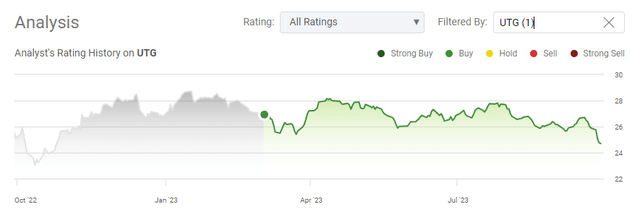

It hasn’t been a good year for utilities, and since my last article (can be read here) on the Reaves Utility Income Trust (NYSE:UTG), it’s declined by -11.81%. When the distributions are factored in, UTG has a total return of -7.45% since 3/3/23 compared to the S&P appreciating by 7.25%. I am not surprised that utilities have gone through a tough patch as the yield on risk-free assets continues to increase. UTG is trading at the low end of its 52-week range and has $1.82 billion in assets under management (AUM). Despite the declining share price, UTG continues to pay a monthly distribution of $0.19 which amounts to an annualized yield of 9.23%. Shares of UTG have declined by -8.16% since 9/15/23, and I think the latest pullback is creating an opportunity. If utilities continue to sell off, then UTG could face continued downward pressure, but I believe 2024 will be a much better year for UTG as risk-free assets become less appealing. I have a long-term focus on UTG as it’s part of an overall income strategy I have constructed and I plan on adding to my position at the 52-week lows.

Seeking Alpha

What’s causing UTG to decline in 2023

UTG has an investment strategy that is true to its name. The fund invests at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. The utility industry hasn’t fared well in 2023. The Utilities Select Sector SPDR Fund ETF (XLU) has declined by -16.41% in 2023, while individual utility companies such as NextEra Energy have declined by -31.66%, and The Southern Company (SO) has fallen by -9.99% YTD. It would be incredibly tough for UTG to have a positive year when the sector ETF is in the red, and 2 of its largest holdings are in the red. While UTG uses a different investment methodology to generate a significantly larger yield than investing in utilities directly, its long-term appreciation is predicated on the utility industry’s appreciation, which hasn’t occurred in 2023.

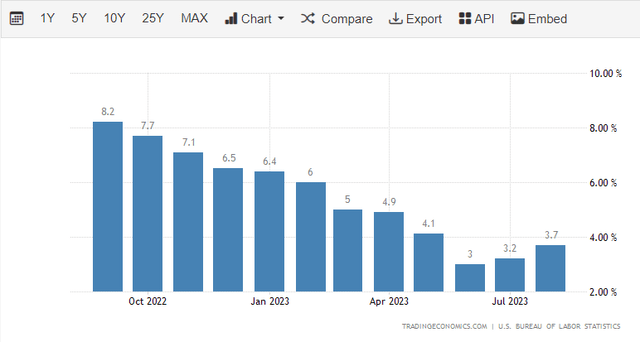

Utility companies have been an appealing alternative to fixed income for income investors in previous years when we were living in a yield-starved environment. Income investors look for stability and yield and put less of an emphasis on capital appreciation. Capital tends to gravitate toward utilities as they lack traditional competition due to being regulated by state, federal, and local agencies. When CDs and treasuries were yielding less than 2% and even less than 1%, getting 3-4% from utilities looked very appealing. You could even buy the basket of 31 utilities with the XLU and generate a yield of 3.6%, but in an environment where rates are high, these investments are much less attractive.

Trading Economics

Until recently, getting 2% or more on your capital risk-free wasn’t realistic. Taking on equity risk to generate a 3-4% yield rather than getting 1% or less in a CD or treasury was an acceptable trade-off because investors were getting paid an acceptable delta. The utility sector never competed with technology as the investments appealed to two completely different types of investors. Investors who are looking for capital appreciation aren’t gravitating toward utilities as the prospects for growth are capped to an extent, and income investors aren’t looking toward tech to generate income.

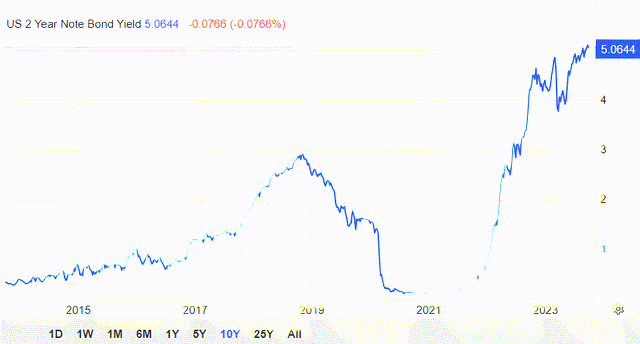

As interest rates increased, it drove up the yield on risk-free assets, causing the 10-year yield to be 4.58%, the 2-year yield to be 5.05%, and a 12-month note to yield 5.47%. Higher yields are an issue for utilities from an investment aspect because investors can generate over 5% with no risk rather than investing in The Sothern Company to generate a 4.16% yield. The lack of capital flowing into utilities, in addition to the macroeconomic environment and market volatility, has made utilities less appealing in 2023. Rates have stayed higher than most people expected, and the Fed has been clear in its message of higher for longer. Utilities could continue to stay depressed as 6-month and 1-year CDs and notes expire and get reinvested back into another CD or note to take advantage of this environment.

Why I think we’re at the end of the cycle and UTG is very interesting at this level.

