ETF Snapshot

The Vanguard Dividend Appreciation ETF (NYSEARCA:VIG) is a 17-year-old passively managed ETF, with $66bn in AUM, that focuses primarily on large-cap US stocks that have grown their dividends annually for at least 10 straight years. Once the initial screening mechanism is done, the top 25% of these names, by annual dividend yield, are excluded from consideration. This helps reduce exposure to high yielders, which could be suffering from weak price effects. Do consider that even though VIG primarily focuses on large-caps, its stocks are not sourced purely from the S&P 500, but the S&P United States BMI, which considers all US-domiciled companies. As things stand, VIG currently offers coverage to 318 of these dividend growers.

Standout Characteristics of VIG Relative To Its Biggest Peer – NOBL

Prima facie, as a structure, there’s quite a bit to like about VIG. Being a passively managed vehicle, costs are very competitive, with an expense ratio of just 0.06%, making it one of the cheapest ETF vehicles around. There’s also an inherent stability to this fund, as exemplified by a lowly annual portfolio turnover ratio of just 12%. In contrast, the median turnover ratio for the average ETF is over 30%.

A stable portfolio would be music to the ears of the classic buy-and-hold investor who’s looking to ride various cycles, but it’s also rather curious to note that VIG hasn’t resorted to a lot of change, as a 10-year track record of dividend growth is something that shouldn’t be unattainable for the average large-cap, and VIG is bound to have a lot of choice to play around with its portfolio. Whereas, if one looks at the next biggest ETF offering from the dividend growers universe – The S&P 500 Dividend Aristocrats ETF (NOBL), which levies more stringent requirements of dividend growth for a much longer period (at least 25 years), one wouldn’t be too surprised to discover if this product was less inclined to churn its holdings every year, given a relatively limited pool of stocks that could keep up such a long track record.

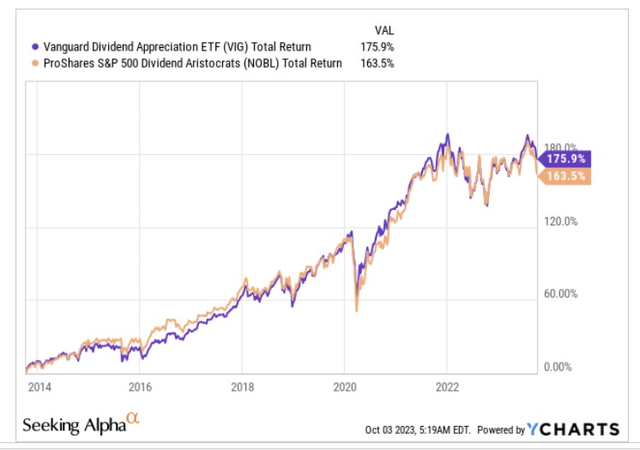

So, does having a longer track record of growing dividends really help attract money and generate ample capital appreciation? Not quite. As illustrated in the image below, since NOBL’s inception (NOBL came to the bourses seven years after VIG) it has underperformed VIG by around 12%.

YCharts

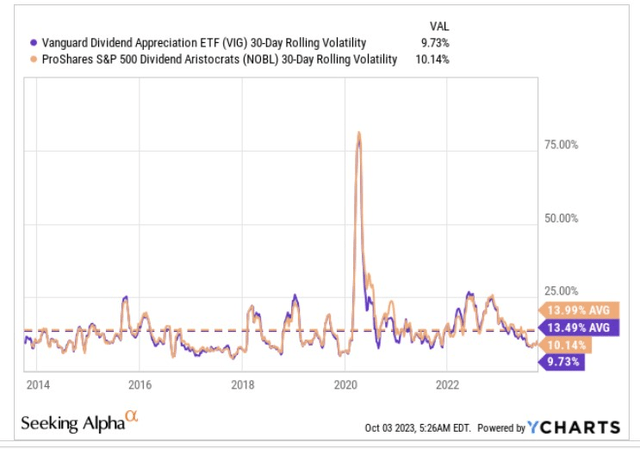

Even from a risk angle, VIG appears to be a safer pick as its volatility profile across time has been lower than NOBL’s portfolio, and this could prove to be a handy facet when risk sentiment in the market turns.

