From my experience, some of the best investment opportunities involve companies that are experiencing pain. During difficult times, the market can inflict more pain on the shares of a company than is sometimes warranted. And when this does occur, the end result can be a great buying opportunity. The difficult part of this approach, however, is determining when the pain in question has been warranted and when it has been overplayed. And while nobody is perfect when it comes to investing, being able to recognize the difference between the two scenarios can make you a great deal of money in the market and, just as importantly, mitigate losses moving forward.

One company that has recently seen some downside, but that I believe does represent a good prospect from this point on, is Ameris Bancorp (NASDAQ:ABCB), a fairly small bank with a market capitalization of $2.61 billion as of this writing. Prior to the current fiscal year, the general trend for the enterprise has been positive. This year, some financial figures have pulled back. But when you look at the picture and its entirety, you see a firm that is trading at attractive levels and that likely has some upside from here.

A solid bank

According to the management team at Ameris Bancorp, the firm operates as a financial holding company that controls a wholly-owned banking subsidiary known as Ameris Bank. Through this subsidiary, the company operates no fewer than 164 full service domestic banking offices, with those locations engaging in traditional banking activities. Examples include but are not limited to accepting deposits, originating commercial real estate loans, originating residential real estate mortgages, offering up agricultural loans, providing commercial and industrial loans, and even providing customers with consumer loans.

Ameris Bancorp

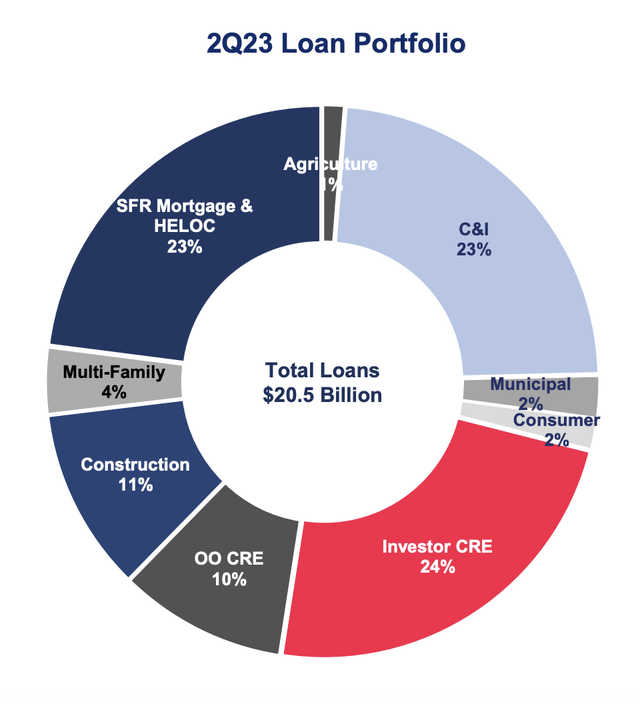

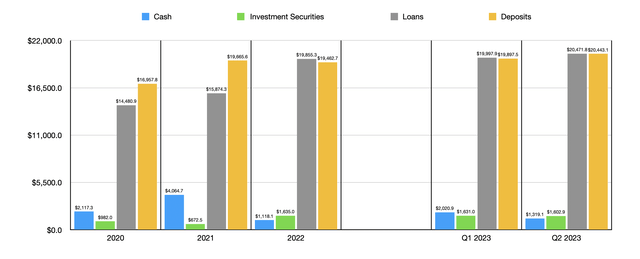

Truth be told, it might be helpful if we dig into the company’s loan portfolio. From 2020 through 2022, the value of loans on its books grew from $14.48 billion to $19.86 billion. Loan exposure continued to grow into the current fiscal year, hitting an all-time high at the end of the second quarter of $20.47 billion. As you can see in the image above, the largest exposure for the company is focused on investor commercial real estate. This is followed up by both commercial and industrial loans, as well as single family residential mortgages and HELOCs at 23% each. It also has a fairly decent amount of exposure to both construction loans and owner-occupied commercial real estate.

I understand that one area in the loan space that investors have been worried about involves office properties. The good news is that, at present, only 6.9% of the company’s loan portfolio is dedicated to non-owner-occupied office loans. This picture does worsen a bit if we include owner-occupied properties and loans dedicated to construction activities that involve offices. Including all of this, combined with total commitments associated with these types of assets, we get approximately 11.1% of the company’s loan portfolio. This is higher than I would normally like to see, but management has said that the average vacancy rate of these offices is less than 10%.

Author – SEC EDGAR Data

The overall growth in the value of loans has only been made possible by a growth in deposits. At the end of 2020, the company had $16.96 billion worth of deposits on its books. Deposits continued to grow, hitting $19.46 billion in 2022. Because of the banking crisis that occurred earlier this year, there was a great deal of uncertainty regarding the stability of certain financial institutions. In response, many depositors withdrew funds. And some banks have even seen funds drop in recent years because of higher interest rates attracting capital out of low yielding opportunities and into higher yielding ones. The good news for management and shareholders is that deposits have only continued to grow. They hit $19.90 billion in the first quarter of this year before climbing to $20.44 billion in the second quarter. Uninsured deposit exposure was not unreasonable. At the end of the first quarter, it totaled 29.5% of all deposits. By the end of the second quarter, it had declined to 28.8%. This is slightly better than the 30% that I consider to be high and that typically causes me to be more cautious with investment prospects.