At the September FOMC press conference, Jerome Powell was overly hawkish. The transcript can be read by clicking here. He discussed that the FOMC decided to maintain the target range for the federal funds rate at 5.25 – 5.5% and continue reducing their balance sheet. He specifically said:

“If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 5.6 percent at the end of this year, 5.1 percent at the end of 2024, and 3.9 percent at the end of 2025. Compared with our June Summary of Economic Projections, the median projection is unrevised for the end of this year but is moved up by a half percentage point at the end of the next two years.

Trading Economics

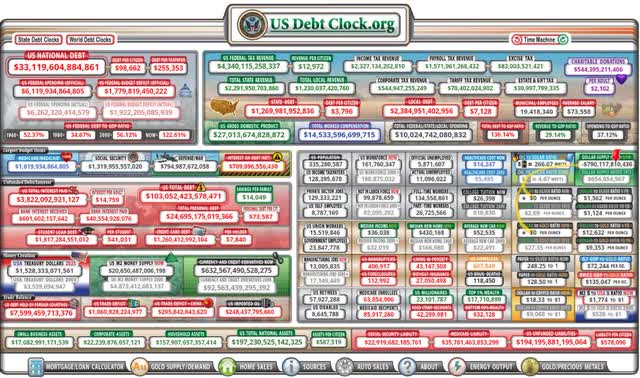

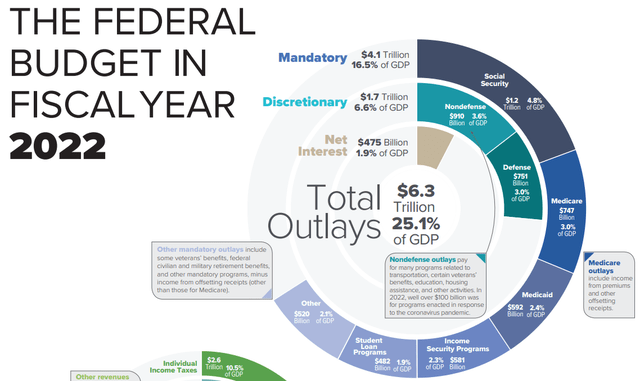

I feel that Jerome Powell is being overly hawkish because the economy is more resilient than anticipated, and inflation has started to tick up. This has caused him to take a higher for longer stance, and while people are citing the housing market and banking industry as reasons why the Fed should cut rates, I am looking at something different. While raising rates is the only tool the Fed has to fight inflation, it also increases the amount of interest we’re paying on our debt. While I hear a lot of people discuss many different reasons as to why the Fed needs to cut, nobody is talking about how much we’re paying in interest on the county’s debt. Due to rates drastically increasing, we are now spending over $700 billion annually on interest for the national debt. The federal government spent $475 billion in 2022 on its interest payments. While many of the other reasons are plausible, I believe Jerome Powell knows how destructive rates are to the fiscal viability of the nation and will be forced to take this into consideration.

We’re headed into an election year, and I feel that an overwhelming amount of pressure will be put on the Fed to start cutting rates from both sides of the aisle. Nobody, democrat or republican, wants to go into an election with an economy that is perceived to be weak. Even if Jerome Powell is hawkish at the November meeting, I am expecting the Fed to cut a bit more than they are leading on in 2024, as the amount of debt we’re issuing at high interest rates is detrimental to the nation’s future.

USDEBTCLOCK CBO.gov

Why UTG is one way I am playing the utility sector

I believe that while rates may stay at this level into Q1 of 2024 that a cutting cycle will be deeper than their revised projection. This will start to make utilities attractive again because yields will fall on risk-free assets. Now is when I want to increase my exposure to utilities because I can’t time the markets and want to be ahead of the curve. UTG allows me to benefit from owning the basket of utilities and generate a larger yield due to their utilization of leverage. Today, UTG trades at a 0.98% premium to its NAV and has a leverage ratio of about 24%. UTG has established a long-term track record of utilizing leverage and is investing in an industry that is regulated and critical for the economy.

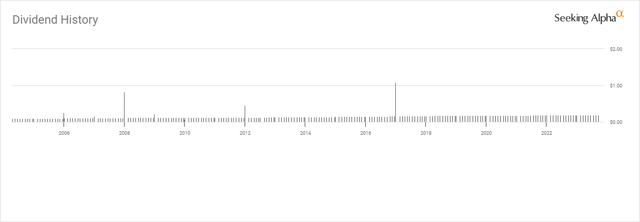

Seeking Alpha

Since going public, UTG has never decreased its distribution and has paid out $35.50 per share in income. UTG went public at $20 at the beginning of 2004. Hypothetically if you had invested at the IPO, the initial share price would have increased by 25.24%, but you would have generated 177.48% in income prior to compounding on your invested capital. The economy goes in cycles, and we’re currently in a cycle that is favoring risk-free assets rather than utilities as a proxy. While utilities have been under pressure, UTG continues to generate large amounts of income, and I am expecting this fund to continue paying $2.28 on an annualized basis through its distributions.

Seeking Alpha

Conclusion

Utilities could continue to face pressure, but eventually, the tide will turn as risk-free assets see their yields decline from a Fed-cutting cycle. I can’t time the markets, but utilities and UTG as a utility-focused fund look very interesting, hovering around 52-week lows. I think we’re going to see capital flow into the utility sector over the next 6-months as investors reposition for a cutting cycle, which should push the sector higher. If this occurs, UTG would be an indirect beneficiary. I will be taking this opportunity to dollar cost average into UTG and reinvesting every distribution it generates as my cost on capital will generate a yield that exceeds 9% on these shares.

Read the full article here