YCharts

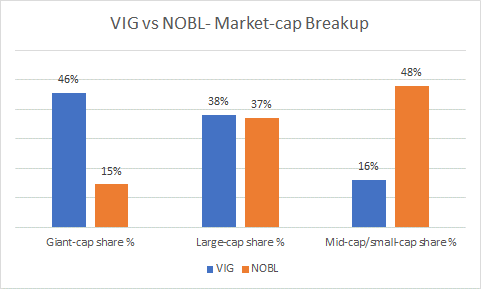

The relatively lower risk profile can perhaps be attributed towards VIG’s greater predilection towards the more stable giant and large-cap dividend growers (84% of total holdings), whereas NOBL’s exposure towards the more volatile mid and small-cap segment is 3x more than VIG. NOBL is also much narrower in scope, focusing on only 68 stocks, or 20% of VIG’s entire universe

Morningstar

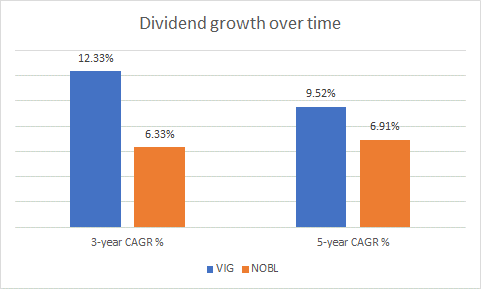

Given that these portfolios focus on dividend growers, it would only be appropriate for them to showcase a decent degree of distribution growth to ETF owners over time. Well, in that regard, it’s fair to say that VIG once again comes across as the more reliable bet, having grown its dividends at larger CAGRs, both on a 3-year and 5-basis.

Seeking Alpha

Also consider that NOBL is not particularly cost competitive, with an expense ratio that is almost 6x that of VIG’s figure.

Closing Thoughts – Is VIG ETF A Good Buy Now?

If you like VIG’s characteristics and are contemplating a long position in this product at this juncture, here are a few encouraging, and not-so-encouraging facets that may abet your decision.

Firstly, note that from a valuation angle, there doesn’t appear to be a sizeable differential between what the broader market is priced at and what the dividend growers are priced at, so there isn’t much to exploit here. Morningstar data shows that VTI is currently priced at 19.5x, whereas VIG is not too far behind at 18.8x P/E. Also note that holdings from the total stock market are on course to deliver long-earnings growth of 12% in the future, over 200bps better off than what VIG’s holdings could deliver. What’s also key is that VIG’s forward earnings growth of high-single-digits will likely be less than what it has seen historically (12.3%).

The decline in the cadence of earnings growth should have some negative effects on the pace of dividend growth of VIG’s holdings going forward, although it must also be reiterated that dividends aren’t a function of earnings alone; various other variables such as the degree of financial leverage employed, the M&A pipeline and the prevailing acquisition multiples, the FCF generating ability of a firm, etc. will all come into play in determining a company’s capital allocation preference and the ability to grow its dividends at a certain pace.

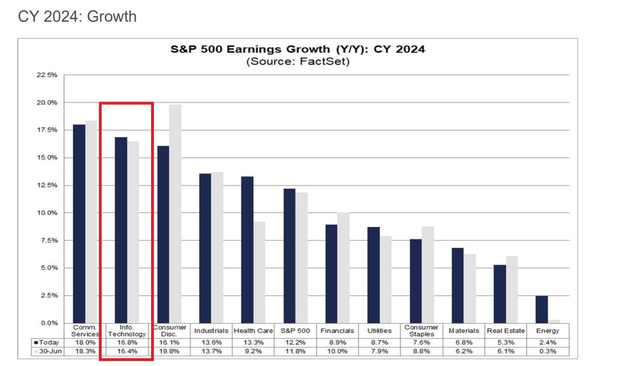

Nonetheless, for what it’s worth, investors can take heart from the fact that the top dividend growers – tech stocks (this sector accounts for the largest share of VIG’s portfolio at 23%) are looking at fairly resilient earnings growth next year (~17% annual growth), with only communication service stocks offering a better earnings runway.

FactSet

Whilst all that is very well, questions could certainly be asked if the tech trade looks a bit overbought right now. The chart below juxtaposes the current position of tech stocks versus the broader markets, and we can see how this is currently not only a long way off the mid-point of the zone, it is also not far from hitting record highs.

StockCharts

Before concluding, let’s also review VIG’s standalone price imprints.

Investing

Firstly consider that we have something akin to an ascending triangle pattern, and things were looking rather promising as the price was moving up and bouncing off the upwardly-sloped trendline. Unfortunately, a couple of weeks back, the trendline failed to hold with the price breaking down, reiterating the bearish undertones that are currently present

Then, also note that for over 20 months, VIG has chopped around within a certain range of $136-$172 (highlighted in blue). Considering the boundaries of this range, a long entry at the current price point ($155) wouldn’t be too optimal (reward to risk of less than 1x) as it is a long way off the lower end of the range.

To conclude, we don’t think VIG would represent a good BUY at current levels.

Read the full article here