Soft landing? Not so fast. The triple threat of rising interest rates, oil prices, and the US dollar is the result of the ubiquitous “higher for longer” theme, which was generally the culprit for the stock market’s decline over the past two months.

Oh, and a government shutdown tossed in the mix makes the macro scene all the trickier.

Higher Treasury yields and a stronger greenback both make sense in this environment of a more hawkish Fed, but many traders can’t quite understand the relationship between tighter monetary policy and a bull run in raw materials.

As for steel prices, they are coiling around the unchanged mark for 2023 after rolling in an early-year hot streak.

Brushing Up on Market Correlations

Taking a step back helps grasp the big picture. During inflationary scares, such as right now, bond prices and commodities usually feature a steeply negative correlation.

We saw it in the 1970s and mid-2000s, and it’s happening again. That’s not to say we cannot have significant pullbacks in areas like energy and agricultural commodities, but investors may want to assess what firms in the Energy and Materials sectors are doing.

Monitoring and scrutinizing what management teams at the industry level are saying can offer clues on these fast-moving and sharp macro trends.

Important Tells from Steel Companies

Our team spotted two key events that tell different stories. Which will play out? Let’s see what we can discern from a pair of September preliminary earnings guidance announcements.

The Bad News

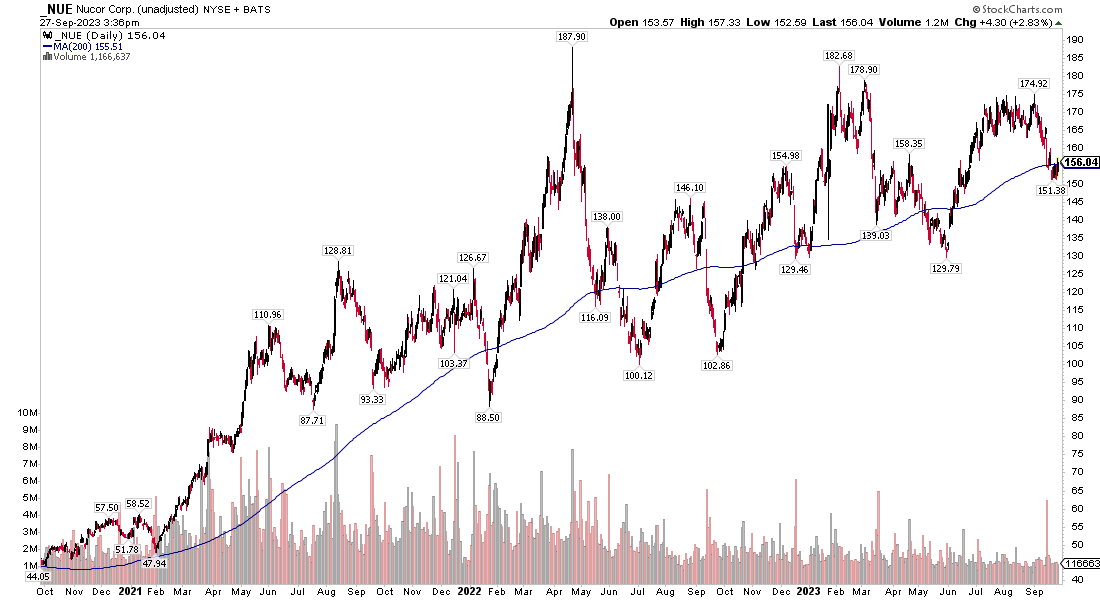

Nucor Corp. (NUE) startled the street after hours on Thursday, September 14. The Materials sector company issued a downbeat Q3 earnings outlook. A new EPS guidance range of $4.10 to $4.20 was served up, below Wall Street’s consensus which had stood north of $4.50. Its year-ago earnings were $6.50.

Driving the bearish projection was weakness in its steel mills segment compared to a quarter earlier. The firm experienced pricing pressure in its steel products segment as well as weaker volumes in its raw materials segment.

Keep your eye on the S&P 500-listed firm’s full Q3 report confirmed for Tuesday, October 24 BMO, and be sure to tune into its conference call later that morning for the latest read on steel demand – a macro bellwether that could buttress spooky dividend trends.

In terms of price action, there was a major volume spike in the session following the preliminary (which also occurred right before options expiration).

