A Quick Take On Lexeo Therapeutics, Inc.

Lexeo Therapeutics, Inc. (LXEO) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The clinical-stage biopharma is developing treatments for various cardiovascular and Alzheimer’s conditions.

When we learn more about management’s pricing and valuation assumptions, I’ll provide a final opinion.

Lexeo Overview

New York, NY-based Lexeo Therapeutics, Inc. was founded to develop drug treatment candidates for various cardiovascular and neurological diseases.

Management is headed by Chief Executive Officer R. Nolan Townsend, who has been with the firm since 2020 and was previously at Pfizer where he was President of Pfizer Rare Disease for the North America region.

The firm’s lead candidate, LX2006, is currently in Phase 1/2 clinical trials for the treatment of Friedreich’s ataxia.

The company expects to report interim data from the LX2006 trial in mid-2024.

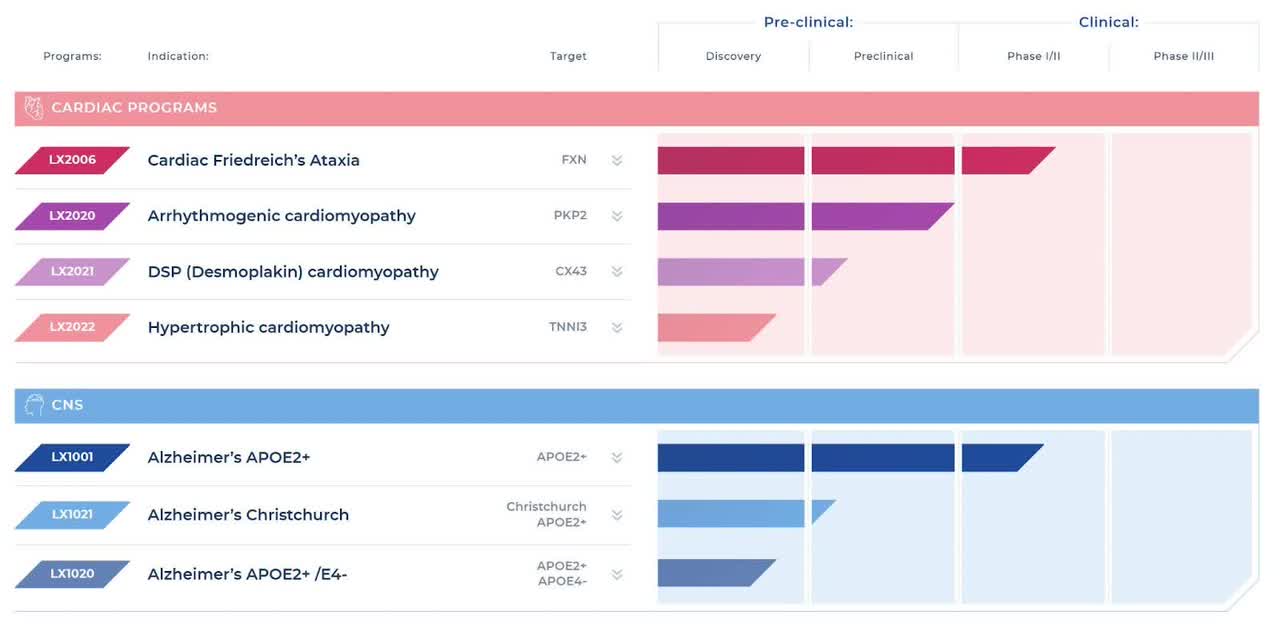

Below is the current status of the company’s drug development pipeline:

Company Pipeline (Lexeo Website)

Lexeo has booked a fair market value investment of $189 million as of June 30, 2023, from investors, including D1, PBM LEX Holdings, Janus Henderson, Longitude Venture Partners, Lundbeckfond Invest, Eventide Healthcare & Life Sciences Fund, Omega Fund and Ronald G. Crystal, MD and affiliates.

Lexeo’s Market & Competition

According to a 2022 market research report by Coherent Market Insights, the worldwide market for treatments for Friedreich’s ataxia is estimated at $777 million in 2022 and is forecast to reach $2.06 billion in 2030.

This represents an expected CAGR (Compound Annual Growth Rate) of CAGR of 13.0% from 2022 to 2030.

Key elements driving this expected growth are the continued development of approved treatment options along with inorganic business collaborations and acquisitions.

Also, by region, North America is expected to hold the largest demand for treatments during the forecast period through 2030.

The company is pursuing drug treatment testing for other multi-billion dollar size markets.

Major competitive vendors that provide or are developing related treatments include:

-

Sanofi.

-

RegenexBio.

-

Sigilon Therapeutics.

-

Sangamo Therapeutics.

-

Reata Pharmaceuticals.

-

Minoryx Therapeutics.

-

Larimar Therapeutics.

-

Cyclerion Therapeutics.

-

Abliva.

-

Amylyx.

-

Eledon Pharmaceuticals.

-

Biogen.

