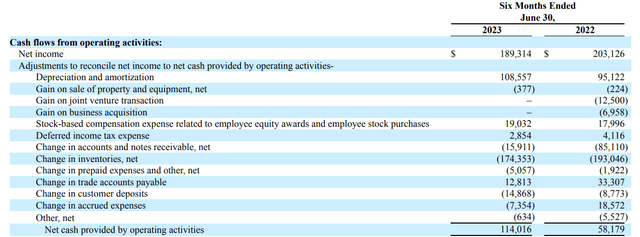

However, cash flow itself looked impressive for H1 FY2023: Receivables on the balance sheet did not increase as much as last year, as cash flow from operating activities increased by 96% year-over-year:

RUSHA’s 10-Q

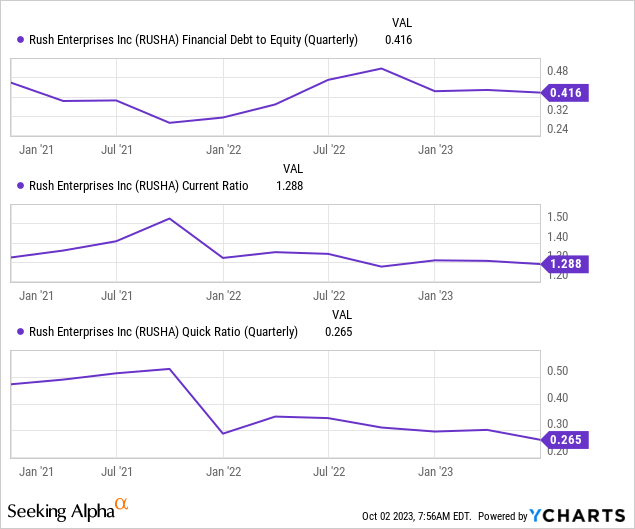

As for the company’s liquidity, I don’t see any red flags here: As of June, RUSHA had approximately $467.0 million in working capital, of which $191.9 million was in cash, available to fund operations. The financial leverage keeps falling, and the current ratio stays above 1, which is also good:

According to the latest 10-Q, RUSHA anticipates selling between 16,500 to 18,000 new Class 8 trucks in the U.S., indicating a 5.2% increase from the previous year. In addition, around 750 new Class 8 trucks are expected to be sold in Canada. For Class 4 through 7 commercial vehicles in the U.S., they project sales of ~12,250 units [mid-range], reflecting a 6.2% increase compared to FY2022, with an additional 250 units expected to be sold in Canada. The company also foresees growth in lease and rental revenue, driven by strong demand for leased commercial vehicles and the consolidation of RTC Canada into their financial results.

During the call, the CEO mentioned that while the freight sector had experienced a downturn due to high inventory levels and supply chain challenges in 2022, he believed the overall economic situation was still relatively strong in many areas. He noted that the recession in freight didn’t necessarily reflect the broader economy.

If this prediction does come true, then RUSHA looks like a very stable company with a growing margin and market share. But how attractive is RUSHA stock after the company’s market capitalization has increased nearly 40% over the past year?

The Valuation & Expectations

As of June 30, 2023, the company had repurchased $71.4 million of its shares of common stock under the current stock repurchase program (of $150 million), spending ~$63.9 million in 1H FY2023, according to the 10-Q. The dividend distribution amounted to ~$23.4 million for the half year, so on a TTM basis the total shareholders’ yield is at ~4.6%, based on my calculations. And it doesn’t look bad, actually.

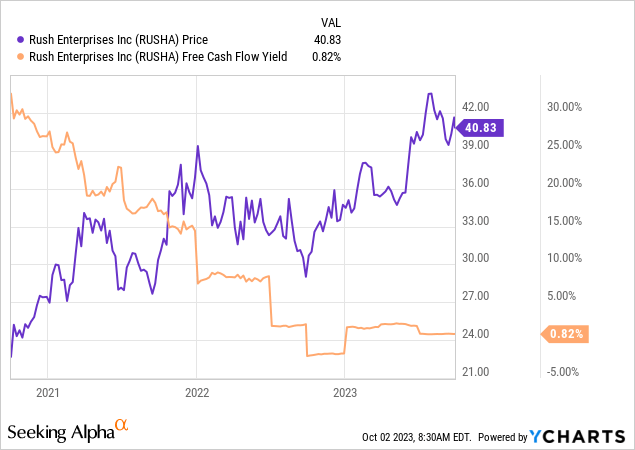

However, due to high CAPEX costs and despite the CFO’s growth, RUSHA’s FCF yield is below 1% and has steadily declined for the past few years:

As we can see from the trading history of RUSHA stock, the FCF yield does not really drive the stock’s valuation – I do not see a classic cyclical dependence of the company’s capitalization on this specific metric.