The stock wavered in the days after the preliminary report but didn’t fall much further into the end of the month. With a broader uptrend still generally in place, one could argue that this may just be a hiccup in a more bullish cycle.

Nucor: Rising Long-Term Trend Tested Following a Bearish Guidance Update

Source: Stockcharts.com

The Good News

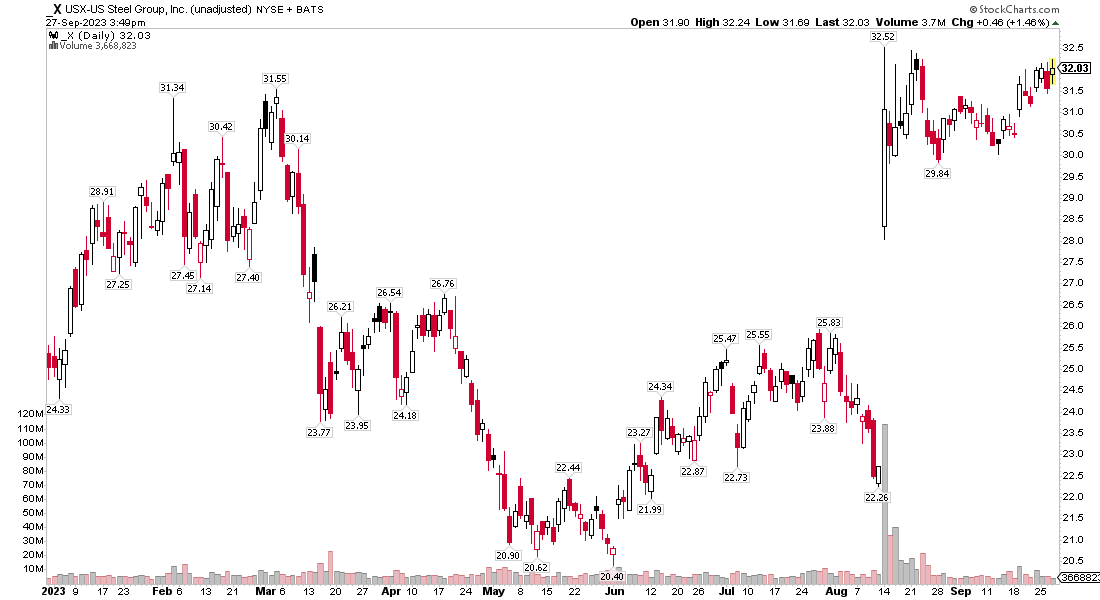

Just days after the sour steel sentiment from Nucor, a company in a storm of takeover speculation offered up a sanguine story.

US Steel (X), potentially to be acquired by rival Cleveland-Cliffs (CLF), perhaps wanted to underscore the value of its operations and equity while it’s in the spotlight.

Late last week, it was reported that CLF signed an NDA and standstill agreement in its effort to acquire X.

On the evening of Monday, September 18, the American steelmaker guided its Q3 adjusted earnings to the range of $1.10 to $1.15, significantly above the $0.97 consensus but, like NUE, much weaker compared to the same quarter a year ago.

In the press release, the Pittsburgh-based $7 billion market cap company stated that all of its operating segments outperformed previous estimates in the third quarter and contributed to robust EBITDA.

The UAW Strike Has Material Downstream Impacts

It wasn’t a glowing update all around, however. Amid ongoing labor disputes between the United Auto Workers union and the major American car manufacturers, X announced that it expects to temporarily idle a blast furnace at its Granite City Works site in Illinois.

Counter to Nucor, US Steel cited strong average selling prices, which could help margins in its upcoming Q3 earnings report due out on Thursday, October 26 (unconfirmed); X’s mettle will indeed be tested.

Following the M&A-related gap higher on August 14, shares consolidated but have recently drifted higher. The cash-plus-stock deal of course impacts the market price for X shares.

US Steel: Strong Q3 Results Reported Following CLF’s Acquisition Announcement

Source: Stockcharts.com

The Bottom Line

Resource-related industries are seeing high volatility as earnings season approaches. A rising dollar is often bearish for commodity prices, but Nucor and US Steel have differing messages to offer investors.

Expect key insights to be reported later this month on the labor situation as well as how demand is shaping up as the broader economy may be headed for a Q4 slowdown.

Original Post

Read the full article here