Today, we received news from Pitney Bowes Inc. (NYSE:PBI) that CEO Marc Lautenbach has “stepped down” as CEO and as a member of the Board of Directors! On August 17th, I wrote about several scenarios that PBI was facing. Specifically, I wrote that if Kurt Wolf of Hestia Capital was able to convince Steve Brill or another non-Hestia appointed director to force the resignation of Marc Lautenbach that:

This path is the most shareholder-friendly as it involves no legal or proxy costs.

I have to admit, I did not see this coming at the time I wrote my last article. However, after I wrote my article, both Bradley Radoff, one of the largest individual shareholders, and Ancora, one of the largest debt holders, both wrote scathing letters that you can read here and here. I honestly thought that the probability of the Board of Directors coming to this decision was extremely low, but all of the external pressure obviously had a significant impact.

One thing is clear – Kurt Wolf of Hestia Capital is clearly making a name for himself. First, he won over Bill Simon at GameStop (GME) which resulted in Ryan Cohen taking over the Board of Directors/company there. Now, Kurt has won over one (or most likely multiple) members of the PBI Board of Directors in a very similar scenario. Furthermore, with Marc Lautenbach no longer a member on the Board of Directors, with no immediate replacement, Hestia Capital backed candidates are now required to back any future decision the company makes as they control 4 out of the 8 total board seats.

Path Forward

The path forward now is very clear. With Marc Lautenbach out as CEO and the company seeking to “advance key initiatives,” it is obvious that the company has begun shopping the Global Ecommerce segment. Why didn’t the company just announce this instead of using coded language? They most likely did not want to be too overt over fears that it could either lead to customer turnover and/or difficulty in winning new customers.

While there may not be any official announcements until the segment is sold, we can be assured that the current Board of Directors is clearly working towards this conclusion.

Furthermore, the Radoff and Ancora letters called on PBI to target $50M and $100M respectively in reductions to unallocated corporate overhead. In my last article, I forecast that with the sale of the Global Ecommerce segment that PBI could reduce unallocated corporate overhead by one-third or $68M which is just slightly below the midpoint of the recommendations of Radoff and Ancora.

As shareholders, we should expect the new CEO to immediately announce a corporate cost-cutting plan to cut at least $50M and up to $100M in corporate overhead.

Jason Dies as Interim CEO

Jason Dies was promoted in January of 2023 to the role of:

Executive Vice President and Group Executive. In this newly created position, Dies will be responsible for overseeing the Sending Technology Solutions (SendTech) and Presort Services business units as well as the functional groups of Human Resources, Information Technologies, Marketing and Communications.

Keen observers will soon note something very obvious. Jason was basically put in charge of every area of the company with the major exception of Global Ecommerce. If anyone needed further confirmation that Pitney Bowes future plans do not include the Global Ecommerce segment, look no further.

Given that the Presort and Sending Technology Solution segments showed actual YOY growth over the first 6 months of 2023 in a difficult economy, it makes sense that the company decided to promote him to Interim CEO.

Based on the press release, Kurt Wolf of Hestia Capital is the co-chair for finding a permanent CEO replacement. Typically, these processes can last about 3 to 6 months. Not only is Kurt Wolf the co-chair, but with Hestia Capital having 4 of 8 votes within the Board of Directors any permanent CEO will require Kurt Wolf’s/Hestia Capital’s blessing.

If Jason has his sights set on becoming the permanent CEO he will likely do everything he can to ensure the immediate sale of the Global Ecommerce segment for as much money as possible. Furthermore, given that Bradley Radoff, Ancora, Kurt Wolf (during the proxy battle), as well as DOMO Capital have all called on Pitney Bowes to reduce unallocated corporate overhead by $50M to $100M dollars… one can only assume that Jason would immediately announce a plan to cut at least $50M in expenses over the next 3 to 6 months if he has any aspirations of becoming the permanent CEO.

Valuation

As previously broken down, if the Global Ecommerce segment is sold for $1 billion (Pitney Bowes has already invested at least $742.5M into the segment) and if unallocated corporate overhead can be cut by $68M annually then the company would be able to reduce interest expense by at least $75M annually (using the 2022 average rate of 7.5% which is extremely conservative).

Under this scenario, Pitney Bowes would generate over $275M annually with a total debt of only $1.2B and significantly lower net debt as the company already has over $500M in cash on hand. With the Presort and Sending Technology Solution segments showing actual YOY growth over the first 6 months of 2023 the company should be able to command a price to earnings ratio of at least 10x on what would be around $1.57 in annual earnings per share. This would place the value of PBI at over $15 per share!

Short Attack May Soon Lead to a Short Squeeze

Short sellers recently began attacking the company, as shares short (based on official data) have gone from 9.89M as of 8/1/2023 to 12.54M as of 9/15/2023 (based on official data released on 9/26/2023) which is over a 26% increase.

