Key Takeaways

- The U.S. government agreed an eleventh-hour deal on Saturday night, avoiding a government shutdown over the federal budget

- Hundreds of federal departments were set to shut down, costing the economy’s growth and impacting livelihoods

- The trouble is set to rise again in November, as the bill was only a stopgap measure

On Saturday night, the U.S. government stunned the world by agreeing to a bill that narrowly avoided a government shutdown. Of course, it’s only a stopgap measure until November – but when the bar is this low on Republicans and Democrats working together to get vital measures passed so the economy doesn’t tank, we’ll take what we can get.

After suffering a poor September, the stock market had a mixed reaction to the news – likely recognizing the worst isn’t over yet and a few headwinds on the horizon for the U.S. economy. Bond yields, however, are on the rise again.

Here’s everything you need to know about the government shutdown that thankfully wasn’t meant to be in the end but very much might still happen in a few weeks’ time (sigh).

What’s the last-minute deal that avoided a shutdown?

Late on Saturday evening, when there was literally no time left to avoid a government shutdown, President Biden signed a stopgap bill funding the government budget through the middle of November.

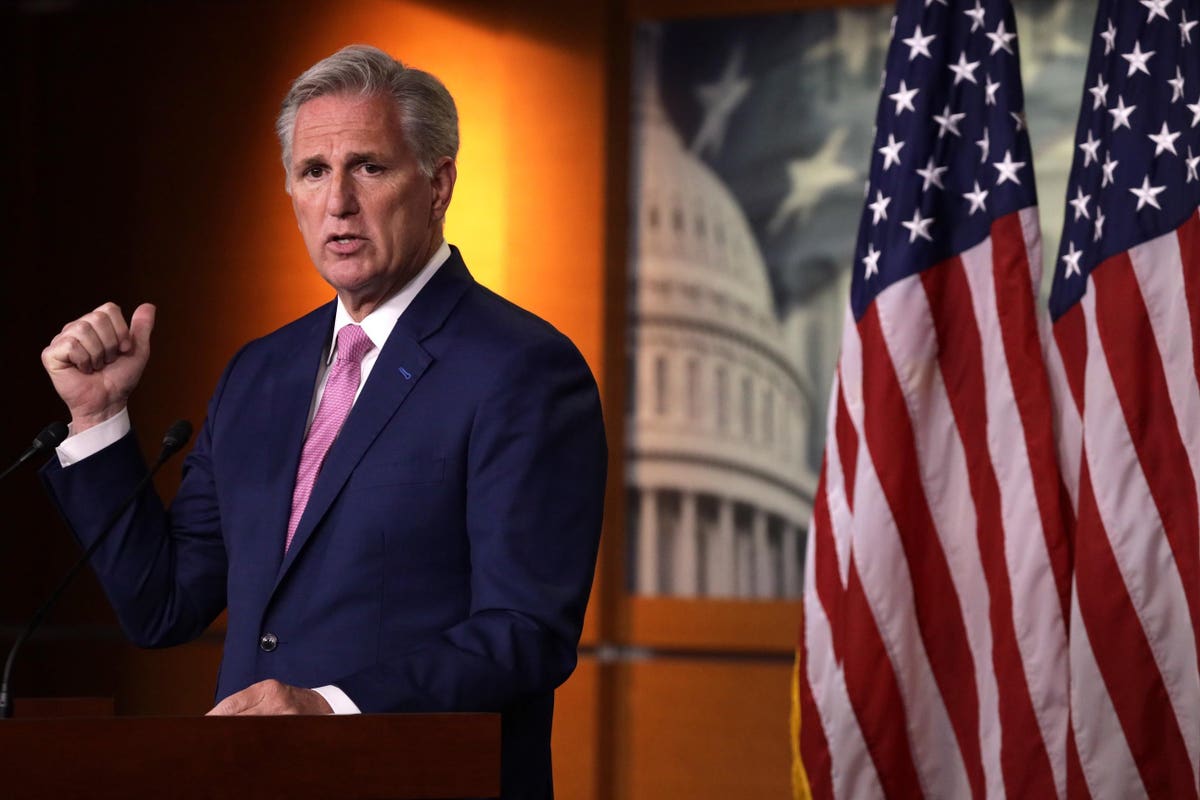

The stopgap bill kept most spending at the same levels as the previous year, though no funding was mentioned to support Ukraine in its defense against Russia’s invasion, which is a blow to the Democrats. The Republicans don’t consider it a win, either: some hardliners in the party are calling for Speaker McCarthy’s resignation after he submitted the bill without their blessing.