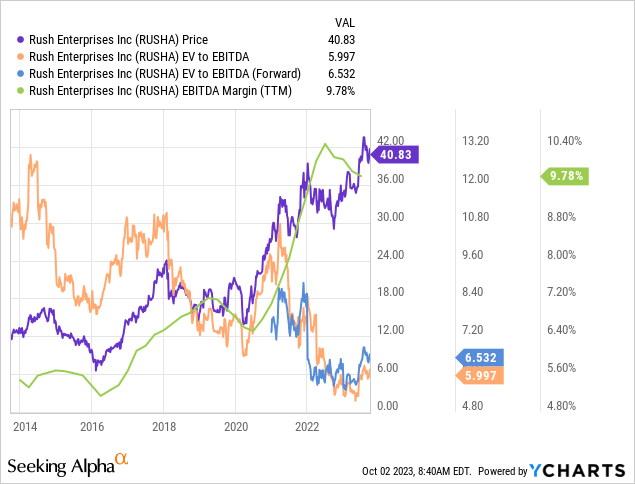

What definitely shows some dependency is the behavior of the EV/EBITDA ratio and the stock – in the perspective of the last 10 years, we have seen that the stock fell as a result of the deterioration of margins, and the EV/EBITDA ratio did not grow but only fell. However, in 2023, this relationship has been broken: The company has achieved a historically high EBITDA margin, while the debt load seems reasonable, but for some reason, EV/EBITDA [both TTM and FWD] are in no hurry to expand.

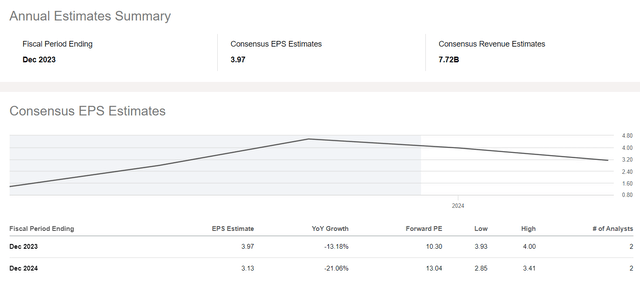

Apparently, the market assumes that the current margins are only a temporary effect – hence the discount. EPS forecasts confirm my suspicions – analysts appear to believe that RUSHA’s current margins have peaked and will continue to decline.

Seeking Alpha, RUSHA

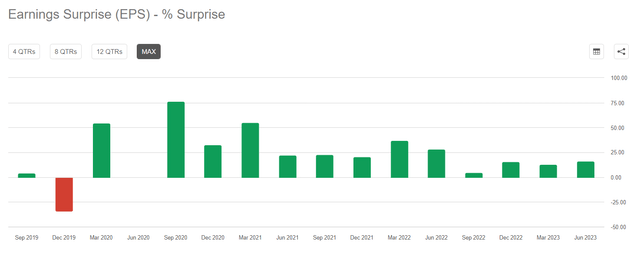

This is slightly at odds with the optimism expressed by management in the last earnings call, as far as I can tell. It is worth noting that the company has managed to easily beat consensus expectations in recent years, so I have more faith in management than Wall Street this time as well.

Seeking Alpha data

Assuming RUSHA beats EPS estimates by 5% in FY2023, which is quite realistic in my view given historical trends, RUSHA’s price target should be $50 at a P/E of 12x, which is below the average of the last 10 years. This is 23.1% higher than the current market price.

The Bottom Line

As always, any bull thesis carries risks, and mine is no exception. Investing in RUSHA stock involves risks related to its industry’s cyclicality, economic sensitivity, and specific challenges. The company relies on manufacturers for its vehicles, faces competition, and is vulnerable to supply chain disruptions. Regulatory shifts, interest rate changes, and market concentration in certain regions can affect its financial performance. The evolving landscape of technologies like electric and autonomous vehicles introduces further uncertainties. Investors should thoroughly evaluate these risks, taking into account their risk tolerance and investment timeline, when considering RUSHA stock.

However, looking at RUSHA’s results for the first half of 2023 and comparing them to last year, the company seems to be doing quite well financially. The market has taken a discount to RUSHA’s valuation, which may disappear or become smaller once the company resumes reporting EPS growth above consensus, as it has done many times before. This is exactly what I am counting on, considering the company is undervalued and giving it a medium-term upside potential of 23.1%.

Thanks for reading!

Read the full article here