-

Eli Lilly.

-

Others.

The company is developing treatments for other cardiovascular conditions and for Alzheimer’s Disease.

Lexeo Therapeutics, Inc. Financial Status

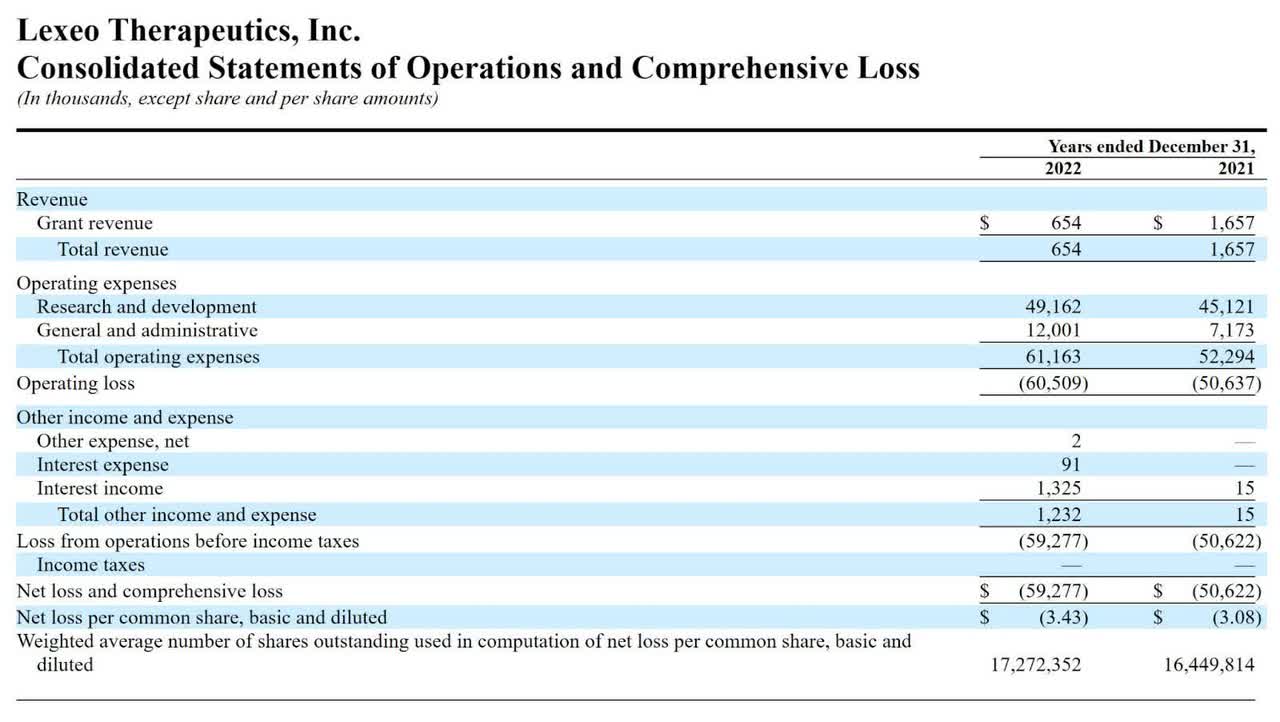

The firm’s recent financial results are typical of a development-stage biopharma in that they feature minimal revenue and material R&D and G&A expenses associated with its pipeline program activities.

Below are the company’s financial results for the past two calendar years:

Statement Of Operations (SEC)

As of June 30, 2023, the company had $45.5 million in cash and $23.5 million in total liabilities.

Lexeo Therapeutics, Inc. IPO Details

Lexeo intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

to fund our ongoing and planned clinical development of LX2006 for the treatment of FA cardiomyopathy.

to fund our ongoing and planned clinical development of LX2020 for the treatment of PKP2-ACM.

to fund our ongoing and planned clinical development of LX1001 for the treatment of Alzheimer’s disease in APOE4 homozygous patients.

to fund the continued development of our other programs and cardiac discovery efforts.

the remainder for working capital and other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not currently subject to any material legal actions.

Listed book runners of the IPO are J.P. Morgan, Leerink Partners, Stifel, RBC Capital Markets, and Chardan.

Commentary About Lexeo’s IPO

LXEO is seeking public capital market investment to advance its pipeline of treatments for cardiovascular disease and Alzheimer’s Disease.

The firm’s lead candidate, LX2006, is currently in Phase 1/2 clinical trials for the treatment of Friedreich’s ataxia.

The company expects to report interim data from the LX2006 trial in mid-2024.

The market opportunity for the various conditions the company is targeting is substantial and expected to grow in the coming years.

Management hasn’t disclosed any major pharma firm collaborations but is collaborating with academic centers at Cornell University and the University of California, San Diego.

The company’s investor syndicate includes some notable life science venture capital firms.

Lexeo is pursuing high-risk treatment areas that have had limited success in the past.

When we learn more about the Lexeo Therapeutics, Inc. IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Read the full article here