Had the shutdown gone ahead, hundreds of federal government agencies would have had to close down and millions of federal employees would have been left without pay. A shutdown is triggered when Congress can’t agree on the 30% of federal spending they must approve by October 1, the start of the fiscal year.

POTUS made his feelings clear in an X post: “Tonight, Congress voted to keep the government open, preventing an unnecessary crisis that would have inflicted needless pain on millions of hardworking Americans. This is good news, but I want to be clear: we should never have been in this position in the first place.”

The government avoided a shutdown by the skin of its teeth, but the can has merely been kicked down the road until November 17. Before then, Congress needs to pass 12 more bills that fund different branches of the federal government. That will be interesting to watch, given we’ve already endured a debt-ceiling crisis this year and these latest shenanigans.

What was happening in the run-up to the shutdown?

Heading into the weekend, the prediction was that there was a 90% chance of a government shutdown, and Goldman Sachs had estimated it would have lasted around three weeks had a last-minute deal not been arranged. Goldman also estimated the economic cost would have been heavy, with 0.2 percentage points knocked off of the U.S. GDP every week the shutdown went on.

Consumer sentiment in September fell from the month before, partly due to the looming government shutdown and worries over the auto workers’ strike. According to the University of Michigan survey’s data, sentiment dropped to 68.1 in September from 69.5 in August.

There was also rising concern a government shutdown would slow an already flagging property market. That’s because the National Flood Insurance Program (NFIP) was set to expire on Saturday, with any home sales requiring flood insurance facing potential delays.

From an investment perspective, the Securities and Exchange Commission (SEC) wouldn’t have gone untouched by the chaos. Out of the 4,600 employees working at the SEC, only 437 would be working to keep necessary operations running – which would have put new rules and regulations development on hold.

How has the stock market held up?

Treasury yields resumed their march upwards to reach the highest levels in over a decade as the threat of higher interest rates loomed over the markets. The ten-year Treasury note rose to 4.7%, nearing the steepest gains since August 2007, while the 30-year note rate climbed to 4.81%, a high not seen since April 2010.

As for stocks, the short-term jubilance over avoiding a government shutdown was overshadowed by the threat of higher interest rates. All three of the major markets had struggled in September, with the Dow Jones losing 2.6%, the S&P 500 falling by 3.65% and the Nasdaq dropping by 4.1%. It’s the second month in a row the major indexes marked monthly losses.

Stocks started the week off mixed, with the Dow Jones falling 0.4% on Monday, the S&P 500 fluctuating between losses and gains, and the Nasdaq climbing by 0.4%. The indexes continued to edge lower on Tuesday as bond yields rose.

What’s the impact on the U.S. economy?

This pending government shutdown felt heavier than others (there have been three in the last decade). With hundreds of thousands of auto workers mobilized and ready to go for a national strike, student loan payments resuming, oil prices rising again, and a frozen property market, adding a government shutdown into the mix may have tipped the economy into a recession.

Not that we’d even know for a little while – the federal government is responsible for all of the facts and figures we get about jobs, inflation and economic growth so we can work out how the economy is performing. At least the Fed will have something to work with when they meet in November to decide future monetary policy.

But there’s a long-term issue: the credit ratings agencies. In August, ratings agency Fitch downgraded U.S. debt from the highest level to AA+. Fitch cited a perceived deterioration in governance in the U.S. had led to the decision. The move was denounced by the White House, with Treasury Secretary Janet Yellen calling the move “arbitrary and based on outdated data”.

It’s the second credit rating agency to do so since 2011, after Standard & Poor made the same decision when the Obama administration was at loggerheads with Republicans over the federal budget.

The impact? The political brinkmanship and holding the U.S. economy hostage is considered a problem. This latest development in the budget drama is unlikely to sway the credit agencies’ views.

The bottom line

The unfortunate reality is that while the government avoided a shutdown in the nick of time, we will see the same story played out as we approach November 17. Until the Democrats and Republicans can better align their spending priorities, we don’t see President Biden and Speaker McCarthy having any fun times ahead of them.

All of the uncertainty means it’s more worry for those who wouldn’t get paid during a potential shutdown and a weight on the stock market – not to mention the ratings agencies tearing their hair out at how the world’s largest economy chooses to behave. As McCarthy said, “There has to be an adult in the room.”

Read the full article here