Pitney Bowes Short Interest (Yahoo Finance)

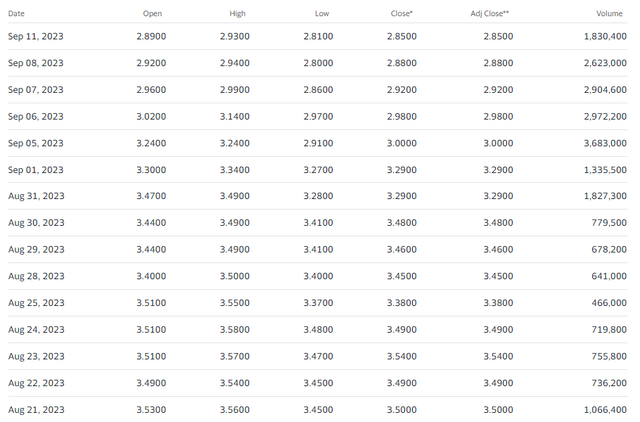

This was on full display from September 5th through September 11th where we can see that suddenly volume jumped from less than a million a day to nearly 3.7M shares traded in a single day taking the stock from a prior close of $3.29 down to $3.00 per share (with a low of $2.91 on the day). The heavy volume continued over the following days with shares falling as low as $2.81.

PBI Historical Trading Data (Yahoo Finance)

Why would short sellers attack Pitney Bowes? The company recently (on July 31st) signed a Note Purchase Agreement that included the following language (emphasis added):

(iv) so long as no Default or Event of Default has occurred or is continuing (which condition, in the case of a regular quarterly dividend, shall be tested at the time of declaration of such dividend only, so long as the relevant dividend is paid within 60 days after the date of such declaration), the Issuer may declare and pay dividends with respect to or repurchase its Equity Interests in an aggregate amount for all such dividends and repurchases not to exceed $36,000,000 per fiscal year of the Issuer so long as, to the extent such Restricted Payment is made on account of Equity Interests, such Restricted Payment does not result in an annualized dividend yield (measured based on the average of the daily volume weighted average prices of the Issuer’s common equity on the New York Stock Exchange over the period of thirty (30) consecutive trading days ending ten (10) Business Days prior to the declaration date for relevant dividend) greater than 6.25%; provided that amounts used pursuant to Section 6.14 shall reduce the amount available under this Section 6.08(a)(iv); provided further that for the purposes of this clause (iv), each Dollar applied to such repurchases of Equity Interests shall count as $2 for purposes of the calculation of this basket.

What does this mean? It means that if the shares traded at a volume weighted average price (VWAP) of less than $3.20 ($0.20 dividend/$3.20 share price = a 6.25% dividend yield) for 30 consecutive trading days ending 10 business days prior to when the dividend is declared… that the company would be forced to cut the dividend rate in order to get under the annualized 6.25% dividend yield threshold.

It appears obvious that short sellers latched onto this and have aggressively targeted the company (as shares sold short increased by over 26% since the Note Purchase Agreement was signed) in order to force a dividend cut knowing that such an action would have likely resulted in a major sell-off for the shares on heavy volume that would have allowed them to immediate exit their short with a huge profit. Note that this is precisely what happened with GameStop when they eliminated their dividend with shares falling over 35% on June 5th, 2019.

As Pitney Bowes shares have already risen over 10% in pre-market trading a forced dividend cut is now extremely unlikely as shares are likely to run much further once the market opens. Furthermore, all of the shares sold short from $3.3 down to below $2.85 per share are now underwater and a potential short squeeze (potentially triggered by a gamma squeeze if traders start using options to bet on a sale of the Global Ecommerce segment within the next 6 months) has instantly become a real possibility.

We can see that this actually already recently happened with Pitney Bowes shares back on January 26th of 2021 where they jumped from $7.53 to $15.50 in 2-3 days on no news other than short sellers being forced to cover other short positions such as GameStop:

PBI Historical Trading Data (Yahoo Finance)

With over 8% of the total Pitney Bowes float short and a lot of it locked up (as Hestia Capital’s ~10% position would obviously be in an earnings blackout period given that the quarter just ended) – it’s very probable that there could soon be short-squeeze that pushes the shares back into the double digits.

Risks

In my last article, I listed the following risks:

- “The biggest risk facing Pitney Bowes at this point is no change in strategic direction” – This is no longer a risk.

- “No new activist” – This is no longer a risk.

- “No change in heart from a majority of the current board members.” – This is no longer a risk.

- “No change in the constitution of the board even with another proxy battle in 2024” – This is no longer a risk.

In short – with one fell swoop, the Board of Directors appears to have completely eliminated all of the major risks facing the company by removing Marc Lautenbach.

That being said, if we have to be forced to find a risk, it would simply be that Pitney Bowes is unable to find anyone to acquire the Global Ecommerce segment. We view the probability of this risk as extremely low.

Conclusion

In conclusion, the Pitney Bowes Board of Directors’ decision to change leadership has officially begun to unlock significant shareholder value (shares immediately shot up over 10% on the news during pre-market). It is clear the company will now work towards unlocking more shareholder value by selling the Global Ecommerce segment that is clearly more valuable to potential suitors that will operate the segment profitably. As money is used to materially deleverage Pitney Bowes as well as reinvested towards growing the already profitable Presort and Sending Technology Solution segments (as well as the Pitney Bowes Bank) the shares should rise towards $15 by the end of 2024 compared to the $3.02 price the shares closed at on Friday, September 29th. For long-suffering shareholders, today’s news could not be any better!

The path forward for Pitney Bowes was unclear, but the eventual destination was obvious and led to the same conclusion no matter which path ended up becoming a reality. Thankfully for shareholders, the most shareholder-friendly possible action was taken with the sudden change in leadership. Shareholders can now be assured that the Global Ecommerce segment will be put up for sale, major cost reductions will be implemented, and that the company will materially de-leverage over the next year.

The future looks extremely bright for Pitney Bowes Inc.!

Read the full article here