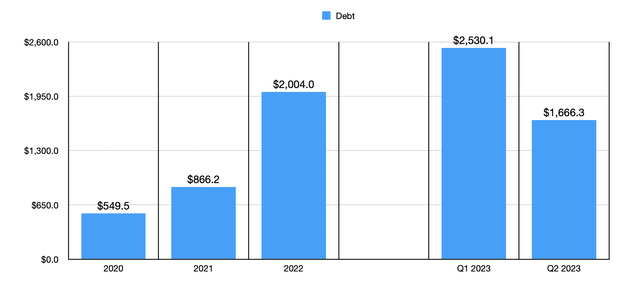

Author – SEC EDGAR Data

One thing that is really positive for shareholders is that the growth in deposits, combined with growing profits, has allowed the company to actually pay down debt this year. Gross debt totaled $2 billion at the end of 2022. By the end of the first quarter of this year, it had fallen to $1.67 billion. At the same time, the value of cash and cash equivalents actually expanded from $1.12 billion to $1.32 billion, while debt securities dropped only modestly from $1.64 billion to $1.60 billion. All combined, this shows a company that is getting healthier by the quarter.

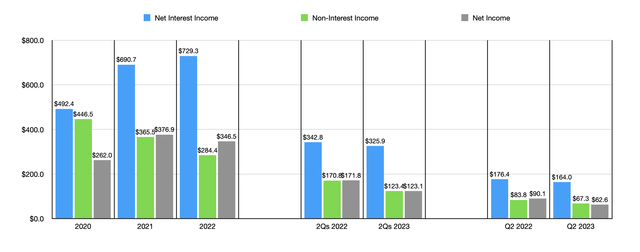

The growth in deposits and loans has allowed the company to grow its overall financial condition from a revenue and profit perspective. Net interest income, for instance, jumped from $492.4 million in 2020 to $729.3 million in 2022. However, there was some weakness when it came to non-interest income. This metric actually fell from $446.5 million to $284.4 million over the same window of time. Although there are multiple working parts here, the single largest driver of this decline involved the company’s mortgage banking activity. Income from this category dropped from $374.1 million in 2020 to $184.9 million in 2022. This, management said, was driven largely by a decline in the production of mortgages, combined with the tightening of gain on sale spreads completed from year to year.

To put this in perspective, in 2022, total mortgage production in the retail category for the company was $5.5 billion. Only one year earlier, in 2021, it was $8.9 billion. Gain on sale spreads during this window of time declined from 3.31% to 2.27%. All of this makes sense when you consider that the combination of higher prices and higher interest rates aimed at combating inflation would result in a slowdown of mortgage activity.

Author – SEC EDGAR Data

Even though this proved to be a problem, it did not stop net income for the company from rising from $262 million to $346.5 million. Unfortunately, this year has been somewhat different. Net interest income in the first half of the year declined from $342.8 million to $325.9 million. Normally, this would occur because of a narrowing of the spread in the net interest margin and/or because of a decline in certain assets. I have seen both of these scenarios pop up when analyzing other banks. But that was not the case regarding Ameris Bancorp. The culprit here was actually a surge in the provision for credit losses from $21.2 million to $95.2 million. And all of that increase involved a jump in the provision for loan losses from $10.5 million to $93 million. A drop in both residential and commercial real estate prices, as well as a decline in organic loan growth, was responsible for this change. It is possible that the company could go on to recognize lower loan losses. But this is a good estimate in the eyes of management of what investors should expect.

As a result of the decline in net interest income, combined with a drop in non-interest income from $170.8 million to $123.4 million, net income for the company fell from $171.8 million to $123.1 million. As the chart that shows this illustrates, the most recent quarter on its own, which should be the second quarter of the 2023 fiscal year, was also impacted in this regard. And frankly, it is highly probable that this trend will continue for as long as interest rates are elevated and there are concerns about the macroeconomic environment. In fact, I would even go so far as to predict for the next quarter or two could be even more painful, not only for Ameris Bancorp but also for other banks like it.

Author – SEC EDGAR Data

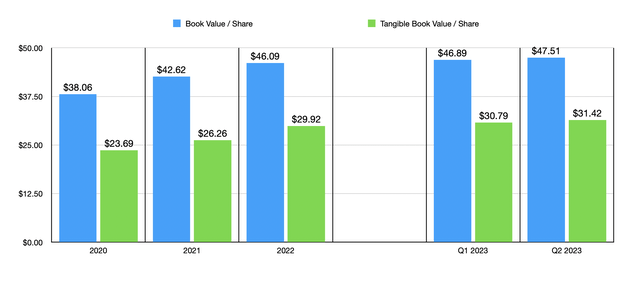

Despite these issues, Ameris Bancorp has done well to grow its book value per share. As you can see in the chart above, the company has seen a consistent uptrend in both its book value per share and tangible book value per share. In fact, the enterprise is actually trading at a 21.6% discount to its overall book value per share and is trading at a premium of only 18.5% to its tangible book value per share. I have seen other banks both higher and lower than this. But in general, even trading below book value should be considered a positive.

Now, it is true that we don’t know what the future holds. At some point, I would wager, financial performance will revert back to what it was in 2022. If that does come to pass, then shares would be trading at a price to earnings multiple of 7.5. But even if we annualize results seen so far for 2023, we would get a reading of 10.5 on a forward basis. The average in the space right now is about 10.3, so Ameris Bancorp is in appropriate shape. But if you think about it from a long-term perspective, then the stock looks quite attractive.

Takeaway

All things considered, Ameris Bancorp strikes me as an intriguing prospect. Shares are attractively priced and management has done well to grow the company’s asset base. Uninsured deposit exposure is in check and, while I fully expect financial performance to worsen in the near term, all of these factors combined will work to improve performance in the long run. While the stock is up 31.5% compared to its 52-week low, it is still down 31.3% from its 52-week high. When you add all of the other data to this, I would say that we have a prospect that is worthy of a ‘buy’ rating at the moment.

Read the full article here